How To Improve Your IPI Score & Maximize Amazon Sales

Leverage FBA Alternatives To Overcome FBA Inventory Limits and Save Q4 Sales

Introduction

Fulfillment by Amazon’s (FBA’s) latest change from ASIN-level quantity limits to storage-type quantity limits is forcing Amazon sellers into massive changes to their Amazon fulfillment strategy. The lucky few with a catalog of nearly all fast-moving ASINs may be unaffected or even see increases in their storage limits. Most sellers, however, have been hit with deep reductions to their storage levels. The change has reduced overall storage levels from between 20% to 65% – blocking growth right before a sure-to-be record-setting Q4. Amazon sellers who are overly dependent on FBA for fulfillment will not be in a position to capture growth in the ‘21 holiday shopping season. Now is the time to understand how to optimize Amazon Inventory Performance Index (IPI score) and add alternative fulfillment strategies to save Q4 sales.

Read on for actionable advice on how to improve your IPI score and develop alternative eCommerce order fulfillment strategies that will mitigate risk and maximize Amazon sales in Q4 and beyond.

Here’s what you’ll learn in this article and on-demand webinar:

- What are the new FBA storage-type inventory limits?

- Why has FBA changed quantity limits again?

- What’s the impact of new FBA storage-type limits on Amazon sellers?

- How can sellers improve their Amazon IPI scores?

- What’s the best way to manage seasonal sellers and new product launches?

- What are the critical FBA shipping dates to watch for in Q4 2021?

- How can sellers use FBA alternatives to maximize sales and protect their businesses?

- How can sellers drive more sales through their website?

What Are The New FBA Storage-Type Limits?

On April 22, 2021, FBA announced that quantity limits were changing immediately from ASIN-level limits to storage-type limits. Under the new restriction, sellers’ items fall into six storage-type categories: Standard, Oversize, Footwear, Apparel, Flammable, or Aerosol.

New FBA Restriction: ASIN-level > Store-type Inventory Limits

It is important to note that sellers cannot self-identify the items’ categories. Amazon determines these categories based on the characteristics of each item. Each category has specific limits in and of itself, and these limits are not interchangeable. Crucially, this means that if sellers have extra capacity in one category of their account, they cannot use that space for another category where they’ve run into their limit.

Why Has Amazon Changed Quantity Limits Again?

Simply put, demand for FBA far outstrips Amazon’s ability to add capacity, so in recent history, Amazon has consistently made FBA a better deal for themselves and worse for sellers.

FBA is bursting at the seams. After years of steady 15% growth in the eCommerce world, last year, that rate suddenly doubled to 27%. As further evidence of Amazon’s dominance in the global eCommerce sales and logistics space, Amazon signed up an additional 750,000 new sellers in 2020. Most of them want to take advantage of FBA. Additionally, top sellers are doing more business on Amazon than ever, contributing to an ever-increasing need for FBA.

Despite the enormous variety of offerings on Amazon, FBA is designed for fast-moving SKUs and can’t easily handle much of what merchants want to sell. The overwhelming growth in demand for FBA services has led Amazon to continually tighten the criteria for how much inventory they’ll take in and for how long. They’ve reduced the time before long-term storage kicks in, introduced various types of inventory limits, increased the price of long-term storage, introduced IPI score, and now have implemented storage limits by type. They’re quickly building out capacity, and at the same time, they’re limiting what they take in to only what’s the very best for their business – a great place to be in. Unfortunately, what’s good for Amazon is not what’s good for sellers.

The short but volatile history of FBA teaches us one thing – we can expect more Amazon-centric changes in the future. Sellers need to have robust alternatives to FBA or risk their businesses’ ability to grow.

What’s the Impact of New FBA Storage-Type Limits on Amazon Sellers?

1. New Storage-Type Limits Reduce Account-Level Inventory Volume

The new storage-type limits came as a complete surprise to Amazon sellers. Overnight, they found significantly reduced account level inventory limits. Here are just a few examples of sellers’ reactions to the new FBA storage-type restriction.

2. Storage-Type Limits Mean Smaller Restock Orders, More Frequent Inbounds

Ironically, FBA positioned the change as offering “more flexibility in managing your shipments.” The reality is that the new storage-type limits result in the need for smaller, more frequent shipments, increased shipping costs, and additional storage and handling costs. Lower storage-type limits mean that inventory cannot sit in the FBA network very long. As a result, many sellers found that they can no longer send full container loads to FBA. Instead, sellers must now contract with 3PLs and pay for things like breaking down container loads, storage, and forwarding numerous, smaller shipments to FBA. The limits are so low that many sellers now send restock orders daily, increasing shipping costs and overhead.

