Pier 1 consolidating three warehouses into one to improve gross margins

In this article

- Fulfillment and operations fixes will play a major role in pulling Pier 1 out of the downward spiral of 11.4% same-store sales declines, said CEO Alastair James on an October earnings call.

- James said “pool distribution,” speeding up fulfillment and consolidating three warehouses into one Columbus, Ohio facility — which happened three months ago — will bring greater speed and efficiency needed to re-engage customers in-store.

- CFO Nancy Walsh named “higher supply chain costs” among the factors putting pressure on gross margins, and the company is evaluating whether tariff hikes could hit margins further.

Pier 1’s “pool distribution,” in which one truck delivers to more than one location, is expected to double store delivery days to twice per week and meant to reduce stockouts and increase the chain’s ability to replenish stores quickly, said the CEO.

James also mentioned the warehouse consolidation as a source of increased efficiency. “The newly configured space which moves us from three buildings down to one is enabling faster processing, improved accuracy, and smarter packaging. We’re now positioned to take the learnings from this transformation and bring this model for the remainder of our supply chain network over time,” said James.

But there is still a serious element of uncertainty behind these strategies to increase efficiency and boost margins since Pier 1 relies so heavily on imports from China. “Approximately 59% of our sales in fiscal 2019 are expected to be generated from goods produced in China. And about half of that will consist of product classes that are subject to the 10% tariff that went into effect last week,” said Walsh.

He added that the retailer is “evaluating” the effects of tariffs in the new year, when they will rise to 25%.

Offer 1-day and 2-day shipping at ground rates or less.

Recent Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations and

USPS Hazmat Shipping Guidelines – How to Ship Fast While Staying Compliant

Hazardous Materials What is a Hazardous Material? What Items Are HAZMAT? Classes of HAZMAT Items What Classes Can Ship on Various USPS Services? What Changes

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy

Deloitte Study: Holiday Shoppers Hooked on Fast and Free Shipping

In this article

According to Deloitte’s 33rd annual “Holiday Survey” of consumer spending intentions and trends, for the second consecutive year, 88 percent of survey respondents prefer free shipping over receiving their holiday packages faster (12 percent).

The majority (61 percent) of holiday shoppers report they will buy items that qualify for free shipping this season. For free shipping, two-thirds (66 percent) are willing to wait 3-7 days for their merchandise. More than 3 in 5 people surveyed (62 percent) define “fast shipping” as two days or less, up from 54 percent in 2017. One-quarter (25 percent) define three to four day delivery as fast shipping, down from 35 percent in 2017. Among the reasons for shopping in stores, 47 percent of respondents said it was to “avoid shipping costs.” Their No 1. reason to shop online is “convenience” (77 percent) followed by “free shipping” (72 percent).

Offer 1-day and 2-day shipping at ground rates or less.

Recent Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations and

USPS Hazmat Shipping Guidelines – How to Ship Fast While Staying Compliant

Hazardous Materials What is a Hazardous Material? What Items Are HAZMAT? Classes of HAZMAT Items What Classes Can Ship on Various USPS Services? What Changes

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy

What Target’s Free 2-Day Shipping Means For Other Retailers

In this article

Target’s free shipping perk creates additional pressure on everyone to race to the common denominator — which is fast, free shipping.

It’s clearly a conversion driver for retailers and sets the longer term implication that fast, free shipping is going to be expected as the standard at all times and on all items. It’s surely becoming the norm and retailers have to be extremely efficient in order to be successful because of the high cost of shipping. All signs indicate this will be competitive holiday season.

Offer 1-day and 2-day shipping at ground rates or less.

Related Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations

Amazon Buy With Prime: A Game-Changer for Customers, But a Trojan Horse for Merchants

For customers, Buy With Prime is a great service, but for ecommerce merchants, it’s a Trojan Horse. Amazon Prime circumvents the entire order checkout process from the merchant’s platform, and payment processing goes through Amazon

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy consumers

16 Fulfillment Metrics Every Ecommerce Company Should Monitor

In this article

1 minute

1 minute

“If you cannot measure it, you cannot improve it,” said famed British physicist Lord Kelvin about scientific experimentation over 100 years ago.

It’s still pertinent today as you seek to improve ecommerce operations, remain competitive and improve our profitability and customer service. In order to improve operations, you first need to measure key fulfillment metrics such as total cost per order (CPO), shipped cost per carton, cost per line and cost unit. Once you understand what these metrics show, you can then develop options for processes that reduce steps and cost, or improve service levels such as order turnaround time.

What key fulfillment metrics do you monitor and use to improve your performance? Here are 16 we recommend you use as a starting point.

Up to 64% Lower Returns Processing Cost

Free Shipping Becomes a Blessing and Curse at Amazon and Target

In this article

Amazon.com Inc. and Target Corp. have opened the floodgates on free shipping. Web orders with the free service have increased 13% in 2018. Offer can boosts sales but wreaks havoc with profit margins.

Recent moves by the two retailers to eliminate minimum-purchase amounts for free shipping have boosted the share of online orders that get delivered gratis, according to data from retail analytics company DynamicAction. Orders with the free service included have risen 13 percent so far this year through Nov. 16, including an 18 percent spike in the week that began Nov. 5., when Amazon unveiled its offer.

Free Falling

Amazon and Target have eliminated shipping fees for online holiday orders

“Free shipping is the new normal,” DynamicAction’s Chief Marketing Officer Sarah Engel said.

While free shipping can entice customers to buy, it can wreak havoc with retailers’ profit margins, which are typically razor-thin already during the holiday quarter due to rampant discounts and increased marketing costs. Web orders that included some sort of promotion since the end of October have risen 13 percent from the same period last year, DynamicAction found. It also doesn’t help that transportation costs were already soaring this year due to a shortage of truckers.

Target is offering two-day free shipping from Nov. 1 through Dec. 22 on hundreds of thousands of items with no minimum purchase, while Amazon said on Nov. 5 that shoppers without Prime memberships need not buy at least $25 to earn free regular shipping, which typically takes five to eight business days.

Walmart Inc. has thus far declined to match the offers, sticking with its $35 minimum purchase requirement. The world’s largest retailer has suffered from narrowing gross profit margins in recent quarters, even as its online sales have grown.

E-commerce sales overall will jump 17 percent this holiday season, according to data tracker EMarketer, and account for about 12 cents of every holiday dollar spent. Amazon garners just under half of all online sales in the U.S., EMarketer said.

This article was written and published at Bloomberg by Matthew Boyle

Offer 1-day and 2-day shipping at ground rates or less.

Recent Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations and

USPS Hazmat Shipping Guidelines – How to Ship Fast While Staying Compliant

Hazardous Materials What is a Hazardous Material? What Items Are HAZMAT? Classes of HAZMAT Items What Classes Can Ship on Various USPS Services? What Changes

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy

How to Win in an Amazon Prime World

In this article

A 5% increase in customer retention can improve a company’s profitability by 75%, according to Bain research. Yet most retailers are more focused on acquisition and conversion than retention. Despite investing billions in this pursuit, ecommerce has created a “customer experience gap” for retailers unable to engage customers at key post-purchase moments. Brands are learning the hard way that lackluster engagement and an afterthought communication strategy is a guaranteed way to lose loyalty.

To address this important issue Pulse Commerce conducted mystery shopping at nearly 500 leading U.S. online merchants prior to the 2017 peak holiday shopping season. The result is a picture of true behavior rather than survey feedback, and benchmarking by product category for comparison to peers as well as to Amazon.

Offer 1-day and 2-day shipping at ground rates or less.

Recent Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations and

USPS Hazmat Shipping Guidelines – How to Ship Fast While Staying Compliant

Hazardous Materials What is a Hazardous Material? What Items Are HAZMAT? Classes of HAZMAT Items What Classes Can Ship on Various USPS Services? What Changes

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy

The Prime Effect

In this article

How Amazon’s two-day shipping is disrupting retail. The quest to offer fast, free delivery has triggered an arms race among the largest retailers.

