Both USPS and Amazon Experience Data Security Glitches

In this article

In the midst of the kickoff to the busiest shopping season of the year, news emerged that both the U.S. Postal Service and Amazon experienced data glitches that exposed customer information.

The USPS may have exposed the personal data of more than 60 million customers via a security hole, including access to information on when checks and other critical documents were set to arrive. Amazon meanwhile told an unknown number of customers their names and email addresses were exposed due to a technical error on its ecommerce site.

Offer 1-day and 2-day shipping at ground rates or less.

Recent Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations and

USPS Hazmat Shipping Guidelines – How to Ship Fast While Staying Compliant

Hazardous Materials What is a Hazardous Material? What Items Are HAZMAT? Classes of HAZMAT Items What Classes Can Ship on Various USPS Services? What Changes

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy

USPS Price Hikes on Jan. 27 to Cost Amazon More than $1 Billion

In this article

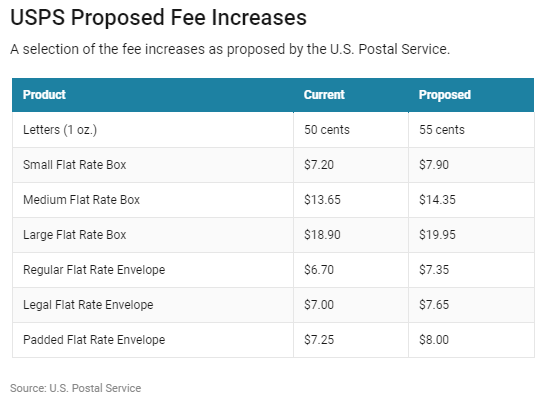

Amazon.com Inc.’s retail operating income could take a 5% hit from shipping cost inflation if the U.S. Postal Service’s proposed price hikes go into effect, according to calculations by Barclays analysts. The proposed uptick in shipping and mailing fees at the U.S. Postal Service could cost Amazon more than $1 billion in 2019, according to Credit Suisse, which cut its near-term estimates for operating profit on the e-commerce behemoth.

“As we roll forward the sensitivity analysis to 2019, we arrive at a potential incremental Shipping Expense range of $400 million to $1.1 billion range with the assumption that 40 percent to 50 percent of U.S. packages are shipped via the Postal Service,” analyst Stephen Ju wrote Monday. “Our math …suggests Amazon will have 5% lower retail operating income from this shipping cost inflation, if we assume there are no offsetting factors,” Barclays said. The changes would go into effect on Jan. 27, 2019.

“Specifically, the USPS shipping rates for small and medium boxes, typically used by e-commerce companies, are proposed to be increased by 10% and 5% respectively,” Barclays analysts led by Ross Sandler wrote. “[T]he price increases for packages suggested by USPS this year are higher than in prior years.”

“If other Amazon shipping partners like UPS, FedEx, On-Trac, etc. raise their prices, which has happened in the past (but we are currently not factoring in), every 5% hike for last mile would weigh down operating income by an additional 3%, all else constant,” the note said.

President Trump said the USPS is Amazon’s “delivery boy” in a tweet earlier this year, and blamed the e-commerce giant for its billion-dollar-plus losses in the second fiscal quarter. However, the USPS said it’s actually government policy that’s hurting the group’s finances. The USPS said “legislative and regulatory changes” would be necessary for financial stability.

“To be clear, our current estimates already factor in [a] shipping cost increase by a modest level, consistent with prior years,” Barclays said. “However, the steeper increase proposed for 2019 could weigh further on Amazon’s FY19 profitability.”

Barclays forecast that Amazon shares could take a hit after third-quarter earnings if they are in line with guidance and forecast below expectations. And in the fourth-quarter, the $15 minimum wage hike will add about $310 million to expenses.

Amazon will already see declines due to the $15 minimum wage hike, analysts say. Barclays analysts think the minimum wage hike is just one of a few coming initiatives that could impact operating margin expansion.

Offer 1-day and 2-day shipping at ground rates or less.

Recent Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations and

USPS Hazmat Shipping Guidelines – How to Ship Fast While Staying Compliant

Hazardous Materials What is a Hazardous Material? What Items Are HAZMAT? Classes of HAZMAT Items What Classes Can Ship on Various USPS Services? What Changes

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy

The Post Office Wants to Raise the Fees it Charges Amazon and Other Shippers

In this article

The U.S. Postal Service has proposed a 9 to 12 percent increase in fees for the shipping service used by Amazon, just months after President Donald Trump criticized the USPS, saying it gives Amazon too good of a deal.

The parcel select service, which is also used by United Parcel Service and FedEx, is the last and typically the most expensive step in the shipping process that gets the packages to customers’ doorsteps. The USPS proposed a 9.3 percent increase on this service for packages weighing over one pound and a 12.3 percent increase on lighter packages.

Trump issued an executive order in April to set up a task force to examine the USPS, claiming that it was on an “unsustainable financial path.” He’s also tweeted that the USPS is Amazon’s “delivery boy” and doesn’t make money from Amazon’s business.

Offer 1-day and 2-day shipping at ground rates or less.

Recent Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations and

USPS Hazmat Shipping Guidelines – How to Ship Fast While Staying Compliant

Hazardous Materials What is a Hazardous Material? What Items Are HAZMAT? Classes of HAZMAT Items What Classes Can Ship on Various USPS Services? What Changes

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy

Free Shipping Becomes a Blessing and Curse at Amazon and Target

In this article

Amazon.com Inc. and Target Corp. have opened the floodgates on free shipping. Web orders with the free service have increased 13% in 2018. Offer can boosts sales but wreaks havoc with profit margins.

Recent moves by the two retailers to eliminate minimum-purchase amounts for free shipping have boosted the share of online orders that get delivered gratis, according to data from retail analytics company DynamicAction. Orders with the free service included have risen 13 percent so far this year through Nov. 16, including an 18 percent spike in the week that began Nov. 5., when Amazon unveiled its offer.

Free Falling

Amazon and Target have eliminated shipping fees for online holiday orders

“Free shipping is the new normal,” DynamicAction’s Chief Marketing Officer Sarah Engel said.

While free shipping can entice customers to buy, it can wreak havoc with retailers’ profit margins, which are typically razor-thin already during the holiday quarter due to rampant discounts and increased marketing costs. Web orders that included some sort of promotion since the end of October have risen 13 percent from the same period last year, DynamicAction found. It also doesn’t help that transportation costs were already soaring this year due to a shortage of truckers.

Target is offering two-day free shipping from Nov. 1 through Dec. 22 on hundreds of thousands of items with no minimum purchase, while Amazon said on Nov. 5 that shoppers without Prime memberships need not buy at least $25 to earn free regular shipping, which typically takes five to eight business days.

