3PL Returns: How Outsourced Returns Actually Work and Where Brands Lose Money

In this article

26 minutes

26 minutes

- Introduction to Ecommerce Returns

- What 3PL returns means operationally

- The journey of a returned package through a 3PL facility

- Common reverse logistics disposition paths and their economic implications

- SLAs and where they break down

- Hidden costs in 3PL returns operations

- Benefits of Outsourcing Returns

- What brands should control versus what to outsource in returns management

- Common failure modes impacting customer satisfaction and how to prevent them

- Best Practices for 3PL Returns

- Technology and integration requirements

- When to keep returns in-house versus outsource

- Future of 3PL Returns

- Frequently Asked Questions

Most brands outsource returns to a 3PL expecting cost savings, but returns fail when disposition rules, SLAs, and audit controls are undefined. 3PLs can help brands save money by reducing logistics costs and achieving reverse logistics cost savings, especially by optimizing returns processing and warehouse operations. The real risk in 3PL returns is not software, but loss of visibility and accountability after the package arrives. Industry data shows that returns processing through 3PLs can take 10-14 days on average, with some operations extending to 20+ days during peak seasons. When brands lack defined disposition logic, clear SLAs, and audit mechanisms, they discover hidden costs through inventory shrinkage (2-5% of returned goods), delayed restocking that creates phantom stockouts, and billing disputes that can reach thousands monthly. High labor costs are a significant burden on third-party logistics providers in the logistics industry, and outsourcing returns to a 3PL can help mitigate risks associated with handling returns, such as high labor costs and inefficiencies.

For mid-market Shopify brands processing hundreds or thousands of returns monthly, understanding what actually happens inside a 3PL’s reverse logistics operation determines whether outsourcing reduces costs or simply moves complexity out of sight. The operational reality is that returns management requires as much strategic oversight as outbound fulfillment, regardless of which entity physically handles the packages.

Introduction to Ecommerce Returns

Ecommerce returns are an unavoidable aspect of running an online business, and how they are managed can make or break customer satisfaction and operational efficiency. The returns process involves much more than simply accepting products back—it requires careful coordination of receiving, inspecting, and processing returned items, all while keeping customers informed and happy. For many ecommerce companies, handling the entire returns process in-house can be time consuming and resource-intensive, especially as order volumes grow. This is where third party logistics providers (3PLs) play a critical role. By leveraging the expertise and infrastructure of third party logistics, ecommerce businesses can ensure a smooth process for both their operations and their customers. Effective management of ecommerce returns not only supports maintaining customer satisfaction but also drives operational efficiency, helping ecommerce companies stay competitive in a demanding market.

What 3PL returns means operationally

3PL returns refers to outsourcing the reverse logistics process to a third-party logistics provider who receives, inspects, processes, and dispositions returned merchandise on behalf of the brand. Unlike outbound fulfillment where the workflow is straightforward (pick, pack, ship), returns involve decision trees that directly impact inventory value, customer experience, and financial reconciliation.

The operational scope typically includes receiving returned packages from customers or carriers, performing initial inspection and condition assessment, executing disposition decisions based on predefined rules, updating inventory systems to reflect returned stock, processing refunds or exchanges according to brand policies, managing defective or damaged items, coordinating liquidation or disposal for unsellable goods, and providing reporting on return reasons, processing times, and disposition outcomes. The use of return merchandise authorization (RMA) numbers is standard practice to track and manage returned items throughout the entire process, ensuring transparency and efficient reverse logistics.

What 3PL returns does not automatically include unless explicitly contracted: customer-facing return portal management (this often remains with the brand or a separate software platform), return policy definition and updates, disposition logic creation, fraud detection and investigation, customer service for return inquiries, and strategic decision-making on how to handle edge cases.

The handoff point is critical. The entire process starts when a customer requests shipping details for reverse logistics, typically through the brand’s system (Shopify, a returns app, or custom portal), receives a prepaid return shipping label, and ships the package back. Once the return shipment arrives at the 3PL warehouse, the items are logged against their Return Merchandise Authorization (RMA) number. The 3PL’s responsibility is to process returns, manage refunds, and handle the returned merchandise according to the brand’s policies. Everything before arrival remains the brand’s operational responsibility unless additional services are contracted.

For brands accustomed to controlling outbound fulfillment details, the mental shift required for returns outsourcing is substantial. You cannot inspect what you cannot see, and once packages enter the 3PL facility, visibility depends entirely on the systems, processes, and SLAs you established upfront.

Make Returns Profitable, Yes!

Cut shipping and processing costs by 70% with our patented peer-to-peer returns solution. 4x faster than traditional returns.

See How It WorksThe journey of a returned package through a 3PL facility

When a return arrives at a 3PL warehouse, it enters a multi-stage process where each decision point creates opportunity for value recovery or value loss. The receiving stage involves scanning the return label or RMA number to log receipt in the warehouse management system, visual inspection of outer packaging for damage, and sorting into processing queues based on priority (date received, product type, or customer tier). Returns fulfillment often takes longer than initial order fulfillment due to the additional steps required in returns processing.

Initial inspection and condition assessment follows, where warehouse staff open the package and verify contents match the return authorization, inspect product condition against predefined criteria (new, like new, damaged, defective, missing components), photograph items when condition is questionable or high-value, and flag discrepancies between what was authorized and what arrived. A dedicated return warehouse with trained staff enables more efficient returns processing and professional handling of returned goods, reducing errors and processing time.

This inspection stage represents the first critical control point. 3PLs typically employ one of three inspection models: basic visual inspection taking 2-3 minutes per item, detailed inspection with functionality testing taking 5-10 minutes per item, or automated inspection using standardized checklists or AI-assisted imaging. The inspection depth directly correlates with accuracy of disposition decisions and restocking rates.

Disposition execution follows the inspection. Based on predefined rules (which should be documented in the 3PL contract), items are routed to restock (return to sellable inventory), refurbish (cleaning, repackaging, or minor repair before restocking), liquidation (sell to secondary market buyers at discounted rates), donation (transfer to charitable organizations), or destruction (dispose of unsellable, hazardous, or brand-protected items).

Inventory system updates should occur simultaneously with disposition, but this represents a common failure point. Many 3PLs operate on batch update cycles (end of day or end of shift) rather than real-time updates, creating windows where inventory shows as unavailable even though inspection determined it’s sellable. Reliance on manual processes in these updates can introduce inefficiencies and delays, impacting inventory management and operational speed. For high-velocity SKUs, a 12-hour lag between physical inspection and system update can trigger stockouts and lost sales.

Financial reconciliation closes the loop, with the 3PL billing for receiving fees, inspection fees, disposition fees, storage fees for items awaiting processing, and any value-added services (cleaning, repackaging, photography). Simultaneously, the brand must reconcile inventory value changes (full-price restock versus liquidation recovery versus total loss) and update customer accounts with refunds, store credit, or exchange shipping.

Common reverse logistics disposition paths and their economic implications

An effective 3PL returns strategy relies on several key components: implementing automated return systems, establishing dedicated inspection areas, and leveraging technology for integration with inventory systems. These elements streamline reverse logistics, reduce processing costs, and improve value recovery.

Restock represents the optimal outcome where returned items re-enter sellable inventory at full value. Industry benchmarks suggest that 40-60% of ecommerce returns qualify for direct restocking, though this varies dramatically by category (apparel sees lower rates due to wear and hygiene concerns, electronics higher rates if unopened). The economic value is straightforward: a $50 item restocked recovers $50 in inventory value minus processing costs (typically $3-8 per item for 3PL handling).

