How 3PLs Can Register for FDA-Approved Warehouse Status

In this article

7 minutes

7 minutes

Imagine a spotless warehouse stacked with pallets of potato chips or cases of juice. That’s what people imagine when they think of what “food-grade warehousing” often means: strict cleaning protocols, temperature controls, and temperature-controlled environments for sensitive products, plus intensive audits by certifiers to prove it. Quality control, monitoring, and tracking are indeed essential for maintaining standards in these facilities. But here’s the catch: there’s no official “FDA food-grade certificate.” In other words, no inspector from the FDA comes by and stamps a “food-grade” label on your door. Instead, the FDA regulates facilities by simply requiring them to register if they handle food.

Having food-grade certification is a voluntary, industry-driven quality label. FDA Food Facility Registration, however, is a mandatory legal listing for any business that manufactures, processes, packs, or holds food (including dietary supplements and animal feed) for U.S. consumption. To clarify, an FDA-certified warehouse goes through a more rigorous process of demonstrating a higher level of compliance with FDA regulations, which is voluntary. “Registration,” on the other hand, is a basic requirement for all facilities handling food, essentially notifying the agency about their activities.

In short, having SQF or “organic” or even SQF Level 3 qualification is great for customers and safety, and also supports brand reputation and benefits ecommerce businesses, but it doesn’t exempt you from the law. If your 3PL warehouse stores consumer foods, drinks, pet snacks, or supplements, it must be entered in the FDA’s facility registry, regardless of how clean or certified it is. Companies in various industries, such as food, beverage, and supplements, need to comply with these requirements. An FDA spokesperson bluntly reminds us: any facility holding food for U.S. humans or animals must register, unless a specific exemption applies. This is essential for public health and health protection. For example, proper registration allows for the tracking of an E. coli outbreak back through all the facilities where it was held to identify the source.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyIf your warehouse or fulfillment center stores food, you must register. The supply chain, logistics, and fulfillment services provided by 3PLs are all impacted by these requirements. The FDA’s own FAQ reminds us, under the act (such as the Food Safety Modernization Act) and drug administration oversight, that registration is not optional.

If you’re a manufacturer, you must register. Appropriate storage conditions and maintained standards are required to ensure compliance. If your core business is storage, the products are stored, and inventory management practices must meet regulatory expectations. If you only ship (no storage), you’re probably exempt. However, management systems and control of inventory are still important for compliance.

Different 3PLs have warehouses that offer a range of services and solutions, and choosing the right partner is important for helping you ship FDA-regulated products efficiently.

When Does a 3PL Warehouse Need to Register?

As soon as your warehouse is holding regulated food or feed for sale in the U.S., it falls under the FDA’s food facility rule. That means if your 3PL stores any packaged foods, beverages, snacks, dietary supplements, or animal feeds (even pet chews) destined for U.S. consumers, you must register with the FDA. Dietary supplements count as “foods” under the law, so a vitamin or protein powder you warehouse still triggers FFR. Same if you handle pet treats or livestock feed, animal feeds can be considered food (or drugs), and holding them for distribution requires registration. In practice, virtually all 3PLs storing consumer food or supplement products will need to register. There’s no minimum volume or frequency, even short-term “holding” qualifies. FDA guidance clarifies: “There is no timeframe associated with holding… a facility that holds food… is not exempt.”

Exemptions: The law does carve out a few narrow exceptions, but they usually don’t apply to commercial 3PLs. Common carrier transportation is exempt (trucks, ships, planes) because vehicles are not considered “facilities”. A Post Office or courier sorting center with packages is likewise viewed as transit, not as a holding facility. Retail grocery outlets and restaurants are also exempt (they’re “retail food establishments”), but an independent warehouse that isn’t part of a store chain doesn’t qualify. Importantly, storage of non-food items (like empty bottles, labels, or packaging materials) is exempt too, since the FDA defines “food” as excluding food-contact materials. In short, if your 3PL’s core business is storage of packaged food/beverage/supplement products, you’re in, otherwise, you’re probably out.

- Must register: Facilities manufacturing/processing, packing, or holding food or animal food for U.S. distribution. This includes dietary supplements, snacks, drinks, pet food, feed supplements, etc.

- Does not need to register: Pure carriers/transport trucks (no holding activity); retail stores or restaurants; farms holding their own produce; and facilities storing only packaging or non-food items.

Product Triggers: What Counts as “Food”?

The FDA’s definition of food is very broad, and it explicitly includes dietary supplements and many pet products. In practical terms, any finished food or beverage product triggers registration. That means snacks, cereals, bottled water, sodas, juice, nut butters, supplements, infant formula, spices, etc., all count. A helpful FDA Q&A spells it out: “A dietary supplement and a component of a dietary supplement are ‘foods.’ Accordingly, a facility that … holds a dietary supplement … is required to register as a food facility.” Likewise, pet foods and chews must be registered, they’re considered animal food. By contrast, cosmetics, drugs, medical devices, or chemicals do not fall under the food registration rule (they’re regulated by other FDA centers). So, if your warehouse does mixed storage, only the racks holding food/work trigger FFR.

It’s worth double-checking borderline cases. For example, a facility storing bulk sugar or starch used for food probably needs to register, because those ingredients are food. But if a warehouse only holds bottles, jars, or foam peanuts (food-contact materials), that is not “food,” and you wouldn’t register for those alone. Whenever in doubt, recall this rule of thumb: if it can be eaten (or fed to animals), the warehouse holding it likely needs to register.

How to Register (Step-by-Step)

Registering is straightforward and free. Start by getting an FDA Industry Systems (FIS) account at access (FDA calls this portal “FURLS”). Once logged in, choose the Food Facility Registration Module (FFRM) and hit “Register a Food Facility.” The online system will guide you through sections for facility info, contact data, and product categories. A handy user guide on the FDA’s site walks you through each page.

Registrants must submit electronically through FDA Industry Systems unless FDA has granted a waiver; only then may registration or renewal be submitted by mail or fax using Form FDA 3537. If you do need a paper backup (e.g., in an emergency or with a waiver), the FDA provides Form FDA 3537. This form is available on the FDA’s website and can be mailed or faxed to the FDA’s registration office. However, 99% of businesses just use the online portal; it’s faster and automatically gives you a confirmation. Tip: Add @fda.gov and @fda.hhs.gov to your safe sender list so you don’t miss FDA registration alerts.

Information You Must Provide

The registration form (online or 3537) asks for basic data about your facility and operations. In short, be ready with facility identity and contact info, product categories and activities, and key attestations. Specifically, FDA requires: name, address, phone (and emergency contact phone) of the facility; mailing address (if different); any parent company name; all trade names used at the facility. It also needs the name, address, and phone of the owner/operator/agent in charge, plus their email address (unless FDA granted a waiver).

You must also list which types of foods you handle. FDA provides a menu of “food product categories” (36 choices), just check all that apply (e.g., “beverages,” “bakery goods,” “dairy products,” “supplements,” etc.). For each category, indicate whether you manufacture/process, pack, or hold that product. If you hold multiple categories (snacks, drinks, supplements, etc.), you must list them all.

Importantly, you must also include a Unique Facility Identifier (UFI) that FDA recognizes. FDA recognizes the D-U-N-S (DUNS) number as an acceptable Unique Facility Identifier (UFI) for Food Facility Registration and uses it to verify the facility’s address information. If you have a DUNS number for your company, include it (if not, obtain a DUNS number from Dun & Bradstreet; some optional services may be paid, but the DUNS identifier itself is obtained through D&B). Just make sure it’s correct; the FDA will verify that the address matches.

Finally, the form includes a couple of statements and signature fields. You must certify that FDA may inspect the facility per law, and that all provided info is true and accurate. The owner/operator (or an authorized representative) signs off on this. If you file electronically, the system will still record your submission and display your unique registration number (FEI) and PIN on screen. In other words, once you click submit, you instantly get your FDA registration number.

(Foreign facilities note: U.S. law requires a U.S.-based agent as well. Foreign registrants must provide the name, address, phone, and email of their U.S. agent contact.)

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPNo Fees or Fancy Licenses

Here’s a relief for ecommerce brands: The FDA does not charge any fee for food facility registration. Domestic facilities pay nothing. (Foreign facilities must hire a U.S. agent, but that’s an independent business service fee, not an FDA fee.) There’s no formal inspection or license process tied to the registration itself; you don’t need an FDA “permit.” The registration simply identifies you in the FDA’s database.