In its usual fashion, FBA gave no advance notice for this radical change. As a result, many sellers chose to cancel and reroute inbound orders to 3PLs to avoid a negative impact on their IPI metrics. With how little inventory Amazon will now hold, sellers must have alternative storage for their FBA inventory. In light of the global supply chain crisis, this is no easy task.

“Cahoot has amazing technology in addition to their large warehouse network, sort of like FBA but without the hefty fees or restrictions. Cahoot saved our peak-selling season!”

– Joel Frankel, Fames Chocolates

3. Storage-Type Limits Create Uncertainty for Seasonal Sellers

Merchants’ IPI scores are based on the preceding 90 days of sales and are said to account for seasonality. The lack of clarity on any seasonal adjustments is creating significant uncertainty in the availability of FBA for handling sellers’ peak season sales. It’s important to note that merchants with many Q4 seasonal sellers see a continuous decline in storage-type limits in the preceding months. Amazon frequently has receiving delays in Q4, making it challenging to execute just-in-time shipments in the latter part of Q4. At this time, it is unclear whether FBA will make any significant increases in storage-type inventory limits for seasonal sellers.

4. Storage-Type Limits Make New Product Launches Especially Tricky

The earlier ASIN-level limit of 200 units for new ASINs made launching new products difficult. If a hot new product sold out quickly, merchants faced sales ranking hits due to stockouts, torpedoing the launch. The new storage-type limits fixed that problem but introduced a new one. New ASINs do not impact IPI scores for the first 90 days; however, they consume part of merchants’ storage-type limits. So, sellers may have to displace the storage space for their top sellers with new products yet to be proven. On the other hand, a new hot-seller can eventually positively impact IPI scores, but it’s a risky bet to take in Q4.

5. Inventory Planning is More Critical Than Ever

Because restock limits are based on total storage-type limits, minus current storage numbers, minus incoming inbounds, the new FBA storage-type limits make planning more demanding than ever. Sellers must be cautious not to fall into the death spiral of stockouts and ever-decreasing storage limits. When bestsellers go out of stock, sales ranks go down; because of this, sell-through rates tank, IPI drops, and storage limits decline – potentially resulting in further stockouts.

How Can Sellers Improve Their Amazon IPI Scores?

What is Amazon’s FBA IPI Score?

The FBA Inventory Performance Index, or IPI Score, measures how efficiently and productively Amazon sellers are managing their FBA inventory. In short, FBA wants sellers to be supply-chain experts and to manage their FBA inventory with the same level of rigor and attention to detail that FBA applies to managing inventory levels in its network. The score combines the past three months of sales, inventory levels, and costs into a single rolling metric that is updated weekly.

Sellers can find their current IPI score in their Inventory Dashboard within Seller Central, and scores can range from 0 to 1,000. The current minimum IPI score is 450. Sellers whose IPI falls below this threshold will see their storage-type limit reduced to 25 cubic feet, and all other FBA inventory will incur punitive storage charges. Sellers with IPI scores above the minimum can still see further reductions, and there are no clear thresholds for specific IPI scores to hit to achieve increases in storage-type limits. Sellers should check it frequently and take the necessary steps to remedy any problems as quickly as possible.

Your IPI score is based on four factors:

- Excess inventory

- Sell-through rates

- Stranded inventory

- In-stock inventory

Amazon hasn’t published the exact algorithm, but the better sellers do with these individual influencing metrics, the higher their IPI scores. The higher the IPI score, the higher storage-type limits become. And of course, the lower the IPI score, the lower the storage-type limits.

Sellers are expected to quickly sell or dispose of slow-moving inventory, maximize the sell-through rate of all ASINs, quickly fix stranded inventory, and keep enough inventory at FBA to not go out of stock.

How Can Sellers Reduce Excess Inventory, Improve Sell-Through Rates, Fix Stranded Inventory, and Avoid Stockouts?

Sellers should also be vigilant about taking immediate action to remedy problems when they arise. Some factors are more straightforward to influence than others. Here are some practical and actionable tips that sellers can follow to improve their IPI scores.

1. Reduce Excess FBA Inventory

The new storage-type restriction makes it more important than ever not to send too much inventory to FBA at once. To minimize the potential of excess FBA inventory in the first place, Amazon sellers should store most of their merchandise at trusted 3PLs, and send smaller, more frequent shipments to FBA as described above.

When sellers do have excess FBA inventory, they should create disposal or return orders immediately. Excess inventory under removal or disposal orders no longer impacts sellers’ IPI scores; the excess inventory, however, continues to incur storage fees up to the point of physical removal. Removal and disposal orders are a low priority for FBA. These processes can take weeks, so it’s essential to take immediate action to avoid high storage fees.