The timeline matters critically for restocking value. An item returned, inspected, and restocked within 3-5 days maintains full sellability. The same item taking 14-21 days to process may face markdown pressure due to seasonality shifts, new model releases, or simply aging in fast-moving categories. Fashion and electronics face the steepest depreciation curves, where a two-week delay can reduce sellable value by 10-20%.

Refurbish or repackage creates a middle path for items that are functionally sound but cosmetically imperfect or missing original packaging. This might involve cleaning, replacing damaged packaging, bundling with new accessories, or light repairs. 3PLs typically charge $5-15 per item for refurbishment services, and brands must decide whether the recovered value justifies the cost. A $100 item that can be refurbished for $10 and sold for $85 delivers $75 net value versus $0-20 from liquidation.

Liquidation channels vary in recovery rates. Wholesale liquidators typically pay 10-25% of retail value for bulk lots. Recommerce platforms (B-Stock, Optoro, Liquidity Services) may achieve 20-40% through competitive bidding. Direct-to-consumer outlets or flash sale sites can reach 40-60% if the brand controls the channel. The key variable is volume and product category. High-demand consumer electronics recover more than generic apparel. Large consistent volumes command better rates than sporadic small lots.

Destruction represents complete value loss plus disposal costs. Beyond the lost inventory value, 3PLs charge $2-10 per item for disposal depending on whether special handling is required (hazmat, data destruction, witnessed destruction for brand protection). Some categories demand destruction: recalled products, expired consumables, counterfeits, or items where brand integrity requires preventing secondary market sales. One brand reported destroying $50,000 in returned goods annually to prevent liquidation channel conflicts with authorized retailers.

The strategic decision framework requires calculating total value recovery across all paths. If 50% restock at 100% value, 30% liquidate at 25% value, and 20% destroy at 0% value, average recovery is 57.5% before processing costs. Processing costs of $6 per item average reduce net recovery to approximately 45-50% for a $50 average order value product. These economics explain why high return rates (above 20-25%) can eliminate profitability entirely for margin-constrained categories.

SLAs and where they break down

Standard 3PL returns SLAs typically promise 3-5 business days for inspection and disposition after receipt, 95-98% inventory accuracy in system updates, and 24-48 hours for reporting on return reasons and disposition outcomes. These SLAs sound reasonable but obscure critical gaps.

The “after receipt” qualifier creates the first gap. Receipt means when the 3PL scans the package into their facility, not when the customer ships it. If a customer ships Monday and the carrier delivers Thursday, that’s three days before the SLA clock starts. If the 3PL then takes five business days to process, total time from customer shipment to disposition is 8+ business days. For the customer expecting a refund, this timeline feels unacceptable even though the 3PL met their SLA. Effective communication during the returns process is essential for reducing customer anxiety and maintaining customer trust, as timely updates and transparency help reassure customers and foster loyalty.

Inventory accuracy SLAs measure whether the system reflects physical inventory correctly, not whether disposition decisions were correct. A 3PL can achieve 98% inventory accuracy while making poor disposition choices (liquidating items that should restock, or restocking items that should liquidate). The accuracy metric confirms the database matches the warehouse, not that the warehouse made optimal decisions.

Peak season carve-outs represent another common gap. Many 3PL contracts include provisions allowing extended processing times during Q4 (November-December) when return volumes spike 200-400%. These clauses may extend the 5-day SLA to 10-15 days, precisely when customers are most sensitive to refund timing. One Shopify brand reported 18-day average processing during December 2024, creating massive customer service burden and refund inquiries.

The most critical SLA gap involves exception handling. Standard SLAs govern routine returns, but 15-25% of returns are non-routine: wrong item received, damaged in transit, fraudulent return, missing components, or condition that doesn’t match inspection criteria. Most 3PL contracts don’t define SLAs for these exceptions, leading to items sitting in “pending review” queues for weeks while the brand and 3PL exchange emails about disposition authority.

Enforcement mechanisms for SLA violations are often weak. Contracts may promise “service credits” for missed SLAs, but these credits typically cap at 5-10% of monthly fees. If poor returns processing causes $10,000 in lost sales due to inventory delays, a $500 service credit provides inadequate remedy. The real cost of SLA failures isn’t the contractual penalty but the operational impact on inventory availability and customer satisfaction. Continuous improvement in returns management is vital for maintaining customer satisfaction and operational efficiency, ensuring that processes evolve to meet changing expectations and reduce recurring issues.

Convert Returns Into New Sales and Profits

Our peer-to-peer returns system instantly resells returned items—no warehouse processing, and get paid before you refund.

I'm Interested in Peer-to-Peer ReturnsHidden costs in 3PL returns operations

Shrinkage represents the most insidious hidden cost. Industry averages suggest 2-5% of returned inventory disappears between customer shipment and final disposition, with higher rates in certain categories (small valuable items like jewelry or electronics accessories). Shrinkage sources include theft, misplacement within the warehouse, incorrect disposition (items destroyed that should have been restocked), and data entry errors where items are written off in the system but physically present.

The financial impact compounds when shrinkage affects high-value items. A 3% shrinkage rate on $100,000 monthly return volume equals $3,000 monthly or $36,000 annually. Many brands don’t discover this loss because they lack independent audit mechanisms. The 3PL reports “received and processed 1,000 returns” and the brand accepts this number without verification against customer shipping data or carrier delivery confirmations.

Delayed restocking creates opportunity cost that doesn’t appear on 3PL invoices. When a bestselling SKU shows out-of-stock but 50 units sit in the returns processing queue, every day of delay costs potential sales. For an item selling 20 units daily at $40 margin, a one-week processing delay costs $5,600 in lost contribution margin. The 3PL’s processing fee might be $250, but the total cost to the brand is $5,850.

Billing complexity and disputes consume operational time. 3PL invoices for returns typically include per-item receiving fees, per-item inspection fees, per-item disposition fees that vary by path (restock cheaper than refurbish or liquidate), storage fees for items pending processing, special handling fees for exceptions, and miscellaneous fees for photography, additional packaging, or customer service inquiries.

Reconciling these invoices against actual return volume and expected costs requires dedicated financial operations resources. One mid-market brand reported spending 15-20 hours monthly on 3PL invoice reconciliation and dispute resolution, discovering overbilling errors averaging $800-1,200 monthly. Over a year, the discovered errors exceeded $10,000, but the labor cost to find them was nearly $8,000 (assuming $40/hour loaded cost).

Technology integration gaps create manual work and errors. If the 3PL’s WMS doesn’t integrate seamlessly with Shopify inventory management, someone must manually update stock levels, product condition codes, and disposition statuses. This manual work introduces lag (updates happen daily or weekly rather than real-time) and errors (data entry mistakes, missed updates during high-volume periods). Manual processes not only increase the risk of errors but also drive up operational costs, making 3PL returns less efficient and more expensive.

The quality control gap emerges when 3PL inspection standards don’t match brand standards. What the 3PL deems “like new” and restocks might fail the brand’s quality bar, leading to customer complaints, negative reviews, and returns of already-returned items. One apparel brand found that 15% of items their 3PL restocked were returned again within 30 days with condition complaints, effectively doubling the return rate and processing costs for those items. Poor returns management can directly result in negative reviews from customers, especially when expectations for product quality or refund speed are not met.

Many e-commerce businesses do not have the processes or staff in place for effective returns management, and returns management is often regarded as a major operational hurdle by warehouse operators.

Benefits of Outsourcing Returns

Outsourcing the returns process to a 3PL offers ecommerce businesses a range of strategic advantages. By entrusting the entire returns process to a specialized provider, brands can free up internal resources and focus on growth-driving activities. 3PLs are equipped to handle everything from receiving and inspecting returned products to processing refunds and restocking inventory, which helps reduce labor costs and improve inventory accuracy. Their advanced systems and processes also minimize errors and ensure that returned inventory is quickly made available for resale, supporting better cash flow and inventory management. Additionally, 3PLs provide valuable insights into customer return behavior and reasons for returns, enabling ecommerce companies to identify trends, address product issues, and optimize their operations. Ultimately, outsourcing returns to a 3PL enhances customer satisfaction by ensuring a fast, reliable, and transparent returns experience, giving ecommerce businesses a competitive edge.