Minimum qualifications: You don’t need a food degree to register. Any business that legitimately handles food (and isn’t otherwise exempt) can register. The key requirements are simple: have a real physical facility or address, designate who the owner/operator is, and be ready to let FDA inspectors in if there’s a problem (FDA will ask for an inspection assurance on the form). Beyond that, you should follow good hygiene/CGMP practices (FDA’s Title 21 CFR Part 117), but those standards aren’t part of the registration. In short, if your 3PL warehouse fits the description above, you can (and must) register; the process doesn’t require extra credentials beyond normal business paperwork.

Timeline: Registration, Renewal, and Expiration

The registration process itself is quick. In practice, if you have all the information ready, you can complete an online registration in less than 20 minutes. Once submitted, the FDA site immediately assigns you a registration number (FEI) and PIN, which appear on-screen. There’s no waiting for mail or manual review. You can email or print your registration form right away. As soon as you’re done, your facility is officially in the system.

But don’t forget renewals! The FDA requires a biennial renewal cycle. That means every two years, you must update or resubmit your registration. In practice, the FDA opens the renewal window from October 1 through December 31 of every even-numbered year (e.g., 2026, 2028, etc.). Next renewal window: October 1 to December 31, 2026. During that period, you log back into FIS, review your info, make any changes (new address, products, contacts, etc.), and resubmit. After Dec 31, any facility that hasn’t renewed is considered expired.

So mark your calendar: the next renewal window opens October 1 of the next even year. If you register for the first time in an odd-numbered year (say June 2025), you must renew by Dec 31, 2026, to avoid lapsing. FDA will normally send reminders, but it’s best to track this yourself. (And remember: renewals are free too.) If your business goes out of scope or closes, you should also cancel your registration in FIS to avoid future reminders.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkKey Requirements & Timelines: At a Glance

- Who must register: Any facility manufacturing/processing, packing, or holding food or animal feed for U.S. distribution (snacks, beverages, supplements, pet food).

- Who is exempt: Pure carriers (trucks, ships) in transit; retail stores and restaurants; farms holding their own produce; facilities storing only non-food items.

- How to register: Online via FDA’s FIS portal (FURLS Food Facility Registration Module); paper only by FDA waiver.

- Information needed: Facility/contact details; food categories and activities; Unique Facility Identifier; attestations and signature.

- Timeline: Instant registration upon online submission; biennial renewal October 1 – December 31 of even years; expiration if not renewed.

- Fees: There is no FDA fee for domestic registration or renewal. (Foreign firms only pay for their required U.S. agent service.)

- Duration: Each registration lasts until the next biennial renewal period (essentially 2 years). After renewing, you’ll receive a new registration confirmation for the next period.

Staying on top of these rules ensures your 3PL warehouse is legally compliant with the FDA’s food regulations and avoids nasty surprises like cancelled imports or penalties. When in doubt, consult the FDA’s resources (see citations below) or call their FURLS help desk. Safe storing!

Frequently Asked Questions

Do 3PL warehouses need an FDA “food-grade” certificate to store food?

No. There is no official FDA “food-grade” certificate. However, any facility that stores food products must register with the FDA as a food facility. Voluntary certifications (SQF, BRCGS) support trust and safety but do not replace the legal registration requirement.

What products trigger the need for FDA registration?

Any facility storing food, beverages, dietary supplements, or animal feed intended for U.S. consumption must register. This includes snacks, bottled drinks, pet treats, and vitamins. Even temporary “holding” triggers registration.

How does a 3PL warehouse register with the FDA?

Warehouses register through the FDA Industry Systems portal (FURLS) using the Food Facility Registration Module. Registration is free and requires facility details, product handling categories, and a Unique Facility Identifier (e.g., DUNS number).

Are there exemptions to the FDA registration rule?

Yes. Pure carriers in transit, retail stores and restaurants, farms holding their own produce, and facilities storing only packaging materials do not need to register. Most commercial 3PL warehouses handling food must register.

How often must FDA food facility registration be renewed?

Every two years during the October 1 – December 31 window of even-numbered years (2026, 2028, etc.). Registrations expire if not renewed by December 31.

Citations

- Argos Software: 7 Quick Q&As for FDA Food Facility Registration

- FDA: Food Facility Registration User Guide: Registration of Food Facilities, Step-by-Step Instructions

- FDA: Online Registration of Food Facilities

- FDA: Questions & Answers Regarding Food Facility Registration (7th Ed.)

- FDA: Registration of Food Facilities & Other Submissions

- FDA: Biennial Renewal User Guide

- FDA: Paper submission/waiver rule

- FDA: Reminder: Food Facilities Register/Renew Registration

- Smart Warehousing: Getting Certified as a Food-Grade Warehouse

- Smart Warehousing: The Role of Food-Grade Warehousing in Meeting Regulatory Requirements for Food Storage

Turn Returns Into New Revenue

Amazon Limits How Sellers Can Message Buyers

In this article

3 minutes

3 minutes

Amazon’s Buyer-Seller Messaging tool lets you reach out to customers when there’s a hiccup with an order or when they have questions: think missing details, address clarifications, or service follow-ups. It’s never been a billboard for promos or marketing; it’s strictly a support channel. Starting now, Amazon is tightening things up even further to protect buyer preferences and ensure you only send messages that truly matter.

How It Worked Before

Until recently, you could mark a subject line with “[Important]” to push your message past a buyer’s opt-out settings. In other words, even if a buyer said, “No thanks, I don’t want seller emails,” you could override that if you slapped “[Important]” on the subject. Amazon trusted sellers to use that sparingly, only for truly critical updates like “Your customized widget is delayed” or “Need help with your order return.” But, let’s be honest, there was room for misuse (even if accidental).

The New Changes

Amazon has removed the ability to add “[Important]” and override buyer opt-outs. If a buyer has opted out of seller communications, your message won’t get through, unless it’s genuinely critical to completing the order. In practice, that means:

- No More Subject-Line Overrides: You can’t flag any message as “[Important]” manually.

- Opt-Out Respect: If a buyer has chosen not to receive non-essential messages, your message gets blocked, unless it’s a truly order-critical update.

- Critical Messages Still Go Through: If you’re contacting someone to confirm a custom size, fix a shipping address, or resolve a payment hiccup, Amazon will deliver your message even if the buyer opted out.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWhat Sellers Should Do Next

- Rethink Your Subject Lines

- Don’t worry about manually tagging “[Important]” anymore; Amazon handles critical identification on its end. Keep your subject lines clear and concise—“Issue with Your Order #123-4567890” is fine.

- Use Amazon’s Message Templates

- These templates auto-insert the order ID, translate into the buyer’s language of preference, and automatically flag truly critical content. They’re a time-saver and help ensure Amazon recognizes your message as essential.

- Focus on Truly Critical Communication

- Ask yourself: “Is this message truly necessary to complete the order?” If you need to verify a shipping address, correct a payment method, or address an out-of-stock situation, go ahead. If it’s a follow-up—“Hey! Buy my new product!”—save it for social media or your own email newsletter.

- Stay Organized & Document Everything

- Because Amazon now filters more messages, keep detailed records of when and why you contacted buyers. If a buyer reaches out later asking why they didn’t get your message, you’ll know exactly what happened.

Why These Changes Matter

At the end of the day, Amazon is aiming to keep buyer inboxes free of clutter. You want your truly essential messages (like “Your order requires more info” or “Your refund is processed”) to land easily in your buyer’s inbox, not buried under promotional noise. By removing the “[Important]” override, Amazon ensures that only messages genuinely vital to order completion break through.

For sellers, it’s a quick pivot: lean into Amazon’s templates, keep communication laser-focused on order fulfillment, and respect buyer opt-outs. That way, you maintain trust, avoid blocked messages, and keep your operations running smoothly, one critical message at a time.

Turn Returns Into New Revenue

New 2025 Amazon Premium Shipping Requirements

Amazon’s Premium Shipping program has always driven better conversion rates, improved Buy Box share, and happier customers. But come June 29, 2025, Amazon is rolling out sweeping changes to Premium Shipping performance requirements, and they’re not kidding around. If you’re an ecommerce pro, brand operator, logistics expert, or retail strategist, buckle up. Here’s everything you need to know, served in a conversational style, with a dash of candor, and a sprinkle of “keep-your-cool” honesty.

From Monthly Roll-Ups to Weekly Check-Ins

Let’s cut to the chase: under the old system, you needed a 97% on-time delivery rate (OTDR) over a rolling 30-day window to keep that Premium Shipping eligibility. Amazon looked at your performance once a month, sent one warning if OTDR dipped below 97%, and gave you until the next month to fix it. Easy enough—if you had a random bad week, you could smooth it out with stellar performance the rest of the month.