Another alternative is to switch excess inventory listings from FBA to Amazon Multichannel Fulfillment (MCF) and offer them through additional sales channels, including other marketplaces like eBay or even merchants’ websites. Remember that MCF will cost more than it does to fulfill Amazon orders, and the inventory will still impact IPI score and incur storage costs until sold. Using MCF vs. FBA hurts margins, but sell-through rates and IPI scores could improve as a result.

Regardless of FBA’s storage limits, most sellers know that adopting a multichannel sales strategy is a smart way to increase revenue. According to Shopify, merchants who sell on three or more channels can see a 200% increase in sales. Of course, selling on multiple channels introduces other fulfillment challenges. To learn more about grabbing growth with multichannel sales while building operational excellence, check out the on-demand webinar How To Build an Effective MultiChannel Fulfillment and Sales Strategy.

2. Improve FBA Sell-Through Rates

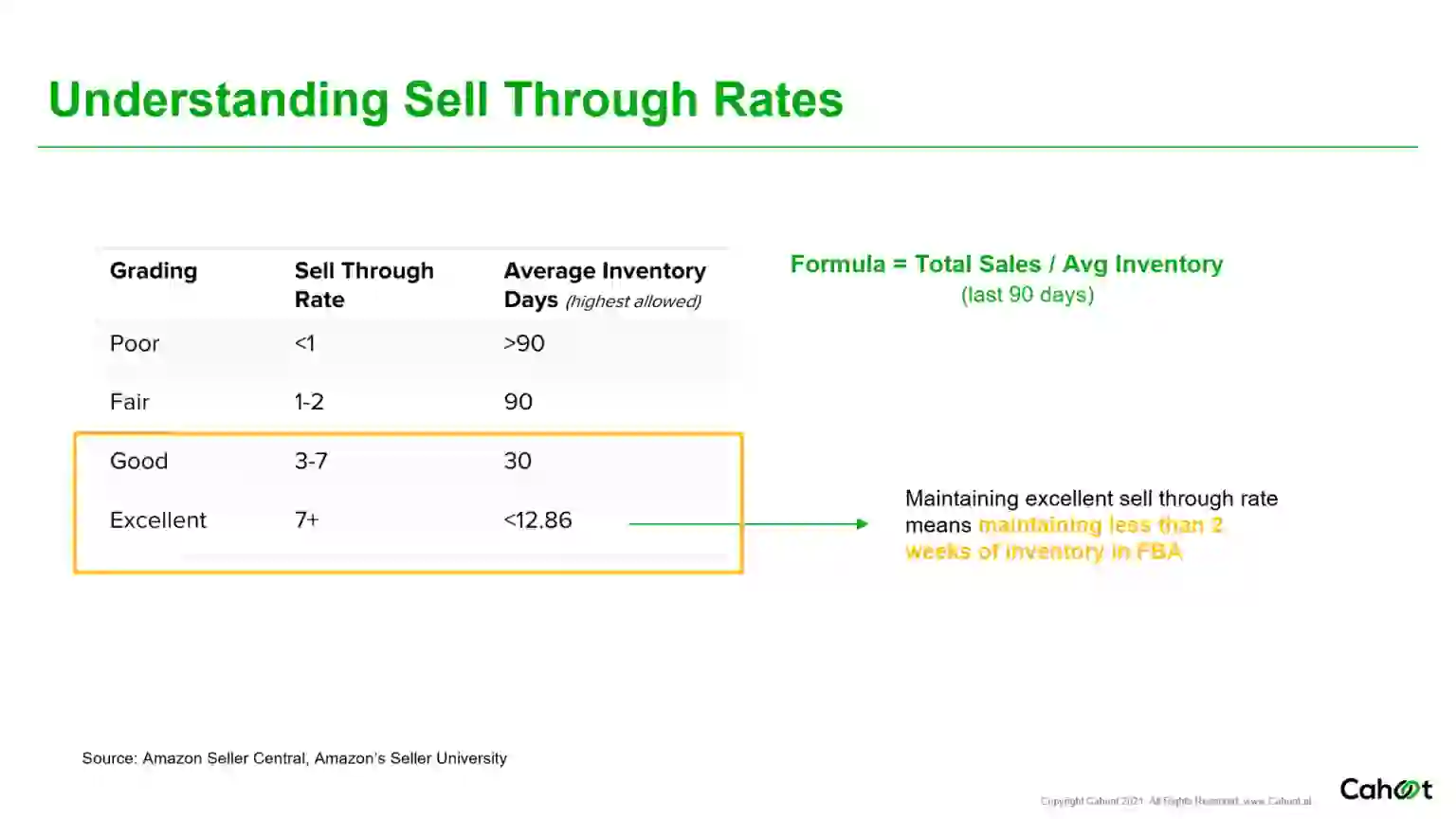

It’s essential to clearly understand what sell-through rate is, how it’s calculated, and what poor, fair, good, and excellent scores are. The formula is quite simple: the sell-through rate is the Total Sales of each ASIN divided by the Average Inventory Level of each ASIN for the last 90 days. Let’s break it down:

