The Ultimate Guide to Selling and Winning on Amazon Seller Fulfilled Prime

Last updated on May 14, 2025

In this article

31 minutes

31 minutes

- What is Seller Fulfilled Prime?

- SFP – Now More Relevant For Sellers Than Ever Before

- Diversify Beyond FBA

- Seller Fulfilled Prime – An Essential Tool for Ecommerce Growth

- The Competitive Advantages of Seller Fulfilled Prime

- Succeeding at SFP is Hard – Here’s Why

- The Cheat Sheet for Winning at Seller Fulfilled Prime

- Frequently Asked Questions

Watch On-Demand Webinar:

Amazon SFP – How To Sell and Win

In June 2023, Amazon announced they would reopen enrollment for their Seller Fulfilled Prime (SFP) program. Like most things in the Amazon world, the news was received with mixed reactions by Sellers. For those familiar with the Amazon ecosystem, they know that this program is challenging. Many feel the list of requirements is daunting and that Amazon holds them to higher standards than the ones it sets for its in-house Fulfilled By Amazon (FBA) logistics network.

Most people are familiar with the requirements that Amazon expects Sellers to meet, but far fewer are aware of the roadblocks that make success hard to achieve. An even smaller number are aware of the strategies they can deploy to meet Amazon’s criteria and surpass them. We’ve outlined all of that and more in our Ultimate Guide:

- We start by helping you understand what the program actually is and its benefits.

- Despite the daunting SFP requirements, the reward can be immense – we highlight the value that success in the program can deliver to your business.

- However, SFP success is not easy, and many Sellers find the program extremely challenging – we do a deep dive into the most common stumbling blocks that trip up even experienced Amazon merchants.

- Finally, we give you an essential cheat sheet needed to start selling and winning on Amazon Seller Fulfilled Prime!

One critical aspect to consider is the Seller Fulfilled Prime cost. Understanding the financial implications, including the program fee per item sold, percentage fees, and minimum fees, is essential for assessing potential profitability and managing profit margins effectively.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWhat is Seller Fulfilled Prime?

Before we do a deep dive, it’s essential to understand – what is the Seller Fulfilled Prime program?

Definition and Benefits of Seller Fulfilled Prime

Seller Fulfilled Prime (SFP) is a program offered by Amazon that allows third-party Sellers to display the Prime badge on their listings while maintaining control over their fulfillment process. This means sellers can ship Prime orders directly to customers within two days, ensuring fast and reliable delivery. By participating in SFP, sellers can significantly boost their visibility, credibility, and sales potential, all while providing an enhanced customer experience.

The benefits of SFP include:

- Increased Visibility and Credibility: Listings with the Prime badge are more likely to be seen and trusted by customers.

- Greater Control: Sellers have more options and control over their fulfillment process and inventory management compared to using Fulfilled by Amazon (FBA).

- Brand Building: Sellers can build their brand, including flexibility to provide unique experiences for customers, such as custom packaging, while maintaining Prime status.

- Increased Sales and Profits: The Prime badge can lead to higher sales and better profit margins.

- Amazon’s Customer Service: Access to Amazon’s customer service and support for handling customer service inquiries, but the ability to own customer service if desired.

- Lower Fees: Freedom from the high fees associated with Amazon FBA.

- Improved Support for Challenging SKUs: The ability to meet the consumer expectation for free and fast shipping even on slow-moving, seasonal, larger-sized, and heavier SKUs.

While all these are great, the biggest one for any Seller is that the program allows your product listings on the Amazon Marketplace to feature the coveted Prime badge. With over 180 million subscribers in the United States in 2025, Amazon’s loyalty program has a great promise for the end customer – pay $139 (plus taxes) annually, and Amazon will deliver you stuff for free in under two days.

The program has far more profound implications for Sellers – their ranking on Amazon search results and ability to win the “Buy Box” is heavily and positively influenced by ensuring their products are Prime eligible. It’s also no secret that most shoppers on Amazon toggle the filter when browsing the store just to see products that qualify for Prime. All this means that an Amazon merchant’s survival, let alone success, largely depends on ensuring each SKU is Prime-eligible.

Seller Fulfilled Prime offers Sellers the best of both worlds – the Prime badge and autonomy over order fulfillment. However, it isn’t all smooth sailing, and Sellers have tended to shy away from the program because of its exacting standards. However, there are indications that the present time is a good one to begin seriously considering enrolling in the program.

“Cahoot has amazing technology in addition to their large warehouse network, sort of like FBA but without the hefty fees or restrictions. Cahoot saved our peak-selling season!”