Starting June 29, though, those monthly buffers disappear. Amazon will track OTDR on a weekly basis, from Sunday through Saturday, and drop any Seller Fulfilled Prime (SFP) orders from that calculation. If your OTDR for Premium Shipping falls below the new minimum, 93.5%, you’ll get your first email warning. Do it again next week, and you’ll receive a second warning. Miss the same threshold three times within four consecutive weeks, and you’re out of Premium Shipping until you earn it back.

Why 93.5%? Amazon’s rationale is that they want customers to experience the same reliability they’ve come to expect from the Prime program. Dropping the requirement from 97% to 93.5% might seem like a concession, but trust me, hitting 93.5% every single week is not easy when you’re dealing with carriers that are out of your direct control.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWhy This Matters (and Why It’s Tougher Than It Sounds)

No More “Average” Weeks

Under the old model, you could have one sloppy week at, say, 94%, and then three spectacular weeks at 99%, and your overall 30-day OTDR would still be above 97%. Now, if that first week is below 93.5%, you’ll get dinged immediately. A single underperforming week can trigger a warning, and you can’t “erase” it with future weeks once that four-week window closes.

Carriers Need to Be in Your Back Pocket

Amazon explicitly calls out approved carriers like UPS, FedEx, USPS, and OnTrac. If a carrier misses scans, delays pickups, or delivers late, you’re on the hook. The OTDR calculation counts the percentage of orders that arrived on or before the promised “Deliver by” date. If your package is scanned late, or not scanned at all, Amazon assumes it’s going to be late unless an on-time delivery scan is received later. That’s why it’s more important than ever to monitor each carrier’s performance, review their “Last-Mile Delivery” scorecards, and swap out underperformers.

Shipping Settings Automation & OTDR-Protected Labels

Good news: Amazon is offering tools to help you hit your weekly targets. Shipping Settings Automation (SSA) will calculate transit times automatically so your “Deliver by” promises match real-world carrier performance. You still need to set accurate handling times, but SSA can help avoid accidentally over-promising.

Then there’s OTDR protection: if you enable SSA and purchase an OTDR-Protected label through Amazon Buy Shipping, Amazon won’t penalize you for late deliveries as long as the delay is due to factors outside your control. It’s essentially a safety net—except it only applies if you do everything else right (set your handling time properly, buy the right label, and ship on time).

What Sellers Must Do Right Now

1. Audit Your Carriers

- Pull up your Carrier Scorecard in Seller Central each Monday morning.

- Look for patterns: Who’s got the slowest last-mile scans?

- Drop carriers that regularly clock in under 95% weekly on-time scans, because once you hit 93.5%, there’s zero wiggle room.

2. Enable SSA on Every Shipping Template

- Navigate to Shipping Settings → Edit Template → Toggle on Shipping Settings Automation.

- Let Amazon calculate transit times based on carrier data. If you don’t do this, you’re basically flying blind and promising delivery dates you can’t reliably meet.

3. Purchase OTDR-Protected Labels

- Go to Manage Orders → Buy Shipping and look for the shield icon indicating “OTDR Protected.”

- If you use an external tool like Cahoot, make sure it’s integrated and configured to buy the correct labels.

4. Track Your OTDR Like a Hawk

- Check your Account Health → Shipping Performance → On-Time Delivery Rate view, filtered to the “Last 7 Days.”

- Log it in a simple spreadsheet or dashboard; if you’re at 95% on Thursday but have a big FedEx hiccup on Friday, you might dip under 93.5% by Saturday.

5. Prepare an Appeal Template

- If you get that dreaded second warning email, you have two weeks to appeal.

- Your appeal should include:

- Specific orders that caused the miss (order IDs, promised vs. actual dates).

- Evidence that you used SSA and OTDR-Protected labels (screenshots help).

- Steps you’re taking to prevent a repeat (e.g., switching carriers, adjusting handling times).

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPThe Ripple Effects on Your Business

Margin Compression vs. Service Reliability

Yes, spending more on premium carriers or buying OTDR-protected labels adds cost. But losing Premium Shipping can crater your conversion rate, tank your Buy Box percentage, and even affect organic search ranking. You have to run the numbers: maybe offering fewer SKUs with Premium Shipping is cheaper in the long run than risking weekly OTDR failures that affect your sales on your highest-performing SKUs (by being kicked out of the program).

Operations & Inventory Juggling Acts

Keeping enough stock in the “right” warehouses, so carriers aren’t shipping from the opposite coast, matters more than ever. If you sell nationally, you may need multiple fulfillment locations (a 3PL or micro-fulfillment center network). Staggering your replenishment orders (especially around holidays) can prevent stockouts that force you to oversell and then ship late.

Small Sellers vs. Big Sellers

Large brands with multi-warehouse setups and teams dedicated to carrier management can adjust more fluidly. If you’re a one-person operation fulfilling out of your garage, you’ll need to be extra strategic—maybe select just two to three proven carriers and ship as many orders as possible the same day you pick them. The bar is higher now, and patience for shipping errors is slim.

A Few FAQs to Keep You Sane

Q: What happens if a hurricane or blizzard slows down my carrier?

A: If Amazon deems it a “major disruption event,” late deliveries in that region won’t count against your OTDR. But you still need SSA + OTDR-protected labels before the delay. Don’t wait for your messages to start flooding; enable those tools now.

Q: Will this affect Seller Fulfilled Prime?

A: Sort of. SFP has its own stricter OTDR requirements, also on a weekly cadence, but it’s evaluated separately. Just remember, your SFP and Premium Shipping OTDRs are on parallel tracks; a slip in one doesn’t automatically tank the other, but it’s best to nail both.

Q: Can I regain Premium Shipping status after removal?

A: Yes, but you must meet all OTDR requirements for four consecutive weeks after your third infraction (without another miss). It’s basically a “clean slate” window: stay above 93.5% each week for four weeks, and Amazon resets your eligibility for that specific requirement.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkFinal Thoughts: Embrace the Change (or Get Left Behind)

Amazon’s shift from a 30-day OTDR roll-up to a 7-day weekly check is a clear message: if you want to hang with Prime-level sellers, you need rock-solid operational consistency and carrier partnerships. There’s no “coasting” on the back of a stellar month anymore; you have to nail every single week.

Yes, the change feels daunting. Your margins may squeeze, and your team (even if it’s a team of one) will need to revamp processes. But savvy ecommerce pros know adversity breeds opportunity. Rethink your shipping playbook:

- Lean into SSA and OTDR-protected labels.

- Cultivate trusted carrier relationships (and ditch underperformers ASAP).

- Monitor your weekly OTDR like your P&L depends on it (spoiler: it does).

- Build redundancy, FBA hybrid, multi-warehouse, or strategic 3PL partnerships.

Master these moves, and you won’t merely survive—you’ll thrive. Happy selling, and may your weekly OTDR always stay north of 93.5%.

Citations

- Amazon Seller Central – Upcoming changes to Premium Shipping

- Amazon Seller Central – Frequently asked questions about on-time delivery rate (OTDR)

Turn Returns Into New Revenue

Fewer Sellers, Bigger Gains: Seizing Amazon’s Shrinking Competition in 2025

Amazon used to feel like a never-ending battlefield: millions of sellers duking it out for every eyeball. Fast-forward to 2025, and things have quietly shifted. Yes, a ton of new sellers keep signing up—roughly a million a year—but the number of active sellers (those getting at least one review in the past year) has actually fallen from about 2.4 million in 2021 to under 1.9 million in 2025. That’s a 20% drop, and it means there’s more traffic up for grabs per seller. In plain English, the average Amazon seller now gets nearly 31% more visits than four years ago. Cue the confetti for anyone still standing, and some serious sticker shock for those just starting out.

Why the Dip in Active Sellers Matters

Let’s unpack that number: Amazon’s overall traffic has stayed roughly level since 2021, clocking in at around 5 billion visits per month across its global network. But active sellers declined from 2.4 million to 1.9 million between 2021 and 2025. Divide the same or slightly higher traffic by fewer storefronts, and voilà, monthly visits per seller climbed from 2,162 to 2,837. In other words, if you’re still in the game, you’ve got about 31% more potential buyer eyeballs on your listings than your counterparts did a few years back.