Walmart Inc. has thus far declined to match the offers, sticking with its $35 minimum purchase requirement. The world’s largest retailer has suffered from narrowing gross profit margins in recent quarters, even as its online sales have grown.

E-commerce sales overall will jump 17 percent this holiday season, according to data tracker EMarketer, and account for about 12 cents of every holiday dollar spent. Amazon garners just under half of all online sales in the U.S., EMarketer said.

This article was written and published at Bloomberg by Matthew Boyle

Offer 1-day and 2-day shipping at ground rates or less.

Recent Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations and

USPS Hazmat Shipping Guidelines – How to Ship Fast While Staying Compliant

Hazardous Materials What is a Hazardous Material? What Items Are HAZMAT? Classes of HAZMAT Items What Classes Can Ship on Various USPS Services? What Changes

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy

How to Win in an Amazon Prime World

In this article

A 5% increase in customer retention can improve a company’s profitability by 75%, according to Bain research. Yet most retailers are more focused on acquisition and conversion than retention. Despite investing billions in this pursuit, ecommerce has created a “customer experience gap” for retailers unable to engage customers at key post-purchase moments. Brands are learning the hard way that lackluster engagement and an afterthought communication strategy is a guaranteed way to lose loyalty.

To address this important issue Pulse Commerce conducted mystery shopping at nearly 500 leading U.S. online merchants prior to the 2017 peak holiday shopping season. The result is a picture of true behavior rather than survey feedback, and benchmarking by product category for comparison to peers as well as to Amazon.

Offer 1-day and 2-day shipping at ground rates or less.

Recent Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations and

USPS Hazmat Shipping Guidelines – How to Ship Fast While Staying Compliant

Hazardous Materials What is a Hazardous Material? What Items Are HAZMAT? Classes of HAZMAT Items What Classes Can Ship on Various USPS Services? What Changes

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy

UPS 2019 Rate Increase of 4.9% Given 3 Weeks Before Effective Date

In this article

Less than three weeks before the prices take effect the day after Christmas, UPS announced its 2019 rate schedule, including an overall rate increase of 4.9% for its ground, air and international services, leaving shippers scrambling to adapt at the busiest time of year.

Last year UPS announced its general rate increase (GRI) in October, and in September the year before that. FedEx announced its 4.9% GRI for 2019 in early November. While the new FedEx rate schedule takes effect Jan. 7, UPS’s hike happens as of Dec.26, meaning it will hit the first massive wave of Christmas returns.

“This year (UPS) announced it three weeks before the effective date and in the heat of the fourth quarter peak shipping,” said parcel consultant Jerry Hempstead. “Large shippers will have little time nor the IT resources to sift through the nuances of this year’s announced changes.”

Offer 1-day and 2-day shipping at ground rates or less.

Related Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations

USPS Hazmat Shipping Guidelines – How to Ship Fast While Staying Compliant

Hazardous Materials What is a Hazardous Material? What Items Are HAZMAT? Classes of HAZMAT Items What Classes Can Ship on Various USPS Services?

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy consumers

The Prime Effect

In this article

How Amazon’s two-day shipping is disrupting retail. The quest to offer fast, free delivery has triggered an arms race among the largest retailers.

Amazon is already making up most of the US ecommerce sales. However, they rely heavily on 3rd party sellers. These sellers experience major pain related to shipping cost and time. Fast shipping is now an expectation, but it is expensive for most sellers. Sellers often limit fast shipping to veru=y samll items or to local addresses. This limits their buy box opportunities.

Alongside life, liberty and the pursuit of happiness, you can now add another inalienable right: two-day shipping on practically everything .

Amazon.com Inc. has made its Prime program the gold standard for all other online retailers, according to surveys of consumers. The $119-a-year Prime program—which now includes more than 100 million members world-wide—has triggered an arms race among the largest retailers, and turned many smaller sellers into remoras who cling for life to the bigger fish.

In the past year, Target Corp. , Walmart Inc. and many vendors on Google Express have all started offering “free” two-day delivery. (Different vendors have different requirements for no-fee shipping, whether it’s order size or loyalty-club membership.)

Optimizing Prime

Amazon’s shipping infrastructure isn’t used just by Amazon. As shoppers who read the fine print know, it’s also available to its retail partners through its Amazon Marketplace. Of the top 10,000 sellers on Amazon—collectively representing about half of Amazon’s Marketplace revenue—at least 90% have one product in the Fulfillment by Amazon program, says Juozas Kaziukėnas, chief executive of Marketplace Pulse, a business-intelligence firm focused on e-commerce. Almost 70% use it to stock and ship at least half of their products, he adds.

Competitors Great and Small

Amazon’s nominal competitor in online retail, Walmart, also offers a marketplace for third parties to sell their goods; the big difference is, it doesn’t assist them with fulfillment—and forbids them from using Amazon’s fulfillment services.

Scale is essential. Mom-and-pop shops and even midsize retailers can no longer assume buyers will put up with getting their goods days later via the U.S. Postal Service. In response, startups are trying to aggregate enough retail customers that they can offer the all-important fixed rates for nationwide two-day shipping.

Offer 1-day and 2-day shipping at ground rates or less.

Related Blog Posts

The Ultimate Guide to Selling and Winning on Amazon Seller Fulfilled Prime

Most people are familiar with the requirements that Amazon expects sellers to meet, but far fewer are aware of the roadblocks that make success hard to achieve. An even smaller number are aware of the strategies they can deploy to meet Amazon’s criteria and surpass them.

Amazon Buy With Prime: A Game-Changer for Customers, But a Trojan Horse for Merchants

For customers, Buy With Prime is a great service, but for ecommerce merchants, it’s a Trojan Horse. Amazon Prime circumvents the entire order checkout process from the merchant’s platform, and payment processing goes through Amazon

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy consumers

Warehouse Picking Process: Pick and Pack Fulfillment – An Ecommerce Guide | Cahoot

In this article

16 minutes

16 minutes

- What is Warehouse Picking?

- Why Pick and Pack Fulfillment Quality Matters for Customer Satisfaction

- Pick and Pack Warehouse Picking Strategies

- Technology in Warehouse Picking

- Warehouse Order Picking Best Practices

- Common Challenges in Warehouse Picking

- How Does Pick and Pack Work for Fragile Items?