~ Joel Frankel, Fames Chocolates

Speak to a fulfillment expert

How Seller Fulfilled Prime Works

To participate in SFP, sellers must meet Amazon’s stringent performance requirements. These include:

- Own Warehouse: Sellers must have their own warehouse, (or partner with a robust and capable modern 3PL), and an Amazon Professional Seller account.

- Premium Shipping Options: Offering premium shipping options to customers.

- Exceptional Performance Metrics: Consistently exceeds for the On-Time Delivery, Valid Tracking, and Delivery Speed metrics while maintaining a very low Order Cancellation Rate.

- Supported Carriers: Delivering orders with Amazon’s approved Seller Fulfilled Prime carriers.

- Amazon Returns Policy: Agreeing to the Amazon Returns Policy.

Sellers must also complete a trial period, during which they must fulfill at least 100 Prime packages while adhering to all of Amazon’s strict shipping requirements. Once the trial period is successfully completed, the Prime badge will be displayed on their listings, granting access to Prime customers. More on this later.

SFP – Now More Relevant For Sellers Than Ever Before

Several reasons have combined to make Seller Fulfilled Prime more relevant than ever before for Sellers, some of Amazon’s own making along with others that are not as palatable to the company:

The “Prime Effect”: Everybody Wants Fast Shipping

When Amazon first introduced Prime in 2005, it announced that it would ship customer orders over $35 for free in 2 days. At the time, people in the industry thought that the company had lost its mind and that this strategy would surely fail. It took competitors over a decade to offer free 2-day shipping – retailers like eBay and Walmart introduced their competing services only in 2017.

However, when Prime moved from its 2-day timeline to free 1-day shipping in 2019, Walmart and BestBuy responded almost immediately, offering customers the same experience. That captures just how much Amazon has raised the bar and redefined customer expectations – the Prime effect means that all of us expect everything delivered in under two days for free.

The stakes are high for ecommerce merchants across every channel – it does not matter whether you serve customers through a Shopify storefront, eBay, Amazon, or Walmart – you have to meet the consumer expectation for fast order fulfillment.

Shipping is no longer a back-office operation; it has become the defining element of the customer experience.

The company that created the Prime Effect is arguably the most customer-obsessed organization in the world. For years, Amazon has focused relentlessly on creating value for its customers – often at the expense of Sellers on its platforms. At every turn, the company has weaponized the size of its customer base and the network effects of its marketplace model to squeeze Sellers while delighting customers.

People, regulators, and governments aiming to call out the company on some of these practices have been met with a frequent refrain, “As long as the end customer is happy, how does it matter?” But why are customers so happy with Amazon, and how does the company have so many of them (most of whom are Prime members)? The most important reason is Amazon’s ability to ship products in under two days, nearly always on time.

“Cahoot allows us to offer 2-day shipping on our website in addition to driving more sales nationwide SFP on Amazon. This app saves us a ton of time and money every single day!”

~ OZ Medical

Speak to a fulfillment expert

Diversify Beyond FBA

For Sellers operating on Amazon, the approach has often been relatively straightforward: let Amazon FBA take care of it all and only use Fulfilled By Merchant (FBM) or SFP as a backup in the rare event of an emergency. However, given how FBA has repeatedly proven to quickly and substantially change program requirements and fees, a backup may no longer suffice – Sellers may need to devise an entirely new order fulfillment strategy.

Sellers Have Traditionally Relied on FBA

According to Jungle Scout, 64% of Amazon Sellers use FBA exclusively to deliver their orders, with only 14% choosing to completely cut ties with FBA and handle everything independently.

There are good reasons for this – the algorithm determining whether a product listing will win the Buy Box uses fast order fulfillment as a leading criterion. The fact that FBA listings are automatically Prime eligible is attractive for many Sellers (SFP listings also have a great chance to win the Buy Box, while merchant-fulfilled non-Prime orders trail well behind).

The well-known A10 algorithm, which ranks products in search results on Amazon, also prefers listings with fast order fulfillment, which has led Sellers to lean in heavily on FBA (again, a Seller Fulfilled Prime order can show up favorably, subject to the merchant doing other things right, such as optimizing for the right keywords in their product detail page copy).

The question Sellers might ask is: why would I do all the extra work required by SFP listings when it’s easier to win the buy box and rank well with FBA alone? To answer the question with a question: why not both? Not only do you get more shots on the Buy Box goal, but SFP listings typically sell for 15 – 20% more, plus increased discoverability and conversion compared to non-SFP FBM listings (82% of Sellers are offering both FBA and FBM versions of their listings).

So, why not all three? If you like FBA, continue to sell on FBA, but add SFP to your FBM listings and some will sell at the higher price and you’ve done nothing other than duplicate your listings. When the 180 Million Prime members apply the Prime-only filter when browsing for products on Amazon, they do it for no other reason than fast and free delivery. Will you be there to sell to them?

