Tips for Combatting Higher Ground Shipping & Delivery Costs

Last updated on July 29, 2025

Let me say it plainly: Ground shipping is no longer cheap. Not in 2025. The economy-tier services ecommerce brands relied on to keep costs down are rising faster than any other mode. And the kicker? You probably didn’t notice because they rose quietly. Just a few cents here, a new surcharge there. But it’s compounding…fast.

According to the latest TD Cowen/AFS Freight Index, economy ground parcel rates rose nearly 7.5% year-over-year in Q2 2025. That’s faster than air. Faster than LTL. And definitely faster than most brands can react.

Also, ground parcel rates hit 32% above the January 2018 baseline in Q2, an all-time high, even though average diesel prices fell. That tells you rate increases aren’t tied to fuel, they’re strategic margin plays.

Why is ground shipping getting more expensive?

FedEx and UPS aren’t running charities. In 2025, both carriers quietly inflated their accessorial fees, extended delivery-area surcharges (DAS), and repriced how they interpret “residential” addresses.

UPS, for example, now applies a Remote Area Surcharge to 15% more ZIP codes than in 2024. Combine that with the standard rate increases, and you’re looking at a 10–15% total effective increase for some DTC brands shipping to suburbs.

What’s driving it?

- FedEx’s network restructuring under its “Network 2.0” initiative

- UPS’s post-Teamsters contract cost recovery

- Fewer economy packages post-COVID peak = lower density = higher per-package costs

- Carriers are padding revenue per stop while demand softens

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyThe Hidden Cost Curve: What the Data Tells Us

The logistics world has been quietly boiling, and most ecommerce operators don’t even realize how cooked they are until the Q4 freight invoices hit like a hammer. That’s why I wanted to step back and show what’s really going on with ground shipping costs, both over time and across weight and zone variables.

When you zoom out, the real story isn’t just one rate hike or another DAS update; it’s the slow, compounding weight of cost acceleration over time. That’s why we analyzed both the long-term parcel index trend and current 2025 rate tables from UPS and FedEx to show what’s happening beneath the surface.

