Seller Fulfilled Prime vs FBA: The Inventory and Delivery Truth Amazon Doesn’t Fix

Last updated on December 19, 2025

In this article

4 minutes

4 minutes

- FBA’s Prime Delivery Problem: Inventory Placement Gaps

- SFP’s Strict Delivery Standards vs. FBA’s Flexibility

- Inbound Delays and Stockouts: FBA’s Unseen Time Cost

- Returns and Control: FBA’s Lenient Policies vs SFP’s Oversight

- Fee Surprises and Predictability: FBA’s Surcharges vs SFP’s Costs

- The Accountability Asymmetry: Convenience vs Control

- Frequently Asked Questions

Amazon’s Fulfillment by Amazon (FBA) promises Prime convenience, but when one fulfillment center runs out of stock, Prime delivery times can quietly stretch to four or five days even if inventory exists elsewhere.

For Amazon sellers, the choice between Seller Fulfilled Prime and FBA shapes far more than shipping costs. It determines who controls delivery speed, inventory positioning, and customer expectations. The uncomfortable truth is that Amazon does not routinely rebalance inventory across warehouses to preserve two-day Prime speeds. Meanwhile, Seller Fulfilled Prime (SFP) holds sellers to strict 1-day and 2-day delivery standards, highlighting a stark accountability asymmetry in how Prime shipping is achieved.

In this article, we’ll break down why FBA’s convenience often trades away control and reliability. We’ll examine how lack of dynamic inventory placement leads to regional Prime delays, how inbound receiving bottlenecks leave sellers waiting with no SLA, and how FBA’s lenient returns and unpredictable fees add hidden costs. By contrast, we’ll see how SFP’s demanding requirements can actually deliver more consistent Prime service through operational control and accountability. If you’re evaluating FBA vs SFP, understanding these differences will help you avoid costly mistakes and choose the fulfillment model that truly meets your delivery reliability and inventory control needs.

Prime Delivery Promises vs What Customers Actually See

Prime eligibility and Prime delivery speed are often treated as the same thing. They are not.

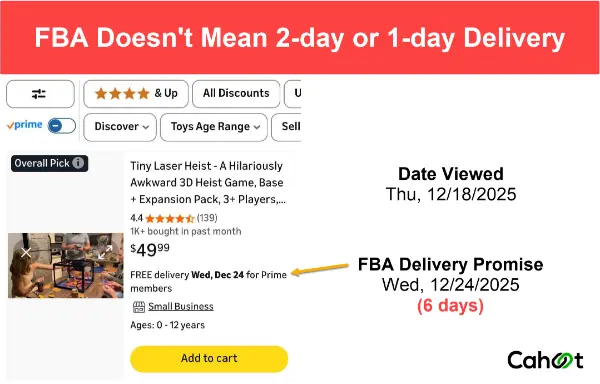

On many Fulfilled by Amazon listings, customers see a Prime badge but are quoted delivery dates four or five days out at the moment of page view. This is not an edge case. It happens when inventory is unevenly distributed across fulfillment centers and Amazon does not rebalance stock fast enough to preserve speed.

Under Seller Fulfilled Prime, this gap does not exist. Listings are either eligible for one-day or two-day delivery, or they are not. Sellers are held strictly accountable to those delivery promises, and Prime eligibility can be removed quickly if performance slips.

The result is a structural difference in accountability. FBA allows Prime listings to degrade on delivery speed without seller-level consequences. SFP does not. From the customer’s perspective, the promise is clearer, and from the seller’s perspective, delivery performance is enforced rather than assumed.

FBA’s Prime Delivery Problem: Inventory Placement Gaps

Under FBA, Amazon decides where to store your products, and it does not actively redistribute your inventory solely to maintain fast Prime delivery nationwide. Your inventory is stored in Amazon’s fulfillment centers, and merchants incur storage fees for inventory stored there. That sounds like a fair trade until you realize what you are giving up: the ability to keep delivery speed consistent across regions when demand shifts.

Operationally, Prime speed depends on distance. The moment your closest node runs out, the system has two options: move inventory between nodes to keep delivery promises intact, or ship from farther away and accept a slower ETA. Amazon often chooses the latter because inter-warehouse moves cost time, labor, and capacity. The result is a Prime badge that stays visible while the experience quietly degrades.

This is not about Amazon being “broken.” It is about incentives. Amazon optimizes network-wide efficiency and cost, not the delivery precision of any single seller’s ASIN in every zip code. That means you can do everything right as a seller, keep inventory healthy overall, and still watch Prime ETAs stretch because your stock is sitting in the “wrong” place.