- Future Trends in Warehouse Picking

- Cahoot: The Best Pick and Pack Fulfillment Service

- Frequently Asked Questions

Simply put, “pick and pack” is the process of picking a customer’s order off of a shelf (or wherever it’s stored) and packing it in a box to be shipped to the customer. If you’re a new seller with just a few orders a day, you’re probably doing your own picking and packing – maybe out of your living room! The time, energy, and focus it takes to correctly pick and pack order after order quickly overwhelms sellers as they grow, though, which is why most turn to a 3PL and outsource their ecommerce order fulfillment once they get traction in the market. As you can imagine, picking and packing gets a lot more complex in a warehouse optimized for speedy and accurate ecommerce fulfillment. Read on to learn how pick and pack quality impacts your ecommerce store, how the experts optimize their order picking, and how you can find the best pick and pack fulfillment service for your needs.

What is Warehouse Picking?

Warehouse picking is the process of selecting and retrieving products from a warehouse or storage facility to fulfill customer orders. It is a critical component of the supply chain and plays a vital role in ensuring customer satisfaction. The picking process involves several steps, starting with receiving products into the warehouse, storing them in designated locations, and then picking the items as orders come in. Strategic planning, coordination, and execution are essential to ensure efficiency and accuracy in warehouse picking. By optimizing these processes, businesses can improve their overall operational efficiency and deliver a better experience to their customers.

Why Pick and Pack Fulfillment Quality Matters for Customer Satisfaction

Picking speed is an essential behind-the-scenes metric for ecommerce stores because it dictates order cutoffs and on-time delivery. These metrics in turn have a big impact on your conversion rate and repeat customer rate, and therefore your overall growth!

Your order cutoff time is the time in the day before which a customer has to place an order that can be shipped out that same day. Faster, more efficient picking operations can set later order cutoffs. In the days of 7 day shipping, this wasn’t such a big deal. With the rise of 1 and 2-day shipping, though, missing an order cutoff means a customer has to wait twice as long to receive their package. According to McKinsey, almost half of online shoppers will buy elsewhere when the estimated delivery time is too long – so an early cutoff means lost customers.

Picking accuracy is perhaps even more important than picking speed. As more sellers pile into ecommerce, price and advertising competition continue to rise, squeezing margins. Repeat customers who don’t need advertising to convert are critical to a seller’s ability to build a sustainable long-term business model. Sending customers the wrong order kills a brand’s image, likely loses the chance to create a long-term customer, and on top of that incurs return shipping fees.

Finally, intelligent packing can make the difference between a profitable sale and an unprofitable one. How? It’s all in the box.

It’s easy enough to set rules that guide which single item orders are put in which boxes. But what about multi-item or multi-quantity orders? They can quickly get confusing for warehouse personnel, and workers under pressure to go fast default to using too-big boxes to fit all the items. That, in turn, increases the dimensional weight of the box, which increases the cost of the shipping label.

Top ecommerce fulfillment 3PLs like Cahoot have efficient picking operations that work quickly while minimizing errors and cost. Cahoot’s processes enable 2 pm cutoff times that are a full two hours later than the industry standard, while its teams use barcode scanners to eliminate errors. When every single pick is checked by a computer, the order is right every time. Finally, Cahoot software creates intelligent and dynamic rules even for the most complicated multi-item orders that minimize shipping cost, saving you money.

Pick and Pack Warehouse Picking Strategies

How does picking and packing work in an ecommerce warehouse? The answer varies widely based on the sophistication of the operation and what types of items they’re working with. Automation also has a huge impact on how warehouses pick and pack, with the most tech-forward operations leaning heavily on robots and conveyor belts to quickly move items to humans doing the picking and packing. Different warehouse picking strategies can be employed to optimize efficiency and accuracy, depending on the specific needs of the operation.

Piece Pick and Pack

Piece Picking is the most straightforward method. Fulfillment personnel will pick orders one at a time as they come in, moving about the warehouse to pick items before returning to a packing station to prep the package for handoff to a carrier.

In most warehouses, each item will be stored in its own bin or case in a distinct location. When an order comes in, warehouse software will automatically generate a “pick list” that tells the worker where each item is stored in the warehouse. That way, the worker knows where to go to find each item and can grab them one at a time.

While this is the simplest pick and pack method, it’s also the least efficient, and most medium-to-large warehouses have moved past it.

Batch pick and pack

Batch Picking is similar to Piece Picking in that workers still move about the warehouse picking items for individual orders, but in Batch Picking, workers pick items to fulfill more than one order at a time.

Intelligent warehouse management software (WMS) guides this process to its optimal level of efficiency. Larger warehouses with more orders coming in have more opportunities for personnel to pick for multiple orders at once. Let’s say that four orders come in for the same pack of soap within three minutes of one another; in this simple example, the WMS will send just one worker to pick the soap for all four orders, bring it all back to a packing station, and to pack all the orders sequentially. Of course, this saves several trips to the soap shelf and helps the warehouse run more efficiently.

Zone pick and pack

Zone Picking is the first big step up in complexity, and it involves splitting the entire warehouse into different “zones” and giving different workers responsibility for each zone. Order pickers stay in their zone, and they pick items from their assigned zone only. Instead of the worker passing from zone to zone, they pass the picking box or cart over to the next zone from which it needs items. Once all of the needed items have been picked, they’re passed to the packing station, which is a separate and final zone.

Warehouses that use Zone Picking often have automated parts of the process – for instance, many will have conveyor belts that connect different zones to one another. That makes handoffs between personnel in different zones much quicker and more efficient, freeing them up to focus on fast and accurate picking. Each zone will also connect to the packing station via conveyor belt, so that orders of single units can quickly be passed up to the packing station for shipping.

Wave pick and pack

Finally, Wave Picking combines Zone Picking and Batch Picking. Each zone picks a large amount of items needed for orders in a batch, and then that batch is combined with batches from each other zone and sent up to the packing station. Workers at the packing station then grab what they need for orders from the batches packed from each zone to prepare for shipping.

Like Zone Picking, Wave Picking benefits significantly from automation and is frequently employed in large, sophisticated ecommerce fulfillment facilities.

Technology in Warehouse Picking

Technology plays a vital role in enhancing warehouse picking processes. Some of the most common technologies used in warehouse picking include:

- Warehouse Management Systems (WMS): A WMS is a software solution that manages and optimizes warehouse operations, including picking, packing, and shipping. It helps streamline the entire picking process by providing real-time data and insights, ensuring that orders are fulfilled accurately and efficiently.

- Voice Picking: Voice picking uses voice commands to guide pickers through the picking process. This hands-free technology improves accuracy and efficiency by allowing pickers to focus on their tasks without the need to handle paper lists or devices. Voice-directed picking with natural language processing moves beyond simple voice commands to systems that understand more complex natural language, reducing errors and training time.