Seller Fulfilled Prime – An Essential Tool for Ecommerce Growth

Well, technically, you do have more to do than just duplicate your listings. You have to fulfill the orders with fast and free shipping, and you must meet the uncompromising performance metrics.

Seller Fulfilled Prime Requirements

- Maintain an On-Time Delivery Rate greater than 93.5% (A delivery is on time if it is delivered on or before the delivery date promised to the customer when they checkout).

- Maintain a Valid Tracking Rate (VTR) higher than 99% – a package has Valid Tracking if it has at least one carrier scan. This scan must occur before the package is delivered to ensure it provides a tracking number that can be used by the customer to track their order.

- Any product linked with a Prime shipping template must offer a minimum shipping speed of 3-5 days to the contiguous United States (the lower 48 states), across all 3 size tiers: Standard, Oversize, and Extra Large.

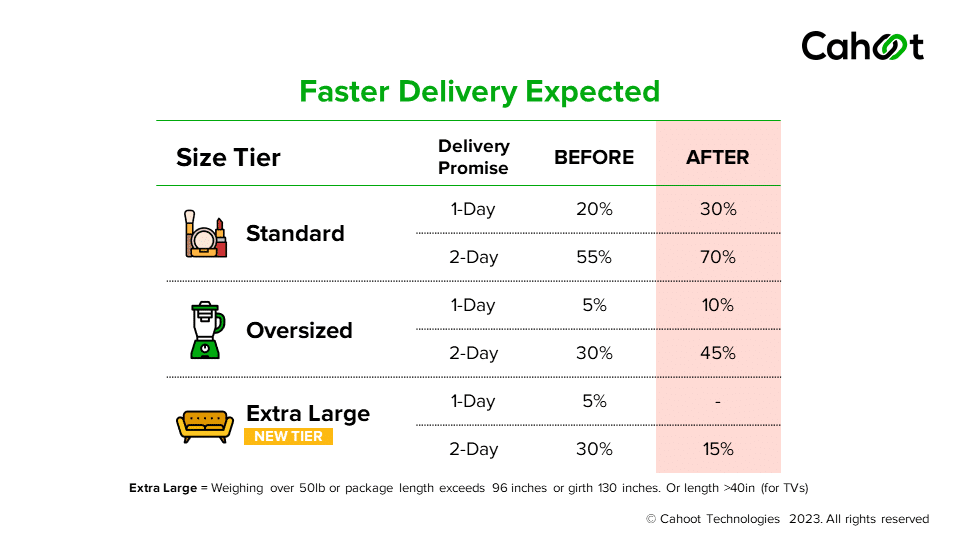

- Product detail page views must promise 1-day nationwide delivery to at least 30% of customers looking at Standard-size products, and 2-day nationwide delivery to at least 70% of page viewers of the same size tier. For Oversized products, these metrics are 10% and 45%, respectively. For Extra Large products, 15% of product detail page views must promise 2-day delivery (there is no 1-day expectation for these SKUs at this time). Note that Oversize and Extra Large SKUs may use regional shipping templates, so they are not required to deliver nationwide in 2 days or less.

- Merchants must first go through a pre-qualification process before starting their SFP trial. In the 90 days leading up to starting an SFP trial, they must self-fulfill at least 100 packages, with a Cancelation Rate <2.5%, Valid Tracking Rate >95% and Late Shipment Rate <4%. Once they are approved for the trial, they must ship at least 100 packages in 30 days while meeting all the SFP program requirements above.

- To fulfill Prime trial orders, Sellers should identify these orders within Seller Central by looking for the Prime badge and ‘IsPrime’ tag, which help in managing these specific orders efficiently.

- Sellers must provide free returns for all eligible items weighing less than 50 lb, for any reason.

- Amazon will not excuse late deliveries due to a carrier’s failure to deliver on time during the trial period (after passing the trial, they will). You must make sure that your order volume can incur a few late deliveries per trailing 7 days and still exceed the On-Time Delivery performance metric.

- During this entire period, the Prime badge will not be visible to customers on listings. After successful completion of the pre-qualification and trial period, Amazon will enable the Prime badge for your listings.

- You can request a 30-day SFP trial three (3) times per calendar year, and any trial overlapping the 30 days before major selling events such as Prime Day, Black Friday–Cyber Monday, or Christmas will be ineligible for graduation. Plan your trials in quieter months (e.g., January – February) to avoid wasted attempts.