When Prime delivery speed quietly degrades, the downstream impact is real. Customers do not compare your operational constraints. They compare your listing to the next Prime option that still shows two-day delivery. If you are running ads or relying on organic rank, the timing mismatch can show up as a conversion dip that looks like a product problem, even though it is actually an inventory placement problem.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWhen One Fulfillment Center Runs Dry (Example)

To make this concrete, imagine you send 100 units to FBA and Amazon splits them across two nodes. Say 50 units land in California and 50 units land in Arizona. Demand from the Southwest burns through Arizona first. Now an order comes in from Phoenix or Las Vegas after that Arizona node is empty.

In that moment, you still have inventory in the network, but not in the right place. Amazon can ship from California, which preserves availability, but it often stretches the promised delivery window. Suddenly the same Prime-eligible listing can show a 4 or 5-day “Prime” delivery timeframe even though inventory exists elsewhere. The seller did not change anything. The customer experience changed anyway.

That gap between “inventory exists” and “inventory is positioned correctly” is where FBA’s convenience starts to look like a control problem. As a seller, you cannot tell Amazon to reposition units to a different node. You also cannot force the platform to prioritize speed over network cost when the closest facility is out.

No Dynamic Rebalancing = Slow Prime in Some Regions

Amazon does not routinely rebalance inventory between fulfillment centers to preserve Prime delivery speeds. That “routinely” is the key word. Inventory can move for Amazon’s broader reasons, but it is not a seller-facing mechanism designed to keep your ASIN at two-day Prime everywhere, all the time.

What makes this especially frustrating is the invisibility. Prime members can receive slower delivery without seller penalties, and sellers often do not notice until performance declines show up elsewhere. Your listing still looks Prime, but customers see the truth in the delivery estimate.

This is the first major accountability asymmetry. FBA absorbs delivery slippage as a platform outcome rather than a seller performance failure. The badge stays. The listing stays. The conversion damage is yours to carry.

SFP’s Strict Delivery Standards vs. FBA’s Flexibility

One of the biggest contrasts in Seller Fulfilled Prime vs FBA is how delivery performance is enforced. Under SFP, Amazon treats delivery speed like a seller-controlled promise. Under FBA, Amazon treats delivery speed like a network outcome. That difference shapes everything about how Prime is experienced by customers.

SFP is not “easier” than FBA. It is the opposite. It is a compliance regime. You are responsible for the pickup cutoffs, the carrier selection, the weekend handling, the scan discipline, the packaging accuracy, and the routing logic that ensures the order arrives within the Prime window. If you fail, the program corrects you quickly.

That is exactly why SFP can be operationally superior for sellers who can run a disciplined fulfillment operation. You do not have to accept silent Prime degradation due to inventory placement decisions you cannot influence. You earn the badge by meeting the delivery standard directly.

Prime Delivery SLAs: One-Day and Two-Day or Else

SFP sellers must meet strict on-time delivery, tracking, and cancellation thresholds or risk losing their Prime badge. Amazon enforces these standards weekly, which means the feedback loop is tight. If your operation drifts, you find out immediately through metrics and enforcement, not through a gradual conversion decline.

This enforcement is not “fair” in a philosophical sense, but it is clear. SFP tells sellers exactly what the standard is and expects it to be met consistently. That creates operational accountability. It also forces sellers to build inventory positioning and routing strategies that actually match demand, rather than relying on Amazon’s network to make it work behind the scenes.

Now contrast that with FBA. FBA listings can quietly slip to four-day or five-day Prime delivery in certain regions without seller consequences, because the seller is not the party being measured for transit performance. The customer sees slower Prime. The badge stays. Nobody “fails” the SLA because, under FBA, the seller is not the accountable entity for the final delivery promise.

That is the second major accountability asymmetry: SFP sellers carry strict SLAs, while FBA sellers can experience Prime slippage that looks similar to a service failure but is not treated as one.

If you want the Prime badge to mean “reliably fast,” not “eligible but variable,” SFP’s enforcement model is the reason it can outperform FBA in practice.

If you want a deeper look at how SFP fulfillment is operationalized, see Cahoot’s Amazon SFP fulfillment overview.

Why Multi-Line Orders Expose the Limits of Naive Fulfillment Logic

Single-item orders are easy to fulfill. Multi-line orders are where fulfillment systems reveal their limitations.

In many FBA networks, not all SKUs are stocked at every fulfillment center. When a customer orders multiple items, the system must decide whether to split the shipment across locations or ship everything from a single, farther warehouse.

Both options introduce risk. Splitting shipments increases cost. Shipping from farther locations increases delivery time. Yet sellers are still held to Prime expectations, even when no single fulfillment center can satisfy the order optimally.

The real challenge is decision-making. Does the system understand when to consolidate, when to split, and when to expedite? Can it balance delivery speed, cost, and Prime compliance without manual intervention?

For sellers operating at scale, this intelligence gap becomes one of the most common reasons Prime performance erodes.