- Collaborative Mobile Robots (Cobots): Employing collaborative robots (cobots) that can safely work alongside human pickers in shared workspaces, performing tasks like transporting picked items or assisting with heavy lifting. These robots are designed to work alongside human pickers, handling repetitive and labor-intensive tasks, enhancing productivity and reducing the physical strain on workers.

- Barcode Scanning: Barcode scanning, (a.k.a. Pick Scanning), uses barcodes to track and verify products throughout the picking process. This technology improves accuracy by ensuring that the correct items are picked and reduces the likelihood of errors leading to re-picks (which also reduces the likelihood of working putting the mis-pick back in the wrong bin location).

- Automated Guided Vehicles (AGVs): AGVs are robotic vehicles that automate the transportation of products within the warehouse. They improve efficiency by reducing the time and labor required to move items from one location to another, allowing human workers to focus on more complex tasks.

Warehouse Order Picking Best Practices

Implementing best practices in warehouse order picking can help improve efficiency, accuracy, and customer satisfaction, while limiting the amount of financial waste. Some of the most effective best practices include:

- Optimizing Warehouse Layout: A well-organized warehouse layout can significantly reduce travel time for pickers, improving overall picking efficiency. Grouping frequently picked items together and placing them in easily accessible locations can streamline the picking process.

- Implementing Efficient Picking Methods: Utilizing efficient picking methods, such as Batch Picking or Zone Picking, can enhance productivity and reduce labor costs. These methods allow pickers to handle many orders simultaneously or focus on specific zones, minimizing unnecessary movement. Personalized picking instructions based on worker experience tailors picking workflows to individual worker experience levels, optimizing for both speed and accuracy.

- Utilizing Technology: Leveraging technology, such as WMS or VoicePicking, can improve accuracy and efficiency in the picking process. These tools provide real-time data and guidance, helping pickers make informed decisions and reducing the likelihood of errors. Using computer vision to identify items during picking is another technology that reduces errors and speeds up verification.

- Providing Continuous Training: Continuous training for pickers is essential to maintain high levels of accuracy and efficiency. Regular training sessions can help workers stay updated on best practices, new technologies, and safety protocols, reducing errors and improving overall performance.

Common Challenges in Warehouse Picking

Warehouse picking is a complex process that presents several challenges, including:

- Inaccurate Inventory: Inaccurate inventory records can lead to picking errors, delays, and lost sales. Ensuring accurate inventory management is crucial to avoid these issues and maintain efficient warehouse operations.

- Inefficient Picking Routes: Inefficient picking routes can cause pickers to travel long distances within the warehouse, leading to longer pick times and higher labor costs. Optimizing picking routes through strategic planning and technology can help reduce travel time which improves efficiency.

- Labor-Intensive Processes: Manual picking processes can be labor-intensive, leading to higher labor costs and potential errors. Automating repetitive tasks and utilizing technology can help reduce the physical strain on workers and improve accuracy.

- Lack of Training: Untrained or poorly trained staff can lead to mistakes, inefficiencies, and safety risks. Providing comprehensive training and ongoing education for warehouse staff is essential to ensure smooth and accurate picking processes.

- Compliance and Regulations: Warehouses must comply with various industry regulations and standards, which can be challenging to manage. Staying updated on regulatory requirements and implementing compliance measures is crucial to avoid penalties and maintain operational efficiency.

How Does Pick and Pack Work for Fragile Items?

When picking and packing fragile items, speed becomes less important than the safety of the goods. After all, sending items that arrive broken is even worse than sending items slowly; you’ll have to write off the value of the broken items and pay to ship out replacements.

Picking and packing fragile items so that they don’t break in the warehouse or during transit used to come down to the experience and know-how of individual staff. Like most processes in the warehouse, though, guesswork is being replaced by intelligent automated rules to ensure that products arrive safely.

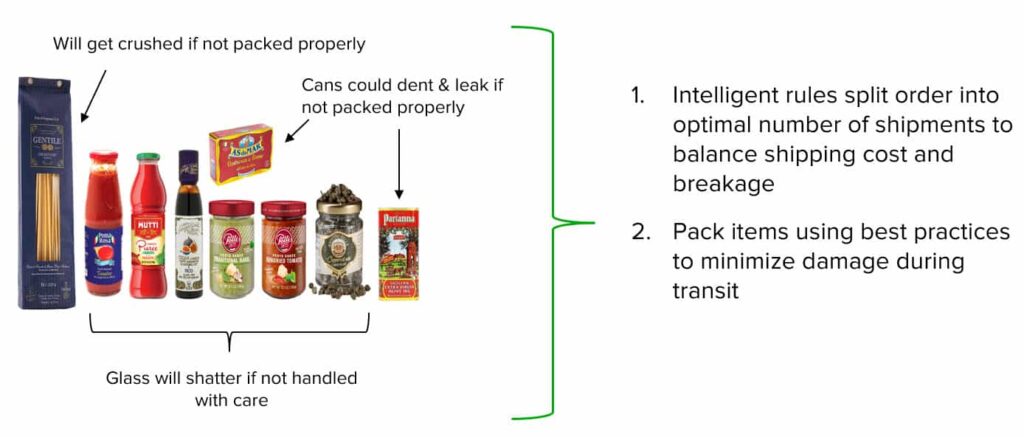

Consider our example below of a host of fragile goods from a fine Italian food purveyor. Each item is a damage risk, making an order with all of them a nightmare for most warehouse personnel.

An intelligent shipping software will make the difficult feasible by splitting the order into a number of shipments that finely balances shipping cost and breakage risk. It will then give guidance to the packing station on how to precisely protect and package each item to fit into the smallest box that will prevent damage in transit.

Many warehouses are set up for peak speed and efficiency, and thus, they don’t have the flexibility to intelligently adapt to different types of goods that need different treatment. That’s where Cahoot sets itself apart.

Future Trends in Warehouse Picking

The world of warehouse picking is constantly evolving, driven by technological advancements, changing consumer demands, and global economic shifts. Some of the future trends in warehouse picking include:

- Adoption of Artificial Intelligence: Artificial intelligence is expected to play a larger role in warehouse picking, automating tasks, and improving efficiency. AI-powered systems can analyze data, dynamically calculate the most efficient picking routes in real-time, considering factors like traffic, order priority, and worker location, and predict demand, enhancing overall warehouse operations.

- Increased Use of Robotics: Robotics is expected to become more prevalent in warehouse picking, automating tasks, and improving efficiency. Advanced robots can handle complex picking tasks, work alongside human workers, and adapt to changing warehouse environments.

- Growing Importance of Sustainability: Sustainability is becoming increasingly important in warehouse picking, with companies looking for ways to reduce their environmental impact. Implementing eco-friendly practices such as reducing waste and optimizing energy use can help warehouses become more sustainable.