FBA considers an excellent sell-through rate to be 7+ units a day with an average time in stock of fewer than two weeks. Good is a sell-through rate of 3-7 units a day with an average of 30 days in stock. Fair is 1-2 units a day with an average time in stock of 90 days or less. Finally, Poor is a sell-through rate of <1 unit a day with an average time in stock of over >90 days.

Improving sell-through rates is the most significant factor in determining IPI scores, and on top of that, it’s great for business. This is the first place to look and one of the fastest and easiest things to influence.

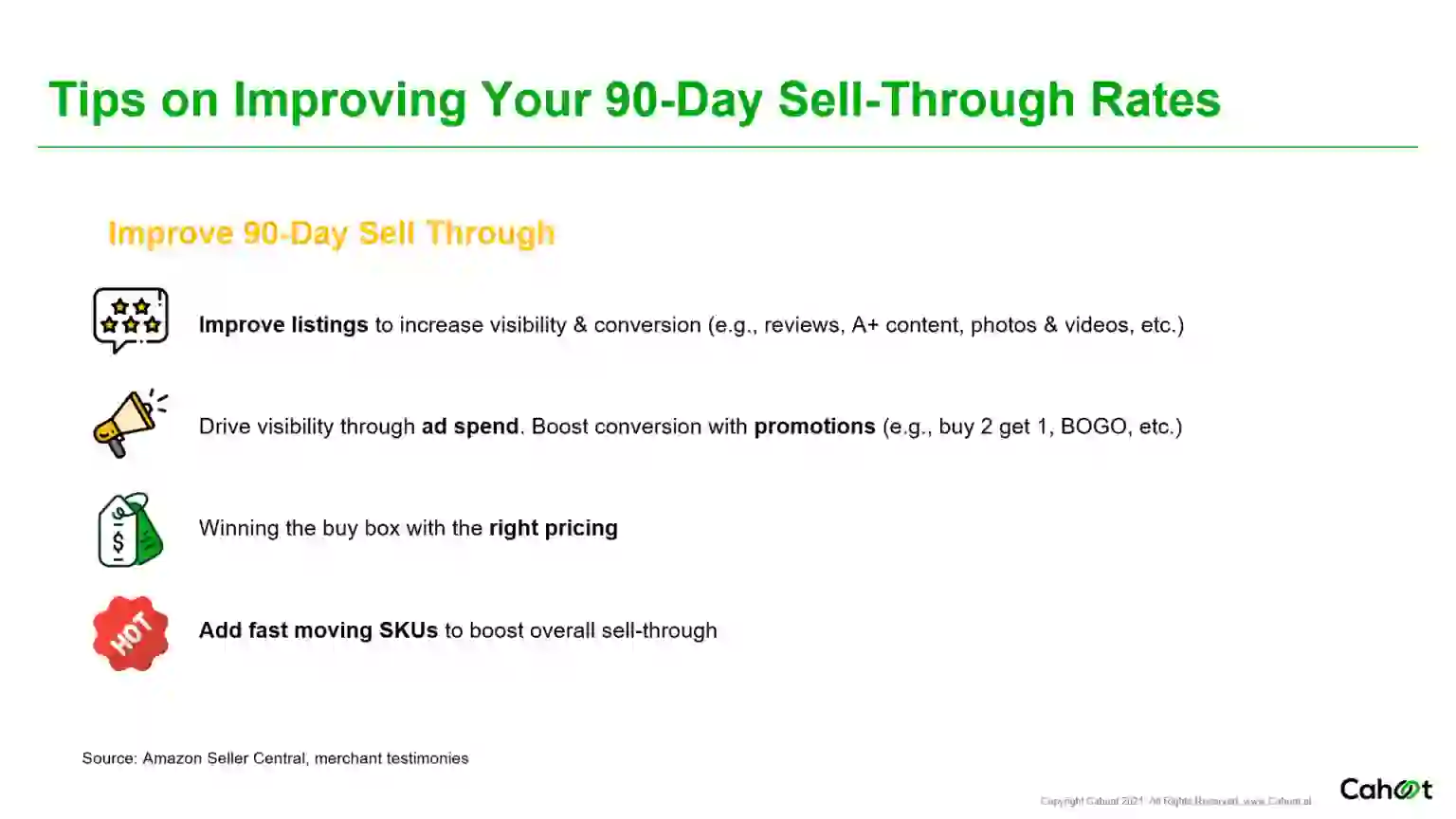

Optimize Amazon FBA Listings for Impressions & Conversion

Great reviews and A+ content are some of the best ways to increase visibility and conversion. Use tools like eComEngine’s FeedbackFive to drive more reviews throughout Q4 and the rest of the year. Use high-quality photography, videos, and SEO-ed copy that is complete and accurate. For a comprehensive strategy on optimizing listings on Amazon and other marketplaces like Walmart and eBay, check out this on-demand webinar; How to Optimize Listings for Maximum Impressions and Conversion.

Drive Visibility Through Ad Spend and Promotions

Consider boosting the visibility of listings with Amazon Advertising and driving more conversions with offers like free shipping and BOGO. Of course, it is vital to consider the impact of advertising on margins. Big ad spends without compelling offers can be a waste of money, but well-executed campaigns can pay off.

Increase Search Rank with the Right Pricing and Free and Fast Delivery

It’s no secret that the right pricing and the Prime badge help win the Buy Box. For this to be profitable, sellers must constantly monitor the pricing of their entire catalog and seek to maximize the average selling price of each listing. Most Amazon sellers assume that using FBA or maintaining strict Amazon Seller Fulfilled Prime (SFP) requirements with their in-house fulfillment are the only ways to increase search rank with free and fast shipping. Think again.

Distributed fulfillment networks have disrupted the legacy 3PL industry by offering a credible alternative to FBA’s restrictive fulfillment services. These best-in-class networks have nationwide 1-day and 2-day coverage, same-day fulfillment, and offer Amazon SFP fulfillment services and Amazon FBM fulfillment services. While FBM listings won’t always win the Buy Box over listings with the Prime Badge, offering competitive pricing and free and fast shipping on your FBM listings will give you the best chance at converting.

Such services also offer eCommerce order fulfillment integrations that can help increase sales with fast and free delivery on other marketplaces and shopping carts like Shopify, BigCommerce, and Magento, further boosting growth.

Add More Fast-Moving SKUs

While this is easier said than done, adding more fast-moving SKUs is a straightforward way to boost IPI scores.