- After graduating from the trial, you must fulfill a minimum 100 Prime-eligible packages each calendar month (evenly spread out) or face dynamic caps on your Prime order volume until you restore consistent output. It is not acceptable to ship 15 SFP orders in the first 3 weeks and then play catch-up in the last week; you will be throttled.

The critical thing to remember (which is the kick in the teeth for Sellers) is that Amazon FBA does not face any penalties for missing any of these performance metrics – whereas the onus is on the SFP merchant to diligently track these metrics and ensure you never fall below the minimums. To enable Prime shipping, Sellers must adjust their shipping templates and make specific selections in Seller Central to choose delivery regions for Prime service.

If this list appears daunting, you’re not alone – many Sellers feel these criteria are tough to meet. So before even looking at where the challenges and roadblocks lie, it’s worth asking – why is it worth being part of the program, and what value can it deliver to your business?

“Amazon SFP is such a demanding program, it is very difficult to find partners with the ability to pull this off. Cahoot is clearly geared towards Amazon Seller Fulfilled Prime, and excels at it via a network of strong fulfilment partners and a deeply knowledgeable team.”

~ Cali’s Books

Speak to a fulfillment expert

The Competitive Advantages of Seller Fulfilled Prime

While these are all great benefits for Sellers and provide their businesses with significant competitive advantages, making a success of the SFP program is highly challenging. Most merchants know that the requirements list is rigorous and demanding, but few are aware of the exact stumbling blocks that trip up people. Fewer are aware of solutions available to overcome these roadblocks and win at SFP.

Succeeding at SFP is Hard – Here’s Why

While the list of criteria is long and rigorous, we’ve identified the most challenging aspects of the program that trips up most Sellers:

Nationwide Fast Delivery Forces Most Sellers to Use Expensive Air Shipping

- In the past, Amazon had “regional Seller Fulfilled Prime” – which allowed Sellers to manage order fulfillment in certain geographical parts of the country while still having the Prime badge on their product listings.

- The Regional SFP program allowed merchants who owned a single warehouse or worked with a traditional 3PL with a single warehouse location to meet the program’s requirements through economical ground shipping.

- However, Amazon now expects Sellers to make products across every size tier available within 3-5 days (at the most) across the entire continental U.S. – additionally, approximately 70% of standard sized item orders must be delivered in under 2 days across the nation.

- The new requirements eliminate the possibility of regional models working any longer – having your inventory stationed in just one location means that shipments to certain parts of the country cross multiple shipping zones. The only way to deliver orders on time in such “single-node” operations is by using expensive air shipments. Making expensive shipments by air completely nullifies any cost savings merchants hoped to achieve when leaving FBA – in fact, it could worsen things.

- It becomes vital in such a scenario to use an SFP fulfillment partner with a strategically located network of fulfillment centers, such as Cahoot, whereby it is possible to cover the entire country in 2 days while still using economical ground shipping rather than express air shipments. Such a network is one of the very few ways it is still possible to both have nationwide coverage and significant cost savings over FBA.

- Lastly, Sellers must ensure that their product listings are classified correctly by Amazon. The metric for % of product detail pageviews that must promise a certain delivery speed is based on the size tier the item falls into (if an oversized or extra large item is classified as standard sized by mistake, you will be under pressure to get a large number of orders of those items delivered in under 2 days).

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPAmazon Expects Delivery in 2 Calendar Days, While Carriers Operate on Business Days

Amazon now expects Sellers to make Prime deliveries in 2 calendar days (necessitating the need to work with carriers that support weekend pickup and delivery). This requirement has caused Sellers a lot of pain and grief, and here’s why:

The Misleading Page Views Metric

In its latest round of revisions to the program criteria, Amazon has increased the percentage of product detail page views that must promise 1 calendar day and 2 calendar day delivery. Thirty-percent (30%) of product detail page views for standard sized products must promise 1-day delivery, while 70% must promise 2-day delivery. But when does your listing promise 1-day delivery, and when does it promise 2-day delivery? Let’s understand this with a few examples:

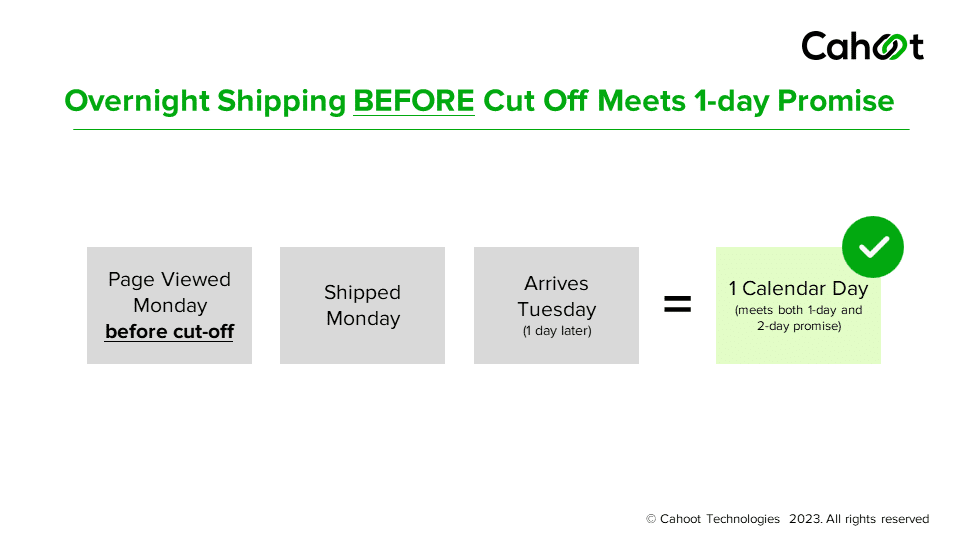

Let’s imagine every order is delivered the very next day after it ships. If a customer views your order on a Monday and places their order before the cutoff time, you will ship it that same day, and it reaches the customer the next day. In this case, Amazon displays a 1-day delivery promise and this page view counts towards your 1-day metrics.

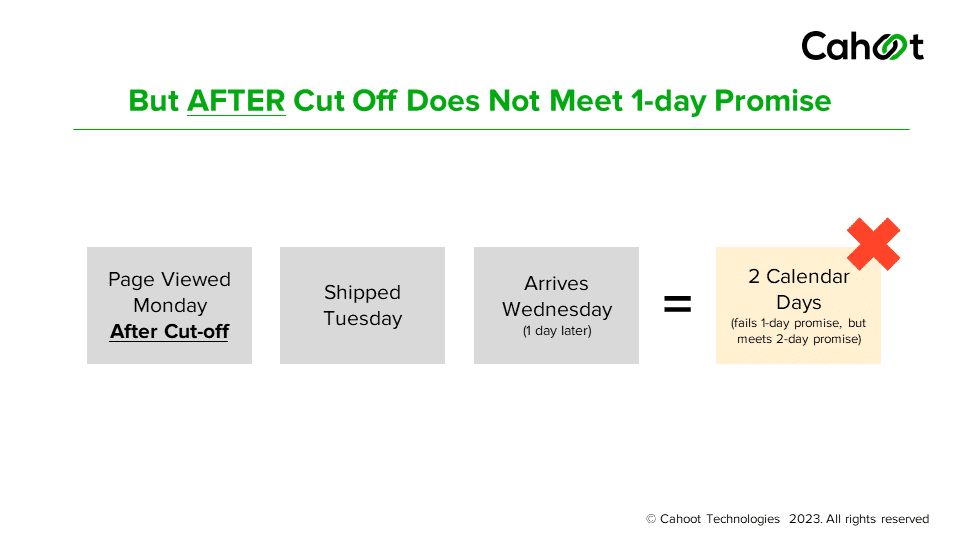

In this second case, when a customer looks at the product detail page after the cutoff time, you ship the order the next day after it is placed, and it reaches the customer the following day. This therefore fails to meet the 1-day promise, but meets the 2-day delivery promise (which means that if a 2-day promise was made after Monday’s order cutoff time, one-day shipping still needs to be used to deliver it in 2 calendar days).

In this last case, it gets really bad. If a customer views your listing on a Saturday evening, the item is expected to ship on Monday (assuming you don’t ship Sundays) and it will be delivered to them on Tuesday – a full 3 days later.

