Are Free Customer Returns Coming to An End?

The era of free ecommerce returns is undergoing increasing scrutiny as many retailers reassess and adjust their return policies as they face mounting financial pressures, environmental concerns, and changing consumer behaviors. Once a hallmark of customer convenience, free and unlimited returns became the cornerstone upon which customer trust and loyalty was earned and purchases derisked. Now, these retailers are part of a growing trend where about 40% of retailers are now charging return fees, up from 31% in 2022, according to Narvar research. This shift could redefine the industry, marking a pivotal moment in the relationship between online shoppers and retailers.

The Financial Burden of Returns

Returns have become one of the most challenging financial burdens in e-commerce. Projections for 2024 suggest U.S. retailers will endure losses exceeding $100 billion annually due to returns, contributing to an estimated $890 billion global economic impact. Processing returns often incurs costs surpassing 30% of the product’s original price, encompassing transportation, restocking, and operational expenses. Seasonal and rapidly obsolescent items, as well as items damaged in transit, further exacerbate these losses and erode profitability, compounding the financial strain.

The rapid growth of ecommerce through the pandemic has intensified this issue, but now that the online shopping rate is returning to the mean, the returns rate hasn’t followed suit. Categories such as apparel and electronics are particularly affected where sizing issues and unmet expectations drive higher returns.

The Environmental Impact

Beyond financial implications, the environmental impact of returns is staggering. In the United States alone, returned goods generate an estimated 9.5 billion pounds of landfill waste annually and contribute 24 million metric tons of carbon dioxide emissions. Many returned items cannot be resold as new, often ending up in liquidation channels or being discarded entirely. This unsustainable cycle is prompting retailers to factor eco-friendly considerations into their return strategies.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyEvolving Returns Policies

To mitigate these challenges, retailers are tightening return policies. Strategies include shorter return windows, fees for mail-in returns, and restocking charges. Leading brands like American Eagle, DSW, and H&M are at the forefront of these changes, signaling a departure from lenient practices of the past (see a larger list of retailers charging e-commerce return fees in December 2025, which is by no means exhaustive, at the bottom of this article). Even Amazon started charging $1 for certain return types.

Some retailers are also exploring innovative solutions to mitigate return rates. Technologies like augmented reality (AR) and virtual try-on tools aim to improve purchasing accuracy, reducing the likelihood of returns. Enhanced product descriptions, interactive sizing guides, and AI-driven recommendations are further helping customers make more informed choices.

Another emerging trend is the adoption of “returnless refunds,” where customers are allowed to keep items that are not economically viable to process as returns. While this reduces logistical costs, it raises questions about waste and sustainability, as well as abuse by bad actors, highlighting the need for balanced approaches. But there are very real instances where the “Keep It” approach makes sense. Low-cost/low-margin items, for example. Or, when there are sanitary concerns and items cannot be resold; such as food, undergarments, and pillows.

Avoid Policies That Are Too Strict

Many online stores are simultaneously making their return rules stricter to stave off returns fraud. They might ask for proof of purchase, shorten the return window, or create tough return conditions. While this sounds like a good way to prevent financial losses, it often backfires.

Customers really care about how easy it is to return things. If a store makes returns too difficult, many shoppers will simply stop buying from that store. These practices may be intended to deter wardrobing and bracketing that lead to returns without question, but they frequently alienate customers by failing to account for shopping histories and past loyalty. Plus, people get frustrated when returns are complicated, take too long, or seem unfair. Even customers who used to love a brand might walk away if they have a bad return experience. And inconsistent policy enforcement undermines trust and deters repeat purchases, even among previously loyal customers.

The good news is that stores can protect themselves from fraud without pushing customers away. The best approach is to use smart technology to understand different types of customers, monitor patterns, etc. Some shoppers return items more often than others, but that doesn’t mean they’re trying to cheat the system. By creating flexible return policies that treat loyal customers well, stores can actually make more money in the long run. The key is finding a middle ground. When stores get this right, customers feel valued and are more likely to maintain brand affinity.

Aligning Customer Expectations and Merchant Realities

While consumers remain attached to the convenience of free returns, their expectations are gradually adapting to new retail realities. Surveys reveal that flexibility and transparency are more valued than free returns. Clear communication about return policies, quick refund processing, and multiple return options are becoming critical components of the post-purchase experience, and ultimately, customer satisfaction. And when return fees are employed, the key is to make them reasonable; perhaps introduce them slowly and increase them over a long period of time.