What brands should control versus what to outsource in returns management

The strategic framework divides returns management into policy decisions (brand retains control), execution standards (brand defines, 3PL executes), and physical operations (3PL performs, brand audits).

Brand-controlled elements must include return policy definition (timeframes, conditions, refund versus store credit), disposition logic for each product category and condition, pricing for liquidation channels and markdown strategies, fraud detection thresholds and investigation protocols, customer communication templates and timing, and escalation procedures for exceptions requiring brand judgment.

These elements represent core business strategy and cannot be delegated without risking brand integrity and financial performance. A 3PL can advise based on industry benchmarks and operational feasibility, but the final policy decisions must remain with the brand owner.

Jointly defined execution standards include inspection criteria and condition definitions (what qualifies as “new” versus “like new” versus “damaged”), quality control sampling protocols, turnaround time expectations and prioritization rules, inventory system update timing and accuracy requirements, reporting frequency and metrics, and audit and verification procedures. Regulatory compliance is critical in returns processing, as the complexity of returns can lead to compliance issues that may result in delays and increased waste if not properly managed.

These standards should be documented in the 3PL contract with specific examples and photographic references. “Inspect for damage” is too vague. “Items with visible wear, stains, missing tags, or non-functional components must be photographed and flagged for brand review before disposition” provides actionable guidance.

3PL-executed physical operations include receiving and scanning returned packages, performing inspection according to defined standards, executing disposition based on brand logic, updating inventory systems, coordinating liquidation channel shipments, processing refunds and exchanges, and generating weekly or monthly reporting. 3PLs can also support sustainability by implementing efficient and environmentally responsible returns management practices, reducing waste and promoting operational efficiency.

The critical requirement is that 3PL execution follows brand standards, not 3PL convenience. If the brand requires same-day inventory updates but the 3PL operates on batch cycles, either the 3PL must change their process or the brand must find a different provider. Service requirements should drive vendor selection, not vendor limitations constraining brand operations.

Audit and verification mechanisms must be brand-controlled. Recommended practices include monthly physical inventory audits (comparing 3PL reported inventory to actual counts), disposition decision reviews (sampling 5-10% of processed returns to verify correct disposition), customer feedback monitoring (tracking complaints about refund timing or restocked item quality), financial reconciliation (comparing 3PL invoices to contractual rates and actual volumes), and performance metrics tracking (measuring actual processing times, restock rates, shrinkage, and customer satisfaction).

One sophisticated brand implements quarterly “mystery returns” where they ship known products in known conditions and track whether the 3PL correctly identifies the items, applies proper disposition, updates inventory accurately, and processes within SLA. This provides objective performance data beyond the 3PL’s self-reported metrics.

A simplified returns process not only enhances customer satisfaction but also encourages repeat purchases, supporting long-term customer loyalty.

Common failure modes impacting customer satisfaction and how to prevent them

The undefined disposition authority failure occurs when returns arrive in conditions not covered by the brand’s disposition logic. The 3PL doesn’t know what to do, items sit in pending queues, and inventory remains unavailable. Prevention requires comprehensive disposition matrices covering all realistic scenarios: new/unopened, opened but unused, light wear, moderate wear, damaged packaging only, functional defect, cosmetic defect, missing accessories, wrong item received, and suspected fraud.

The inspection quality failure happens when 3PL staff lack training, time, or incentive to inspect thoroughly. Items that should liquidate get restocked and later returned by customers, or items that could restock get unnecessarily liquidated. Poor returns management can lead to disgruntled customers, damaging brand reputation and customer loyalty. Prevention requires detailed inspection protocols with photographic examples, quality control sampling by the brand, and financial incentives tied to restock rates and customer satisfaction rather than processing speed alone.

The inventory lag failure creates phantom stockouts where items are physically available but show unavailable in the system for days or weeks. Prevention demands real-time or near-real-time inventory updates (within 2-4 hours of disposition) and system integration rather than manual data entry.

The billing opacity failure leaves brands unable to verify if they’re charged correctly. Prevention requires detailed invoicing with line-item charges tied to specific RMA numbers or return IDs, automated invoice validation against contracted rates, and monthly reconciliation processes.

The peak season capacity failure occurs when the 3PL underestimates Q4 volume and processing times balloon from 5 days to 20+ days. Prevention involves contractual capacity guarantees, early peak season planning (by June or July for Q4), temporary staffing plans, and alternative disposition paths (like temporarily halting liquidation to focus on restocking high-value items).

The customer experience disconnect failure happens when customers contact the brand about return status but the brand lacks real-time visibility into where the 3PL is in processing. Prevention requires customer-facing tracking integration, proactive status updates at key milestones (received, inspected, refund processed), and empowering customer service teams with 3PL system access. Best practices for 3PL returns management focus on creating a seamless, transparent, and efficient reverse logistics process that streamlines operations and enhances efficiency in handling customer returns.

Customer feedback during the returns process can inform product improvements and better inventory decisions.

Best Practices for 3PL Returns

To maximize the value of a 3PL returns process, ecommerce businesses should adopt several best practices. Start by establishing clear communication channels with your 3PL provider, ensuring that roles, responsibilities, and performance expectations are well defined from the outset. Implement a streamlined returns process that prioritizes both efficiency and customer satisfaction, with standard operating procedures that minimize delays and errors. Regular updates and transparent reporting from the 3PL are essential, allowing the ecommerce business to monitor the returns process and quickly identify areas for improvement. It’s also important to choose a 3PL that offers flexible and scalable solutions, so your returns management can adapt as your business grows or as return volumes fluctuate seasonally. By following these best practices, ecommerce companies can ensure an efficient, customer-centric, and scalable 3PL returns process that supports repeat business and brand loyalty.

No More Return Waste

Help the planet and your profits—our award-winning returns tech reduces landfill waste and recycles value. Real savings, No greenwashing!

Learn About Sustainable ReturnsTechnology and integration requirements

Effective 3PL returns require integration between multiple systems: the ecommerce platform (Shopify), the returns management platform (if using dedicated software like Loop, Narvar, or Returnly), the third party logistics (3PL) provider’s warehouse management system, the brand’s inventory management system, the accounting system for financial reconciliation, and customer service tools. Third party logistics (3PL) providers play a crucial role in managing supply chain operations, including transportation, warehousing, inventory management, order fulfillment, and especially returns, ensuring an efficient supply chain for business success.

The minimum viable integration provides daily inventory updates via CSV or API, weekly returns reporting with disposition data and return reasons, and monthly financial reconciliation data. This enables basic operations but creates significant lag in inventory availability.

The optimal integration provides real-time inventory updates within 2-4 hours of disposition, real-time return tracking visible to customer service teams, automated financial reconciliation with anomaly flagging, and API-based data exchange eliminating manual data entry. Data feedback loops in returns management help identify product defects and marketing inaccuracies, allowing for improvements that lower future return rates and reduce future returns.

The technical capability gap often emerges here. Many 3PLs, particularly smaller regional providers, operate on legacy WMS platforms with limited API capabilities. They can provide data but only through manual exports and email. Advanced 3PLs may use AI-driven systems to detect return fraud, such as item swapping, during the inspection process. Brands accustomed to real-time ecommerce platforms find this unacceptable, but switching to a more technically capable 3PL may cost 20-30% more in processing fees.