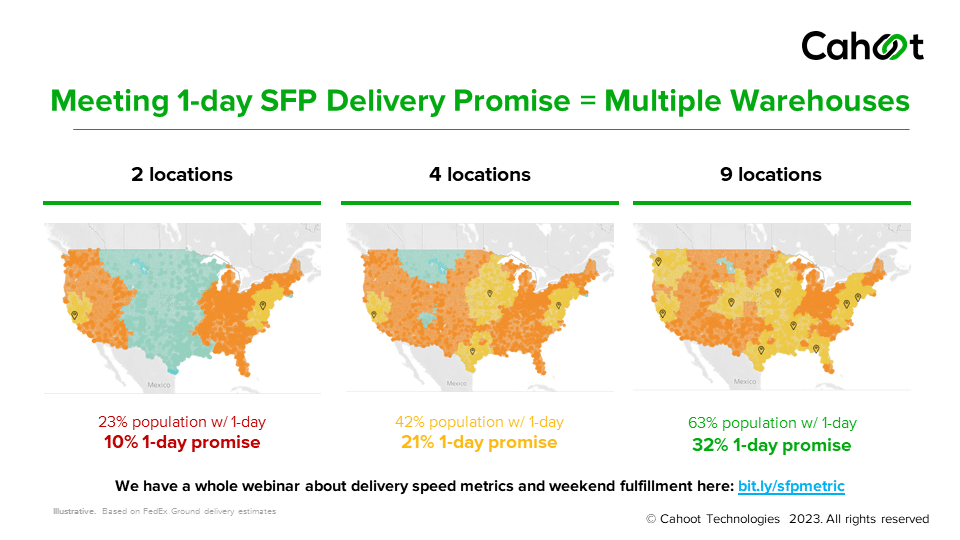

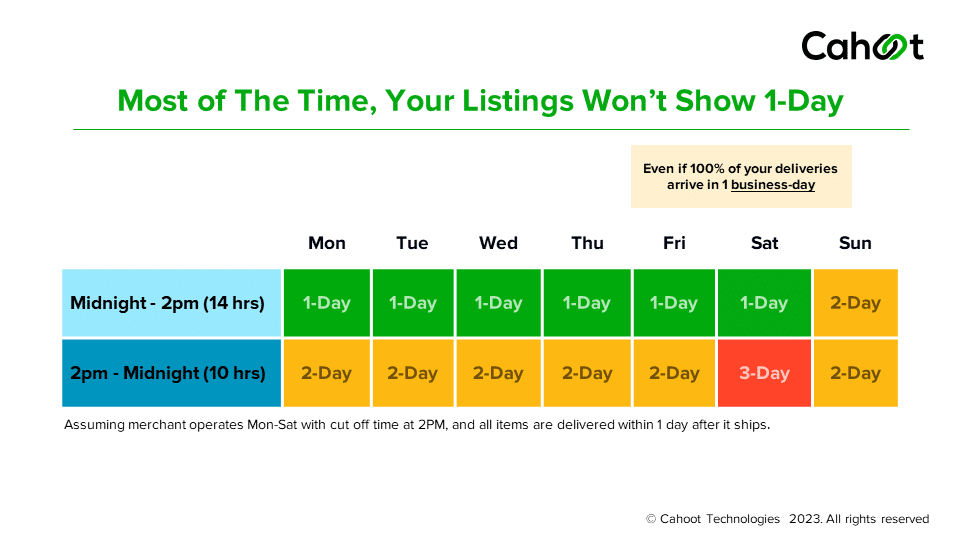

In this case, such a page view counts toward neither the 1-day nor 2-day metrics. The implication is clear – your listings will display 2-day and even 3-day delivery promises for significant periods of time. The mapping between the number of warehouses you have, the percentage of the US population you can service with 1-day delivery, and the % page views that actually promise 1-day delivery is not linear. This graphic illustrates that:

If you have warehouse locations, you can cover 42% of the US population with 1-day delivery. But different customers look at your product detail pages at different times of the day, and see different delivery speed promises. As per our research, in reality, only 21% of page views may actually promise 1 calendar day delivery. To meet the new Seller Fulfilled Prime delivery requirements, it could take as many as six to nine strategically located warehouses. These demanding metrics mean that traditional 3PLs will find it nearly impossible to help Seller Fulfilled Prime merchants (learn more about why traditional 3PLs are failing, and how peer-to-peer order fulfillment networks are designed to help you find success on SFP here). It becomes crucial for merchants to partner with order fulfillment networks that have warehouses at different strategic locations across the country, ensuring customers from anywhere see fast delivery promises. While merchants may want to upgrade to a fulfillment partner who is better positioned to meet these requirements, it’s easier said than done to leave your current 3PL for better alternatives. Many merchants don’t know how to evaluate and find the perfect fulfillment partner for them. If you’re looking for a step-by-step guide on migrating fulfillment partners, check out our guide here!

The Juggling Act Between Cut-off Times, Economical Shipping, and Meeting SLAs

With Seller Fulfilled Prime, a late cut-off time can potentially increase the number of orders your carrier picks up the same day, boosting your 1 and 2-day delivery metrics. If FBA faces any issues or does not meet the delivery promise shown to the customer on the product listing, there are no penalties for Amazon – but a Seller must meet the 93.5% on-time delivery criteria. Here’s a graphic demonstrating how delivery timelines look like when operating with a 2 PM cutoff time (based on our discussion of the page views metric):