Amazon is already making up most of the US ecommerce sales. However, they rely heavily on 3rd party sellers. These sellers experience major pain related to shipping cost and time. Fast shipping is now an expectation, but it is expensive for most sellers. Sellers often limit fast shipping to veru=y samll items or to local addresses. This limits their buy box opportunities.

Alongside life, liberty and the pursuit of happiness, you can now add another inalienable right: two-day shipping on practically everything .

Amazon.com Inc. has made its Prime program the gold standard for all other online retailers, according to surveys of consumers. The $119-a-year Prime program—which now includes more than 100 million members world-wide—has triggered an arms race among the largest retailers, and turned many smaller sellers into remoras who cling for life to the bigger fish.

In the past year, Target Corp. , Walmart Inc. and many vendors on Google Express have all started offering “free” two-day delivery. (Different vendors have different requirements for no-fee shipping, whether it’s order size or loyalty-club membership.)

Optimizing Prime

Amazon’s shipping infrastructure isn’t used just by Amazon. As shoppers who read the fine print know, it’s also available to its retail partners through its Amazon Marketplace. Of the top 10,000 sellers on Amazon—collectively representing about half of Amazon’s Marketplace revenue—at least 90% have one product in the Fulfillment by Amazon program, says Juozas Kaziukėnas, chief executive of Marketplace Pulse, a business-intelligence firm focused on e-commerce. Almost 70% use it to stock and ship at least half of their products, he adds.

Competitors Great and Small

Amazon’s nominal competitor in online retail, Walmart, also offers a marketplace for third parties to sell their goods; the big difference is, it doesn’t assist them with fulfillment—and forbids them from using Amazon’s fulfillment services.

Scale is essential. Mom-and-pop shops and even midsize retailers can no longer assume buyers will put up with getting their goods days later via the U.S. Postal Service. In response, startups are trying to aggregate enough retail customers that they can offer the all-important fixed rates for nationwide two-day shipping.

Offer 1-day and 2-day shipping at ground rates or less.

Related Blog Posts

The Ultimate Guide to Selling and Winning on Amazon Seller Fulfilled Prime

Most people are familiar with the requirements that Amazon expects sellers to meet, but far fewer are aware of the roadblocks that make success hard to achieve. An even smaller number are aware of the strategies they can deploy to meet Amazon’s criteria and surpass them.

Amazon Buy With Prime: A Game-Changer for Customers, But a Trojan Horse for Merchants

For customers, Buy With Prime is a great service, but for ecommerce merchants, it’s a Trojan Horse. Amazon Prime circumvents the entire order checkout process from the merchant’s platform, and payment processing goes through Amazon

Protect Your Amazon Listings from Search Suppression, Hijackers, and Stockouts

Amazon is a competitive platform. You need to have a quality product, excellent listing content, and plenty of reviews to catch the attention of busy consumers

Everyone’s Building Ecommerce Fulfillment Networks, But They’re Not So Fulfilling for Sellers

In this article

11 minutes

11 minutes

- Multi-Channel Selling is More Profitable

- Amazon FBA: Penalizing Multi-Channel Order Fulfillment

- Shopify Order Fulfillment Network (Flexport)

- Walmart Fulfillment Services (WFS)

- Fulfilled by TikTok (FBT): The New Kid On the Block

- Be Careful Jumping Onto the Bandwagon

- The Future of Order Fulfillment is Wide Open

- Offer 1-day and 2-day shipping at ground rates or less.

Seeing the success of Amazon’s outsourced fulfillment service Fulfilled By Amazon (FBA), marketplaces and e-commerce platforms are racing to build their own e-commerce order fulfillment networks. Undoubtedly, it is beneficial for sellers to have access to third-party fulfillment services wherever they choose to sell, but at what cost? Do these marketplaces have the sellers’ best interests at heart?

Multi-Channel Selling is More Profitable

When Third-party Sellers first started selling online, the first questions were, “Should I sell on Amazon or eBay besides my e-commerce website?” However, over time, that question has changed into, “How do I sell on both, as well as Walmart and other marketplaces when they make sense for my business?”. In fact, with the current e-commerce trend, it is almost imperative for online sellers to sell on multiple channels to survive, let alone grow. Numerous studies show that retailers selling on two or more sales channels have a healthier bottom line, on average, than those that don’t. But it gets complicated. Now, each platform has its e-commerce order fulfillment service and prioritizes the display and, thus, the sale of items fulfilled through them.

Let’s take a closer look at each.

Amazon FBA: Penalizing Multi-Channel Order Fulfillment

Amazon launched its third-party marketplace to satisfy customer demand for a broader assortment of products. Third-party (3P) Sellers add products much faster than Amazon, sourcing all the items themselves and helping build the “everything store” behemoth. According to recent data, over 60% of all physical goods sold on Amazon are from Third-party Sellers, meaning most products sold on the platform come from independent sellers rather than Amazon itself.

Then came Fulfillment by Amazon (FBA), a large-scale distributed warehousing and order fulfillment network for its Third-party Sellers. FBA helps Amazon offer nationwide 1- and 2-day delivery to customers (and regional same-day delivery) even if a 3P Seller sold the item. Commanding approximately 37.6% of all U.S. e-commerce spending in 2023, Amazon negotiated unbeatable shipping rates from all major carriers and offered incredibly low fulfillment fees to sellers. Opting for FBA gives Sellers a distinct advantage within the Amazon ecosystem. FBA sellers are more likely to win the “buy box” and are outright forgiven for any shipping-related customer complaints.

However, using FBA to fulfill non-Amazon orders is not as rewarding financially. Amazon uses FBA to deliver an excellent shopping experience for Amazon customers and power its famous growth flywheel by prioritizing its FBA services for its marketplace customers. The fees for non-Amazon orders are much higher, sometimes by as much as 30–50%. Moreover, Walmart outright banned FBA from its platform due to Amazon’s aggressive branding on boxes. In recent years, Walmart has approved using either Flexport or ShipBob fulfillment services to fulfill Walmart orders, but not both.

Shopify Order Fulfillment Network (Flexport)

Shopify started as an e-commerce platform that enabled sellers to quickly create their own professional online store independent of marketplaces. With its vibrant app ecosystem, Shopify aims to be a one-stop shop for small and midsize online sellers.

One of its growth strategies has been the app marketplace. Shopify’s incredible store diversity also means a high demand for specialized features. Keeping up with this expectation through Shopify’s development team is very challenging. Therefore, they’ve created an app marketplace to serve their sellers’ growing needs quickly. Through the marketplace, third-party companies can build and monetize specialty apps that augment and extend Shopify’s native functionality.

To continue fueling its growth, Shopify launched additional services to power more parts of the seller’s business and capture a larger share of the wallet. These services include Shopify Payments, Point-of-Sale, Shopify Capital, and Shipping Label printing. Small and midsize (SMB) sellers need these services, and they like the simplicity of a one-stop shop. These value-added services have increased Shopify’s revenue per seller over time.

Shopify also tossed its hat into the e-commerce order fulfillment ring as an extension of the same strategy. ‘Shopify Fulfillment Network’ (sold to and rebranded as Flexport in mid-2023 but still operating the Shopify Fulfillment Network app) is geared towards Shopify sellers with options such as custom packaging. The pricing and shipping speed aren’t expected to be near FBA (at least not in the near term), as Shopify does not own any logistics infrastructure. However, there are plans to partner with other warehouses and Third-party Logistics (3PL) providers. Smaller Shopify sellers who fulfill orders by themselves may find it a step up, but it’s too early to say. One thing we know for sure is that fulfilling orders through Shopify will not boost their “buy box” chances on Amazon. Shopify is serious about this move, as demonstrated by their acquisition of 6 River Systems for $450 M in September 2019.