The strategic question is whether the operational benefit of real-time data justifies the cost premium. For high-velocity businesses where inventory turns weekly and stockouts cost thousands in lost sales, the answer is typically yes. For slower-velocity businesses with longer planning cycles, daily batch updates may suffice.

When to keep returns in-house versus outsource

The decision framework balances volume, complexity, and strategic importance. For an online retailer, several key components must be considered when deciding whether to outsource returns, including the impact on customer loyalty. In-house returns make sense when monthly return volume is below 200-300 units (below this threshold, 3PL minimum fees often exceed in-house costs), when product inspection requires deep brand knowledge or specialized equipment, when return reasons provide critical product development feedback, when the brand operates its own warehouse for outbound fulfillment, or when tight control over customer experience and refund timing is competitively critical.

3PL returns make sense when monthly volume exceeds 500+ units and the brand lacks warehouse infrastructure, when returns processing distracts from core business operations, when seasonal volume spikes create capacity challenges (in-house team can’t scale for Q4 then downsize), when multiple fulfillment locations require distributed returns processing, or when the brand wants to consolidate logistics operations with a single partner handling both outbound and returns. 3PL providers can automate return processes, which improves workplace productivity rates.

The hybrid model splits returns by type: high-value or complex returns processed in-house where brand expertise adds value, while commodity or straightforward returns go to the 3PL. This requires clear allocation rules and typically higher operational complexity, but it optimizes for value recovery on items where inspection quality matters most. A well-managed returns process can enhance customer satisfaction and encourage repeat business.

Future of 3PL Returns

The future of 3PL returns is being shaped by rapid technological innovation and evolving consumer expectations. As shoppers demand faster, easier, and more sustainable returns, ecommerce businesses and their logistics partners must adapt to stay ahead. 3PL providers are increasingly investing in automation, artificial intelligence, and advanced data analytics to support efficient returns management and deliver a seamless customer experience. These technologies enable faster processing, better inventory control, and more accurate insights into return trends, all of which contribute to higher customer satisfaction. Additionally, the focus on sustainability is driving 3PLs to develop greener reverse logistics solutions, such as optimizing transportation routes and reducing waste. To meet rising consumer expectations, 3PLs are also offering more personalized and flexible returns options, supporting both customer convenience and brand loyalty. By embracing these trends, ecommerce companies and their logistics partners can create a future-ready returns process that enhances operational efficiency, supports sustainability, and keeps customers happy.

Frequently Asked Questions

What does 3PL returns actually mean and what do they handle?

3PL returns means outsourcing reverse logistics to a third-party logistics provider who receives, inspects, processes, and dispositions returned merchandise. The 3PL’s scope typically includes receiving returned packages, inspecting item condition, executing disposition decisions (restock, refurbish, liquidate, destroy), updating inventory systems, and providing reporting. What it doesn’t automatically include: customer-facing return portal management, return policy definition, disposition logic creation, customer service for return inquiries, or fraud detection. The 3PL’s responsibility typically begins when returned packages arrive at their facility, not when customers initiate returns.

What happens when a returned item arrives at a 3PL warehouse?

The package enters a multi-stage process: receiving (scanning return label, logging in WMS, visual inspection of outer packaging), initial inspection (opening package, verifying contents, assessing condition against criteria, photographing questionable items), disposition execution (routing to restock, refurbish, liquidation, or destruction based on predefined rules), inventory system updates (returning sellable items to available inventory), and financial reconciliation (billing for processing fees, updating inventory values). The critical control point is inspection quality, which determines whether items are correctly dispositioned for maximum value recovery.

What are common return disposition paths and how much value do they recover?

Restock returns items to sellable inventory at full value (typically 40-60% of returns qualify, recovering 100% of inventory value minus $3-8 processing costs). Refurbish involves cleaning or repackaging for $5-15 per item, recovering 70-90% of value. Liquidation sells to secondary markets, recovering 10-40% of retail value depending on category and channel. Destruction represents total loss plus $2-10 disposal costs. Average recovery across all paths typically reaches 45-50% of original value after processing costs. Timeline matters critically as items taking 14-21 days to process face 10-20% value depreciation in fast-moving categories.

What are typical 3PL returns SLAs and where do they break down?

Standard SLAs promise 3-5 business days for inspection and disposition after receipt, 95-98% inventory accuracy, and 24-48 hour reporting. Breakdowns occur because “after receipt” starts when the 3PL scans packages (not when customers ship), adding carrier transit time. Peak season carve-outs extend processing to 10-15 days during Q4. Inventory accuracy measures system accuracy, not disposition decision quality. Exception handling (15-25% of returns) often lacks defined SLAs, causing items to sit in pending queues. Enforcement mechanisms are weak, with service credits capping at 5-10% of fees while operational impacts from delays can cost 10-100x more.

What hidden costs appear in 3PL returns that don’t show on invoices?

Shrinkage averages 2-5% of return value ($36,000 annually on $100,000 monthly returns) through theft, misplacement, incorrect disposition, or data errors. Delayed restocking creates opportunity costs when bestsellers show out-of-stock while units sit in processing (one week delay on a 20-unit/day SKU at $40 margin costs $5,600 in lost sales). Billing reconciliation consumes 15-20 hours monthly, discovering $800-1,200 in overbilling errors. Quality control gaps cause 15% of restocked items to be returned again with condition complaints. Technology integration gaps require manual updates introducing lag and errors.

What should brands control versus outsource in returns management?

Brands must control policy decisions including return timeframes, disposition logic, liquidation pricing, fraud thresholds, customer communication, and exception handling. Jointly define execution standards including inspection criteria, quality sampling, turnaround times, inventory update timing, reporting metrics, and audit procedures. Outsource physical operations including receiving, inspection (following brand standards), disposition execution, system updates, liquidation coordination, and refund processing. Maintain audit mechanisms including monthly inventory audits, disposition decision reviews (sampling 5-10% of returns), customer feedback monitoring, financial reconciliation, and performance metrics tracking. The 3PL executes operations, but the brand defines standards and verifies compliance.

Turn Returns Into New Revenue

DSCO Fulfillment Explained: What Sellers Still Get Wrong

In this article

15 minutes

15 minutes

- What DSCO actually does vs what it does not do

- Why sellers confuse EDI compliance with fulfillment readiness

- Order Fulfillment Strategies

- Retailers that rely heavily on DSCO

- Cancellation and late-shipment penalties tied to DSCO metrics

- Real operational examples sellers underestimate

- The role of 3PLs in DSCO success

- What “DSCO readiness” actually looks like in practice

- Strategic takeaway for operations leaders

- Frequently Asked Questions

DSCO fulfillment is where strong EDI still loses to weak execution. DSCO can standardize retailer communication, but it cannot make your warehouse hit SLAs. If you are onboarding to retailer drop shipping, the most common failure mode is treating EDI compliance as the finish line instead of the starting gun.

DSCO’s commitment to operational excellence and providing reliable, innovative logistics solutions sets it apart in the fulfillment landscape.

DSCO is valuable because it creates a common language between retailers and suppliers: order routing, inventory integrations, shipment confirmation, and tracking updates are standardized so a retailer can scale drop ship without custom one-off connections for every brand. That standardization is real. DSCO’s features, such as real-time validations and robust data standardization, further enhance order fulfillment efficiency and accuracy. It is also the reason the operational gaps show up so fast. Once DSCO orders start flowing, retailers judge you on what customers actually experience: ship speed, cancellation rate, tracking reliability, and whether returns and post-purchase support work cleanly.

DSCO provides 100% data standardization with over 70 real-time validations to ensure inventory, product, and shipping data accuracy.

The hard truth is simple. Sellers fail DSCO programs when their warehouse operations cannot meet retailer SLAs, not because of EDI issues.