Sellers must carefully make the tradeoff between increasing their cutoff times (if they can schedule a late pickup with their carriers) versus also ensuring that those orders reach the customer the next day. Increasing the cutoff times increases the percentage of page views that promise 1 and 2-day delivery, but you must ensure that you can actually get the product to the customer’s doorstep within the time you’re promising. Here also, Sellers need to strategically place their inventory in a network of warehouses to avoid shipping orders placed close to cut-off times through expensive overnight air shipments. Placing inventory in different strategically located warehouses will enable nationwide coverage through economical ground shipping, all while meeting the customer’s expectations. Pay attention to time zones. A 2PM cutoff time is specific to the local time zone, so an order received before 5PM Eastern Time may need to ship from a western time zone to deliver on time, depending on the delivery promise. This makes it essential that your promotional activities (advertising, marketing) also closely follows the local time zones of the eyeballs you’re trying to reach. But it’s all very doable and Cahoot offers SFP consulting services to help. Reach out if you’d like to talk.

The shift to calendar days has had the most significant impact on the operational side of things – Sellers now have to plan a whole different way of running their business and schedules, which have also become challenges:

Operational Excellence Needed

Challenging to Staff And Operate Warehouses on Weekends

As we’ve mentioned before, staffing is often the biggest bottleneck towards finding success with order fulfillment. With weekend pick up and delivery expected to meet the calendar day-based SLAs, most merchants with a single warehouse or those working with 3PLs face difficulties succeeding in the program. If you own and operate your warehouses, paying your staff to work on the weekends or hiring additional people may eat into your margins to unfeasible extents. Traditional 3PLs, which are asset-heavy, also face cost pressures around labor – which they may be forced to pass onto Sellers. While these options erode any cost savings that Sellers see over FBA, you are not without alternatives – consider platforms like Cahoot, where each of our fulfillment centers is vetted for operational excellence and meets all the challenging requirements.

Arranging for Carrier Pickups on Weekends

In addition to warehousing, your carriers are another critical element in making your logistics work. Not all carriers offer weekend pick up and delivery – some may require you to be a large shipper and maintain minimum order volumes. All this means you may have to contact your account manager at the various carriers and enquire about possible options that may incur additional fees. However, while all this can be done, the biggest reason Sellers shy away from SFP is the heavy amount of process management, collaboration, and busy work needed to keep this operation running.

Managing Weekend Operations Can Overwhelm Sellers

It becomes easier to understand why so many Sellers shy away from Seller Fulfilled Prime – between working with multiple 3PLs to ensure your inventory covers the country, to operating and staffing your warehouses on the weekend as well as coordinating with your shipping carriers to arrange for weekend pickups, it can seem incredibly overwhelming and drain your bandwidth, time, and resources. You might often wonder whether managing so many stakeholders and sifting through so much busy work is worth it when FBA offers you only one party to work with – even if that party is Amazon, whose interests often tend to be misaligned with yours. It does not have to be this way – Sellers must spend time identifying partners who provide a unified experience where they get to work with just one vendor. Platforms like Cahoot help Sellers meet and exceed the SFP program requirement while ensuring you deal with only one company rather than coordinating between multiple 3PLs and carriers, preserving precious time and resources for you and your business.

Scaling Made Easy: Calis Books’ Fulfillment Journey

Learn how Calis Books expanded nationwide, reduced errors, grew sales while cutting headcount, and saved BIG with Cahoot

See Scale JourneyUnnecessary Surcharges From Amazon Buy Shipping

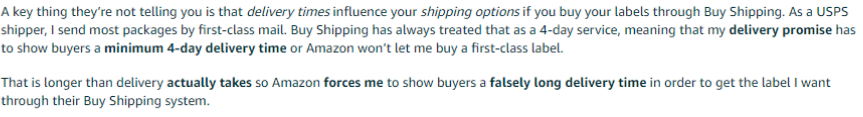

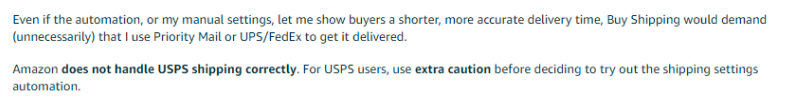

In its latest round of revisions, Amazon no longer mandates the use of its Buy Shipping platform to print shipping labels. This is a major relief for Sellers, because Amazon Buy Shipping comes with one major issue that they have reported anecdotally – the platform is not great at estimating the delivery timelines for USPS services (the comment below from Amazon’s Seller Central forums highlights the issue):

In many situations, Buy Shipping does not accurately estimate the delivery timeline within which a USPS service can make orders. In such cases, Sellers are faced with a choice to pick from two bad alternatives: fail to show the customer a fast delivery promise (not an option for SFP Sellers) or buy a more expensive label from the choices that Buy Shipping does believe are capable of meeting the SLA:

This can be tough for Sellers to swallow – as order volumes increase, the extra costs paid on each shipping label begin to mount, eroding margins and profitability. Thankfully, Amazon no longer requires the mandatory use of the service. However, this does not automatically mean that you will see increased savings. You still need to make sure that you’re picking the most economical label on every order! This requires technology like Cahoot’s next generation shipping software, which intelligently rate shops across all carriers and shipping services from all available warehouse locations to always print the cheapest label that will meet the delivery date promised to the customer.