Walmart Fulfillment Services (WFS)

Walmart introduced a fulfillment network similar to FBA in 2020 called Walmart Fulfillment Services (WFS). Third-party Sellers ship their inventory to Walmart’s network of over 40 domestic fulfillment centers for storage and then e-commerce orders are picked, packed, and shipped to customers. Walmart reported recently that 66% of its third-party Sellers use the service to ship more than half of Walmart Marketplace orders (up from fulfilling only ~25% of e-commerce orders just three years ago). The program aims to take the fulfillment burden off its Seller partners and increase delivery speeds for the end customers (often within 2 days). It also supports customer service for WFS‑fulfilled orders and handles returns, which frees up Sellers to focus on growing their business.

Unlike Amazon, Walmart ships approximately half of its e-commerce orders from its 4,600+ physical stores. This is possible because a store is within 10 miles of ~90% of the US population. While WFS rates are reported to be about 15% lower than competitors’, the captive order fulfillment services are tied to product discoverability on the marketplace, making participation more or less mandatory for merchants that choose to partner with Walmart.

The strategic bet paid off big time, as Walmart’s marketplace grew to become the second-largest in the US, edging out eBay.

Fulfilled by TikTok (FBT): The New Kid On the Block

Despite being the newest social commerce platform in the US, TikTok Shop is already estimated to be the third largest, trailing only Facebook and Instagram. In a strategic move that mimics the fulfillment services competitors that came before it, TikTok Shop launched Fulfilled by TikTok (FBT) in late 2024 to manage the storage, picking, packing, and shipping of orders placed on TikTok for its creators and brands. Sellers will like that inventory can also be intelligently distributed to support the same nationwide fast delivery at ground shipping rates that other fulfillment networks offer.

It remains to be seen if there will be a captive component to FBT such that product discovery and sales are undeniably linked to using the new service. Still, since the native influencer- and creator-first nature of TikTok and TikTok Live drive much of TikTok Shop’s traffic, it may be some time before a long-term stickiness strategy is developed. We know now that early users will benefit from subsidized storage and shipping costs, as well as ‘free’ customer service for order and shipping support. Customizable ‘badges’ help early users stand out from the competition.

Be Careful Jumping Onto the Bandwagon

So, nearly every major marketplace in the U.S. now has a preferred e-commerce order fulfillment network. Using a non-preferred fulfillment network has definite downsides, some outright punitive. These moves contradict the trend of multichannel selling and come at the sole expense of Sellers.

So why not sign up for all the order fulfillment networks?

It’s not even about the fees these networks charge, which can be significant for any business. The large hidden costs come from maintaining inventory at multiple locations. Let’s break it down:

- Redundant inventory in key markets: Imagine a merchant who wants to offer fast shipping to customers in California and operates on three different marketplaces. The merchant would then need to store its inventory in California at three separate warehouses for each marketplace. After accounting for safety stock, that’s a lot of excess capital tied up unnecessarily.

- Multiple inbound shipments: If a merchant signs up with three fulfillment networks, they must ship their inventory to three warehouses in every major region. This will be more expensive because they’ll be splitting their one big inbound shipment into multiple smaller inbounds.

- Safety stock: Splitting the same amount of inventory between multiple warehouses instead of one or two increases the amount of safety stock merchants must maintain. The square root law of inventory calculates the additional safety stock that needs to be kept on hand as the number of fulfillment centers increases.

- Clearance through multiple channels: If a product doesn’t sell well, merchants will incur the cost of clearing the dead stock through each of these redundant fulfillment centers.

- Returns through multiple channels: Sellers must also compensate or pay for restocking returns on every platform, which can be as high as 20% in some product categories.

Apart from the tangible costs, managing multiple fulfillment programs can cause headaches—for example, the added complexity of juggling multiple contracts, billing audits, and keeping track of ever-changing rates and terms. Furthermore, holding more inventory exposes sellers to a higher risk of losses from shifts in customer demand or during a recession. If a Seller opts to go with an unaffiliated third-party logistics provider, they become a buy box pariah on every platform.

It is hard to ignore the environmental costs, too. The inefficiencies of excess inventory at its core result in a larger carbon footprint through excess transportation and warehousing operations. The repercussions are brutal to ignore when humanity is inching towards irreversible damage to the climate every day. Sellers are losing, and so is our planet!

The Future of Order Fulfillment is Wide Open

The platforms and marketplaces are doing what’s best for them. They are building their e-commerce order fulfillment networks to drive revenue and lock Sellers into their platforms. However, what’s best for marketplaces may not be best for Sellers. Captive order fulfillment services add unnecessary costs and do not scale to a seamless customer experience across channels.

The optimal future of order fulfillment is customer-centric. It means delivering goods to customers how they prefer, not limited to the options the seller or the fulfillment partner thrust upon them. The options should not be limited to lightning-fast delivery or Buy Online Pickup in Store (BOPIS). They should also allow the customer to choose greener delivery options for the Earth or the ability to have the order delivered the same day from a local store without costing an arm and a leg. When order fulfillment networks operate under this new paradigm, they’d be able to offer these options (and more) to merchants of all sizes, and such services will not be a luxury limited to large multi-billion dollar retailers (think Amazon-Kohls or Amazon-Staples) as an example.

The future of e-commerce order fulfillment must also be efficient, where all supply chain constituents work together to serve the customer profitably and responsibly. Instead of walls and hurdles preventing growth and advancement, true next-generation fulfillment solutions will facilitate collaboration between all value chain members. It will unite the manufacturers, the retailers, and everyone in between, including the competitors. At Cahoot, we firmly believe that customer centricity and merchant profitability will continue to suffer unless we re-imagine and re-design our captive order fulfillment models. You can read more about the future of order fulfillment and how our solution can help you get there today.

Offer 1-day and 2-day shipping at ground rates or less.

Related Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations

How AI Agents Will Transform Ecommerce Order and Inventory Management Systems

Knowledge workers will either need to learn to harness the power of AI to 10X their output (or the output from the tools at their disposal), or AI agents will take over those jobs at a fraction of the cost.

Preparing for Peak Holiday Season [A Guide for Sellers]

The peak holiday season is the most critical time of the year for e-commerce businesses, characterized by intense order volumes, high consumer expectations, and operational complexities.

Up to 64% Lower Returns Processing Cost

On Demand Warehousing: Right for You?

In this article

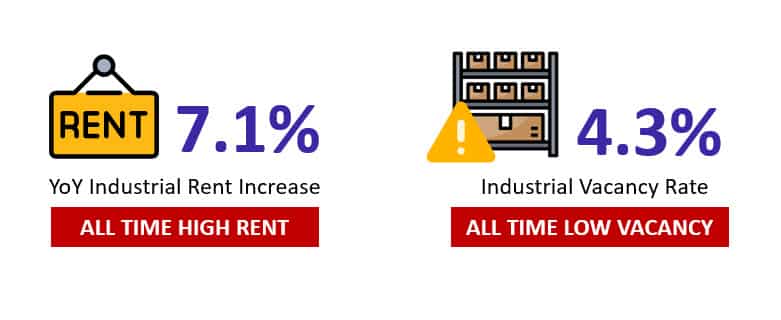

Trying to find extra warehouse space as a merchant is daunting. According to JLL’s recent Industrial Outlook, the market for industrial rent has never been worse. Vacancies are at a miniscule 4.3%, an all time low, and rents rose a whopping 7.1% in 2021, reaching an all-time high.

And yet, you need room to grow. Higher sales and more products demand bigger inventories, and that’s without mentioning the supply chain crisis that’s forcing merchants to load up on more inventory than usual.