- Blockchain for supply chain transparency and tracking: Using blockchain technology to track items throughout the supply chain with up to the minute status and location.

- Increased Focus on Customer Satisfaction: Customer satisfaction is becoming increasingly important in warehouse picking, with companies looking for ways to improve delivery times and fulfillment accuracy. Enhancing the picking process through technology and best practices can help meet customer expectations and drive business growth.

By staying ahead of these trends and continuously improving their picking processes, warehouses can ensure they remain competitive and meet the evolving needs of their customers.

Cahoot: The Best Pick and Pack Fulfillment Service

Cahoot’s nationwide network of over 100 warehouses provides affordable national ecommerce order fulfillment for online merchants. Our wide and diverse network enables us to fulfill a wide variety of needs, from sellers who need absolute peak speed at minimum cost to those that have fragile items or others that require special handling.

Our fulfillment centers are outfitted with dedicated personnel and technology that confers all the benefits of a top pick and pack service:

- Efficient picking enables late (2pm local time) order cutoffs

- Barcode scanning all but eliminates fulfillment defects

- Intelligent pick and pack software optimizes box size for every order, minimizing shipping cost for simple and complex orders

- Lowest cost by design

Unlike other providers, Cahoot also has the flexibility to work alongside existing merchant-owned warehouses (if you have them). We know that many merchants with non-standard items and order profiles carefully manage fulfillment themselves due to how difficult the process can be. Cahoot will analyze your existing network and customer base, then add a few locations of our own to seamlessly extend your network into a nationwide footprint.

With this approach, you can continue to get value out of your existing assets while delighting your customers and your bottom line with affordable fast shipping. Of course, our approach works just as well for merchants who want to fully outsource their fulfillment, and we’d be more than happy to take that on. Getting started with Cahoot is fast and easy – with pre-built integrations for major ecommerce channels like Amazon, Walmart, Shopify, and BigCommerce, we can get merchants started in as little time as it takes to send us your inventory. Talk to one of our experts today and explore how we can be the key that unlocks the next level of your profitable ecommerce growth.

Frequently Asked Questions

What is warehouse picking?

Warehouse picking is an order fulfillment process where item(s) from a customer order are retrieved from their inventory location(s) in a fulfillment or distribution center such as in a bin or on a shelf or pallet. Warehouse picking is the step that occurs before products are packaged and shipped out to their destination.

What is the picking process in a warehouse?

Warehouse picking is the process of finding items within a warehouse or fulfillment center and preparing them for shipment to customers. But there’s a lot of different ways to go about warehouse picking to ensure that it’s done as effectively and efficiently as possible.

What do you do as a warehouse picker?

Warehouse pickers are responsible for finding, picking, and packing goods for dispatch. They work in various locations, including e-commerce warehouses, wholesalers, and cold storage warehouses. It’s a physically demanding role that involves bending, lifting, and carrying products.

How to do picking in warehouses?

There are many strategies for picking in warehouses, which include batch picking, wave picking, zone picking, and piece picking. The best strategy for your warehouse picking setup will depend on the order volume running through your warehouse, the total number of SKUs in storage, your total number of pickers working at the same time, the type of facility you have, and the inventory management system and other technologies you have at your disposal. The different picking methods each have their own advantages and drawbacks.

What is voice picking in a warehouse?

Voice picking is a method of warehouse picking where pickers are equipped with a headset and microphone so they can easily communicate with the warehouse manager about picking details. Some systems are connected with an automated management system, which eliminates the need for a human on the other end of the line. Similar to other wearable warehouse picking options, voice picking has proven to be a time-efficient method and it also cuts down the likelihood of picking errors.

Up to 64% Lower Returns Processing Cost

Everyone’s Building Ecommerce Fulfillment Networks, But They’re Not So Fulfilling for Sellers

In this article

11 minutes

11 minutes

- Multi-Channel Selling is More Profitable

- Amazon FBA: Penalizing Multi-Channel Order Fulfillment

- Shopify Order Fulfillment Network (Flexport)

- Walmart Fulfillment Services (WFS)

- Fulfilled by TikTok (FBT): The New Kid On the Block

- Be Careful Jumping Onto the Bandwagon

- The Future of Order Fulfillment is Wide Open

- Offer 1-day and 2-day shipping at ground rates or less.

Seeing the success of Amazon’s outsourced fulfillment service Fulfilled By Amazon (FBA), marketplaces and e-commerce platforms are racing to build their own e-commerce order fulfillment networks. Undoubtedly, it is beneficial for sellers to have access to third-party fulfillment services wherever they choose to sell, but at what cost? Do these marketplaces have the sellers’ best interests at heart?

Multi-Channel Selling is More Profitable

When Third-party Sellers first started selling online, the first questions were, “Should I sell on Amazon or eBay besides my e-commerce website?” However, over time, that question has changed into, “How do I sell on both, as well as Walmart and other marketplaces when they make sense for my business?”. In fact, with the current e-commerce trend, it is almost imperative for online sellers to sell on multiple channels to survive, let alone grow. Numerous studies show that retailers selling on two or more sales channels have a healthier bottom line, on average, than those that don’t. But it gets complicated. Now, each platform has its e-commerce order fulfillment service and prioritizes the display and, thus, the sale of items fulfilled through them.

Let’s take a closer look at each.

Amazon FBA: Penalizing Multi-Channel Order Fulfillment

Amazon launched its third-party marketplace to satisfy customer demand for a broader assortment of products. Third-party (3P) Sellers add products much faster than Amazon, sourcing all the items themselves and helping build the “everything store” behemoth. According to recent data, over 60% of all physical goods sold on Amazon are from Third-party Sellers, meaning most products sold on the platform come from independent sellers rather than Amazon itself.

Then came Fulfillment by Amazon (FBA), a large-scale distributed warehousing and order fulfillment network for its Third-party Sellers. FBA helps Amazon offer nationwide 1- and 2-day delivery to customers (and regional same-day delivery) even if a 3P Seller sold the item. Commanding approximately 37.6% of all U.S. e-commerce spending in 2023, Amazon negotiated unbeatable shipping rates from all major carriers and offered incredibly low fulfillment fees to sellers. Opting for FBA gives Sellers a distinct advantage within the Amazon ecosystem. FBA sellers are more likely to win the “buy box” and are outright forgiven for any shipping-related customer complaints.

However, using FBA to fulfill non-Amazon orders is not as rewarding financially. Amazon uses FBA to deliver an excellent shopping experience for Amazon customers and power its famous growth flywheel by prioritizing its FBA services for its marketplace customers. The fees for non-Amazon orders are much higher, sometimes by as much as 30–50%. Moreover, Walmart outright banned FBA from its platform due to Amazon’s aggressive branding on boxes. In recent years, Walmart has approved using either Flexport or ShipBob fulfillment services to fulfill Walmart orders, but not both.