So while a lot can potentially go wrong, Sellers can also make the program work for them and find success by following specific, vital strategies. Start finding success in the SFP program by using the tricks and recommendations in our SFP Cheat Sheet!

“Cahoot is a game-changer. Their fully automatic shipping label creation intelligently assigns the best carrier and shipping service for all my orders across all my channels.”

~ LoveOurPrices.com

Speak to a fulfillment expert

The Cheat Sheet for Winning at Seller Fulfilled Prime

To enable Prime shipping, sellers must adjust their shipping templates and make specific selections in Seller Central and add all the warehouse addresses orders will ship from to support delivery regions for Prime service.

- Achieve Nationwide Coverage With a Warehouse Network: Making orders nationwide in under two days is no easy task. You need to distribute inventory strategically in at least 6 different locations to cover 97%+ of the country in this window. Operating from a single warehouse or one or two 3PL fulfillment centers will simply not cut it – you need to distribute your products across a network to meet the program requirements economically.

- Use Data to Guide Inventory Placement And Avoid Air Shipping: Even with a network model, it is crucial to analyze where most of your orders are coming from – placing your inventory close to those “order hubs” becomes a vital part of ensuring you will meet and exceed the one and two-day delivery requirements. This also ensures that you can reach all of your customers through economical ground shipping rather than being forced to make too many expensive air shipments.

- Consolidate Relationships And Eliminate Busywork: SFP can lead you down the rabbit hole of investing in multiple 3PLs and coordinating with numerous carriers to make the program work for you. Sellers need to conduct research and identify a platform that provides a single relationship for you to manage – otherwise, logistics can overtake your focus on the activities that matter – selling and taking care of your customers.

- Save Every Dollar Across Every Shipment: The whole point of moving away from FBA towards a program like SFP is to extract cost savings. It is essential to align your technology towards automation, whereby you’re automatically generating the lowest price shipping labels on every single order.

- Monitor Metrics Like a Hawk: Amazon provides you with dashboards on Seller Central that provide all the SFP metrics needed. It is crucial to constantly stay on top of these and keep adjusting your strategy to ensure you’re meeting expectations.

- Appeals Process: You get 14 calendar days from notice to file, 4 days to respond to Amazon’s follow-up, and are limited to 3 appeals per quarter (successful appeals don’t count against your quota). Each appeal must include order IDs, scans, zip codes, and proof of any carrier delays.

Succeeding in this program is challenging, but we think these tips are a great place to start. As Q4 and the holiday season approach, now is the time for Sellers looking to diversify their order fulfillment beyond FBA and offer fast, profitable free shipping across every SKU to identify a partner who can help you win at Amazon Seller Fulfilled Prime. If you’d like to understand how Cahoot can be with you every step of the way, just fill out this form, and we’ll be in touch!

Frequently Asked Questions

What is Seller Fulfilled Prime on Amazon?

Seller Fulfilled Prime allows you to list your products as Prime-eligible and handle the fulfillment yourself.

What is the difference between seller-fulfilled and Amazon fulfilled?

Logistics. Within the framework of Fulfillment by Amazon (FBA), the platform handles the entire logistics process – from product storage in warehouses to dispatching. Seller Fulfilled Prime (SFP) leaves you 100% in charge of everything in this regard, yet forces you to cover dispatch fees at your own cost.

How do you pre qualify for the Seller Fulfilled Prime trial?

To pre-qualify for the Seller Fulfilled Prime trial you must meet the following criteria over the past 90 days: Self-fulfilled at least 100 packages, Cancellation rate less than 2.5%, Valid tracking rate greater than 95%.

What is the difference between SFP and FBA?

FBA offers scalability and customer trust but comes with higher costs and limited control. FBM provides cost savings and customization options but requires more time and effort. SFP combines Prime eligibility with control over costs but has stricter requirements and operational challenges.

Is Seller Fulfilled Prime worth it?

In reality, it’s more of a trade-off. Seller fulfilled Prime offers the advantage of the Prime Badge and lower fees than FBA, but Amazon also levies stricter, potentially more costly requirements than FBM. But SFP orders can command higher prices (15 – 20%) and allow for more control. With a well-managed program, it can be quite beneficial.

Turn Returns Into New Revenue