At the same time, many merchants aren’t using all of their own warehouse space. It’s tough to get the perfect size warehouse, so many err on the side of caution and start with more room than they need.

That’s where on demand warehousing comes in – merchants who need space can get the warehouse capacity they need from those who have more than they need.

What is On Demand Warehousing?

On-demand warehousing is the idea that merchants can rent out space in other merchants’ warehouses to help with their storage and fulfillment needs.

The Wall Street Journal describes it well:

“The idea is to tap into unused space in a crowded U.S. industrial real-estate market where distribution centers near population centers are fetching a growing price premium. Retailers and manufacturers are trying to position goods closer to customers without getting locked into long-term contracts or multiyear leases when rapid changes in buying patterns and trade conditions have made forecasting demand more difficult.”

On-demand warehousing platforms connect merchants to others that can provide warehousing services. A user on one of their platforms will be able to see a variety of warehouse owners that may be able to suit their needs with temporary space. They can then negotiate for warehouse space and services directly from those owners, securing the extra footprint they need.

On-demand warehousing is rising in prominence because it’s becoming more difficult to “go it alone” in the eCommerce era. Before the rise of Amazon Prime, merchants could easily lease space solely around their home base, keeping inventory centralized and easy to manage. Prime, though, has pushed customer expectations for fast delivery ever higher – and those customer expectations extend past Amazon’s marketplace to DTC stores and brick & mortar retailers alike.

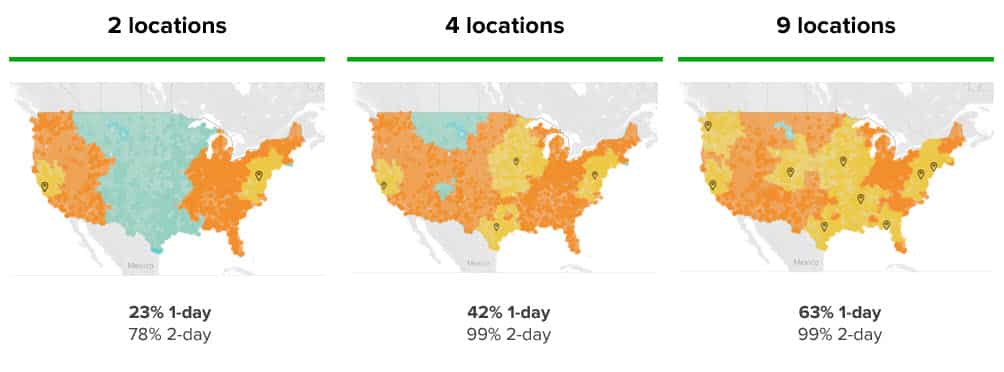

To provide fast shipping at an affordable cost, merchants need to strategically deploy inventory in four or more locations across the country. Put it all together, and you see why merchants are looking to expand their footprint across the United States. On demand warehousing offers one way to build a nationwide ecommerce order fulfillment strategy.

Pros and Cons of On Demand Warehousing

On demand warehousing can solve many challenges for merchants, but it comes with its own issues. In this section, we’ll cover what it does well and what it doesn’t address.

Pros of On Demand Warehousing

1. Flexible growth

The retail landscape seems to shift at warp speed – we went from talking about 2-day delivery to same-day delivery in the blink of an eye. The pandemic has only accelerated the pace of change, and while the total retail and eCommerce markets grow rapidly, it’s more difficult than ever to predict their futures.

Will curbside pickup from big box retailers disrupt Amazon? Will dark stores powering same-day shipping leap over customer demand for 1- and 2-day shipping? What’s just over the horizon?

If you’re buying or leasing your own space and investing heavily into operations, you’re locking yourself into one particular mode of fulfillment for years to come. On demand warehousing’s short contracts and endless options, on the other hand, present an opportunity to shift your approach at the drop of a hat and satisfy the newest customer demands.

2. Enables fast shipping

On demand warehousing is a flexible way for merchants to strategically place their inventory in 4+ US fulfillment centers. Directly owning or leasing space across the country requires a huge investment of time and capital, and it’s simply out of reach for most merchants. 4+ locations, though, are necessary to cover the entire country with 2-day shipping at ground rates. With on demand warehousing, nationwide inventory distribution is feasible even for smaller merchants.

Source: Cahoot analysis of FedEx Ground delivery times

It also helps larger enterprises strategically deploy inventory in regions where they think they’ll experience a demand spike. For instance, when natural disasters unfortunately occur, large retailers will send a massive amount of relevant equipment to on demand warehouses in a nearby area to ensure that they don’t go out of stock on essential goods. It can also help with the holiday rush if a retailer feels that they don’t have enough inventory in a critical part of the country.

3. Low capital requirements

On demand warehousing fits entirely into Operating Expenses. This minimizes the risk of investing in the wrong areas, and it maximizes the capital available to deploy towards other critical parts of the business.

For instance, you can flexibly rent out more space to try out a new product, and if it doesn’t move, you can quickly get out of the on demand lease. If you had leased out commercial warehouse space yourself, you might be stuck in a 12-month or longer lease, and tied up money that could have gone to a new hire or to expanding the marketing budget to make up for the new product failure.

Cons of On Demand Warehousing

1. Questionable warehousing & fulfillment quality

Fast and accurate fulfillment is hard, and warehouses that weren’t designed with it in mind can’t keep up. When you use an on demand platform to contract with one or more warehouses, you just won’t know the level of quality you’ll receive until your products have been shipped.

The benefit of enabling affordable fast shipping with a nationwide network will quickly be stripped away by errors in the fulfillment process if you contract with a fulfillment center that can’t keep up with the rigors of same-day shipping. Moreover, as the pressure to work quickly increases, the error rate at many operations skyrockets – just ask the merchants that have been dropping out of the Seller Fulfilled Prime program.

On top of that, you’re unlikely to get good customer support when working with warehouses on demand. Warehouses that sign up for an on demand warehousing platform don’t usually consider customer service a core competency, and you might not even have a reliable way to get someone on the phone to talk out issues.

On demand warehousing gives you tremendous flexibility in choosing who to work with, but it doesn’t come with a central control tower to help make sure things go right. Problem solving and troubleshooting with multiple different facilities will be up to you, and if even just one warehouse isn’t up to par, it’ll eat up a huge amount of your time – and not to mention your profit.

2. Integration complexity

If you just work with one other warehouse through an on demand platform, you’ll have to build a two-way data integration with them to ensure that you have visibility into what’s happening with your products and orders.

Now imagine that you’re doing the same thing with 2 or 3 more warehouses – that’s not a fun tech problem!

No two warehouses’ tech stacks are alike; just about everyone has a different mix of WMS, OMS, IMS, Shipping Software, and more. That means that every additional warehouse you want to add comes with another integration, which adds expense and slows the process down.

This may not be a problem for an enterprise like Walmart, which secured 1.5 million sq ft of temporary space through an on-demand platform, but it can bury a SMB.

3. Short term solution

The benefits of a short-term contract also come with a downside: just as you aren’t locked into a long-term commitment, neither is the warehouse providing you with space and fulfillment capabilities. If they want to expand their own operations, or if they find a customer that will pay more for you, you can find yourself needing to find a new place for your inventory with only a few weeks’ notice.

Not to mention, your expanding needs will force you back into the on demand marketplace over and over to find new partners. The warehouses that you contract with at first only have so much space and only have certain capabilities, so as you expand, you’ll need to add new warehouses. You’ll find yourself going back to the platform over and over, which incurs significant managerial time costs. And on top of that, you’ll add more and more complexity instead of enjoying economies of scale.

Who Uses On Demand Warehousing?