That traffic bump isn’t just academic. With Amazon’s revenue surging 36% (from $470 billion in 2021 to $638 billion in 2024), it’s clear the pie is growing even as some sellers fall out. Third‐party sellers, who already sold 56% of units in Q4 2021, pushed their share up to 62% by Q4 2024. Translation: More of a bigger pie is yours for the taking if you can navigate the challenges.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWhy Sellers Are Fading Out

Okay, so why are fewer “active sellers” sticking around? A few big reasons: rising fees, logistical headaches, and cutthroat price wars.

- Amazon’s Fees Have Ballooned

- In some categories, referral, FBA pick‐and‐pack, and storage fees now gobble up over 50% of a product’s list price.

- Monthly or seasonal storage surcharges and random “reclassification fees” can make it feel like Amazon’s charging you just for breathing.

- The result? Margin erosion that many newcomers can’t stomach.

- Inventory & Case-Management Headaches

- FBA is a blessing until your inventory gets stranded, buried under storage‐fee surcharges, or stuck in removal limbo. Solving these requires hours of back-and-forth with Seller Support.

- Switching to FBM (Fulfilled by Merchant) isn’t a slam dunk either; sourcing reliable carriers, managing returns, and weathering holiday shipping bottlenecks add a new layer of complexity.

- Regulatory & Tariff Unknowns

- Tariff rates have been fluctuating unpredictably, particularly for goods from China or certain apparel categories. A 10% hike overnight can wreck your COGS (cost of goods sold) if you’re unprepared.

- Sales tax laws and cross-border customs rules shift every few quarters. Small sellers risk penalties if they slip up.

- Chinese Seller Dominance

- Chinese merchants make up over half of the top-performing Amazon accounts, often undercutting U.S. sellers with razor-thin margins. It’s tough to compete on price when factory-direct sellers list at rock-bottom rates.

Put those together, and it explains why many hopeful sellers register, list a few products… and then disappear. In fact, more than 60% of the top 10,000 Amazon sellers launched before 2019, proving that experience and staying power are huge advantages.

Why the U.S. Marketplace Still Reigns Supreme

If you’re deciding where to list, the U.S. marketplace is still the gold standard. Sure, places like Saudi Arabia boast 8,228 visits per seller, and South Africa is close behind at 8,065. But those markets simply don’t have the total volume or category breadth of Amazon.com. In the U.S., a niche term like “sourdough starter jar” gets roughly 26,766 monthly searches, compared to 179 in Australia or zero in Saudi Arabia. In other words, niches thrive stateside in a way they can’t elsewhere.

Even better: 73% of U.S. sellers who joined in the past year hit their first sale within 12 months. That’s substantially higher than Germany (38%), the U.K. (32%), or Canada (16%). For new sellers looking for quick validation, the U.S. simply offers the best odds.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPChallenges to Confront Head-On

More traffic is great, but it doesn’t magically overcome the hurdles. Here’s what you’ll face if you jump into Amazon today:

- Margin Erosion: Even with extra visits, if your fees and COGS leave you with negligible profit per unit, those extra eyeballs won’t matter. Carve out a robust pricing model, know your true landed cost—including tariffs, shipping, Amazon fees, and PPC.

- Inventory Planning: Sell-through rates matter. Overstocking triggers costly storage fees; understocking loses you the Buy Box and lets competitors swoop in. Sophisticated 3PL integrations or tools like Forecastly can help you thread the needle.

- Competitive Pricing & Buy Box Battles: Repricers can help, but they’re not magic. When Chinese sellers aggressively undercut, you risk starting a race to the bottom. Focus on unique value propositions, bundling, subscription offers, or enhanced branding to stand out.

- Regulatory Compliance: Keep up with tariff updates. For instance, electronics gear imported from Asia might incur new duties under a 2025 trade ruling—know it before it blindsides your margin.

- Account Health Vigilance: A single A-to-Z claim or policy violation can drop your seller rating. If you rely on Amazon for 80% of your sales, a suspension can be devastating. Build redundancies: own a Shopify store or diversify into Walmart Marketplace.

How to Capture Your Piece of the (Growing) Pie

1. Lean Into Niche Categories: If you’re selling something ultra-specialized—think artisan beard balm, eco-friendly pet toys, or limited-edition kitchen gadgets—your “competition” pool is smaller. Use tools like Helium 10 to spot emerging micro-niches before they catch fire.

2. Optimize Listings with SEO & Enhanced Content: Keywords matter, but so does conversion. High-res images, 360-degree product videos, and A+ content can take your listing from meh to must-buy. When you’ve got 30% more visits, conversion-rate improvement is pure gold.

3. Strategic PPC & DSP Budgets: With that extra traffic cushion, you might discover that CPCs (cost per click) in your niche are actually lower now due to lighter competition. Run a lean Sponsored Products campaign; if your listing’s solid, you can turn that paid traffic into organic momentum.

4. Leverage Prime & Subscription Models: Products eligible for Prime enjoy a higher click-through rate. If the margin allows, consider bundling or small subscription programs to lock in recurring revenue rather than one-off purchases.

5. Diversify Fulfillment Options: FBA is convenient, but a 3PL (third-party logistics company) hybrid or FBM can be more cost-effective once you hit a certain volume. Free two-day shipping is table stakes; just make sure your margins survive the shipping fees.

6. Plan for International Growth, But Don’t Rush: The data shows 69% of sellers stay confined to one marketplace. If you nail the U.S., expanding later to Canada or Mexico can be a logical next step. But don’t spread inventory too thin across 22+ marketplaces when your U.S. business still has growth levers to pull.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkThe Road Ahead

As Amazon’s marketplace matures, the landscape will keep shifting—new fees might pop up, algorithm tweaks could rearrange SERP rankings, and global trade winds will bring fresh tariff puzzles. But right now, a rare alignment exists: fewer active sellers, steady or growing buyer traffic, and a rising slice of third-party volume. For brands with grit, this means more opportunity if you’re willing to do the heavy lifting.

The parting advice? Amazon’s game has always been about endurance. Weather the headwinds, optimize your listings, master your costs, and don’t be afraid to lean into niche categories—and you might just ride this 30% traffic bump into the kind of scale that felt impossible a few years ago.

Is it crowded? Sure. Is it still worth it? For those who can adapt, absolutely.

Citations

- Marketplace Pulse: Amazon Is Less Competitive Than Four Years Ago

- Marketplace Pulse: U.S. Is Amazon’s Most Beginner-Friendly Marketplace

- Marketplace Pulse: 69% of Amazon Sellers Sell in Just One Marketplace

Turn Returns Into New Revenue

TikTok Shop’s 2024–25 Shift: From Free Viral Reach to Pay-to-Play

TikTok Shop’s U.S. launch (Sept 2023) initially promised easy viral exposure on the For You Feed. In 2024, TikTok lured merchants with low fees and promotional subsidies (free shipping, discounts) to jump-start its marketplace. However, by late 2024/early 2025, this “freebie” era faded. Industry reports and insiders confirm that TikTok is pulling back organic traffic; brands now generally must pay for views that once came for free. For example, TikTok’s U.S. launch helped sellers of quirky products (e.g., “Taco Blanket” and “Claw-Toe Socks”) rack up millions of views without ad spend, but today, unpaid view counts are “few and far between,” and small merchants report steep drops in sales.

Decline of Free Organic Reach

- Honeymoon Over. Business Insider and industry sources say TikTok Shop spent 2023 supplying free feed traffic to early U.S. sellers. That helped small brands go viral overnight, but those days are gone. “The era of free traffic on TikTok is fading,” one report bluntly states.

- Small Sellers Squeezed. Merchants who called TikTok a “cheat code” to reach customers cheaply now struggle. One case: Cell Phone Seat’s Scott McIntosh saw organic sales drop almost 95%, from ~$1,000/day to just ~$50/day, after the free-traffic era ended. Agencies note that brands once relying on lucky viral hits must now rethink strategy. Influencer marketers agree that “organic reach becomes increasingly difficult” on TikTok, forcing a shift toward deliberate paid promotion.

- Battle for Discoverability. TikTok still touts its “discovery ecommerce” model (personalized in-feed shopping), but sellers find their products no longer pop up organically unless paid. Many report having to post hundreds of videos (often via affiliates) just to get noticed. In short, viral organic drops and bonus order surges are now extremely rare.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyRise of Paid, Performance Ads

- Pay-to-Play Pivot. Multiple sources confirm that TikTok Shop has shifted to a paywall model. “TikTok is shifting away from sending traffic … for free. Instead, businesses will need to pay for TikTok ads” to get the views they previously enjoyed. TikTok partners advise brands to build as if on an ad-driven marketplace; without ad spend, “you’re destined to falter,” says Orca CEO Max Benator. In other words, paid ads are now the default way to attract buyers.