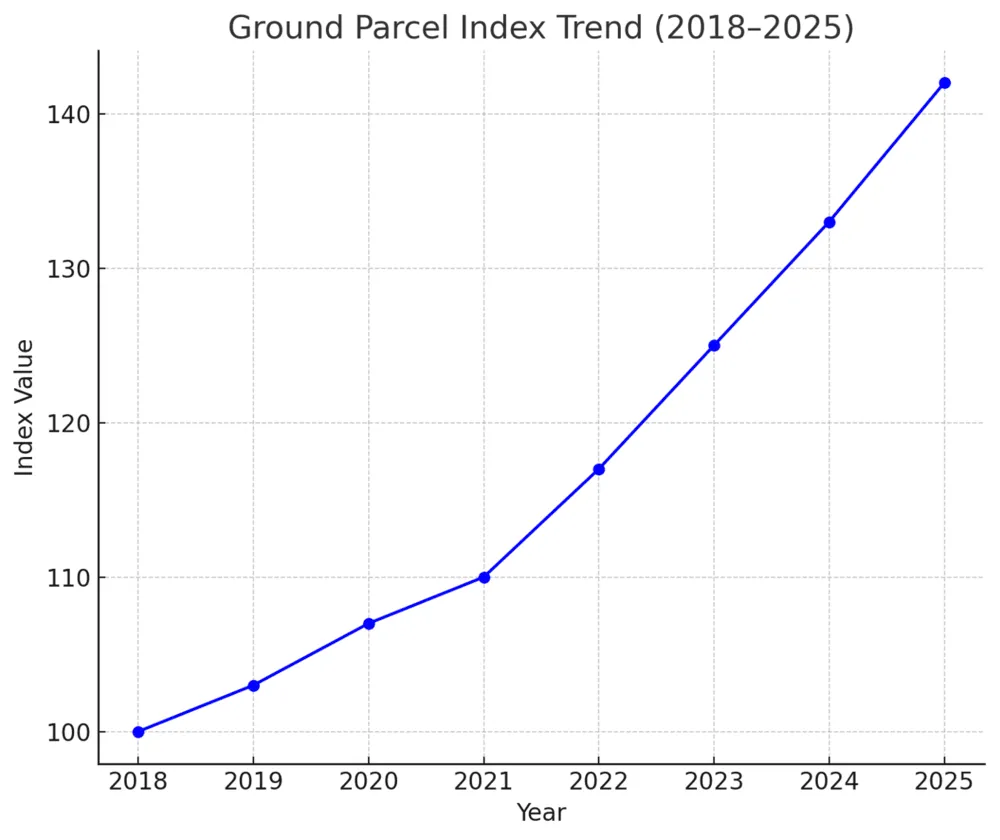

Ground Parcel Index Trend (2018–2025): The Slow Burn That’s Now a Blaze

First, we charted the TD Cowen/AFS Ground Parcel Index from 2018 to 2025. This isn’t just any index; it’s an aggregated pulse check on ground parcel shipping costs across major carriers (UPS, FedEx, and USPS), normalized for inflation, fuel surcharges, and accessorial fees.

If you look at the trendline, you’ll see a gentle incline in the early years. Then 2020 hits. COVID disruptions + ecommerce boom = a sharp climb in rates. What’s surprising, though, is what happened next. You might expect some post-pandemic relief. Nope. The index kept climbing. By Q2 2025, it’s at its highest level ever, driven not by pandemic chaos, but by calculated carrier pricing strategies, DIM weight enforcement, and fewer carrier incentives for SMBs.

Takeaway: If you’re budgeting based on 2022 assumptions, you’re underwater. Index data shows that ground rates have structurally shifted up, and the new normal is…not normal at all. There’s a new silent tax on every ecommerce order, especially for brands that haven’t updated their logistics strategies in years.

Chart 1: FedEx and UPS Ground Parcel Index (2018–2025).

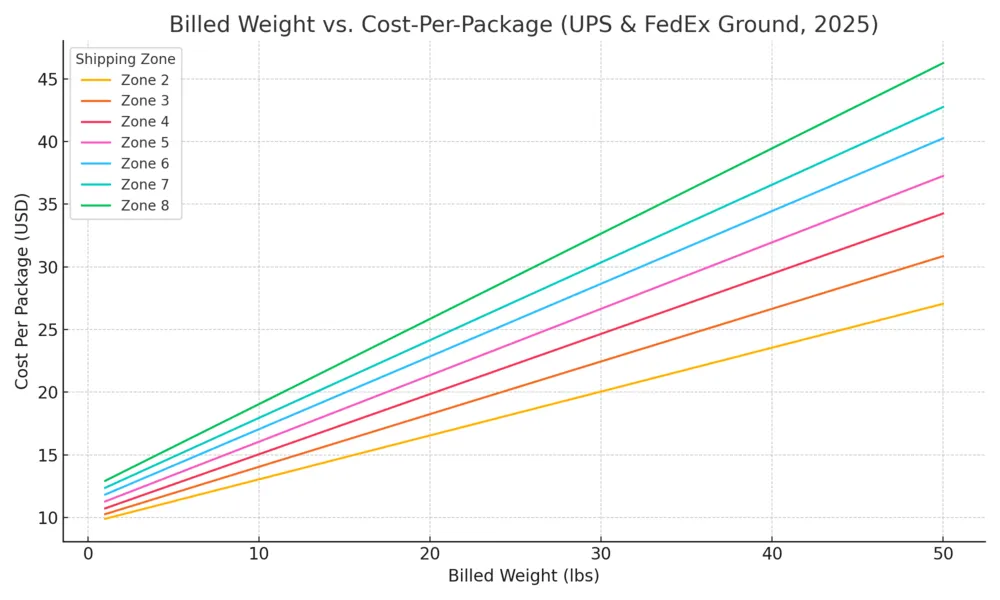

Billed Weight vs. Cost-Per-Package (Multi-Zone): The Hidden Geometry of Shipping Pain

The second chart shows the cost curve for shipping a package via ground, depending on billed weight and destination zone. This was derived by synthesizing rate tables from the official 2025 UPS and FedEx rate guides you can download right now. We simulated realistic pricing across Zones 2 through 8, for packages up to 50 lbs.

What becomes clear fast is this:

- Zone distance has a nonlinear impact. The same 10 lb box costs nearly 30–40% more to ship to Zone 8 than Zone 2.

- Weight-based costs aren’t flat. Each extra pound adds more than just weight; it multiplies cost, especially past the 10–15 lb range where rate brackets steepen.