On demand warehousing is the best fit for sophisticated enterprises that have the resources and capability to manage a high degree of complexity in their operations. They use on demand warehousing to meet specific, short-term goals without deploying capital. In this way, they can take advantage of growth opportunities and find creative solutions for logistics challenges without putting a huge bet on an uncertain or short-term strategy.

Consider our example of Walmart from earlier – they leased out a full 1.5 million extra square feet of space through an on demand portal. They know exactly what their short-term needs are, and importantly, they know exactly how they’ll move on from their short-term on demand solution.

Ace Hardware presents another interesting example of how on demand warehousing can work well for enterprises. During the 2018 hurricane season, they used on demand warehousing to flexibly stage disaster-relief items near regions that were hardest hit by the natural disasters, ensuring that they could get people the products that they needed to rebuild quickly. Like the Walmart example, Ace used the flexibility offered by on demand warehousing to execute a very specific short-term strategy.

On the other hand, SMBs don’t have the time or capabilities to evaluate, integrate with, and manage short-term warehouse partnerships. If you’re an SMB and want to take advantage of the benefits of on demand warehousing, what can you do?

Cahoot – Your Nationwide Network, Without the Hassle

You want a nationwide footprint to power your growth with affordable fast shipping, but you don’t have the time to manage multiple relationships with on demand warehouses across the country.

At Cahoot, we handle the hard part for you.

We’ve built a nationwide network of top-quality merchant fulfillment centers already, and we continuously monitor them to ensure a leading >99.95% on-time shipping rate. Your dedicated Cahoot account manager will be your one point of contact, and our software gives you real-time visibility into our fulfillment performance and your inventory. You may have inventory in four of our locations, but from your perspective, you’re just working with one great company.

On top of that, we’ll strategically evaluate your order flow and make recommendations to improve your inventory placement across our network. Need to add a location? You don’t have to go back to an on demand platform again to find yet another partner – we’ll just add one with the click of a button, and you’ll be ready to grow.

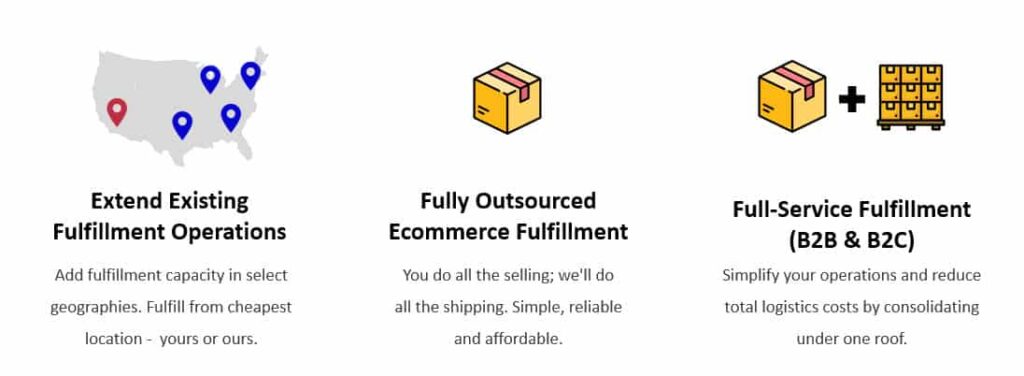

Whether you already have a warehouse and want to expand your footprint or are looking for a full-service fulfillment provider, we have the flexibility to handle your specific needs.

Talk to an expert today and see how our peer-to-peer network will power your profitable growth.

Offer 1-day and 2-day shipping at ground rates or less.

Related Blog Posts

Packaging Design That Will Make Fulfillment Easy and Cut Costs

E-commerce Revolution with Strategic Packaging Solutions Like anyone in the e-commerce world, small business owners are always looking for ways to streamline their operations and

How AI Agents Will Transform Ecommerce Order and Inventory Management Systems

Knowledge workers will either need to learn to harness the power of AI to 10X their output (or the output from the tools at their disposal), or AI agents will take over those jobs at a fraction of the cost.

Preparing for Peak Holiday Season [A Guide for Sellers]

The peak holiday season is the most critical time of the year for e-commerce businesses, characterized by intense order volumes, high consumer expectations, and operational complexities.

Ecommerce Innovators: Exploring Cahoot, the World’s First Peer-to-Peer Order Fulfillment Network

In this article

32 minutes

32 minutes

Listen to podcast here.

Podcast: The Uber of the Shipping and Delivery Industry, Manish Chowdhary, Founder and CEO at Cahoot

Ecommerce Innovators is a podcast hosted by John LeBaron, Chief Revenue Officer at Pattern, that explores innovative strategies and trends in global ecommerce by bringing together experts in the industry. The podcast features a special guest, Manish Chowdhary, Founder and CEO of Cahoot, the world’s first peer-to-peer order fulfillment services network. In the podcast, Chowdhary explains that Cahoot is an ecommerce network where ecommerce brands and retailers can join as order fulfillment partners and monetize their spare warehouse capacity, similar to Airbnb. Brands and retailers that are looking for order fulfillment services can benefit from a lower cost structure and a large scale warehouse network. Cahoot provides a fully managed order fulfillment service, much like Uber, and ensures all stakeholders are participating and being successful. Chowdhary got into this space in 2002 when he discovered a significant number of identical products crisscrossing coast-to-coast, causing shipping inefficiencies in delivery and costs. He then applied for his first patent and started Cahoot.

Speaker 1:

Welcome to Ecommerce Innovators, a podcast that brings together the brightest minds in the industry to explore innovative strategies and trends in global ecommerce. Our host is John LeBaron, chief Revenue Officer at Pattern, the premier partner for global ecommerce Acceleration.

John LeBaron:

Thank you so much for joining the show today. This is Ecommerce Innovators. I’m your host, John LeBaron, and I’m the Chief Revenue Officer at Pattern. And we have a special guest today that I’m very excited to introduce to you. Manish Chowdhary is the founder and CEO of Cahoot. And it says this is the world’s first peer-to-peer order fulfillment services network. So welcome to the show today, Manish.

Manish Chowdhary:

Thank you, John. Thanks for having me.

John LeBaron:

Yeah, you bet. So Manish, I got to meet you in person a few weeks ago at our Accelerate Summit. I don’t know when this will air, but it was really fascinating. You’re clearly very bright and you know a lot about this industry, I think you spend a lot of time studying it. And so I’m excited to introduce you to the listeners of this show and have them learn a little bit more and share some of the goodness that you have spent your whole life kind of dedicated to. So you’re a crazy serial entrepreneur and a little bit of a mad scientist. Tell us a little bit about what a peer-to-peer order fulfillment services network is.

Manish Chowdhary:

Thank you for your kind words, John. You’re giving me more credit than I deserve, but I’ll take it for now. peer-to-peer order fulfillment or peer-to-peer network is essentially brands and retailers helping other brands and other retailers. And in context of fulfillment, what Cahoot has done is created a large scale network where a brand can join Cahoot as a fulfillment partner, so if a brand or a retailer has a warehouse or multiple warehouse, and they have spare capacity, they can actually monetize their spare capacity for the very first time. Similar to if you were to put up your spare bedroom and your house on Airbnb.

And on the other side, we’ve got brands of retailers that are looking for order fulfillment services. They get to benefit from a lower cost structure and a very large scale network. That is essentially what a peer-to-peer network is, and Cahoot is the governing body so that it provides a fully managed service, and I’ll use the Uber example. So the seller or the brand that’s looking for fulfillment services doesn’t have to negotiate directly with the driver. If you are an Uber driver, Cahoot provides the entire service in a box and ensure that all the stakeholders are participating and being successful.

John LeBaron:

Yeah, that’s amazing and I think it’s so innovative. And we look at order fulfillment and logistics, crazy amounts of innovation. Every time I look at the fastest growing inc., 5,000 type companies, it feels like 50% or more of them have something to do with last mile delivery, or freight forwarding, or anything, direct import, all that sort of stuff. So I think the reason why it’s so expensive and it’s only getting more complex and more expensive, and that capacity just really comes back to bite you if you have too much because there’s so many fixed costs.