Shopify Order Fulfillment Network (Flexport)

Shopify started as an e-commerce platform that enabled sellers to quickly create their own professional online store independent of marketplaces. With its vibrant app ecosystem, Shopify aims to be a one-stop shop for small and midsize online sellers.

One of its growth strategies has been the app marketplace. Shopify’s incredible store diversity also means a high demand for specialized features. Keeping up with this expectation through Shopify’s development team is very challenging. Therefore, they’ve created an app marketplace to serve their sellers’ growing needs quickly. Through the marketplace, third-party companies can build and monetize specialty apps that augment and extend Shopify’s native functionality.

To continue fueling its growth, Shopify launched additional services to power more parts of the seller’s business and capture a larger share of the wallet. These services include Shopify Payments, Point-of-Sale, Shopify Capital, and Shipping Label printing. Small and midsize (SMB) sellers need these services, and they like the simplicity of a one-stop shop. These value-added services have increased Shopify’s revenue per seller over time.

Shopify also tossed its hat into the e-commerce order fulfillment ring as an extension of the same strategy. ‘Shopify Fulfillment Network’ (sold to and rebranded as Flexport in mid-2023 but still operating the Shopify Fulfillment Network app) is geared towards Shopify sellers with options such as custom packaging. The pricing and shipping speed aren’t expected to be near FBA (at least not in the near term), as Shopify does not own any logistics infrastructure. However, there are plans to partner with other warehouses and Third-party Logistics (3PL) providers. Smaller Shopify sellers who fulfill orders by themselves may find it a step up, but it’s too early to say. One thing we know for sure is that fulfilling orders through Shopify will not boost their “buy box” chances on Amazon. Shopify is serious about this move, as demonstrated by their acquisition of 6 River Systems for $450 M in September 2019.

Walmart Fulfillment Services (WFS)

Walmart introduced a fulfillment network similar to FBA in 2020 called Walmart Fulfillment Services (WFS). Third-party Sellers ship their inventory to Walmart’s network of over 40 domestic fulfillment centers for storage and then e-commerce orders are picked, packed, and shipped to customers. Walmart reported recently that 66% of its third-party Sellers use the service to ship more than half of Walmart Marketplace orders (up from fulfilling only ~25% of e-commerce orders just three years ago). The program aims to take the fulfillment burden off its Seller partners and increase delivery speeds for the end customers (often within 2 days). It also supports customer service for WFS‑fulfilled orders and handles returns, which frees up Sellers to focus on growing their business.

Unlike Amazon, Walmart ships approximately half of its e-commerce orders from its 4,600+ physical stores. This is possible because a store is within 10 miles of ~90% of the US population. While WFS rates are reported to be about 15% lower than competitors’, the captive order fulfillment services are tied to product discoverability on the marketplace, making participation more or less mandatory for merchants that choose to partner with Walmart.

The strategic bet paid off big time, as Walmart’s marketplace grew to become the second-largest in the US, edging out eBay.

Fulfilled by TikTok (FBT): The New Kid On the Block

Despite being the newest social commerce platform in the US, TikTok Shop is already estimated to be the third largest, trailing only Facebook and Instagram. In a strategic move that mimics the fulfillment services competitors that came before it, TikTok Shop launched Fulfilled by TikTok (FBT) in late 2024 to manage the storage, picking, packing, and shipping of orders placed on TikTok for its creators and brands. Sellers will like that inventory can also be intelligently distributed to support the same nationwide fast delivery at ground shipping rates that other fulfillment networks offer.

It remains to be seen if there will be a captive component to FBT such that product discovery and sales are undeniably linked to using the new service. Still, since the native influencer- and creator-first nature of TikTok and TikTok Live drive much of TikTok Shop’s traffic, it may be some time before a long-term stickiness strategy is developed. We know now that early users will benefit from subsidized storage and shipping costs, as well as ‘free’ customer service for order and shipping support. Customizable ‘badges’ help early users stand out from the competition.

Be Careful Jumping Onto the Bandwagon

So, nearly every major marketplace in the U.S. now has a preferred e-commerce order fulfillment network. Using a non-preferred fulfillment network has definite downsides, some outright punitive. These moves contradict the trend of multichannel selling and come at the sole expense of Sellers.

So why not sign up for all the order fulfillment networks?

It’s not even about the fees these networks charge, which can be significant for any business. The large hidden costs come from maintaining inventory at multiple locations. Let’s break it down:

- Redundant inventory in key markets: Imagine a merchant who wants to offer fast shipping to customers in California and operates on three different marketplaces. The merchant would then need to store its inventory in California at three separate warehouses for each marketplace. After accounting for safety stock, that’s a lot of excess capital tied up unnecessarily.

- Multiple inbound shipments: If a merchant signs up with three fulfillment networks, they must ship their inventory to three warehouses in every major region. This will be more expensive because they’ll be splitting their one big inbound shipment into multiple smaller inbounds.

- Safety stock: Splitting the same amount of inventory between multiple warehouses instead of one or two increases the amount of safety stock merchants must maintain. The square root law of inventory calculates the additional safety stock that needs to be kept on hand as the number of fulfillment centers increases.

- Clearance through multiple channels: If a product doesn’t sell well, merchants will incur the cost of clearing the dead stock through each of these redundant fulfillment centers.

- Returns through multiple channels: Sellers must also compensate or pay for restocking returns on every platform, which can be as high as 20% in some product categories.

Apart from the tangible costs, managing multiple fulfillment programs can cause headaches—for example, the added complexity of juggling multiple contracts, billing audits, and keeping track of ever-changing rates and terms. Furthermore, holding more inventory exposes sellers to a higher risk of losses from shifts in customer demand or during a recession. If a Seller opts to go with an unaffiliated third-party logistics provider, they become a buy box pariah on every platform.

It is hard to ignore the environmental costs, too. The inefficiencies of excess inventory at its core result in a larger carbon footprint through excess transportation and warehousing operations. The repercussions are brutal to ignore when humanity is inching towards irreversible damage to the climate every day. Sellers are losing, and so is our planet!

The Future of Order Fulfillment is Wide Open

The platforms and marketplaces are doing what’s best for them. They are building their e-commerce order fulfillment networks to drive revenue and lock Sellers into their platforms. However, what’s best for marketplaces may not be best for Sellers. Captive order fulfillment services add unnecessary costs and do not scale to a seamless customer experience across channels.