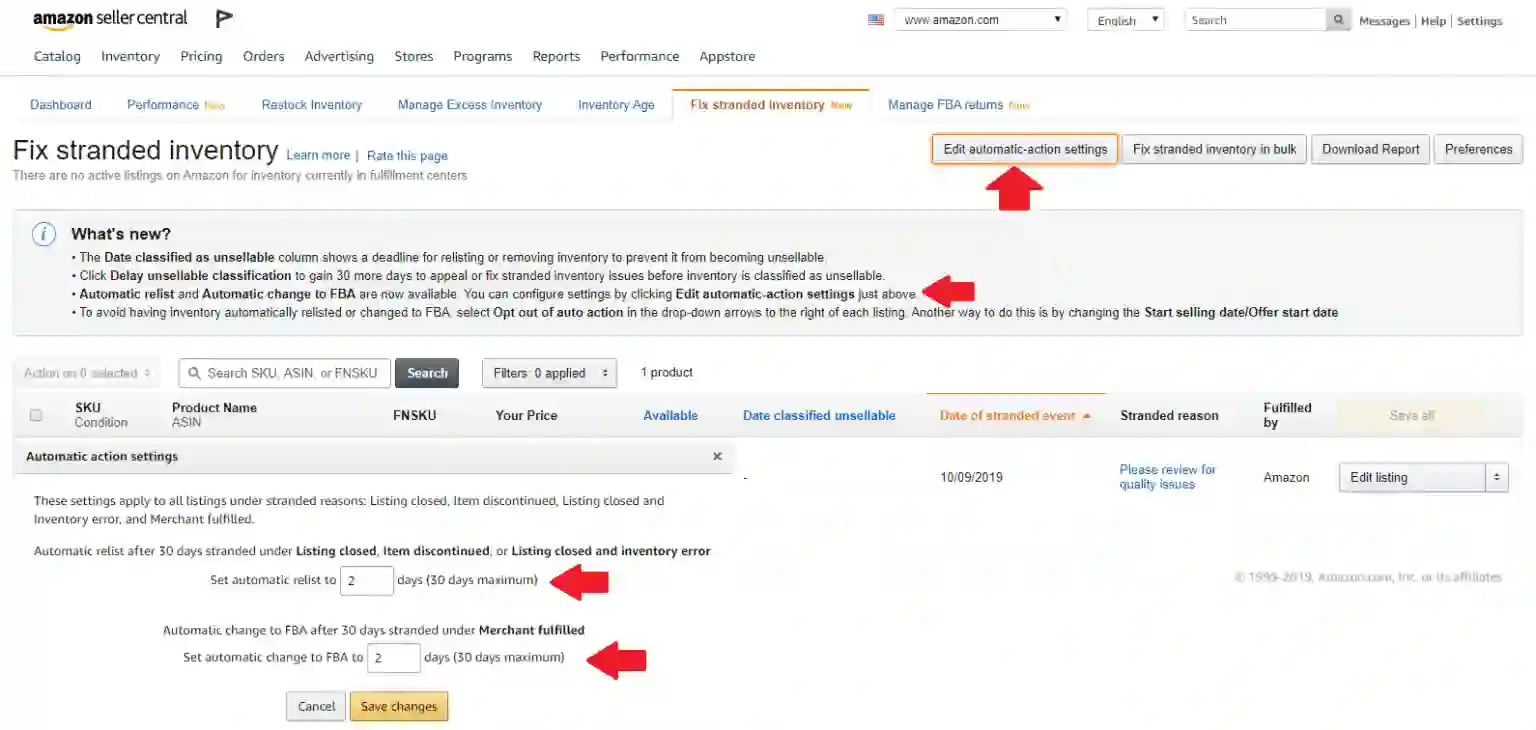

3. Fix Issues with Stranded FBA Inventory

Stranded FBA inventory is not a situation where items become lost. It occurs when FBA is holding inventory, but something caused the listing for that inventory to be removed. As a result, buyers can’t find it, and sellers can’t sell it. Not only does this negatively impact the excess inventory metric, but storage fees for these items also continue – a worst-case scenario for the seller’s bottom lines.

There are several ways that FBA inventory can become stranded. Occasionally inventory in FBA gets inadvertently listed as FBM and thus gets stranded. Sometimes it’s a situation where the listing itself has been closed. It is also possible that pricing triggers an alert, and Amazon shuts down the listing to prevent it from selling outside of the minimum or maximum selling price set by the merchant.

The first step should always be to relist or fix stranded listings. Amazon’s automation tool can sometimes help with this. If the seller cannot fix the listing, the next step is to remove the inventory, which also helps with the excess inventory metric.

4. Avoid FBA Stockouts

In light of the new FBA storage-type restrictions, FBA’s delays with receiving goods in Q4, and the broader global supply chain crisis, stockouts are rightly among the biggest concerns of online retailers everywhere. As described above, stockouts can kill IPI scores and put visibility and product sales into the death spiral.

If Amazon sellers do nothing else with the recommendations in this article, they should create duplicate FBM listings for all of their top-selling FBA ASINs. Then, activate them when FBA inventory is running low or when Amazon experiences receiving delays. Having FBM listings ready to go may just be the thing that saves Q4 Amazon sales for many sellers. With backup FBM listings, merchants can continue to sell without losing a beat. Of course, if sellers are doing self-fulfillment from one location, sales will suffer from slow delivery times or they will incur higher shipping costs if they are offering fast shipping. On the other hand, if Amazon sellers use an FBA alternative to fulfill orders, they can protect their margins and still offer fast and free nationwide shipping.

What’s The Best Way for Sellers to Manage Seasonal Sellers and New Product Launches?