So how did you get into this space? And obviously you have to be very, very smart to figure out the world’s toughest problems, at least ecommerce’s toughest problems. How did you get into this? And tell us a little bit about your career trajectory.

Manish Chowdhary:

Thank you, John. The way this journey started, believe it or not, this was long before Amazon Prime existed, long before the consumers were ever demanding two-day or one-day free delivery. This is back in, I take you back to 2002, and I’ve been involved in ecommerce since 2000. So my other company is an ecommerce platform and we were studying consumer order fulfillment data. So if you may recall in early 2000 the transition, the industry was making transition from film cameras to digital cameras and digital cameras was the hottest thing, if you recall. So essentially what we did was we took sales data or order data from about 70 or so top ecommerce vendors, and this is back at a time when there was an incentive for people to buy out of state because you don’t have to pay sales tax.

John LeBaron:

Absolutely, yeah.

Manish Chowdhary:

So when we plotted that data off these digital cameras, I remember Canon L or one of those Nikon COOLPIX cameras, those were two popular products.

John LeBaron:

Yeah. Of course, yeah.

Manish Chowdhary:

And when we plotted that, what we saw, it was fascinating. What I saw was a 30% of the time a consumer in California was ordering that Nikon COOLPIX from a vendor in New York. And at the same day, a customer in New York or New Jersey, was ordering the same identical product from a vendor on the West Coast. And just a light bulb went off in my head is like 30% of the time, these two shipments are crisscrossing coast to coast, that makes no sense. At the time, it was taking eight days to deliver the item using UPS Ground, it was costing a lot of money, and consumers were waiting 16 extra days. And everybody, it just did not feel to me, I went back to first principles and say, “This should not happen. This is just not natural.”

And that’s where I applied for my first patent at that time, that what if I were to create an exchange where all these vendors could pull their orders and Cahoot would, at the time the word Cahoot didn’t exist, the company didn’t exist, and we would act as a clearinghouse for the orders and facilitate most optimum delivery keeping competitors and allowing competitors to collaborate in an anonymous manner. That is the origin of where the idea came from.

John LeBaron:

Oh, that’s fascinating. So really getting Cahoots with one another and try to co-mingle the inventory that they… Almost, from a blind standpoint, right?

Manish Chowdhary:

That is exactly right, because if you take an example from a parallel industry, like a stock market, you have clearing houses and stock exchanges which do settlements of trade at the end of the day or whatever the closing period is, why could we not apply the same principle to ecommerce? And fast-forward 10, 15 years, this has become a necessity now because when you think about the macro problem that how do you speed up delivery? You need to think from first principles, rather than thinking how something has been so far along and this is how we’ve done things, but true innovation is really thinking outside the box as you refer to.

John LeBaron:

Yeah. Well, and again, a parallel from a different industry, super nerdy too. But again, I spent a fair amount of my career in telecom and yeah, there was always this real big challenge of, I think about Netflix, every user trying to stream and the loading times of how long it takes. At the end of the day, it’s all zeros and ones anyway, but it’s got to get across all the way across that network. And how do you get people from Phoenix and Philadelphia and Seattle all trying to binge-watch their favorite shows and reduce the buffering? And the solution truly was push it closer to the metropolitan areas, push it what we call the edge of the network and allow that transit time to be more instantaneous and almost just again, reduce that buffering.

And technology has eased some of that just in terms of capacity in the network, but I’m with you. And it’s like, it’s so obvious, it stares you right in the face. But that’s kind of why Amazon I guess is one in a way, is because they become that centralized clearing house as a whatever, aggregate platform, but it doesn’t really work in a fragmented world of all of the different retailers trying to ship, the e-tailers trying to ship, and the brands themselves, all the D2C brands. And I think that’s, yeah, ultimately that’s probably where I would love to steer the conversation. We’ll get to some of the quote, unquote, “Canned” innovation type questions that we always kind of cover because you get a different flavor no matter what.

But going down this path, I guess, how do you as a brand or what are some of the big challenges, all these peripheral players outside of Amazon face in trying to get goods to the customer? I’ve got to think Amazon has set this standard that you talked about of same day, overnight, next day, whatever you want to call it, delivery. How can other folks, besides obviously using your service, I’m trying not to be too objective here or subjective.

Manish Chowdhary:

Yeah, of course.

John LeBaron:

Yeah. What are the biggest challenges they face in trying to keep up or compete with a behemoth like an Amazon?

Manish Chowdhary:

Frankly, John, I think a lot of ecommerce brands and retailers really are not up to speed perhaps on the solutions that already exist. If you break down the last mile fulfillment or trying to achieve Amazon-esque, Amazon-like fulfillment experience or consumer experience from the checkout all the way to getting the product in the hands of the consumer, at a high level, first and foremost, you need to… Let’s compare a DTC site, if you’re on a DTC site and in your shopping cart, you need to display when will the product arrive, what I call date-certain shipping, and technologies exist even now. Yes, it may not come all from one single player like Amazon, but I know that some of the bigger ones like Target and Best Buy have done a fabulous job.

And frankly, for a couple hundred bucks a month, you can implement this date-certain shipping. So that’s number one, because consumers do not convert when there’s uncertainty. It’s just like you can see what’s happening in the stock market. The world is not going to come to an end, but because we don’t know when the war is going to end and so on, and therefore there’s a lot of uncertainty. So the solutions exist. Step one, add date-certain shipping to your shopping cart. Number two, bring the shipping on parity with Amazon. It is easier than they think. If you’re spending 15% commission on Amazon, that’s 15% for you to play with and apply that to the shipping subsidy or whatever you want. If you want to think of that as a subsidy, I mean FBA is not free. The consumers are paying a membership fee and all of that, so that’s step one.

And then distribute order fulfillment if you break it down, you got to get your inventory closer to the consumers. So if you want to target a two-day guarantee delivery, if you place your inventory strategically in five warehouses, you can achieve that and you can provide the guarantee. Don’t worry about that one order that you need to overnight are 2% of the orders, it’s retailers and ecommerce brands get too caught up into the exceptions and the 1% to 2% problem, and they throw the baby out with the bathwater and say, “Oh, it’s not possible.”

That is the reason, if you go back to FedEx, the original of FedEx guaranteed delivery at 10:30 AM or your money back. And I can assure you that FedEx did not give a lot of money back and the day they put that guarantee, that’s when the sale just took off. And same thing with Domino’s, pizza delivery within 30 minutes or your money back. I guarantee you Domino’s is still existing, they didn’t go out of business because of the guarantee. So that guarantee is crucial, and then having the technology to ensure and execute against the lost mile delivery.

And then customer communication, that’s another place where we find brands and retailers are not totally up to par. Okay, you’re doing a great job, you’ve distributed your inventory and the order goes out. If you don’t communicate as frequently about the progress of that order fulfillment and delivery along the way, it’s like free-falling in the forest. In fact, we know from data and from anecdotal evidence, Prime does not live up to its promise. I don’t know how many orders you’ve ordered, John, that by Prime it says it’s going to arrive tomorrow, it doesn’t arrive. I would argue that at least double-digits failure in that promise exists, but they communicate with the customer through the text messaging, through the email, and they communicate frequently.

And then finally, the icing on the cake is when you get a picture of the item outside your front door and people think, “Wow, only Amazon can do it.” If you piecemeal all of these solutions together or go to a provider that can offer, I can assure you that you can offer a Prime-like experience.