The optimal future of order fulfillment is customer-centric. It means delivering goods to customers how they prefer, not limited to the options the seller or the fulfillment partner thrust upon them. The options should not be limited to lightning-fast delivery or Buy Online Pickup in Store (BOPIS). They should also allow the customer to choose greener delivery options for the Earth or the ability to have the order delivered the same day from a local store without costing an arm and a leg. When order fulfillment networks operate under this new paradigm, they’d be able to offer these options (and more) to merchants of all sizes, and such services will not be a luxury limited to large multi-billion dollar retailers (think Amazon-Kohls or Amazon-Staples) as an example.

The future of e-commerce order fulfillment must also be efficient, where all supply chain constituents work together to serve the customer profitably and responsibly. Instead of walls and hurdles preventing growth and advancement, true next-generation fulfillment solutions will facilitate collaboration between all value chain members. It will unite the manufacturers, the retailers, and everyone in between, including the competitors. At Cahoot, we firmly believe that customer centricity and merchant profitability will continue to suffer unless we re-imagine and re-design our captive order fulfillment models. You can read more about the future of order fulfillment and how our solution can help you get there today.

Offer 1-day and 2-day shipping at ground rates or less.

Related Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations

How AI Agents Will Transform Ecommerce Order and Inventory Management Systems

Knowledge workers will either need to learn to harness the power of AI to 10X their output (or the output from the tools at their disposal), or AI agents will take over those jobs at a fraction of the cost.

Preparing for Peak Holiday Season [A Guide for Sellers]

The peak holiday season is the most critical time of the year for e-commerce businesses, characterized by intense order volumes, high consumer expectations, and operational complexities.

Up to 64% Lower Returns Processing Cost

On Demand Warehousing: Right for You?

In this article

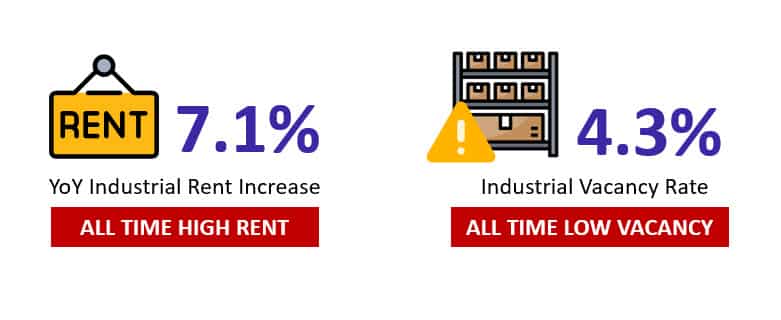

Trying to find extra warehouse space as a merchant is daunting. According to JLL’s recent Industrial Outlook, the market for industrial rent has never been worse. Vacancies are at a miniscule 4.3%, an all time low, and rents rose a whopping 7.1% in 2021, reaching an all-time high.

And yet, you need room to grow. Higher sales and more products demand bigger inventories, and that’s without mentioning the supply chain crisis that’s forcing merchants to load up on more inventory than usual.

At the same time, many merchants aren’t using all of their own warehouse space. It’s tough to get the perfect size warehouse, so many err on the side of caution and start with more room than they need.

That’s where on demand warehousing comes in – merchants who need space can get the warehouse capacity they need from those who have more than they need.

What is On Demand Warehousing?

On-demand warehousing is the idea that merchants can rent out space in other merchants’ warehouses to help with their storage and fulfillment needs.

The Wall Street Journal describes it well:

“The idea is to tap into unused space in a crowded U.S. industrial real-estate market where distribution centers near population centers are fetching a growing price premium. Retailers and manufacturers are trying to position goods closer to customers without getting locked into long-term contracts or multiyear leases when rapid changes in buying patterns and trade conditions have made forecasting demand more difficult.”

On-demand warehousing platforms connect merchants to others that can provide warehousing services. A user on one of their platforms will be able to see a variety of warehouse owners that may be able to suit their needs with temporary space. They can then negotiate for warehouse space and services directly from those owners, securing the extra footprint they need.

On-demand warehousing is rising in prominence because it’s becoming more difficult to “go it alone” in the eCommerce era. Before the rise of Amazon Prime, merchants could easily lease space solely around their home base, keeping inventory centralized and easy to manage. Prime, though, has pushed customer expectations for fast delivery ever higher – and those customer expectations extend past Amazon’s marketplace to DTC stores and brick & mortar retailers alike.

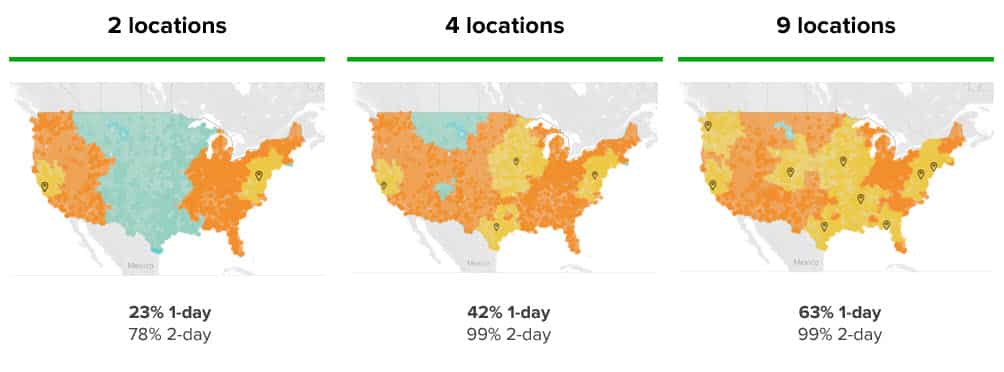

To provide fast shipping at an affordable cost, merchants need to strategically deploy inventory in four or more locations across the country. Put it all together, and you see why merchants are looking to expand their footprint across the United States. On demand warehousing offers one way to build a nationwide ecommerce order fulfillment strategy.

Pros and Cons of On Demand Warehousing

On demand warehousing can solve many challenges for merchants, but it comes with its own issues. In this section, we’ll cover what it does well and what it doesn’t address.

Pros of On Demand Warehousing

1. Flexible growth

The retail landscape seems to shift at warp speed – we went from talking about 2-day delivery to same-day delivery in the blink of an eye. The pandemic has only accelerated the pace of change, and while the total retail and eCommerce markets grow rapidly, it’s more difficult than ever to predict their futures.

Will curbside pickup from big box retailers disrupt Amazon? Will dark stores powering same-day shipping leap over customer demand for 1- and 2-day shipping? What’s just over the horizon?