What DSCO actually does vs what it does not do

DSCO sits in the “communication and compliance” layer of drop shipping. It helps retailers and suppliers manage the entire process of order processing across channels without relying on manual email threads and spreadsheets. In practice, dsco order fulfillment typically includes:

- Receiving sales orders from retail channels in a standardized format

- Passing updates back to the retailer on acknowledgments, cancellations, shipments, and tracking

- Synchronizing inventory levels so a retailer site can decide what to sell

- Supporting consistent status events that feed vendor scorecards and customer service workflows

The integration manager feature of DSCO allows users to track inventory levels and order status in real-time.

That is what DSCO does.

What DSCO does not do is what most sellers secretly need it to do:

- It does not pick, pack, and ship orders

- It does not control your fulfillment centers, labor planning, or cutoffs

- It does not prevent inventory mismatch between your systems and what is physically on the shelf

- It does not force a carrier scan to happen on time

- It does not protect you from shipping costs caused by poor cartonization or service level mistakes

- It does not fix reverse logistics or improve your returns disposition process

DSCO can streamline the connection and make data flow faster. It cannot make execution better. If your warehouse can only ship in two to three business days, DSCO will not change that. If your inventory accuracy is weak, DSCO will not magically reconcile it. DSCO is a mirror. It reflects your operation back to the retailer with timestamps.

Efficient logistics integration with DSCO ensures that product data, order fulfillment, and inventory levels are accurately synchronized across all sales channels.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWhy sellers confuse EDI compliance with fulfillment readiness

This is the single most common operational misunderstanding in dsco fulfillment.

Sellers spend weeks or months getting certified, validating test transactions, and proving the connection works. The integration feels like the “hard part” because it involves outside teams, project plans, and unfamiliar concepts. Once the platform connection is live, everyone wants to believe the account is ready to scale.

But EDI compliance is about message correctness. Fulfillment readiness is about outcome reliability. Efficiently and reliably fulfilling orders is critical for successful dsco fulfillment, as it ensures customer satisfaction and supports business growth.

You can be perfectly compliant and still fail a drop shipping program in your first week if:

- You acknowledge orders on time but ship late

- You send inventory feeds on schedule but oversell due to bad counts. Real-time inventory synchronization is essential for DSCO users to avoid overselling products.

- You generate labels quickly but miss carrier pickup windows

- You provide tracking numbers that do not scan for 24 hours

- You ship partials or substitute SKUs to “save the sale” and trigger chargebacks

Retailers do not grade you on how clean your integration looks. They grade you on the DSCO metrics tied to customer experience: ship on time, ship complete, ship accurately, and keep cancellations low. DSCO makes these metrics measurable, not negotiable.

Order Fulfillment Strategies

Order fulfillment is the backbone of any successful ecommerce business. In the world of DSCO order fulfillment, the right strategy can mean the difference between scalable growth and operational headaches. For ecommerce stores, the challenge isn’t just about getting products out the door—it’s about doing so cost effectively, with real-time tracking, and without hidden fees eating into your margins.

One of the most impactful moves is partnering with a third party logistics (3PL) provider. Companies like LMS Logistics Solutions have demonstrated that leveraging a comprehensive suite of fulfillment services—such as those offered by 3PL Central—can drive efficiency and accuracy. With inventory integrations that automatically update inventory levels and real-time tracking numbers, businesses can maintain near-perfect inventory accuracy and keep customers informed every step of the way.

When evaluating a fulfillment partner, look beyond the upfront cost. Scrutinize for hidden fees, reverse logistics capabilities, and the ability to scale with your business. Cost savings aren’t just about the cheapest rate—they’re about the total cost of ownership, including support, integration, and the flexibility to adjust as your operations grow. Solutions like Extensiv’s DSCO integration offer step integration specific instructions, making it easier to connect your ecommerce order sources, manage inventory, and streamline the entire process from order to delivery.

Drop shipping is another strategy that can help ecommerce businesses expand their assortment without the burden of holding inventory. By working closely with suppliers and retailers, you can fulfill orders directly from the source, reducing shipping costs and allowing your business to focus on sales and growth. This model is especially useful for businesses with limited storage or those looking to test new products without a large upfront investment.

Shipping labels and tracking numbers play a pivotal role in customer satisfaction. Providing real-time tracking and clear communication builds trust and reduces customer service overhead. Whether you’re using your own fulfillment centers, a 3PL, or leveraging Amazon FBA to tap into Amazon’s distribution network, the ability to offer reliable shipping and tracking is non-negotiable.

Distribution strategy matters, too. By creating a network of fulfillment centers—either through your own operations or with a 3PL—you can reach customers faster and more cost effectively, no matter where they are. This is especially important for high-volume products or when serving a wide geographic area.

Ultimately, the most successful ecommerce businesses treat fulfillment as a core competency, not an afterthought. They work closely with their fulfillment partners, suppliers, and retailers to ensure seamless integration and communication. They commit to going the extra mile for customers, providing real-time support, and adjusting their processes as the business scales.

In summary, order fulfillment strategies are not one-size-fits-all. Whether you’re leveraging DSCO integrations, drop shipping, 3PLs, or Amazon FBA, the key is to build a flexible, cost-effective operation that prioritizes customer experience. By focusing on the right partnerships, technology, and processes, your ecommerce store can fulfill orders efficiently, support growth, and stay ahead in a competitive market.

Retailers that rely heavily on DSCO

You do not need a long list to understand the implication, but it helps to name the pattern.

Several large retail programs use DSCO or DSCO-connected infrastructure to run drop ship at scale, particularly in categories like apparel, footwear, accessories, home, and specialty retail. DSCO also supports e-commerce and digital sales channels, enabling smooth management and fulfillment of online orders. You will often see DSCO in the background for retailers that run high-SKU catalogs and rely on brands to fulfill orders directly to consumers under tight standards. Integration with various e-commerce order sources allows for streamlined fulfillment and efficient inventory tracking. The operational theme is consistent across these programs: the retailer owns the customer experience, and you are expected to execute like a first-party warehouse.

DSCO connects to over 60 order destinations, including major retailers like Nordstrom and Kohl’s, simplifying data exchange.

If your team is used to marketplace fulfillment or slower B2B shipping cadences, DSCO-based drop shipping can feel unforgiving. That is because it is.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPCancellation and late-shipment penalties tied to DSCO metrics

DSCO is often described as “communication standardization,” but the commercial teeth are in the scorecard.

Retailers use DSCO metrics to calculate:

- Cancellation rate

- Late shipment rate

- On-time carrier scan adherence

- Tracking timeliness and validity

- Sometimes, defect proxies like returns, customer contacts, or delivery exceptions

When you miss, the consequences are usually economic before they are relational.

Common penalty mechanisms include:

- Per-order chargebacks for late shipments or cancellations

- Fee schedules tied to repeat SLA misses

- Removal from drop ship eligibility after sustained underperformance

- Reduced assortment visibility or limited product eligibility for high intent shoppers

Transparent pricing models are crucial in dsco fulfillment, as they help eCommerce businesses clearly understand the cost structures and avoid unexpected or hidden fees.

This is why dsco fulfillment problems rarely show up as an “EDI error.” They show up as margin erosion. A program can look profitable on paper until you layer in hidden fees from late shipments, expedited shipping used to recover SLAs, and cancellations that create customer service overhead.

DSCO validates supplier invoices for accuracy before routing them to retailers for payment, helping ensure financial accuracy and cost control.

The operational lesson is not “avoid penalties.” It is to understand that DSCO makes your fulfillment performance legible to the retailer. If your operation is not already built to hit strict shipping and accuracy targets, the fees are a symptom, not the disease.