Retailers are also leveraging behavioral insights to enhance return strategies. The “refund effect”, where customers receiving swift refunds are more likely to make additional purchases, is a key consideration. By optimizing refund processes such as offering incentives for exchanges, or offering gift cards that have a slightly higher value than the original purchase to keep the item, rather than return it, retailers can retain customer loyalty while mitigating costs.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPA Balanced Approach

The future of ecommerce returns lies in finding equilibrium between consumer convenience and economic sustainability. Retailers are expected to continue refining policies, potentially introducing tiered return structures where loyal customers or higher-value purchases receive more lenient terms. Technologies that predict return likelihood based on purchase history or provide real-time feedback during the buying process may further reduce return rates.

Environmental sustainability will also play a more prominent role in shaping returns strategies. Partnerships with recommerce platforms, investments in circular economy initiatives, and improvements in reverse logistics can help align business objectives with environmental responsibility.

A Sustainable Path Forward

The e-commerce return ecosystem is not collapsing but evolving toward greater efficiency and balance. Retailers are navigating a delicate path, aiming to uphold customer satisfaction while safeguarding profitability and addressing ecological concerns. The era of unrestricted, free returns is giving way to a more nuanced model that prioritizes thoughtful consumption and sustainable practices.

As this transformation unfolds, the key to success will lie in innovation, transparency, and adaptability. By embracing these principles, retailers can forge stronger connections with consumers while fostering a more sustainable and economically viable future for e-commerce.

Table 1. Returns Fees Charged by Well-Known Retailers in December 2024.

| Retailer/Brand | Returns Fee |

| Abercrombie & Fitch | All customers: $7.00 |

| American Eagle Outfitters | All customers: $5:00: (excluding specific categories) |

| boohoo | All customers: $6:00 |

| Dillard’s | All customers: $9.95 |

| DSW | Non-Members: $8.50; Gold or Elite members: Free |

| H&M | Non-Members: $5.99; H&M Members: $2.99 |

| JCPenney | All customers: $8.00 |

| J.Crew | All customers: $7.50 |

| Kohl’s | All customers: Kohl’s does not pay return shipping costs |

| Macy’s | Non-Members: $9.99; Star Reward Members: Free |

| Oh Polly | All customers: From $2.99 for store credit to $9.99 |

| PrettyLittleThing | All customers: $7.00 |

| REI Co-op | All customers: $7.99 |

| Saks Fifth Avenue | All customers: $9.95 |

| T.J. Maxx | All customers: $11.99 |

| Urban Outfitters | All customers: $5 |

| Zara | All customers: $4.95 |

Turn Returns Into New Revenue

Related Blog Posts

Amazon’s New Shipping & Delivery Policies, Key Changes and Their Implications

In this article

6 minutes

6 minutes

Amazon continues to set the pace for customer satisfaction and delivery expectations. As we approach the latter half of 2024, Amazon is rolling out significant changes to its shipping and delivery policies that will impact Sellers across the platform. These updates aim to enhance the customer experience by ensuring faster, more accurate delivery times while also providing tools and guidance for Sellers to meet these new standards. Let’s dive into the key changes and what they mean for Amazon Sellers.

The Importance of On- Time Delivery

Amazon’s focus on fast and accurate delivery is not new, but it’s becoming increasingly important to the marketplace operator. It’s well known that the delivery speed and reliability of the delivery date expectation set during checkout are major factors in customers’ purchasing decisions. To meet this expectation, Amazon will be rigorously enforcing a new on-time delivery rate (OTDR) policy that will directly affect Sellers’ ability to list products on the marketplace.

Starting September 25, 2024, Sellers will need to maintain a minimum 90% OTDR without promise extensions to continue listing seller-fulfilled products on Amazon.com. This policy change underscores the importance of reliable shipping practices and puts the onus on Sellers to meet customer expectations. For optimal performance, Amazon recommends maintaining a 95% or higher OTDR for all seller-fulfilled orders.

It’s worth noting that this policy doesn’t apply to Fulfillment by Amazon (FBA) orders where Amazon is responsible for meeting delivery promises. However, for Sellers managing their own fulfillment, this change could have significant implications.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyUpdates to Transit Time Settings

To help improve OTDR and the reliability of delivery date promises made to customers, Amazon is reducing the number of transit days allowed for both Standard and Free Economy shipping options in shipping templates.

Some Sellers may have already noticed an update to the transit time requirements which became effective August 25, 2024. For Sellers shipping from the continental United States (excluding Hawaii, Alaska, and US territories), the maximum transit time allowed for Standard Shipping has been reduced to 5 days, while Free Economy shipping will have a maximum of 8 days.