How Merchants with Seasonal Sellers Can Overcome FBA Inventory Limits

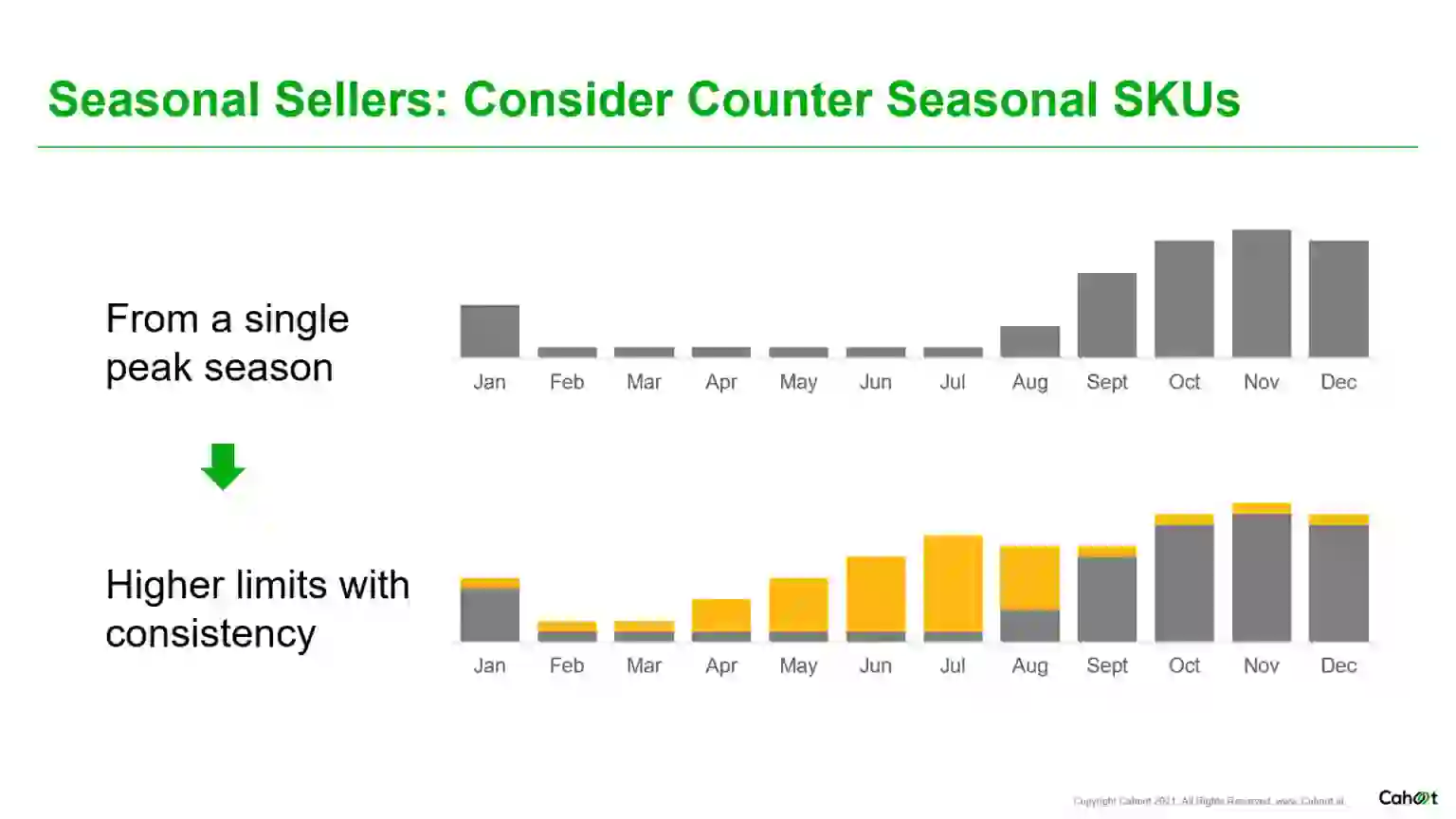

FBA’s advice for addressing seasonal fluctuation in sell-through rates is for sellers to add counter-seasonal SKUs to their catalog to keep their sell-through rates and storage-type limits high enough to handle the peak season. On paper, it can work, but Amazon’s sweaters and swimsuits strategy seems impractical at best.

A more feasible and cost-effective approach is to set up alternative fulfillment that enables merchants to sell beyond their FBA limits. One such option is to use a peer-to-peer fulfillment network that offers Amazon FBM fulfillment services with fast nationwide shipping so that sellers can optimize search rank during their biggest and most critical selling season.

How To Launch New Product Under New FBA Limits

As discussed, new products consume part of already slim storage-type limits and can be especially tricky under the new storage-type limits. We recommend two strategies for launching new products on Amazon. The first is to launch new products outside of Q3 or Q4 when managing IPI scores is typically less critical. The second is to create both FBA and FBM listings for new ASINs. Using FBM eliminates any potential hit to IPI scores from new ASINs that turn out to be slow-moving. Offering new ASINs via FBM also provides a lot of flexibility to respond to demand spikes rapidly. If FBA inventory for a new ASIN is running low, turn on the matching FBM listing and keep selling without losing a beat. Consider using an FBA alternative with nationwide 1-day and 2-day delivery to optimize sales rankings and give new products every chance for success.

“Cahoot has amazing technology in addition to their large warehouse network, sort of like FBA but without the hefty fees or restrictions. Cahoot saved our peak-selling season!”

– Joel Frankel, Fames Chocolates

Watch Out for These Critical Dates for FBA in Q4 2021

Sellers should carefully plan their inbound orders and FBA shipments around critical dates such as Black Friday, Cyber Monday, holiday sales, and initial 2022 restocking. At this time, Amazon hasn’t published the 2021 dates. They may very well be earlier and are unlikely to be later.