Real operational examples sellers underestimate

Most DSCO failures are boring. They are also expensive. These are the patterns that repeatedly sink accounts. To avoid these common DSCO fulfillment failures, it is essential to integrate systems and processes between your e-commerce platform and third-party logistics providers, ensuring seamless data synchronization and operational efficiency.

Integrating DSCO with third-party logistics services helps to save time and money.

Late ship caused by warehouse reality, not system timing

A DSCO order arrives at 2:10 PM. Your warehouse cut-off for same-day picking is 1:00 PM. Your team treats the order like any other ecommerce order and plans to pick it tomorrow.

From the retailer’s perspective, that order is already aging. If the program expects shipment within 24 hours, you are now living inside a clock you did not design. Your integration might be flawless, but you are operationally late before anyone touches a box.

This is why operations leaders should treat dsco orders as a distinct order class with its own routing rules, labor priority, and exception escalation.

Inventory mismatch that turns into cancellations

Your inventory integration sends 42 units available. The warehouse actually has 19, because:

- Cycle counts are infrequent

- Damaged inventory is not quarantined properly

- Returns are not reconciled quickly

- Multiple order sources are drawing from the same pool without real time locking

The retailer sells 10 units. You can ship 8. You cancel 2.

That might feel like “normal ecommerce.” In a DSCO program, it is a scorecard hit. Repeat it often enough and you look unreliable. Retailers care about cancellation rate because cancellations are customer pain and customer service cost. DSCO simply makes that pain attributable.

Carrier scans that do not happen when you think they do

A seller prints labels and sends tracking in time. The packages sit on the dock until the carrier arrives the next morning. Tracking shows “label created” but no acceptance scan.

Some retailers treat the first carrier scan as the real shipment event. Your DSCO status says shipped, but the carrier data says not yet. This gap can trigger late shipment flags even when your team believes they complied.

Operationally, this is solved by pickup discipline, dock processes, and cutoffs aligned to scan reality. “Label printed” is not “shipped” in retailer math.

Wrong service level or routing details that create downstream cost

Retailer drop ship programs often specify service levels, label formats, and packing requirements. Sellers sometimes treat these as administrative details, then discover the penalties later.

A common example is selecting a shipping method that is too slow to meet delivery expectations, then paying to upgrade shipments reactively. Another is failing to include the required packing slip or return label, triggering customer contacts and chargebacks.

None of this is fixed by DSCO. DSCO will happily transmit the shipment confirmation for a shipment that will arrive late.

The role of 3PLs in DSCO success

For brands onboarding to drop shipping, the 3PL question is not about convenience. It is about capability. Strategic partnerships and tailored services for clients are essential in DSCO fulfillment, as ongoing communication and understanding each client’s unique needs foster trust and deliver value.

A strong third party logistics partner can make dsco fulfillment viable because they already operate at the tempo retailers expect. Choosing a 3PL for DSCO orders requires evaluating their industry experience and technological capabilities. The right partner can help with:

- Cutoffs and labor models designed for rapid order processing

- Warehouse discipline around scan compliance and dock flow

- Inventory accuracy through tighter cycle counting and location control

- Standard operating procedures for pack rules, labels, and routing requirements

- Exception handling when a carrier misses pickup or an order needs intervention

A reliable 3PL should also offer modern integration technology to ensure efficient order fulfillment.

This does not mean “use a 3PL and you are safe.” Retailers hold the seller accountable, not the warehouse vendor. If your 3PL misses SLAs, your account takes the hit. The practical implication is that DSCO success requires operational governance regardless of who runs the building.

Operations leaders should treat the 3PL relationship like a program, not a purchase order. You need:

- Shared SLA definitions that match retailer requirements

- Daily visibility into backlog, late risk, and cancellation drivers

- A process for inventory reconciliation and dispute resolution

- Escalation paths for carrier issues and peak volume planning

Flexibility in scaling services is also important when selecting a 3PL for DSCO orders.

If you are running your own warehouse, the same governance still applies. The only difference is who you can fire.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkWhat “DSCO readiness” actually looks like in practice

Most sellers think readiness means the connection is stable. Retailers think readiness means the order experience is stable.

DSCO readiness in operations terms looks like:

- Warehouse cutoffs aligned to retailer ship windows

- Order processing that prioritizes DSCO orders without starving other channels

- Inventory levels that reflect reality, not accounting optimism

- Tracking that scans fast and stays valid through delivery

- Clear playbooks for exceptions: backorders, damages, carrier misses, address issues

- Reverse logistics that does not collapse customer confidence

Notice what is not on that list. It is not a step integration specific instructions document. It is not a deep dive into EDI schemas. The challenge is execution.

This is also why sellers get surprised by DSCO. DSCO makes it easy to start. It does not make it easy to be good.

Strategic takeaway for operations leaders

If you want one mental model for dsco fulfillment, use this:

DSCO standardizes communication. Retailers evaluate execution.

Treat DSCO like a spotlight, not a shield. It will highlight where your operation is strong and where it is fragile. If you are fragile, you will see it first through cancellation and late shipment penalties, then through lowered assortment access, then through program risk.

The correct posture is not to obsess over the integration. It is to build a fulfillment operation that can meet retailer SLAs consistently, even during peak demand, even when a carrier misses a scan, even when inventory is tight. That is what retailers are buying from you when they approve you for drop shipping.

Frequently Asked Questions

What is DSCO fulfillment?

DSCO fulfillment refers to operating a retailer drop ship program where DSCO standardizes order, inventory, and shipment communications, while the seller still performs the physical fulfillment work.

What does DSCO do in drop shipping?

DSCO standardizes retailer and supplier communication for orders, inventory updates, shipment confirmations, and tracking so retailers can scale drop ship programs without custom integrations.

What does DSCO not do for sellers?

DSCO does not execute fulfillment. It does not pick, pack, ship, manage carrier pickups, correct inventory accuracy, or ensure you meet retailer SLAs.

Why do sellers fail DSCO programs even when EDI is working?

They confuse EDI compliance with fulfillment readiness. Retailers score performance based on cancellations, late shipments, and tracking quality, which are operational outcomes.

What DSCO metrics typically trigger penalties?

Retailers commonly penalize high cancellation rates, late shipment rates, missing or delayed tracking, and shipment events that do not meet required timing thresholds.

How do carrier scans impact DSCO performance?

Many retailers treat the first carrier acceptance scan as the proof of shipment timing. A label can be created and tracking sent, but if the package is not scanned promptly, it can still count as late.

How can a 3PL help with DSCO success?

A capable 3PL can improve ship speed, inventory accuracy, scan discipline, and exception handling. The seller must still govern the partnership to meet retailer SLAs.

What operational changes matter most for DSCO readiness?

Tight cutoffs, prioritized order processing, accurate inventory levels, consistent carrier pickups, reliable tracking, and strong exception handling matter more than integration effort.

Turn Returns Into New Revenue

How Rithum Fulfillment Works (And How to Choose the Right 3PL)

In this article

15 minutes

15 minutes

- How Rithum evolved from two competing platforms into commerce middleware

- The order lifecycle from retailer purchase to customer delivery

- Retailer SLAs demand near-perfect execution with significant financial penalties

- Why sellers struggle after Rithum implementation

- What qualified 3PLs need to handle Rithum-connected orders

- Integration architecture connects WMS to retail channels

- Selecting the right fulfillment partner determines retail dropship success

- Frequently Asked Questions

Rithum is the middleware providing the orchestration and data routing needed for seamless order fulfillment, routing orders between retailers like Target Plus, Nordstrom, and Walmart to your fulfillment operation. However, it won’t pick, pack, or ship a single product—those physical actions are handled by your 3PL, in-house warehouse, or Amazon’s Multi-Channel Fulfillment service. By accurately managing inventory levels and order quantities, sellers can feel confident in the reliability of their integrated ecommerce solution, knowing that Rithum orchestrates the entire order fulfillment process.