There’s an important caveat for media items such as books, magazines, and DVDs. These products will continue to have a maximum transit time of 8 days for Standard Shipping. Sellers should pay close attention to their product categories to ensure compliance with these new transit time limits.

For those offering Free Economy shipping, Amazon has already adjusted max transit times in shipping templates from the previously allowed 5 to 10-day range to the new 4 to 8-day requirement. While no action is required from Sellers, they continue to have the option to disable Free Economy shipping if they prefer not to offer this service within the new timeframe.

Introduction of Automated Handling Time

Perhaps the most significant change for many Sellers will be the introduction of Automated Handling Time (AHT), set to take effect on September 25, 2024. AHT will use historical shipping data to set more accurate handling times for each SKU based on how long a Seller has typically taken to ship it in the past. For new products without historical data, AHT will default to the manually configured handling time.

This automation aims to provide customers with faster and more accurate delivery date estimates, potentially leading to increased sales for Sellers. However, it also means that Sellers will need to consistently meet these handling time expectations to maintain an acceptable OTDR. AHT will automatically take Order Handling Capacity into account (the maximum number of orders that have been fulfilled in the past 90 days) and adjust delivery promises to reflect longer handling times accordingly; the objective is to avoid overburdening Sellers with shorter handling times that cannot be met.

This feature will be automatically enabled for Sellers who currently have a handling time gap of 2 days or more compared to their actual shipping performance (Sellers can find their current handling time gap here). AHT is already available in the Order Handling Settings for Sellers that want to test how the new setting will affect their fulfillment workflows in advance of the September 25th obligation.

It’s important to note that handling time only considers business days, excluding weekend days unless weekend operations are intentionally enabled in Order Fulfillment settings.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPAHT for Seller Fulfilled Prime Orders

For Prime orders that have one-day or two-day delivery expectations, the same-day handling time will continue to apply. Prime orders with standard delivery will default to a one-day handling time, unless a same-day default handling time is configured at the account-level, in which case, Prime orders with standard delivery would have a same-day handling time.

Exceptions and Protections

Amazon recognizes that certain products, such as custom-made and/or personalized items, certain media, and heavy or bulky goods, may require more flexible handling times. Sellers can request exceptions for these types of SKUs, allowing them to set manual handling time overrides. However, it’s important to note that exempted SKUs will not receive OTDR protection from late deliveries. OTD protection will be available to provide a safety net for Sellers as they adjust to the new policies.

To qualify for OTDR protection, Sellers must meet three conditions:

- Have Shipping Automation (SSA) enabled on the relevant shipping template. SSA helps set accurate delivery dates through automated transit time calculations based on preferred shipping services. (Learn More)

- Have AHT enabled on their account. (Learn More)

- Purchase “OTDR protected” Standard Shipping services through Amazon Buy Shipping

Preparing for the Changes

With these significant updates, Sellers should take proactive steps to prepare:

- Review current shipping practices and identify areas for improvement.

- Get familiar with the new transit time and handling time requirements.

- Consider enabling Automated Handling Time if it’s not already active to analyze how the required changes will impact business operations and workflows before the September 25th deadline.

- Evaluate product catalogs to determine if any items might qualify for handling time exceptions. Contact Seller Support and request that a ticket is created to have Handling Time exceptions applied to the list of SKUs.

Looking Ahead

Meeting customer expectations for fast and reliable order delivery is more crucial than ever. Amazon’s new policies reflect this reality, pushing Sellers to optimize their fulfillment processes or risk losing visibility on the marketplace. While these changes may present challenges, they also offer opportunities for Sellers to streamline their operations and potentially increase sales through improved delivery promises. Staying informed and continuously monitoring performance will help Sellers to ensure continued success on the Amazon marketplace.

Turn Returns Into New Revenue

Neighborhood Forest Partners with Cahoot to Make Earth Day a Little Greener

In this article

Cahoot fulfillment announced today that it is partnering with Neighborhood Forest for the second straight year to efficiently distribute trees to children around the U.S. for Earth Day.