Inbound Delays and Stockouts: FBA’s Unseen Time Cost

Even if you accept Prime delivery variability under FBA, there is another operational drag that sellers underestimate: inbound receiving time. Sending inventory into Amazon does not mean it is immediately sellable. Units can sit in receiving, processing, or transfer status before they become available for customers to purchase.

The critical issue is that sellers have no seller-facing inbound receiving SLA. During peak congestion or network strain, sellers may wait days or weeks before inbound units are checked in and available for sale. The inventory exists, but it is commercially invisible. That creates “phantom stockouts” where your supply chain is technically healthy, but your listing is not.

Those phantom stockouts compound the placement problem. If your nearby fulfillment node sells out and you replenish, the replenishment may not become sellable in time to prevent Prime ETAs from stretching. You are paying for storage and fulfillment services, but you still cannot control how quickly your inventory turns back into sellable units.

For operators, this is not a minor inconvenience. It distorts reorder points, breaks forecasting, and forces sellers to carry more buffer inventory than they otherwise would. It also punishes sellers during promotional lifts when speed of replenishment matters most.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPSFP: Bypass the Check-In Queue

SFP bypasses Amazon’s receiving delays entirely because the inventory is already under your operational control. Inventory is available as soon as it is on your shelf or in your fulfillment network. There is no “checked in but not sellable” limbo that can last an unpredictable amount of time.

This matters because it restores a direct link between your demand signals and your replenishment actions. When your local node runs low, you can reposition inventory intentionally. When demand shifts, you can reroute fulfillment to the right warehouse the same day. Your Prime performance becomes a function of your decisions, not Amazon’s internal processing priorities.

To understand the mechanics behind that control, see Cahoot’s breakdown of ecommerce order routing and multi-warehouse fulfillment.

FBA Is Not Set It and Forget It. It Just Hides the Work

FBA is often described as hands-off fulfillment. In practice, it is hands-off until something goes wrong.

When FBA misses delivery expectations, customers do not blame the carrier or the fulfillment network. They blame the brand. Late deliveries routinely trigger negative reviews, even when the seller had no control over inventory placement or carrier execution.

At that point, the work reappears. Sellers must monitor reviews, open cases, provide evidence, and request removals. None of this is automatic, and none of it is guaranteed to succeed. The operational cost is not eliminated. It is deferred.

Seller Fulfilled Prime makes the work explicit upfront. Performance is monitored in real time, issues are surfaced immediately, and corrective action happens before customer trust is damaged. The difference is not effort. It is timing and visibility.

Returns and Control: FBA’s Lenient Policies vs SFP’s Oversight

Returns are where FBA’s convenience can quietly become a margin leak. Amazon’s return experience is optimized for customer trust and frictionless refunds. That is great for Prime adoption, but it often shifts risk onto sellers through reduced inspection control, unclear disposition, and limited recovery options.

Under FBA, the seller is not necessarily the party physically handling returns. That can reduce visibility into condition, packaging tampering, missing components, or repeated abuse patterns. It can also make it harder to decide whether a unit should be resold, refurbished, liquidated, or written off. In practice, sellers often discover return quality issues only after inventory health declines and customer complaints rise.

When you do not control inspection and disposition, you lose a key lever in protecting brand integrity. If you sell products where condition matters, such as consumables, premium goods, or items with a high “open box” penalty, that loss of control is not theoretical. It shows up in recoverable value, refund disputes, and long-term customer trust.

SFP: Hands-On Returns and Brand Protection

With SFP, returns come back to the seller or the seller’s fulfillment partner. That gives you the ability to inspect returned items, apply consistent grading rules, and decide the best disposition path. You can re-enter good units into sellable inventory, route damaged units to refurbishment, or flag abuse patterns earlier.

This is not about making returns “harder” for customers. It is about restoring operational oversight so you can protect margin and quality. If your business depends on resale recovery, refurb workflows, or strict condition standards, SFP’s returns control can be the difference between stable profitability and slow leakage.

For more context on returns strategy and recovery levers, see Cahoot’s customer returns management article.

Fee Surprises and Predictability: FBA’s Surcharges vs SFP’s Costs

FBA fees are not just “a fee.” They are a moving system: fulfillment fees, storage fees, peak season surcharges, dimensional adjustments, and program changes that can shift cost structures without much operational warning. Even when you understand the fee table, the lived experience is that costs can change based on factors you do not fully control, such as network congestion and storage duration.

This unpredictability forces sellers to plan with buffers. Buffers in margin. Buffers in inventory. Buffers in pricing. The moment your costs drift and you do not adjust fast enough, you lose money on volume and often do not notice until the monthly report closes.

SFP does not magically make fulfillment cheaper. That is not the point. The point is that SFP shifts cost drivers into places where operators can act: carrier mix, packaging discipline, warehouse labor efficiency, and inventory positioning. Those are controllable levers. You can measure them, improve them, and forecast them. That is operational predictability, not a cost hack.