- New Ad Tools. Reflecting this strategy, TikTok is rolling out sophisticated ad products. In mid-2024 it unveiled the Smart+ AI suite for automated campaign bidding and optimization. This push toward advertising tech underscores that TikTok is focusing on advertiser ROI rather than free virality. (Embedding AI-driven performance tools into its platform is a clear signal that TikTok expects sellers to pay for reach.)

- Influencers & Creators. Because organic feed placement is harder, many sellers rely on paid influencer campaigns and TikTok’s affiliate programs. TikTok Shop merchants “typically use ads and sponsored ‘influencers’ to market their products to TikTok’s 170 million U.S. users.” Even mid-tier creators can earn commissions promoting products, but their videos now often require paid boosts or ads behind them. In practice, most sellers say they must spend steadily on Spark Ads or Shop Ads to stay visible.

Rising Costs and Competition

- Higher Fees and Shrinking Subsidies. TikTok has quietly slashed its seller subsidies. In 2023 it charged a 2% commission and paid much of sellers’ shipping costs; by April 2024 it raised the cut to 6% (then scheduled to 8% in mid-2024). Paid shipping promotions and first-order coupons also began disappearing. As one small seller notes, losing TikTok-paid shipping on a $29 item (with $5 freight) would obliterate his margins. These fee hikes mirror TikTok’s move away from “too good to be true” launch incentives.

- Ad Costs and Fatigue. Advertisers warn that running ads on TikTok is getting pricier and less efficient. TikTok ads “fatigue much faster than on other platforms”: a campaign on TikTok may deliver for only 3–4 weeks, versus months on Facebook/Instagram. In practice, sellers say they must refresh creatives frequently and pump money into ads just to hold reach. With more competitors joining TikTok Shop (Data.ai reports ~240K U.S. sellers on TikTok Shop as of 2024), bidding for FYP space is more intense and costly.

- Price-Sensitive Shoppers. The fee increases have potential side effects. TikTok’s audience skews Gen Z, who are very price-conscious; they can easily compare prices on other channels. Experts warn that passing higher costs to consumers (via slightly higher prices or new fees) could erode loyalty. In short, small brands face a squeeze: rising TikTok fees plus unbundled advertising costs are eating into margins.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPAgency and Expert Reactions

- Social Commerce Pros Sound the Alarm. TikTok-focused agencies and retail analysts describe the shift as an inflection point. Orca CEO Benator (also co-host of the SoCom social commerce conference) urges clients to adopt an “ad-driven marketplace” model. William August of Outlandish agrees that moving to paid is “a sign the platform is maturing.” Retail analysts (Forrester’s Mary Pilecki) note merchants will have to absorb or pass on new fees, likely weakening consumer loyalty. One commenter wryly observes, “When TikTok gets closer to being like Amazon … the less I’m going to focus on TikTok.”

- Brands Feeling the Pinch. Some brand leaders confirm the impact: a beauty retailer told Veeqo that TikTok Shop accounted for about 23% of its DTC sales. Such companies must now consider that ¼ of revenue channel could require ads or disappear. Others (like McIntosh’s gadget business) say they may shift budgets back to Amazon or their own sites if TikTok continues winding down freebies. As RetailBoss CEO Jeanel Alvarado puts it, brands deeply invested in TikTok’s ecosystem risk losing “entire social commerce infrastructure” if they have to suddenly pivot away.

- Agency Playbook Adjusted. Marketing experts advise adapting to the new reality. Influencer strategists suggest focusing on well-targeted, purchase-ready audiences rather than broad reach. They also note user fatigue: TikTok feeds now contain so much Shop content that viewers can feel “overwhelmed by constant promotional content,” which could blunt the impact. Agencies emphasize building robust paid strategies alongside organic content: for instance, Front Row Group’s Yuriy Boykiv calculates that selling on TikTok often requires giving away 50–60% of the product’s price to ads, influencer commissions, and logistics. In practice, many merchants now send thousands of free samples to affiliates and run continual ad campaigns, essentially treating TikTok like a performance channel rather than a free showcase.

TikTok’s Ongoing Incentives & Boosts

- Selective Support Remains. TikTok hasn’t removed every perk. It still foots shipping on orders over $20, offers first-time buyer coupons, and runs frequent sale events (especially around holidays). These programs can help dampen the blow of higher fees. Internally, TikTok staff tell BI that some Shop content is still boosted organically in special cases: brands in TikTok’s strategic categories or promotional campaigns, or sellers entering new markets, can get extra exposure. Account managers also have discretionary “boosts” they can apply for clients. In short, rather than universal free reach, TikTok is now “juicing” the visibility of selected products that align with its priorities.

- New Market Focus. TikTok is actively pushing TikTok Shop in non-U.S. markets, and U.S. sellers are taking note. For example, TikTok has expanded ecommerce incentives to Mexico and Brazil, and sellers tell BI they’re exploring those markets where TikTok is still subsidizing growth. This suggests TikTok is reallocating promotional weight to regions where it can still rapidly grow its shop business.

- Live and Affiliate Programs. TikTok continues to promote its live shopping feature and creator affiliate tools as well. Live-streams remain a priority—U.S. live sessions have nearly tripled year-over-year—and TikTok offers new affiliate commissions to creators with as few as 1,000 followers. While these are organic (non-paid) avenues for discovery, sellers report that even live videos often need ad support to reach broad audiences now.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkStrategic Takeaways

- Business Model Maturing. The overall signal is clear: TikTok is pivoting its U.S. shop from a growth-at-all-costs play to a more traditional commerce model that relies on advertising revenue. As one insider notes, TikTok ultimately wants its shop to look more like China’s Douyin or Amazon—platforms that make their money from paid promotion. Layoffs and cost cuts in the ecommerce team reinforce that TikTok is tightening its belt and looking for efficiency.

- Looking Ahead. For TikTok’s evolving strategy, this shift likely has multiple drivers. With a U.S. ban looming, ByteDance appears less willing to subsidize TikTok Shop long-term; forcing merchants to pay may help preserve profits if the app’s reach shrinks. The higher commissions and ad emphasis also suggest TikTok is testing how sticky its sellers truly are once incentives vanish. This may set the stage for focusing on larger brands that can afford ads, even as some smaller merchants exit or move elsewhere.

- Message to Sellers. In practical terms, U.S. Shopify brands and DTC sellers should treat TikTok Shop as a paid channel. Viral luck alone is no longer reliable. Brands must either invest substantially in TikTok ads and creative campaigns or risk being drowned out by bigger spenders. As BI concludes, companies that benefited from TikTok’s early freebies now “can’t sustain it without an ad program.” This reality check signals that TikTok is maturing into a self-sustaining marketplace, one where visibility costs money, and those costs are rising.

Citations

- Adweek: TikTok Debuts AI-Powered Smart+ Performance Tools

- Business Insider: TikTok Plays Hardball With Sellers

- Business Insider: TikTok Shop’s Era of Free Views Is Fading Fast for Sellers

- Econsultancy: TikTok Shop and social commerce trends for 2025: We ask the experts

- Modern Retail: Brands on TikTok Shop face increased fees & an uncertain future

- Newsroom – TikTok: Introducing TikTok Shop

- Reuters: U.S. spending on TikTok Shop gains as TikTok faces threat of ban, data shows

- Tubefilter: TikTok wants to turn millions of Americans into paid shopping influencers

Turn Returns Into New Revenue

Seller Fulfilled Prime (SFP) & Premium Shipping Requirements Are Changing June 29, 2025: A Side-by-Side Deep Dive

In this article

7 minutes

7 minutes

- Trial Enrollment & Graduation Windows for Seller Fulfilled Prime

- Monthly Volume & Enrollment Requirements

- Size-Tier Misclassification & Network Disruptions

- Appeals Process Overhaul

- OTDR Protection via Amazon-Managed Shipping Tools

- Premium Shipping Changes

- Putting It All Together: A Seller’s Checklist

- Final Thoughts

Starting June 29, 2025, Amazon is rolling out tighter performance guardrails for two of its marquee shipping programs: Seller Fulfilled Prime (SFP) and Premium Shipping. Seller Fulfilled Prime work refers to the process by which eligible third-party Sellers can fulfill Prime orders directly from their own warehouses, provided they meet Amazon’s strict performance requirements. For Sellers, these changes aren’t mere tweaks; they reshape how you qualify, stay in, and recover from hiccups in these programs. Below, we’ll walk through each key requirement as it stands today versus what you’ll need to hit after the effective date, with real-world examples to illustrate exactly what’s at stake. For a rundown of all program requirements, see the full Seller Fulfilled Prime Program and Premium Shipping policies.