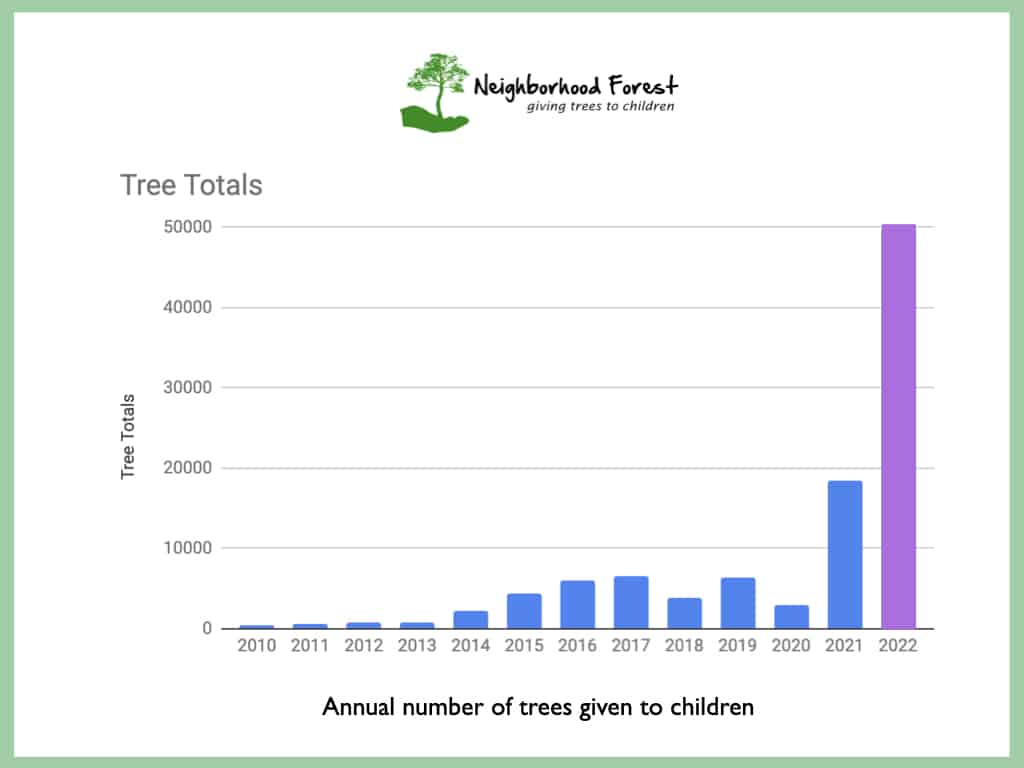

Neighborhood Forest is a non-profit with a simple mission: give every child the priceless joy of planting and watching trees grow. By doing so, they help beautify neighborhoods, put a dent in our carbon footprint, and instill a sense of magic, wonder, and love for the planet in our little ones. They have helped children plant over 100,000 trees since their inception in 2010, but this year will be special: they’re gearing up to give out a record 50,000 trees across 46 US states, Alaska, and Canada!

Source: Neighborhood Forest

Their growth is inspiring, but it also comes with a challenge. How can they efficiently distribute so many trees across the entire nation with a lower carbon footprint? After all, the carbon emissions from transportation are considerable, and we want to absolutely minimize them to support Neighborhood Forest’s mission.

Environmental, social, and corporate governance (ESG) is becoming increasingly prominent in today’s world as forward-thinking leaders and brands seek to help solve the world’s most pressing challenges. According to Bloomberg, ESG investment has exploded in the last five years, growing more than 10x from $144 billion in 2016 to $1.64 trillion in 2021. Limiting emissions to protect our environment is a core principle of ESG leaders.

Cahoot fulfillment services should be on the shortlist for brands that recognize the importance of ESG.

Cahoot’s innovative nationwide fulfillment network dramatically cuts down the distance that packages need to travel for their final mile shipping, the least efficient part of the logistics process. By strategically placing inventory across the country, businesses and non-profit organizations alike can deliver items quickly while using sustainable and low-cost ground shipping. This makes Cahoot the perfect partner for Neighborhood Forest, because we minimize the cost and emissions of distributing trees for Earth Day.

Make Returns Profitable, Yes!

Cut shipping and processing costs by 70% with our patented peer-to-peer returns solution. 4x faster than traditional returns.

See How It WorksCahoot Founder and CEO Manish Chowdhary elaborates, “At its heart, Cahoot makes ecommerce and shipping greener. Ground shipping produces 85% less CO2 emissions and costs up to 50% less than air cargo. It’s a win-win for the planet, the merchant, and the end consumer whenever we optimize an order!”

With more than twice as many trees set to go out this year than last year, those emissions savings add up quickly.

Vikas Narula, Founder of Neighborhood Forest, added, “We love Cahoot! They have helped us with very large, complicated logistics, fulfillment and shipping problems, which have greatly enabled us to scale and grow our operation exponentially. Best of all, we’re doing it affordably and sustainably. I don’t know where we would be without Cahoot..”