FBA Holiday Inbound Dates (last year)

- Black Friday & Cyber Monday – latest arrival at FC is Nov 6, 2020

- Christmas – latest arrival at FC is Dec 1, 2020

- 2021 – earliest arrival at FC is Dec 17, 2020

No Replenishment in Peak Season

- Watch for lead times carefully

- Inbound shipments take away from restocking limits

2022 Inventory Inbounds After Mid Dec Only

- Sellers can’t ship 2022 inventory before mid-December (predicted)

- Sellers need to park their 2022 inventory at a 3PL until it’s allowed by FBA

How Can Sellers Use FBA Alternatives with Nationwide Fast Shipping to Maximize Sales and Protect Their Businesses?

No one could have predicted Covid-19, FBA temporarily excluding non-essential items, or the eCommerce boom and global supply-chain crisis that ensued. Sellers can, however, count on uncertainty moving forward. Therefore, sellers must plan for alternative fulfillment and sales strategies to protect Q4 ‘21 sales and ensure their businesses’ future sales, profitability, and sustainability.

Here’s what Cahoot recommends.

Offer Nationwide Free and Fast Shipping on FBM Listings

If Amazon sellers are not already doing so, they should set up FBM and create backup listings for their FBA ASINs to avoid stockouts and the subsequent death spiral of diminishing search rank and inventory limits. In addition to alleviating the negative impact of FBA stockouts, FBM can facilitate the launch of new products and make up for low storage-type limits for seasonal sellers. In the unlikely event that free and fast shipping doesn’t make or break sales, merchants can do this from their warehouse or a single eCommerce fulfillment center.

A better option is to use a peer-to-peer network that offers Amazon FBM Fulfillment Services. Such services complement merchants’ in-house fulfillment and make nationwide fast shipping economical. It’s not quite a Prime badge, but FBM listings with competitive pricing and free and fast delivery will ranks and convert better than those without it.

Double Down on Amazon Seller Fulfilled Prime (SFP)

With many merchants dropping out of SFP due to the program’s increasing one-day delivery standards, now is the time for those who can keep up to make the most of it. Fulfilling orders via SFP provides all of the Buy Box and sales benefits of Amazon FBA without any of the IPI concerns and or FBA storage-type limits. If merchants struggle to meet strict new Amazon SFP requirements with in-house fulfillment, they can turn to a fulfillment partner like Cahoot that offers Amazon SFP Fulfillment Services. Cahoot meets SFP’s high fulfillment standards with nationwide 1-day and 2-day coverage and affordable same-day fulfillment Monday-Saturday.

Offer Free & Fast Shipping on Your Website

Many Amazon sellers also have Shopify, BigCommerce, or Magento stores, but their website sales are often poor compared to their Amazon sales. Simply put, shoppers won’t buy from brands’ or online retailers’ websites because of slow and costly shipping.

That’s a shame – when merchants sell on their websites, they don’t incur Amazon’s 15% referral fee or all of the costs and hassles associated with FBA. To boost growth and especially margin, sellers need to level the playing field by offering free and fast shipping on their website.

To learn how distributed fulfillment makes it easy and affordable to offer nationwide free and fast shipping on brand websites, check out the on-demand webinar: Your Website vs. Amazon – How To Complete & Win with Free & Fast Shipping.

Maximize Same-Day Fulfillment with Next-Gen Shipping Software

Many FBM sellers are dreading the upcoming Shippagedon. This year, seasonal labor will be in shorter supply and more expensive than ever, so warehouse teams will be pushed to the limit. Maximizing same-day fulfillment capacity during peak season is crucial, but with traditional shipping software like ShipStation, it can take hours each day to rate shop and route orders – even with complex shipping rules in place.

FBM sellers should switch to next-generation shipping software that offers automatic routing and rate shopping and eliminates all the busywork associated with traditional shipping software. With a ShipStation Alternative, all shipping labels are ready before the warehouse staff arrives, so they can start picking orders first thing in the morning. When the cheapest shipping labels are generated automatically, merchants can easily extend their same-day shipping cutoff time till much later in the day. As a result, merchants radically increase same-day fulfillment capacity while reducing fulfillment labor costs by as much as 40%.

Recap

Merchants must pay close attention to critical shipping deadlines, store excess inventory at a trusted 3PL, and send smaller, more frequent shipments to FBA to keep IPI scores high and FBA storage costs low. Merchants must vigilantly monitor their IPI score and take action immediately when excess inventory, sell-through rates, stranded inventory, and in-stock inventory numbers go awry.

Creating FBM listings as backups for FBA listings and using FBA alternatives will make or break Amazon sales in Q4 and beyond. Sellers can’t wait until Amazon tells them that they won’t take their inventory. If sellers set up alternative fulfillment methods now and optimize sales on other channels, they can rest easy knowing that future sales and their bottom line are protected.