John LeBaron:

Yeah, I think that’s amazing. So let’s keep going down this path because I think it’s, to your point, a lot of ecommerce brands and a lot of listeners by extension on the show may not truly understand what’s available. And if you’re the world’s first, that is kind of tricky. So I don’t know if you have a public customer you can talk about, or we can just use the example of a drone or a digital camera or whatever, but how does it work? If you are a brand… Well, we could go through both examples, the person with extra capacity or the person on the demand side of the network or the fly side of the network with a brand. Give us an example of how this works, how they use the software, what it looks like, how much of the inventory are they pushing into the quote, unquote, “Edge” versus kind of keeping consolidated? How does it work?

Manish Chowdhary:

Right, great question. So let’s talk about a real example. I’ll use one of our clients, Cali’s Books is one of our client. They’re a brand, they’ve created innovative children’s books that are audiobooks. Think about Cinderella, and you can actually play that book in different languages. So if you want to learn Spanish, your kids want to learn Spanish, it’s Cinderella in Spanish. And also, people can record. So if you were away from home, John, you could record it and you can send that as a gift to your kids or your loved ones. So it’s a very brilliant concept that they have created. So great demand, they have their manufacturing overseas, and they bring in container loads and they would, first step is to bring it into West Coast because the product comes from China and other places.

So we would first house it just like Amazon into a centralized warehouse, and then we would distribute that inventory across the, in this particular case, Cali’s Books inventory is sitting in six to seven different Cahoot warehouses, strategically located greater New York area, Southern California, Midwest, upper Midwest, the Chicago area, the Dallas region, and somewhere in the Middle North Carolina, and one more. So now you’ve strategically moved that inventory based on demand planning. What is the movement of inventory? You don’t want to send same 10 units to all locations equally because the population and demand is not equal. So that is crucial.

And then in their case, we connect directly to the sales channel, whether the order is coming from Shopify, Amazon, or Nordstrom. So they sell B2B and B2C, so they need the ability to ship both wholesale and retail. And right now with the inventory fully distributed, we are doing Seller Fulfilled Prime (SFP) for this customer so that they’re achieving the Prime target. And in fact, as you know, Amazon holds Seller Fulfilled Prime (SFP) merchants even more accountable than themselves and FBA, and they have had no issues whatsoever, they have been operating flawlessly.

And then, because that Seller Fulfilled Prime (SFP) is being offered on Amazon, they are now in the process of implementing that same guaranteed two-day, one-day delivery on Shopify, on other marketplaces like Target, Walmart, and all the others. So you can see that delivery once you’ve got the infrastructure in place, you can tackle all the sales channel very easily.

John LeBaron:

Yeah. No, I mean it’s really innovative and super fascinating. I guess going back to your comment and the way the business model works, are those actually your warehouses? Or to the other side of it they’re… When you say a Cahoot warehouse, it’s basically someone who’s partnered with you that has spare capacity and they’re doing both the fulfillment and the inbound receipt and all that other stuff, right?

Manish Chowdhary:

That’s right. The reason why we call them a Cahoot warehouse is because Cahoot takes accountability on behalf of the seller because the seller, it’s akin to Uber driver, that driver is driving for Uber. It’s very similar to these are independent warehouses that belong to other merchants that are super successful. The average tenure of these merchants is over 10 years selling online themselves, so they know what it takes to manage and maintain good standards in Amazon because many of them are doing it themselves. And in many cases, Cahoot warehouses are both an order fulfillment provider and also a client. So they have a warehouse in California that is providing fulfillment services. They also need order fulfillment services in New York, so it’s such a symbiotic relationship that they understand that they cannot let Cahoot down, they cannot let our clients down because if that happens, somebody could let them down and Cahoot acts as the governing body ensuring that that doesn’t happen.

John LeBaron:

Yeah, I love that. Well, again, this is just so great. I love your expertise, I love your passion, enthusiasm, it’s definitely coming through here. If you think about on the flip side, there is Amazon, Amazon’s been building like crazy, they definitely had their work cut out for them once COVID hit and trying to scramble and build capacity into the network as quickly as possible. And I’m sure they did not have Cahoot, they should have leaned on you guys. You guys could have given them instant capacity, but they built it out themselves, we’ve now heard in Q1 that they overbuilt capacity. What does that mean for Amazon sellers? What does it mean for other channels?

Manish Chowdhary:

So it means two things. One, the good news is Amazon is unlikely to provide to apply capacity constraints on inbound inventory as they did last year because they were struggling last year, this capacity really just opened up a lot this year. So a lot of the sellers are very concerned about not being able to send enough inventory for the holiday season, the Q4 and so on. So I don’t expect any such bottlenecks this year, so that’s the good news. The not so good news is they have very publicly stated that this over-building is what resulted or partially resulted in them making a loss the first quarter of this year. And Amazon hasn’t had that big of a loss in many, many quarters. So they attributed that to that loss.

And of course, it is safe to say that FBA is somewhat subsidized people, their shipping is very affordable, but I expect because of Amazon’s focus on profitability, sellers should brace for price increases in FBA at least once or two times between now and end of the year. So the good news is you will not have capacity constraints. The not so good news is prepare to pay more for FBA services.

John LeBaron:

Yeah, absolutely. Not only shipping fulfillment, I would say storage as well. Someone’s got to pay the piper if you’ve got too much warehouse capacity, storage fees will likely go up as well, so I think that’s a great observation. And as you look forward to, I often look toward Asia as this harbinger of things to come. I look at JD.com, they’ve got six-hour delivery across like 90% of China. So it’s I think the notion of two days now, one day to same day, to in fact we have an order fulfillment center in Salt Lake City now for Amazon. And back to your point, it’s kind of interesting to watch what Amazon is doing. I’ve lately seen, especially near the weekend, that Amazon will push Prime deliveries out to, if you order even late on a Thursday night, you may not get it until Monday, but there’s this new option that says you can pay $2.99 more and get it in four hours, or you’ll get it overnight, it’ll be on your doorstep.

So it’s kind of fascinating to look at how different things are getting subsidized, but a big piece of what Amazon is doing in many markets is they’re kind of creating their own delivery network as well, all hours of the day and night. And back to your Uber analogy, is that something your company is doing today or do you anticipate it will soon is kind of extend the order fulfillment services network or the notion of the ride-sharing or the Airbnb of storage into the delivery network itself and last mile delivery, is that on the roadmap or is that already happening today?

Manish Chowdhary:

Oh, we are certainly doing a lot more than a traditional third party logistics (3PL) company. So for example, in order to meet SFP, Seller Fulfilled Prime, or let’s just call Prime delivery expectations from Amazon, we need to be fulfilling orders six days a week at least. You need to meet at least 30% one-day delivery targets. And Cahoot is still, Amazon has two decades of lead time over Cahoot, but Cahoot is cashing up fast. So the objective with our peer-to-peer network is this network grows very rapidly and in highly densely populated urban areas, we can achieve same-day delivery using couriers. It’s just a decentralized model versus Amazon’s model is largely vertical integration, which I believe that they’re both, there’s the Apple model and there’s the Microsoft Windows model.

And we believe that we will create more opportunities for partners collectively as part of our network that there will be a large incentive for a lot of folks to participate and also gain from that experience. So when an order fulfillment partner joins Cahoot network, they’re getting a line share of the revenue that we collect, and so there’s an incentive for them to promote that. And also, it’s sort of like if you’re an Uber driver, you want to do a great job so you get a high rating because if you don’t get high rating, then Uber will not select you for the next ride. So Cahoot implements a very similar principle and model.

So I believe that both can coexist, there is room for both of them. And from our perspective, Cahoot is a more capital efficient and it’s a more cost-effective model because you can achieve any target you want, John, you can achieve 30-minute delivery if you want to send a charter plane from Salt Lake City to somewhere.