It may have been fate that brought Cahoot and Neighborhood Forest together – Katie Strand used the word “cahoots” in her fantastic “I Love Trees” song that was dedicated to trees, Neighborhood Forest, and Earth Day.

Want to get involved with a fantastic organization that’s dedicated to helping make our planet greener? You can sign up to get trees from Neighborhood Forest here, and help them fund the tree delivery here.

ABOUT CAHOOT

Cahoot provides eCommerce order fulfillment services that power nationwide 1-day and 2-day deliveries at the lowest cost by design. Cahoot offers lower fulfillment fees because it enables merchants to fulfill for other merchants. Despite the low price, Cahoot’s service offers the highest SLA in the industry thanks to its top-class merchant fulfillment partners and robust software. Contact Cahoot to learn more about how they can boost your store’s profitable growth.

ABOUT NEIGHBORHOOD FOREST

Neighborhood Forest was founded in 2010 by Vikas Narula. When he was a college student in the early 1990s at Maharishi International University (Fairfield, Iowa), he learned of a free tree project started by David Kidd of Ohio. Vikas and his college friends adopted the program and gave away tens of thousands of trees to schoolchildren across southeast Iowa. What began with four schools in Minneapolis has grown to over 800 schools, libraries, and youth groups in 46 states across America and Canada. Neighborhood Forest’s goal is to reach every child in North America and, eventually, the world.

How to Prepare for 2020 Recession: 14 Strategies for Ecommerce Businesses & Online Sellers

In this article

What Ecommerce Companies and Marketplace Sellers Can Do Now to Prepare for the Upcoming Slowdown in 2020

The US economy has been in an expansion period for 11 years, the longest time in the history of the nation. Recessions are cyclical and come back every number of years. Around half of the nation’s business economists predict a recession in the US economy by the end of 2020. And for the first time since 2008, on July 31 this year, the Federal Reserve slashed interest rates as a precautionary measure to reduce 2020 recession risks.

Another early warning signal of a possible 2020 recession is fewer freight shipments across the country. The Cass Freight Index is showing a decline in goods shipped via truck, rail, and air from growing at 7.2% in June 2018 to a drop of 6% in June this year after consistently slowing down since last year. This downturn is different from that in 2015 and 2016 because it’s not caused by oil-related freight but an overall decline across methods. The economy is also showing a slowdown of GDP growth to 1.8% in Q1 2019 versus 3.1% the previous year. Such contraction is consumption also an early indicator of a possible recession. Economic output in Germany, the world’s fourth-largest economy, contracted in the second quarter, according to a report on Aug 14, while a report on factory output in China, the second-largest economy, came in lower than expected.

To add to the deepening global economic slowdown, the U.S. will impose a 10% tariff on the remaining $300 billion worth of imports from China on “certain articles”, originally slated to take effect Sept. 1, now delayed to Dec. 15. These include cell phones, laptops, some toys and some footwear and clothing. Retail executives on earnings calls have warned about the effects of these tariffs on their businesses, noting the potential for eroding margins and higher costs being passed on to consumers.

Last two recessions started the downfall of departmental stores while e-commerce was still in a growth stage. Online sellers have enjoyed unprecedented growth during the economic expansion while the departmental stores continued to struggle. The next recession will test the now widespread online businesses for the first time as the marketplaces are becoming saturated.

Turn Returns Into New Revenue

Amazon to Cut Smaller Wholesale 1P Suppliers

In this article

Two months ago, Amazon.com Inc. halted orders from thousands of suppliers with no explanation. Panic ensued — until the orders quietly resumed weeks later, with Amazon suggesting the pause was part of a campaign to weed out counterfeit products. Suppliers breathed a sigh of relief.

Now a larger, more permanent purge is coming that will upend the relationship between the world’s largest online retailer and many of its long-time vendors. Generally speaking, vendors selling less than $10 million in products each year on the site will no longer get wholesale orders from Amazon in the next few months, although that will vary by category, said the people, who requested anonymity to speak about an internal matter. Amazon’s aim is to cut costs and focus wholesale purchasing on major brands like Procter & Gamble, Sony and Lego, the people said. That will ensure the company has adequate supplies of must-have merchandise and help it compete with the likes of Walmart, Target and Best Buy.