Trial Enrollment & Graduation Windows for Seller Fulfilled Prime

Today:

- You can request a 30-day SFP trial any time.

- The SFP trial period lasts for 30 days and includes specific performance metrics that must be achieved to qualify for official enrollment in the program.

- Graduation from trial depends solely on meeting performance metrics during those 30 days.

After June 29:

- Three Trials Max per Year: You’ll be capped at 3 trial attempts in each calendar year. Any trial that begins before June 29, 2025 doesn’t count toward this limit.

- Quiet Periods Around Major Events: If your 30-day trial spans the 30 days leading up to Prime Days, Black Friday through Christmas, etc., you cannot graduate. This ensures Sellers are battle-tested before the busiest season.

Sellers must successfully complete the trial period by meeting specific performance requirements to gain access to Prime branding.

Why This Matters: Imagine you enroll in an SFP trial mid-October, aiming to graduate in time for Black Friday. Under the new rule, even flawless performance won’t earn you Prime status, you’ll have to re-enroll after the holidays. Plan your trials for quieter times (e.g., late January) to avoid losing a precious attempt.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyMonthly Volume & Enrollment Requirements

Today:

- There’s no fixed minimum monthly SFP volume.

- If you miss on-time metrics, Amazon sends warning emails, but your enrollment status remains until metrics severely degrade.

After June 29:

- Minimum 100 SFP Shipments/Month: You must deliver at least 100 Prime-eligible packages each calendar month, spread reasonably across weeks, to maintain the Prime badge.

- Dynamic Order Limits: Fall below 100 (or cluster all shipments in one week), and Amazon will impose a reduced daily Prime order limit until you return to consistent volume.

- Exemption for Fix-Ups: If you get a second warning for missing any metric, you can pause Prime (no shipments) for a week to get your house in order, and that period won’t count against your enrollment.

Practical Example: You shipped 15 Prime packages in the first 3 weeks of May, then scrambled to ship 90+ in the final week. In June, you’ll wake up to find your Prime orders capped at a fraction of normal volume. Better to target 25–30 SFP orders per week and build in some slack.

Size-Tier Misclassification & Network Disruptions

Today:

- Listing ASINs in the wrong size tier might trigger warning emails, but rarely leads to immediate suspension. Misclassification can also result in higher storage fees, impacting overall profitability.

- Late deliveries during huge storms or carrier outages may or may not be excluded automatically.

After June 29:

- Strict Misclassification Guardrails: Repeatedly offering a product under the wrong size-tier can lead to blocking of SFP offers or Prime status suspension/revocation for those ASINs.

- Automatic OTDR Exclusions for Major Disruptions: Clearer language confirms that any late deliveries from Amazon-identified large-scale carrier or weather events are excluded from your OTDR automatically.

Scenario: You classify a product as having larger dimensions to qualify for the less strict performance requirements that apply to a larger size tier. After three such mistakes, Amazon silently blocks Prime on that ASIN. You’ll need to correct the tier and appeal to restore it—costly downtime.

Appeals Process Overhaul

Today:

- You have a sliding window to dispute removals, but timelines and submission limits are vague.

After June 29:

- 14-Day Filing Window: From the date you receive a notice (e.g., “Your SFP status is paused due to low OTDR”), you have 14 calendar days to open an appeal.

- 4-Day Response to Requests: If Amazon asks for more details, you have 4 days to reply, or your appeal is closed.

- Limit of 3 Appeals/Quarter: You can file up to 3 appeals per quarter (overturned appeals don’t count). Appeals require supporting data (order IDs, tracking numbers, ZIP codes, proof of carrier delays).

Why It’s Tougher: Say your OTDR dips because a regional carrier hub froze over two days. You’ll need to create a case including tracking scans, carrier advisories, and order logs quickly, or forfeit that appeal.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPOTDR Protection via Amazon-Managed Shipping Tools

Today:

- If you use Amazon Buy Shipping and meet delivery cut-offs, late deliveries often still count against you unless you separately request exclusions.

After June 29:

- “OTDR Protected” Labels: If you enable Shipping Settings Automation in your Prime templates and purchase “OTDR Protected” labels through Amazon Buy Shipping, any late deliveries on Standard (for SFP) or Premium shipping won’t hurt your OTDR.

- Continued Exclusion of Major Disruptions: Same carve-out for large-scale network events.

Bottom Line: Automate shipping profiles and purchase labels using Buy Shipping API, and you effectively get “insurance” against minor late-delivery slips.

Premium Shipping Changes

Amazon’s Premium Shipping program (items promised in 1–3 business days) gets its own tightening:

|

Requirement

|

Today

|

After June 29

|

|---|---|---|

|

OTDR Threshold

|

97%

|

93.5%

|

|

Measurement Window

|

Rolling 30-day period

|

Weekly (Sun–Sat)

|

|

Enforcement Steps

|

Removal upon sustained dip

|

3-strike system:

1st miss – warning email 2nd miss – warning email 3rd miss in 4 consecutive weeks – removal |

|

Warning Reset

|

None

|

4 consecutive perfect weeks clears prior infraction

|

Key Impact: Under the new cadence, a single bad week can put you on notice, and three such weeks in a month spells immediate removal from Premium Shipping. You’ll need more consistent performance throughout each month, not just a healthy 30-day aggregate. Sellers must successfully complete the new performance metrics to maintain their status in the Premium Shipping program.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkPutting It All Together: A Seller’s Checklist

- Schedule Your SFP Trial Smartly: Avoid major sale seasons; plan for Q1.

- Lock Down 100+ Prime Shipments/Month: Automate your SFP orders to spread volume evenly across weeks.

- Clean Up Your ASIN Tiering: Audit listings for correct size tiers and package profiles.

- Enable Shipping Automation + Protected Labels: In Seller Central > Fulfillment Settings, turn on SFP/Premium templates and default to OTDR-protected labels.

- Monitor Weekly OTDR: Invest in an operations dashboard that can track your OTDR by week for both SFP and Premium orders.

- Prepare an Appeals Kit: Create a template for submitting an appeal with sections for order logs, tracking scans, and carrier advisories so you can file within 14 days. Cases created after 14 calendar days will not be considered.

- Build in Buffer for Disruptions: If a regional snowstorm hits, pre-notify Amazon to be considered for exemption from performance defects proactively. Consider outsourcing your SFP fulfillment to a distributed fulfillment network that organically solves for carrier network disruptions and ensures the highest performance metrics for continued program eligibility and enrollment.

- Understand SFP Program Requirements: Familiarize yourself with the stringent requirements of the SFP program and adapt to changing Amazon policies to maintain your SFP status.

Final Thoughts

These new Seller Fulfilled Prime (SFP) and Premium Shipping requirements underscore Amazon’s push for ultra-reliable, ultra-consistent delivery, a win for customers, and a heavier lift for Sellers. But by meeting these new standards, (whether independently or with the help of a distributed fulfillment network), Sellers can maintain access to Prime branding and the substantial customer base of Amazon Prime members, mitigating the risk to the sales opportunities afforded by the Amazon Seller Fulfilled Prime Program.

By understanding the before-and-after, planning trial timing, automating wherever possible (especially Prime shipping options), and building a rapid-response appeals process, you can not only stay enrolled in SFP and Premium Shipping programs but thrive in them.

Watch the Video

Turn Returns Into New Revenue

Related Blog Posts

Amazon Pulls the Plug on Thousands of Vendors

In this article

2 minutes

2 minutes

Receive a big check every month for selling your products directly to Amazon wholesale? Get ready to change the way you do business with the e-commerce behemoth. If you own a small business that currently moves less than $10 million in sales volume through Amazon, or Amazon has not paired your company with an assigned vendor manager, the company will now require you to sell your products through its third-party marketplace by default.

Receive a big check every month for selling your products directly to Amazon wholesale? Get ready to change the way you do business with the e-commerce behemoth. If you own a small business that currently moves less than $10 million in sales volume through Amazon, or Amazon has not paired your company with an assigned vendor manager, the company will now require you to sell your products through its third-party marketplace by default.

Moving smaller vendors to its third-party platform allows Amazon to eliminate costs associated with directly supporting smaller companies that bring in less revenue. Once a business is on the third-party platform, Amazon also has the ability to charge for additional services, such as Fulfilled by Amazon and account management.