This distinction matters because retailers like Walmart require 99% on-time shipping with $5-per-order penalties for violations, while Nordstrom cancels orders entirely if shipment doesn’t occur within one business day. When inventory sync fails or carrier performance drops, Rithum’s orchestration capabilities become irrelevant. Rithum maintains real-time inventory levels across all connected channels to prevent overselling and automatically syncs your Amazon inventory quantities with your channels. Your 3PL relationship determines whether you meet these unforgiving standards or face suspension from programs that took months to join. Rithum uses machine learning to provide accurate delivery dates at the time of purchase, accounting for variables like carrier performance, but successful implementation also depends on having the needed information, configuration, and support in place.

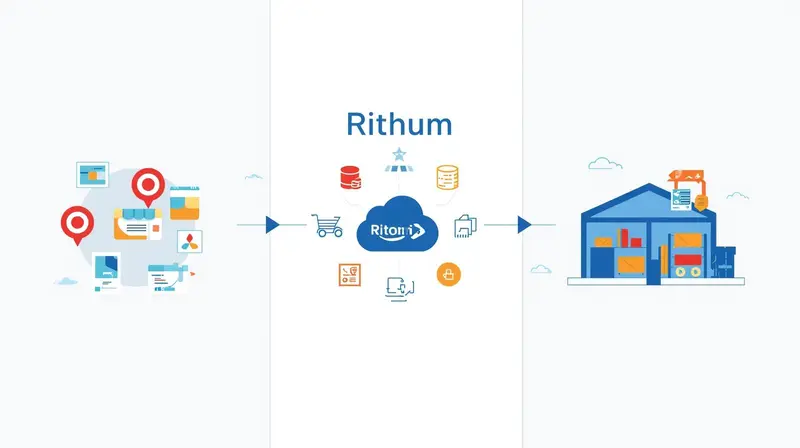

How Rithum evolved from two competing platforms into commerce middleware

Rithum emerged in December 2023 when CommerceHub and ChannelAdvisor unified under a single brand following CommerceHub’s $23.10 per share acquisition of ChannelAdvisor in November 2022. The combined company also absorbed DSCO, a distributed inventory platform acquired in 2020, and Cadeera, an AI company. This consolidation brought together CommerceHub’s enterprise retailer integration strengths (primarily EDI-based connections with major retailers) and ChannelAdvisor’s marketplace listing and advertising platform serving 40,000+ companies globally.

The platform now operates three core systems under the Rithum umbrella. OrderStream from the CommerceHub legacy handles enterprise dropship and retailer integration through EDI and SFTP connections. DSCO provides a modern API-first architecture supporting dropship, marketplace, and buy-online-pickup-in-store workflows. The original ChannelAdvisor platform manages multichannel marketplace listings and digital marketing across 420+ marketplace integrations, allowing users to list products across multiple marketplaces and efficiently manage their catalog.

What unifies these components is their function as translation and routing software sitting between sellers and retail channels. Rithum normalizes purchase orders, inventory feeds, and shipment confirmations across different file formats and retailer-specific requirements. When Home Depot sends an EDI 850 purchase order or Nordstrom expects an ASN within 24 hours of shipment, Rithum handles format compliance and data routing, but the warehouse operations remain entirely your responsibility. To learn more about how these integrations work together, visit the dedicated Rithum fulfillment page or documentation.

If you want to learn more about the unified Rithum platform and how to list your products efficiently, visit this page for additional resources and support.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyThe order lifecycle from retailer purchase to customer delivery

Understanding exactly how orders flow through Rithum reveals where seller responsibility begins and ends. When a customer orders from Target.com or Nordstrom.com, the retailer generates a purchase order transmitted to Rithum’s network. Rithum validates the order against product catalog and inventory data, then routes it to your designated fulfillment endpoint based on pre-configured business rules. Rithum provides an Order Summary page to help users manage their open orders. You can click on the Order Summary page to quickly see the status of all your open orders, which are categorized based on their current state in the order fulfillment lifecycle. Rithum provides real-time visibility into the entire order lifecycle from pick and pack to final delivery.

Your 3PL receives the order via SFTP, API, or EDI connection, typically as an EDI 940 warehouse shipping order. The 3PL acknowledges receipt, picks and packs the product, generates a shipping label, and ships with the carrier. Critically, shipment confirmation data (tracking number, carrier, service level, and ship date) must flow back through Rithum to the retailer via an EDI 856 advance shipment notice, often required same-day for retailers like Nordstrom.

The business rules you configure in Rithum determine routing logic. Orders can route based on warehouse proximity to customers, inventory availability at specific locations, carrier service levels required to meet delivery promises, or cost optimization. You can set quantity buffers to hide listings when stock falls below thresholds and establish priority-based distribution center selection. But these rules only work if your inventory data is accurate and your 3PL can execute within the required timeframes. Depending on your retailer’s business rules, you may be able to partially ship an order when you have enough stock on hand to fulfill some items. You may need to split the items into separate packages, known as a split shipment, when preparing an order for shipment.

You must review your new orders and determine how you plan to ship the items before you can ship your orders or create packing slips.

Sellers configure fulfillment endpoints for internal warehouses, Amazon FBA/MCF, Walmart Fulfillment Services, third-party 3PLs, or dropship supplier networks. Rithum’s recent RithumIQ AI engine claims 96% accuracy in delivery promise forecasting and up to 10% shipping cost savings through machine learning-based routing, but these benefits require accurate underlying data from fulfillment partners. Rithum provides predictive delivery dates at checkout, achieving up to 96% accuracy.

Retailer SLAs demand near-perfect execution with significant financial penalties

Each major retailer connected through Rithum enforces distinct compliance requirements with meaningful consequences for violations. These requirements explain why 3PL selection matters so critically. Missing a single metric can trigger chargebacks, payment denials, or program suspension. Managing order quantities accurately is essential to meet retailer requirements and avoid backorders or inventory discrepancies.

Walmart’s Drop Ship Vendor program sets the most stringent bar: 99% on-time shipping, ≤0.1% backorder rate, and line-level order acknowledgment within four business hours. Orders received before the local warehouse cutoff (typically noon) must ship the same day. Chargebacks include $5 per purchase order for late shipments and $5 per unit for rejected or backordered items. Two or more ignored order alerts trigger a suspension warning, with minimum seven-day suspensions for non-response.

Nordstrom requires shipment within one business day of order receipt. Failure means Nordstrom cancels the order and you receive no payment. The advance shipment notice must transmit the same day as physical shipment. Nordstrom supplies shipping labels through their UPS account, and using the wrong carrier account means no payment. Monthly scorecards track performance across timeliness, compliance, and fulfillment accuracy, with $10 fees per non-compliant invoice.

Managing multiple retailer SLAs can be complex, but Rithum pulls orders from all sales channels into a single platform, providing a unified view of every order. Automation in Rithum helps to eliminate manual errors, achieving up to 40% reduction in errors.

Target Plus requires fulfillment within 24 business hours with a maximum five-business-day transit time. Sellers must use Target-branded packing slips, maintain $5 million commercial general liability insurance, and accommodate all carrier service levels. Amazon and Walmart fulfillment services are explicitly prohibited, requiring US-based fulfillment from your own operation or 3PL.

Best Buy’s Supplier Direct Fulfillment expects shipment within two business days with monthly SLA targets: 99% adjusted fill rate, 95% shipped-on-time rate, 99% timely ship notices, and 95% timely inventory advice. Performance reviews occur weekly at the warehouse level, and orders unfulfilled within 30 calendar days are automatically cancelled.