For sellers who run fulfillment like an operation rather than an outsourcing decision, that predictability can be more valuable than theoretical per-unit savings.

Carrier Variance Is Real and Prime Metrics Do Not Adjust for It

Carriers do not perform evenly across regions or days of the week.

Weekend pickups and deliveries introduce measurable variance, particularly with ground services. In some regions, certain carriers consistently miss weekend delivery commitments. During peak periods, this variance increases as networks strain under volume.

Prime performance metrics do not account for these realities. Sellers are held to delivery promises regardless of carrier behavior, weather events, or weekend constraints. If a seller relies on a single carrier, they inherit that carrier’s weakest performance windows.

Seller Fulfilled Prime requires flexibility by design. Supporting multiple carriers is not a cost optimization tactic. It is a risk management necessity.

Delivery Speed Directly Impacts Conversion and Sales Velocity

Customers do not compare Prime badges. They compare delivery dates.

When the same product shows different delivery promises across regions, customers choose the option that arrives sooner. In competitive categories, a difference of even two days can determine which listing wins the sale.

Operators regularly observe wide delivery variance for the same product across ZIP codes under FBA. In some locations, delivery is same-day. In others, it stretches to four or five days. Customers facing longer waits often choose alternative brands that arrive faster.

This directly affects glance views, conversion rate, and sales velocity. Faster delivery is not just a fulfillment metric. It is a growth lever.

Seller Fulfilled Prime allows sellers to control that lever instead of inheriting it.

The Accountability Asymmetry: Convenience vs Control

If you strip away the marketing, FBA and SFP represent two different accountability models.

FBA is convenience with diluted accountability. You outsource storage, packing, and shipping, but you also outsource the ability to defend Prime speed when inventory placement shifts. If Prime delivery slows because the nearest node sells out, that is treated as a network reality. The seller is not penalized, but the seller also cannot fix it.

SFP is control with enforced accountability. You carry the SLA risk directly, but you also gain the operational authority to design your own inventory positioning, shipping cutoffs, and routing logic to protect Prime speed. When something breaks, the program forces you to correct it quickly, which is painful, but it also prevents silent degradation.

That is the core contrarian insight: SFP’s strictness is not a flaw. It is the mechanism that keeps Prime meaningfully fast because someone is actually accountable for the promise.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkFrequently Asked Questions

Does Amazon rebalance FBA inventory between fulfillment centers to maintain Prime delivery speed?

No. Amazon does not routinely rebalance FBA inventory between fulfillment centers to preserve two-day Prime delivery speed. Inventory can move for Amazon’s broader network reasons, but sellers should not rely on rebalancing as a consistent mechanism to protect two-day delivery in every region.

Why do Prime delivery times slow down on FBA listings when inventory exists elsewhere?

Because Prime speed is driven by where inventory is positioned, not whether inventory exists somewhere in the network. When the closest fulfillment node runs out, Amazon may ship from a farther node rather than moving inventory between nodes to preserve the two-day promise. That distance shift is what turns a two-day expectation into a four-day or five-day Prime estimate.

Why are Seller Fulfilled Prime sellers held to stricter delivery standards than FBA sellers?

Because under SFP, Amazon treats the seller as the responsible party for the Prime delivery promise. The program measures on-time delivery, tracking quality, and cancellations against strict thresholds and enforces them frequently. Under FBA, Amazon is the operator, so delivery outcomes are treated as network performance rather than a seller compliance metric, even when the customer experience resembles a service-level miss.

How do FBA inbound receiving delays affect inventory availability and stockouts?

Inbound receiving delays create a gap between “inventory shipped” and “inventory sellable.” Sellers can have units physically at Amazon facilities but unavailable for purchase while they wait in receiving or processing. Because there is no seller-facing inbound receiving SLA, that delay can be unpredictable, which increases the risk of stockouts, rank loss, and Prime delivery slowdowns that occur even when the seller replenished on time.

How much control do sellers have over returns when using Fulfilled by Amazon?

Less than most sellers assume. Under FBA, returns are handled through Amazon’s customer-optimized process, and sellers often have limited control over inspection, disposition, and recovery decisions. That reduced oversight can increase write-offs, make recovery workflows harder, and reduce visibility into return condition patterns compared to SFP, where returns flow back through the seller’s operation.

When does Seller Fulfilled Prime make more operational sense than FBA?

SFP makes more operational sense when delivery reliability and inventory control matter more than outsourcing convenience. If you have multiple fulfillment locations or a partner network, can meet strict one-day and two-day SLAs, and want direct control over inventory positioning, receiving speed, and returns recovery, SFP can deliver a more consistent Prime experience. It is not a shortcut. It is a model for sellers who are willing to run fulfillment as a disciplined operation and accept accountability in exchange for control.

Turn Returns Into New Revenue