If you’re buying or leasing your own space and investing heavily into operations, you’re locking yourself into one particular mode of fulfillment for years to come. On demand warehousing’s short contracts and endless options, on the other hand, present an opportunity to shift your approach at the drop of a hat and satisfy the newest customer demands.

2. Enables fast shipping

On demand warehousing is a flexible way for merchants to strategically place their inventory in 4+ US fulfillment centers. Directly owning or leasing space across the country requires a huge investment of time and capital, and it’s simply out of reach for most merchants. 4+ locations, though, are necessary to cover the entire country with 2-day shipping at ground rates. With on demand warehousing, nationwide inventory distribution is feasible even for smaller merchants.

Source: Cahoot analysis of FedEx Ground delivery times

It also helps larger enterprises strategically deploy inventory in regions where they think they’ll experience a demand spike. For instance, when natural disasters unfortunately occur, large retailers will send a massive amount of relevant equipment to on demand warehouses in a nearby area to ensure that they don’t go out of stock on essential goods. It can also help with the holiday rush if a retailer feels that they don’t have enough inventory in a critical part of the country.

3. Low capital requirements

On demand warehousing fits entirely into Operating Expenses. This minimizes the risk of investing in the wrong areas, and it maximizes the capital available to deploy towards other critical parts of the business.

For instance, you can flexibly rent out more space to try out a new product, and if it doesn’t move, you can quickly get out of the on demand lease. If you had leased out commercial warehouse space yourself, you might be stuck in a 12-month or longer lease, and tied up money that could have gone to a new hire or to expanding the marketing budget to make up for the new product failure.

Cons of On Demand Warehousing

1. Questionable warehousing & fulfillment quality

Fast and accurate fulfillment is hard, and warehouses that weren’t designed with it in mind can’t keep up. When you use an on demand platform to contract with one or more warehouses, you just won’t know the level of quality you’ll receive until your products have been shipped.

The benefit of enabling affordable fast shipping with a nationwide network will quickly be stripped away by errors in the fulfillment process if you contract with a fulfillment center that can’t keep up with the rigors of same-day shipping. Moreover, as the pressure to work quickly increases, the error rate at many operations skyrockets – just ask the merchants that have been dropping out of the Seller Fulfilled Prime program.

On top of that, you’re unlikely to get good customer support when working with warehouses on demand. Warehouses that sign up for an on demand warehousing platform don’t usually consider customer service a core competency, and you might not even have a reliable way to get someone on the phone to talk out issues.

On demand warehousing gives you tremendous flexibility in choosing who to work with, but it doesn’t come with a central control tower to help make sure things go right. Problem solving and troubleshooting with multiple different facilities will be up to you, and if even just one warehouse isn’t up to par, it’ll eat up a huge amount of your time – and not to mention your profit.

2. Integration complexity

If you just work with one other warehouse through an on demand platform, you’ll have to build a two-way data integration with them to ensure that you have visibility into what’s happening with your products and orders.

Now imagine that you’re doing the same thing with 2 or 3 more warehouses – that’s not a fun tech problem!

No two warehouses’ tech stacks are alike; just about everyone has a different mix of WMS, OMS, IMS, Shipping Software, and more. That means that every additional warehouse you want to add comes with another integration, which adds expense and slows the process down.

This may not be a problem for an enterprise like Walmart, which secured 1.5 million sq ft of temporary space through an on-demand platform, but it can bury a SMB.

3. Short term solution

The benefits of a short-term contract also come with a downside: just as you aren’t locked into a long-term commitment, neither is the warehouse providing you with space and fulfillment capabilities. If they want to expand their own operations, or if they find a customer that will pay more for you, you can find yourself needing to find a new place for your inventory with only a few weeks’ notice.

Not to mention, your expanding needs will force you back into the on demand marketplace over and over to find new partners. The warehouses that you contract with at first only have so much space and only have certain capabilities, so as you expand, you’ll need to add new warehouses. You’ll find yourself going back to the platform over and over, which incurs significant managerial time costs. And on top of that, you’ll add more and more complexity instead of enjoying economies of scale.

Who Uses On Demand Warehousing?

On demand warehousing is the best fit for sophisticated enterprises that have the resources and capability to manage a high degree of complexity in their operations. They use on demand warehousing to meet specific, short-term goals without deploying capital. In this way, they can take advantage of growth opportunities and find creative solutions for logistics challenges without putting a huge bet on an uncertain or short-term strategy.

Consider our example of Walmart from earlier – they leased out a full 1.5 million extra square feet of space through an on demand portal. They know exactly what their short-term needs are, and importantly, they know exactly how they’ll move on from their short-term on demand solution.

Ace Hardware presents another interesting example of how on demand warehousing can work well for enterprises. During the 2018 hurricane season, they used on demand warehousing to flexibly stage disaster-relief items near regions that were hardest hit by the natural disasters, ensuring that they could get people the products that they needed to rebuild quickly. Like the Walmart example, Ace used the flexibility offered by on demand warehousing to execute a very specific short-term strategy.

On the other hand, SMBs don’t have the time or capabilities to evaluate, integrate with, and manage short-term warehouse partnerships. If you’re an SMB and want to take advantage of the benefits of on demand warehousing, what can you do?

Cahoot – Your Nationwide Network, Without the Hassle

You want a nationwide footprint to power your growth with affordable fast shipping, but you don’t have the time to manage multiple relationships with on demand warehouses across the country.

At Cahoot, we handle the hard part for you.

We’ve built a nationwide network of top-quality merchant fulfillment centers already, and we continuously monitor them to ensure a leading >99.95% on-time shipping rate. Your dedicated Cahoot account manager will be your one point of contact, and our software gives you real-time visibility into our fulfillment performance and your inventory. You may have inventory in four of our locations, but from your perspective, you’re just working with one great company.

On top of that, we’ll strategically evaluate your order flow and make recommendations to improve your inventory placement across our network. Need to add a location? You don’t have to go back to an on demand platform again to find yet another partner – we’ll just add one with the click of a button, and you’ll be ready to grow.

Whether you already have a warehouse and want to expand your footprint or are looking for a full-service fulfillment provider, we have the flexibility to handle your specific needs.

Talk to an expert today and see how our peer-to-peer network will power your profitable growth.

Offer 1-day and 2-day shipping at ground rates or less.

Related Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations and

How AI Agents Will Transform Ecommerce Order and Inventory Management Systems

Knowledge workers will either need to learn to harness the power of AI to 10X their output (or the output from the tools at their disposal), or AI agents will take over those jobs at a fraction of the cost.

Preparing for Peak Holiday Season [A Guide for Sellers]

The peak holiday season is the most critical time of the year for e-commerce businesses, characterized by intense order volumes, high consumer expectations, and operational complexities.