Macy’s Vendor Direct Fulfillment also requires shipment within two business days, but critically mandates that sellers cancel orders if product won’t ship within that window, regardless of reason. Out-of-stock items must be cancelled and communicated within one business day.

Why sellers struggle after Rithum implementation

Industry analysis reveals consistent patterns of post-implementation difficulty rooted in platform limitations, inventory synchronization failures, and the inherent complexity of multi-retailer dropship operations. According to a 2025 Threecolts analysis, brands commonly wait months before going live while being billed, with setup involving endless back-and-forth, rigid templates, and a one-size-fits-all workflow.

Inventory accuracy problems compound exponentially with scale. Unlike owned inventory with direct warehouse visibility, retail dropship requires suppliers to accurately report real-time availability across multiple locations. A Rithum and eTail industry report found 40% of companies cite inventory coordination across platforms as their top challenge, with 33% citing marketplace data integration as their second-biggest issue. When a store shows 100 units available but the supplier has zero, the seller faces refunds, angry customers, and potential account suspension. Errors add up to $8,000 to $15,000 in lost profit annually from preventable mistakes.

Multi-location fulfillment complexity creates routing failures where orders route to distant warehouses while closer facilities have stock, or split shipments divide orders across multiple locations unnecessarily. Without proper systems, gaining visibility across multiple warehouses requires calling or emailing each warehouse, waiting for responses, and manually aggregating information. By the time you have the answer, it’s already outdated. A nationwide network can resolve these challenges by increasing efficiency and visibility.

Platform rigidity forces businesses into workflows that don’t adapt to their needs. Custom rules for inventory allocation or specific sequences require additional payment and long waits, with results often partial fixes or compromises that never fully solve the underlying need. However, businesses can expand product assortments without carrying inventory through Rithum. Rithum also allows businesses to test new product categories through dropshipping or private marketplaces without the risk of owning inventory. Adding new channels becomes especially painful. Each marketplace has unique requirements, forcing teams to map attributes manually, reformat catalogs, and wait on slow updates. For successful integration, the needed steps include providing all required information, configuring system connections, and ensuring ongoing support to address marketplace-specific requirements.

Integration failures between Rithum and WMS/ERP systems create disconnects where orders don’t fulfill on time, inventory shows as available when it’s not, and tracking information doesn’t reach customers. Traditional integrations require 60 to 90 days of custom development, with each new client bringing unique tech stacks, data models, and business rules.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPWhat qualified 3PLs need to handle Rithum-connected orders

Selecting a 3PL for retail dropship through Rithum requires specific capabilities that many fulfillment providers lack. The core requirement is certified EDI compliance supporting essential transactions. The required EDI transactions can be listed as follows: EDI 850 (purchase orders), 855 (acknowledgments), 856 (advance ship notices), 810 (invoices), 940 (warehouse shipping orders), and 945 (warehouse shipping confirmations).

Multi-warehouse networks provide geographic coverage enabling one-to-two-day delivery to 96%+ of the US population, with automated order routing based on inventory availability, customer proximity, and SLA requirements. When items are unavailable at one location, orders automatically route to alternative facilities. This redundancy proves critical when individual warehouse disruptions would otherwise cause SLA violations.

Real-time inventory synchronization must flow bidirectionally from WMS to Rithum to prevent overselling, and from sales channels back through the system to maintain accurate availability and quantities across 420+ connected marketplaces. The National Retail Federation reports inventory distortion costs retailers billions annually, making immediate sync of every order, receipt, transfer, and adjustment essential to ensure correct quantities are reflected at all times.

Carrier diversification protects against single-carrier disruptions while enabling rate shopping for cost optimization. Required capabilities include integration with UPS, FedEx, USPS, DHL, and regional carriers, plus support for retailer-supplied shipping labels where programs like Nordstrom provide their own UPS account credentials.

Technical integration typically occurs through SFTP file automation (every Rithum account includes unique SFTP credentials), AS2 protocol for secure data exchange, or REST APIs with webhooks for real-time connectivity. File formats use specific extensions: .neworders for incoming orders, .confirm for acknowledgments, .inventory for stock updates, and .shipment for tracking confirmations.

ChannelAdvisor provides launch services to assist customers with setting up their ChannelAdvisor Fulfillment Services account. The ChannelAdvisor Launch Team is responsible for establishing the necessary calls with customers during the setup process, and customers will have access to the Launch Team via email for the duration of the services period. The number of calls with the ChannelAdvisor Launch Team will not exceed three per Fulfillment Endpoint.

Integration architecture connects WMS to retail channels

Rithum’s integration architecture supports multiple data exchange methods depending on retailer requirements and seller technical capabilities. API-based connections use REST architecture with JSON format, requiring Content-Type, API-Key, Timestamp, and Authorization headers with HMAC signature or access token authentication. Webhooks enable real-time event-driven data push for immediate updates.

EDI connections remain essential for major retailers who require specific document formats. The workflow proceeds from retailer purchase order (EDI 850) through supplier acknowledgment (EDI 855) to warehouse shipping instruction (EDI 940), warehouse confirmation (EDI 945), advance ship notice (EDI 856), and invoice (EDI 810). Each retailer may require different EDI formats, which Rithum translates through its Universal Connection Hub that normalizes supply chain communications across different file formats.

WMS integration connects through pre-built connectors from providers like Extensiv, Shipedge, Logiwa, and Deposco, or through integration platforms like Cleo, TrueCommerce, and SPS Commerce. Pre-built integrations can deploy in under one hour with documentation available on the integration documentation page. To learn more about setup options, click on the integration documentation page for detailed guidance.

SKU mapping across channels requires maintaining a master database with external identifier mappings. A single product may have different SKUs per channel or retailer, requiring one-to-many mapping relationships. Rithum’s Shadow SKU functionality enables channel-specific presentation while maintaining internal inventory consistency. Poor SKU mapping drives 10%+ error rates that cascade into fulfillment failures.

To learn more about Rithum’s integration architecture, visit the dedicated resource page for additional information.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkSelecting the right fulfillment partner determines retail dropship success

The fundamental truth of Rithum-connected retail dropship is that platform capabilities become irrelevant without execution excellence at the fulfillment level. Sellers choosing 3PLs should feel confident in their fulfillment partner’s ability to meet retailer requirements. Sellers should verify specific capabilities: certified Rithum or CommerceHub integration through EDI or API, multi-warehouse network with intelligent order routing, real-time inventory synchronization with sub-15-minute update frequency, and multi-carrier relationships enabling rate shopping across UPS, FedEx, USPS, and regional carriers.

Critical performance metrics to require contractually include 99.5%+ order accuracy (with some 3PLs guaranteeing 99.9%), same-day fulfillment for orders received by cutoff, inventory accuracy matching physical counts to recorded inventory, and OTIF (on-time, in-full) rates meeting or exceeding retailer thresholds. Rithum computes SLA performance based on retailer-provided delivery dates and notifies suppliers of each order that misses requirements, but that notification arrives too late if your 3PL already failed.

Top 3PLs with demonstrated retail dropship expertise are providing comprehensive support for ecommerce businesses by managing the entire order fulfillment process. This includes providers like a2b Fulfillment (specializing in Amazon FBM/SFP and Walmart DSV), ShipBob (distributed inventory with 2-day express shipping), Red Stag Fulfillment (zero shrinkage guarantee with 99.9% accuracy), and DCL Logistics (40+ years of fulfillment SLA expertise). Integration platform partners like Extensiv 3PL Warehouse Manager, Pipe17, and ConnectPointz provide pre-built CommerceHub/Rithum connectors that accelerate deployment.

Frequently Asked Questions

Is Rithum a 3PL or fulfillment provider?