John LeBaron:

Right, absolutely. Well, that begs the question then Amazon with excess capacities is still trying to figure out how do I use this? How do I increase my strangle hold? Prime penetration is massive in the US. You just saw this announcement with Grubhub yesterday of like, how do I get either more loyalty because they’re raising Prime prices? How do you get more stickiness? How do you bring new people onto the platform? It does feel like D2C or other non-marketplace customers are one of the last few frontiers that they haven’t completely dominated. And so you see strategic initiatives starting to emerge, like buy with Prime. So now D2C brands can opt into this buy or e-tailers can opt into this thing. Is that a good idea? What’s your opinion on that?

Manish Chowdhary:

It’s a horrible idea, it is absolutely a DTC killer in my opinion. And that was the topic of my speech at the Accelerate Conference, and it’s not meant to be self-serving, because essentially this is an attempt by Amazon to infiltrate the entire consumer journey. And I know that the talk is going to be published on your website shortly for those folks that are interested in learning more, essentially the way I see this is if you allow Amazon into your DTC site, what’s the difference between selling on Amazon and selling on your DTC site? Who owns the customer? Who controls that customer journey?

And it’s actually, I’ve called it the Trojan Horse. It’s essentially a Trojan Horse that, let’s take a very simple example. If the shopping cart belongs to Amazon and Prime, for long, DTC brands have always encouraged consumers to increase their average order value, the higher cart size by putting free shipping on orders over $49, over $99, but move over to Prime, there is no minimum. So now all of a sudden, if you were Lucky Heart, the popular cosmetics company, if you have a minimum of $49 and you introduced Buy with Prime, your cart size is going to go down dramatically. Now, if people abandon the cart, that ad is going to show up on Amazon. And if you are not on Amazon, your competitor ad is going to show up.

And we know that every Prime shopper, there are about 200 million Prime shoppers in the US, they visit amazon.com once a week. 85% of them visit once a week and $45, over half of them make a purchase once a week. So the likelihood of your competitor product being targeted on amazon.com to that shopper that actually originated the journey on your site is a lot higher. So jury is still out, the program is still in its infancy, it is by invitation only, but it does not appear to be a good idea for DTC brands to take those leap right now.

John LeBaron:

Yeah, it’s definitely deal with the devil or letting the enemy come sleep in your bed or whatever crazy metaphor you want to make. I think it is eyes wide open for sure, you got to figure out how close you want to get to the potential enemy. And not really enemy, right? But it’s like your dependence, the more Amazon has dependence on you as a consumer and certainly as a brand, the less wiggling room you have to be able to chart your own destiny. And I’m with you, the true kind of gold standard of a D2C brand is owning that relationship, owning the experience, owning everything in that customer journey. And the more you kind of outsource that, the harder it is to truly maintain differentiation in the eyes of the customer and a strong brand.

So while this has been so great, I know we don’t have a ton of time left, maybe a handful of other questions just around the topic of innovation. I know we’ve been speaking about it in the periphery here and so many innovative approaches and thoughts here. What advice do you have for brands that are looking to either reduce their dependency or relationship with Amazon or really just trying to build their brand and double down on the D2C front? What advice do you have for brands that are looking to try to grow their brand via ecommerce?

Manish Chowdhary:

That’s a great question, John. I mean, the way I see it’s not so much about dependency, reduction of dependency on any one party. It’s about chartering your own path, it’s about having more independence. I know we talk about in this new world, employees want more flexibility at work and how they work and so on. So ecommerce brands should hold the keys and they should be the one that should own the customer and own the relationship because that’s the definition of a brand. Because if a middleman controls all the customer data, all the relationships, you can’t market to that customer when you want, you can’t have a direct engagement with that customer. It’s hard to say who is the brand.

And when you look at it, when people buy on Amazon, I’m sure there’s data and stats out there, nine out of 10 times the consumer does not remember or know what product they bought and which seller they bought it from. They just say, “I bought it on Amazon.” I have yet to hear, “I bought it from Acme, Inc. on Amazon.” They say, “I bought it from Amazon.” So my advice is really, if you want to succeed in DTC, DTC is a fascinating world, but it’s also full of graveyards. We know that even the likes of the darlings, like Allbirds, are struggling from a profitability standpoint, but focusing on lifetime value is so important.

Basics, going back to basics, that it’s not just about customer acquisition, it’s about customer retention and lifetime value. And that’s why you should be present wherever the customer is, including your website. You cannot have your website not be on parity with marketplaces because marketplaces are a competitive environment. It’s sort of like if you’re competing against others, against other brands, you need to achieve parity. So from an order fulfillment and logistics standpoint, it’s a mandate for brands to take their website with the same level of seriousness and from a fulfillment and logistics, they cannot throw in the towel and say, “Oh, we can’t do it.”

The reality is solutions exist. And believe it or not, in many cases they’re cheaper than FBA and can help you achieve the same outcomes. And I would say that take that really seriously, apply that date-certain shipping, live up to that promise. When you say guaranteed delivery, don’t exclude the few items because again, think about the 2% rule, think about 98% of your outcomes and not worry about the 2%, and I think that will start turning the tide. And then consortium of stores, there will be, I expect innovation where there will be new networks that will be formed. So for example, I know Shopify has been experimenting with Shopify Audiences, and Shopify Promise pay, and so on. So there will be other avenues to tap into, not only on marketplaces.

John LeBaron:

Yeah. Well, it’s so great. So I would just say maybe to close this out, you have been an entrepreneur, again, for a long time. You’ve hired a lot of people, you’ve fired a lot of people, you’ve seen probably a lot of highs and a lot of lows. I always like to ask this question, what is one leadership principle that you particularly love, do you feel like’s been a real big part of your success?

Manish Chowdhary:

I think for me personally, think big and really think and be contrarian. When I started Cahoot with the original idea that I shared competitor collaboration, that really is a highly contrarian. We are taught to compete with each other. Brands or retailers are competing, how do you collaborate? There are ways when collaboration makes sense and there are times when that doesn’t make sense and it actually leads to a greater good and also a win-win relationship. I’ll give you an example. Airlines, we have codeshare. When you want to go from here to Bali, Indonesia, you’re going to probably have to take a flight from Salt Lake City to Los Angeles, and then you’re going to take a flight from there to somewhere else. I know you’re nodding your head.

So if you just take out those constraints that why it cannot be done, and start thinking from first principles and be bold, and if you believe in it and you can prove that it can actually work, then it’s a matter of figuring out how to make it work. And most of us, or most people, and my leadership principle has been challenge your team to think big, think bold, and be contrarian and believe in that self. It’s better to be a monopoly than to be competing in a highly crowded red ocean.

John LeBaron:

Yeah, absolutely. Well, I think you’ve definitely thought big, taking on the world’s biggest logistics company, so to speak, and certainly one of the wealthiest individuals in the world is no small task, and so you’ve definitely thought big. And the good news is it sounds from everything I can see, you’re delivering on it. So where can people find you? Where can they learn more about, help our listeners understand if they want to investigate where should be their next turn?

Manish Chowdhary:

Well, check us out on our website. That’s www.cahoot.ai, that’s Cahoot with no S, C-A-H-O-O-T.ai. And I invite people to come find me on LinkedIn, follow me. I write frequently, I speak quite frequently. And John, thank you so much for having me on this show, it’s such an honor to be here.

John LeBaron:

No, thank you so much. And I’ve learned a lot personally, and that’s what I usually like to do as well. Part of the reason for doing this podcast is just to learn more and get exposure to super smart people that are innovating in this industry. And I think we can all learn a lot from what you shared with us today, so thank you so much for joining. Again, this is Ecommerce Innovators and if you’ve liked what you’ve heard today, go ahead and subscribe on your favorite podcast player and feel free to send feedback as well. Send some comments or shoot me a line at john@pattern.com and we will look forward to hearing you on the next one. Thank you so much, everyone.

Up to 64% Lower Returns Processing Cost