The mom-and-pops that have long relied on Amazon for a steady stream of orders will have to learn a new way of doing business on the web store as a 3P seller. Rather than selling in bulk directly to Amazon as a 1P seller, they’ll need to win sales one shopper at a time. It’s one of the biggest shifts in Amazon’s e-commerce strategy since it opened the site to independent sellers almost 20 years ago. While the plan could be changed or cancelled, it’s currently moving forward, the people said.

Turn Returns Into New Revenue

Google Moves into Amazon Marketplace’s Turf

In this article

Google is positioning itself as a direct Amazon Marketplace competitor with a revamped e-commerce offering. Shoppers will have a personalized homepage on the existing Google Shopping tab, where they can filter results based on features and brands, read reviews, and watch videos about products.

For example, if a shopper is looking for headphones, they can filter for wireless and a preferred brand.

The blue shopping cart on the item shows shoppers they can seamlessly purchase what they want with returns and customer support, backed by a Google guarantee. This new shopping experience will merge select features of the Google Express e-commerce service with the Google Shopping online product search and price comparison platform.

Turn Returns Into New Revenue

Walmart to Offer Next-Day Delivery Without a Membership Fee

In this article

Marc Lore, president and CEO of Walmart eCommerce, announced that Walmart will begin rolling out next-day delivery for more than 220,000 items on its website, including pet food, diapers, paper towels and laundry detergent, this week.

The nation’s largest retailer said Tuesday it’s been building a network of more efficient e-commerce distribution centers to make that happen.

Customers must spend at least $35 to be eligible for next-day delivery. “NextDay” delivery will be available first to Walmart.com customers in Phoenix and Las Vegas, Lore said, and will expand to Southern California later this month.

NextDay delivery is a being positioned as a complement to Walmart’s same-day Grocery Pickup and Delivery options, and free two-day shipping on millions of items. The program figures to boost Walmart’s e-commerce sales.

Turn Returns Into New Revenue

Amazon Wants to Help Its Employees Quit and Start Delivery Businesses

In this article

Amazon announced that it wants to help its employees quit — so they can start their own delivery businesses. Tthe e-commerce giant said that it’s expanding its Delivery Service Partner program to include an incentive for current Amazon workers

The program promises up to $10,000 in startup costs for employees who partake in the program. Amazon is also throwing in the equivalent of three months of an employee’s most recent salary to help soon-to-be entrepreneurs get their fleet of delivery cars off the ground.

The program is Amazon’s solution to its last-mile delivery problem where the company is trying to compete with legacy players like UPS and FedEx.

Turn Returns Into New Revenue

Post Office Wants to Shift Focus from Mail to Ecommerce Deliveries

In this article

USPS has floated a new proposal to Congress that would see it reducing mail delivery from six to five days a week while expanding packaging deliveries to seven days.

The shipping world has changed dramatically over the past decade. Since 2007, total U.S. mail volume has declined 31% to 146 million pieces, including a 41% drop in first-class mail, its most profitable product. At the same time, ecommerce has exploded, offering a way to plug the lost revenue while also adding burden to USPS operations as it handles more packages. USPS has already started to dip its toes into 7-day a week delivery to manage the 20 million packages it averages daily. It now delivers some Amazon.com packages on Sundays and also other ecommerce retail fulfillment during the busy Christmas holiday season.

The agency lost $3.9 billion in 2018, its 12th straight year of losses. According to the agency, this move better reflects the market conditions and would save it billions of dollars per year. Republican and Democratic members of Congress, however are opposed to making a change to mail deliveries.

Turn Returns Into New Revenue

70% of Consumers Worry About the Environment, While 52% Have Changed What They Buy

In this article

American consumers are prepared to reward manufacturers, retailers, and others offering products that benefit the environment as long as any additional costs associated with providing those benefits are not transferred to them in the form of higher prices.

Earth Day 2019, an A.T. Kearney study of 1,000 US consumers’ sentiments on environmental benefit claims found that more than 70% of consumers consider their impact on the environment when shopping. But, even as topics like climate change continue to make headlines, only 52% have shifted their purchase decisions—although this is improving, with 66% intending to shift within the year. Why haven’t they changed? The answer is they want the businesses that serve them to change first.

While nearly 80% of respondents would consider delayed shipping if the environmental benefit was clearly articulated, they are unlikely to settle for higher costs in exchange for environmental benefits.

“What we see in these findings is that the consumer market may be more receptive to buying green products than they were in years past,” said Greg Portell, an A.T. Kearney partner involved in the study. “But, they don’t want to sacrifice quality or pay higher prices to benefit the environment.”

Turn Returns Into New Revenue