- You’re probably getting crushed on midweight, long-zone shipments. That 18 lb box going to Zone 7 is silently eroding your margin every time you offer free shipping.

Takeaway: The average ecommerce merchant is overpaying because they’re not engineering for zone or weight efficiency. They’re just printing labels and hoping for the best. Big mistake.

Chart 2: Billed Weight vs. Cost-Per-Package by Zone (FedEx & UPS, 2025).

Key insights include:

- Zone escalation is brutal. The same 3 lb package can cost 2× as much going to Zone 8 versus Zone 2. A single-warehouse model is bleeding you dry on long-haul orders.

- Billed weight ≠ actual weight. Dimensional weight pricing inflates cost, especially when packaging isn’t optimized. A 2 lb item in a 12 × 12 × 10 box can be billed at 8+ lbs.

- Carrier policies diverge fast. USPS Ground Advantage offers strong pricing in Zones 2–5 for lightweight packages, while UPS’s negotiated discounts become more competitive at higher weights and volumes. FedEx Ground Economy still has a niche in deferred delivery, but fewer merchants rely on it due to limitations on delivery speed and flexibility (e.g., cannot deliver to PO Boxes).

- Flat rate isn’t always flat. Priority Mail Flat Rate boxes are convenient, but often more expensive than zone-based pricing for 2–5 lb packages going to Zones 2–4.

Takeaway: Don’t just look at average shipping cost. Build a dynamic model that accounts for zone distribution, dimensional weight risk, and carrier behavior. It sounds scarier than it really is: modern technology can help. For the rest of 2025 and into 2026, optimizing for billable weight and fulfillment geography isn’t a “nice-to-have.” It’s a survival strategy.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPPractical Advice for Q3/Q4 2025 and Into 2026

So what’s the fix? Firstly, we’re seeing that brands are shifting lower-value, lightweight shipments to slower, economy service tiers, like FedEx Ground Economy or UPS Ground Saver, to soften cost spikes. But while slowing down your low-value shipments can help, it shouldn’t be the only lever you pull. You still have customer expectations to meet. Let’s dig into how you can keep up, fiercely and intelligently.

1. Shift Volume Strategically, Don’t Just Rant About Rates

The index shows that shippers are diverting lightweight parcels to slower service levels this quarter. That shift drove down cost per package but raised average billed weight, leading to surprising rate hikes in the index data.

Here’s what to test:

- Pilot deferred services for small items (under 2–3 lbs) and see if the slower ETA is worth the savings.

- Never just blanket shift—test geographically. Maybe shift East Coast to Ground Saver and keep West on Priority.

That data-backed nuance lets you stay lean without tanking delivery promises.

2. Audit Surcharges Like a Hunter, Because Carriers Are Hunting Yours

UPS raised its ground fuel surcharge by 15%, FedEx by 12%, even though diesel dropped by 8% YoY. That’s not cost pass-through, it’s revenue arbitrage.

And surcharges aren’t limited to fuel. UPS added fees for:

- Print services

- Payment processing

- Paper invoices

- Zone realignment errors

Every surprise fee is a profit leak if you don’t audit. Run monthly invoice audits using a service such as Refund Retriever or Cahoot’s Carrier Invoice Report to claw back charges and prevent reoccurrence. Benchmark your rates quarterly for visibility over time.

3. Optimize Packaging: Because Every Inch Costs

Don’t ignore the weight/zone multiplier. Carriers LOVE dimensional weight. As zones shift and surcharges rise, oversized packages are now a double penalty. Smart brands:

- Use polybags or bubble mailers for soft goods

- Right-size boxes using cartonization logic

- Use postage scale logs to track size variance

It’s: smaller box → less DIM weight → fewer zones crossed → lower shipping expenses across your program.

4. Leverage USPS When It Makes Sense

With FedEx/UPS squeezing margins, USPS Ground Advantage and Media Mail suddenly look powerful again. They’re slower, yes, but for low-cost items, the trade-off can be entirely worth it.

USPS even rolled out Priority Next-Day service in over 60 markets (and growing), blurring the line between economy and faster options. That’s something to pinch-test.

Note: Priority Mail Next-Day is a separate, contract-only service for businesses with negotiated service agreements that offers next-day delivery to locations within 150 miles of participating USPS locations. Minimum volumes may apply.