Amazon’s first-party business will focus on maintaining relationships with high value brands and companies involved in the production of Amazon’s private-label products.

The change is expected prove difficult for smaller, first-party vendors that lack the existing systems and infrastructure to support competitive third-party marketplace sales and distribution.

Turn Returns Into New Revenue

The Evolution of Thrifting: Why Secondhand Shopping Has Gone Mainstream

In this article

11 minutes

11 minutes

- From “Thrift Shame” to “Treasure Hunt”: How We Got Here

- What’s Fueling the Secondhand Surge?

- Not Just Clothes: Recommerce is Expanding

- Brands Are Getting Involved, And Winning

- Tariffs, Trade, and the Return of the Local Supply Chain

- Challenges Ahead: Will It Scale?

- Retail Takeaways: What Leaders Need to Do Now

- Resale vs. Retail – By the Numbers

- Final Thought

- Glossary: Recommerce Terms You Should Know

- Frequently Asked Questions

Once relegated to church basements and garage sales, secondhand shopping has officially gone prime time. What was once a necessity-driven, fringe behavior is now a flourishing multi-billion-dollar industry driven by value-seeking consumers, climate-aware shoppers, and tech-savvy Gen Z and Millennial buyers who wear their thrift finds as a badge of honor.

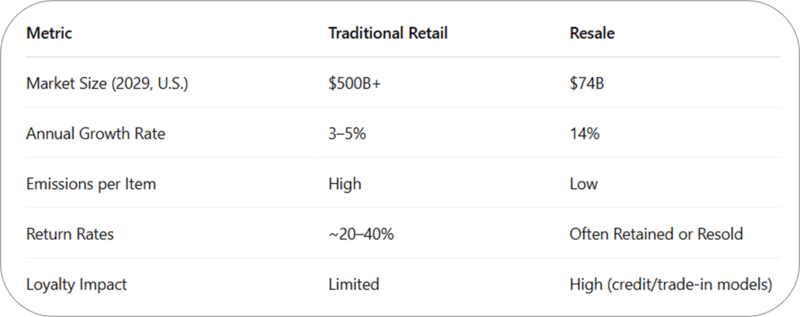

In the U.S., resale is experiencing a meteoric rise. The secondhand apparel market alone grew 14% in 2024, five times faster than the broader apparel sector, and is expected to top $74 billion by 2029. Globally, it’s projected to reach $367 billion. What’s driving this explosive growth? A perfect storm of economic pressure, shifting cultural norms, sustainability concerns, and the digitization of everything from neighborhood thrifting to luxury resale.

For retail executives and brand leaders, the message is clear: resale isn’t cannibalizing your customer base, it’s reshaping it. Understanding this cultural shift is no longer optional; it’s essential.

From “Thrift Shame” to “Treasure Hunt”: How We Got Here

The image makeover of secondhand shopping over the past decade is nothing short of remarkable. What was once associated with financial hardship has been reframed as smart, stylish, and sustainable. Social media has supercharged this transformation. A single TikTok thrift haul can rack up millions of views, turning vintage shopping into a viral aesthetic. On Depop, a Gen Z-favorite resale platform, sellers often model their items themselves, cultivating loyal followings around curated closets.

According to Morning Consult, about half of Americans now shop secondhand regularly, and nearly 1 in 4 have sold an item secondhand in the past three months. Among Millennials and Gen Z, the adoption rate is even higher, with over two-thirds of young adults purchasing used items last year.

“Secondhand is no longer a fallback,” says Alon Rotem, Chief Strategy Officer at ThredUp. “It’s a first-stop shop for the modern consumer.”

Make Returns Profitable, Yes!

Cut shipping and processing costs by 70% with our patented peer-to-peer returns solution. 4x faster than traditional returns.

See How It WorksWhat’s Fueling the Secondhand Surge?

1. Economic Pressures Make Resale Look Smart

Amid inflation, rising interest rates, and growing concern about household debt, consumers are tightening their belts and looking for value. For price-sensitive generations raised in the aftermath of the 2008 recession and the financial disruptions of the pandemic, secondhand shopping isn’t just about affordability—it’s about economic resilience.

A record 58% of U.S. consumers cited the cost-of-living crisis as a motivator for secondhand purchases in 2024. With new imported apparel prices rising, especially due to recent tariffs on Chinese goods, secondhand becomes even more competitive. Thrift finds are not just cheaper; they’re often higher quality than mass-produced fast fashion alternatives.

As Manish Chowdhary, Founder and CEO of Cahoot, puts it: “When prices rise and new inventory becomes more expensive or delayed, secondhand offers a faster, cheaper, and more sustainable supply chain. It’s not just a workaround, it’s a strategic alternative.”

2. Sustainability Has Become Personal

Younger generations are deeply concerned about climate change, and they’re expressing it through their wallets. Fast fashion is increasingly viewed as wasteful and unethical, while secondhand shopping is seen as a form of activism.

In fact, nearly half of Gen Z and Millennials now consider resale value when making a purchase. They understand that a $15 thrifted Levi’s jacket has residual value, while a $7 fast fashion top may end up in a landfill. The resale economy empowers them to be both budget-conscious and climate-conscious.

Buying used is increasingly framed as a responsible lifestyle choice. Social movements like the Circular Economy and #SlowFashion are giving consumers new ways to engage with brands and expect more from them.

3. Uniqueness and Self-Expression

Gen Z isn’t interested in looking like everyone else. Resale offers one-of-a-kind finds that can’t be replicated at the mall. Vintage ’90s jeans, old-school band tees, and retro designer handbags give them an edge and a story to tell.

Nearly half of younger consumers say they shop secondhand for “unique” items that help express their personal style. Unlike mass-market trends, thrifting allows consumers to build wardrobes and homes with character. Platforms like Depop, Poshmark, and 1stDibs are built around discovery and community, turning shopping into storytelling.

4. Digitization and Convenience

A decade ago, thrifting required time, luck, and in-person exploration. Today, you can scroll through thousands of curated listings, filter by size, and check out in seconds. AI-powered platforms like ThredUp now offer visual search and dynamic pricing. Tools like Smart Listing on Poshmark help sellers optimize their listings, while AI authentication ensures buyers are getting the real deal on platforms like The RealReal and StockX.

Modern resale has the polish of traditional ecommerce, and often better UX.

Convert Returns Into New Sales and Profits

Our peer-to-peer returns system instantly resells returned items—no warehouse processing, and get paid before you refund.

I'm Interested in Peer-to-Peer ReturnsNot Just Clothes: Recommerce is Expanding

While apparel leads the way, resale is growing across verticals:

- Furniture & Home Décor: Platforms like Facebook Marketplace, AptDeco, and 1stDibs are booming as shoppers furnish homes with affordable or vintage items.

- Luxury Goods: The RealReal, Rebag, and Vestiaire Collective offer authenticated pre-owned fashion and jewelry with white-glove service.

- Electronics & Media: eBay, Gazelle, and Back Market cater to shoppers looking for refurbished tech.

This diversification shows that resale is no longer a niche; it’s a cross-category movement.

Brands Are Getting Involved, And Winning

Retailers are no longer watching from the sidelines. Over 75% of major brands are either exploring or actively building resale programs. From trade-in initiatives (Patagonia’s Worn Wear, REI Re/Supply) to peer-to-peer resale on brand sites (Rachel Comey, Hanna Andersson), brands are turning recommerce into a loyalty driver and sustainability differentiator.

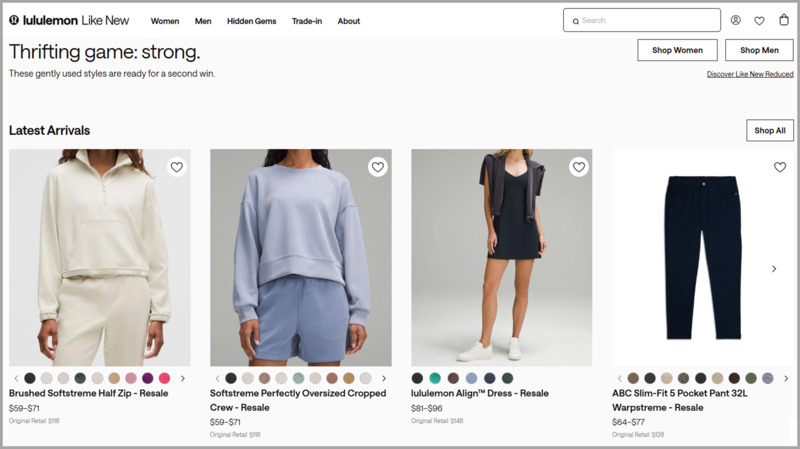

Lululemon’s “Like New” program is an early success story. Customers trade in lightly used gear for credit, and the brand resells it online. In return, Lululemon gains customer retention, deeper engagement, and new revenue streams, all while reinforcing its commitment to sustainability.