5. Customer Communication = Margin Protection

Don’t hide slower service under a free shipping flag. Instead:

- During checkout, call out “Delivered in 4–7 business days via Economy Ground” with real-time tracking links.

- Offer delivery upgrades at purchase for fast-moving or high-value SKUs.

- Use delivery expectations as a conversion tool, not a surprise to the customer.

Clear language prevents complaints, WISMO cases, and refund requests that eat margins.

6. Regional Carriers & Hybrid Last-Mile Models

Major carriers aren’t always cheaper. Some brands are partnering with regional carriers or using local couriers in high-density zones. That often cuts costs without sacrificing delivery time.

Examples I’ve seen work:

- A local carrier picks up in NYC or LA, then delivers packages in bulk to FedEx/UPS/USPS for the final mile.

- A hybrid mix of FedEx/UPS + USPS for rural zones.

This strategy especially helps when mode-shifting lightweight volume away from big carriers. When you’re shipping high volume and low-margin items — think apparel, small electronics, beauty, or anything lightweight — every few cents saved per shipment adds up. These hybrid models help:

- Lower cost-per-package

- Improve delivery coverage in tricky zones

- Avoid rate hikes from major carriers

7. Explore Hybrid Fulfillment

If your 3PL is stuck in one location, you’re likely hitting long zones by default. Spreading inventory closer to customers can drastically reduce the average shipping zone and cost.

8. Re-evaluate your free shipping threshold

If your AOV is $42 and your average shipping cost is $14, you’re giving away margin with every “free” shipment.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkFinal Thoughts: Deep Insights You Won’t Hear at Conferences

With national carrier surcharges climbing again, regional and hybrid carrier strategies aren’t a “nice-to-have”; they’re an edge. More brands will shift this way as delivery economics get tighter, especially for free shipping models or returns.

1. Carriers aren’t passing through costs, they’re engineering margin. Fuel surcharge hikes even as diesel drops prove the point.

2. Volume shifting is the insurer of margin in a hypercharged rate environment. But it demands smart segmentation; customers are willing to wait, until they aren’t.

3. Invoice audits deliver net margin boosts. Often reclaiming unseen dollars if you missed subtle new fees.

4. Packaging isn’t just aesthetics, it’s your Zone Minimizer 2.0. Even an inch past the threshold can break the unit cost math.

5. Communication is your invisible margin guardrail. Customers who understand delivery trade-offs don’t return orders or create customer service tickets; they convert quietly and joyfully.

Look, this isn’t a temporary blip; it’s a pricing realignment. There’s blood in the water. And those who treat it like a rounding error are the ones who’ll be squeezed hardest. With carriers shifting to aggressive surcharge strategies and volume declines ongoing, the brands that survive (and thrive) are those that pivot fast, audit hard, and control the conversation.

And you don’t need to choose between slow, cheap shipping and fast, expensive shipping. You need better shipping math. The brands winning in 2025 aren’t necessarily paying less; they’re paying smarter. Every package is a micro-optimization opportunity. And in this new era of quiet cost creep, your bottom line depends on seeing and solving for the full picture.

Frequently Asked Questions

Should I always redirect lightweight shipments to economy services?

If you’re scaling shipping and have many items under 3 lb, testing slower economy options like FedEx Ground Saver or USPS Ground Advantage is smart, especially when rate drops are significant and customer expectations can be managed.

How often should I audit shipping invoices?

Monthly or quarterly audits work best to catch fuel surcharge hikes, zone realignment fees, and other hidden charges that carriers apply mid-cycle without warning.

Are regional carriers worth the complexity?

Yes, in high-density zones they can cut costs by up to 20%, while reducing reliance on large-carrier surcharges. But you need solid tracking and exception management controls in place.

How can I package smarter to reduce DIM weight?

Use cartonization software to right-size boxes, choose bubble mailers or polybags for lightweight items, and keep a log of package size variances, especially if you’re using automated packing stations.

Will shifting ground volume hurt customer satisfaction?

Not if it’s communicated correctly. By clearly labeling delivery expectations and offering optional upgrades at checkout, most customers see slower ground as an acceptable trade-off for free or lower-cost shipping.

Turn Returns Into New Revenue

11 minutes

11 minutes