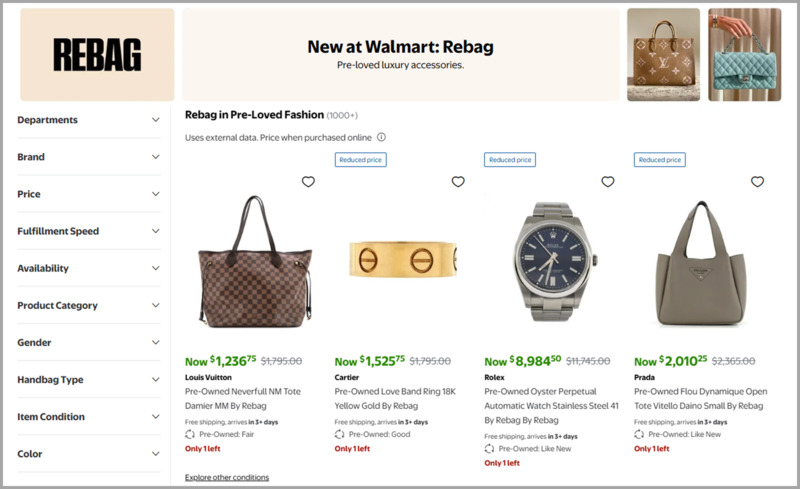

Even Walmart has gotten in on the game, partnering with Rebag to sell pre-owned luxury handbags on its site, proving that resale now appeals across price points and retail formats.

Tariffs, Trade, and the Return of the Local Supply Chain

With rising tensions around Chinese imports and efforts to close tax loopholes exploited by ultra-cheap players like Shein and Temu, new apparel is becoming more expensive and politically charged. The resale market sidesteps these supply chain vulnerabilities. As Rotem of ThredUp notes, “All of the clothing comes from the closets of Americans.”

Recommerce essentially “domesticates” the supply chain. Brands and platforms that embrace this model gain independence from volatile global trade routes, and potentially from looming environmental regulations around overproduction.

Challenges Ahead: Will It Scale?

Despite the momentum, resale isn’t frictionless. Processing single-SKU, one-off products is operationally messy. Trust and quality control remain concerns. Margins can be tight, especially for managed resale services. And a deep recession could simultaneously increase supply (more people selling) and suppress demand (less discretionary spending).

Still, the trendlines are clear. Shoppers want alternatives, and for brands, recommerce offers resilience in pricing, supply, sustainability, and customer loyalty.

Retail Takeaways: What Leaders Need to Do Now

- Understand your resale customer. They’re already buying and selling your products. Are you enabling them? Or ignoring them?

- Audit your supply chain for circularity: Can your products support second, third, or fourth lives?

- Explore RaaS partnerships (Resale-as-a-Service): Trove, Recurate, Archive, and ThredUp can help launch resale with minimal lift.

- Integrate resale into your CX: Consider buy-back incentives, branded resale platforms, and Peer-to-Peer Return options.

- Start with SKUs that make sense: Apparel, accessories, gear, and standardized home goods are ideal starting points.

5 Brands Getting Resale Right

- Patagonia – Worn Wear encourages durability and trade-ins.

- REI – Re/Supply processes thousands of returned items into fresh inventory.

- Lululemon – “Like New” generates loyalty and promotes quality.

- Rachel Comey – Peer-to-peer resale via Recurate integration.

- Athleta – Partnered with ThredUp to launch “Athleta Preloved.”

Resale vs. Retail – By the Numbers

Final Thought

The next decade of retail will be defined not just by what’s new, but by how we handle what’s already been made. Jeremy Stewart, Head of Customer Success at Cahoot, believes that “Recommerce is not a disruption, it’s an evolution. The brands that thrive will be those who view returns, resale, and reverse logistics not as cost centers, but as opportunities to connect, conserve, and compete.”

The closet is open. Are you ready for it?

No More Return Waste

Help the planet and your profits—our award-winning returns tech reduces landfill waste and recycles value. Real savings, No greenwashing!

Learn About Sustainable ReturnsGlossary: Recommerce Terms You Should Know

🔄 Recommerce

Short for “reverse commerce,” recommerce refers to the buying and selling of pre-owned, returned, or surplus goods. It includes secondhand, vintage, refurbished, and resale items, and is central to the circular economy movement.

🛍️ Resale-as-a-Service (RaaS)

A business model that allows brands to launch and manage their own resale programs using third-party tech and logistics providers. RaaS platforms handle authentication, fulfillment, pricing, customer service, and returns. Leading providers include Trove, Recurate, Archive, and ThredUp.

🔁 Circular Economy

An economic model that aims to eliminate waste and maximize the lifecycle of products by keeping them in use through reuse, resale, recycling, or refurbishment. Recommerce is a key pillar of circular retail strategy.

👗 Bracketing

A common ecommerce practice where customers buy multiple sizes or colors of the same item with the intention of returning those that don’t fit or suit them. Bracketing contributes to high return rates, especially in fashion retail.

📦 Reverse Logistics

The process of moving goods from customers back to the seller or manufacturer, often for return, repair, or resale. Traditional reverse logistics can be costly and environmentally taxing; peer-to-peer returns streamline this process.

🤝 Peer-to-Peer (P2P) Returns

A logistics innovation where a returned product is routed directly from one customer to another, bypassing the brand’s warehouse, to reduce shipping costs, emissions, and processing time. Companies like Cahoot are pioneering this model for scalable circularity.

🧾 Buy-Back Program

A retailer-led initiative that invites customers to return used items (often for store credit or cash) so they can be cleaned, verified, and resold. Examples: Lululemon Like New, Patagonia Worn Wear.

💼 Trade-In Program

Similar to a buy-back, but typically focused on higher-value goods (e.g., electronics, luxury fashion, outdoor gear). Items are traded in for credit or resale eligibility and then processed via a recommerce channel.

🔍 Authentication

The process of verifying the legitimacy and condition of pre-owned items—especially luxury goods—before resale. It is often powered by AI (e.g., Entrupy) or expert inspection. It builds buyer trust and ensures resale value.

📈 Net Recovery Rate

The percentage of a returned or resold item’s original retail value that a retailer or recommerce partner can recover through resale. A key KPI for evaluating the efficiency and profitability of circular programs.

📊 Resale Value Consciousness

A consumer mindset in which the anticipated resale value of a product influences the initial purchase decision, especially common among Gen Z and Millennials who view fashion as an asset rather than an expense.

Frequently Asked Questions

How are rising tariffs influencing the long-term economics of new vs. secondhand retail goods?

Tariffs on imported goods, particularly fast fashion and consumer products from low-cost countries, are driving COGS up substantially. For retailers, this makes resale more than just a sustainability story—it becomes a margin play. When the price gap between new and secondhand shrinks, recommerce emerges as a viable buffer strategy. Brands that integrate resale now can insulate themselves from future geopolitical pricing shocks.

What does secondhand shopping reveal about the shifting values of Gen Z and Millennials?

Younger generations are not just frugal—they’re value driven. They want products that reflect their beliefs: sustainability, authenticity, and individuality. Secondhand enables them to reject mass consumption while expressing personal style. For retailers, it’s not just about offering “cheaper stuff”; it’s about enabling self-expression with meaning. Recommerce is not just a revenue channel; it’s a brand alignment opportunity.

How can brands embrace resale without cannibalizing their primary business model?

The misconception that resale erodes new product sales misses the broader picture: resale extends the customer lifecycle. When done right, resale drives acquisition, improves retention, and enhances brand perception. Circular strategies like trade-ins and peer-to-peer returns build ecosystem loyalty. Think of it not as cannibalization, but as ecosystem optimization—your customer is shopping somewhere; make sure it’s still within your brand’s orbit.

Why is recommerce considered part of supply chain resilience in 2025 and beyond?

With global supply chains strained by tariffs, climate events, and transportation costs, recommerce offers a rare thing: a domestic, distributed inventory pool that does not rely on cross-border shipping. Resale platforms are becoming a decentralized warehouse network. That’s not just green—it’s strategic infrastructure. Brands that build a circular foundation today will be better equipped for tomorrow’s volatility.

Could resale, thrift, and peer-to-peer models become the default, not the exception, in 10 years?