Tariff Shock 2025: Understanding the Tariff Shopper’s Mindset

In this article

9 minutes

9 minutes

The 2025 tariff increases have intensified economic pressures on ecommerce sellers, leading to heightened anxiety over rising Costs of Goods Sold (COGS) and the potential loss of customers and revenue due to necessary price adjustments. Meanwhile, consumers are also compelled to adapt swiftly, and sellers must take the time to understand the psychological shifts in consumer spending and implement strategic business adjustments to sustain and grow their businesses in these turbulent times.

The Psychology of the Tariff-Era Consumer

Economic uncertainty, amplified by the recent tariffs, has significantly influenced consumer behavior. Shoppers are exhibiting increased caution, prioritizing essential goods over discretionary spending. This shift is rooted in the desire to maximize value and ensure financial stability amid rising prices. For instance, consumers are stocking up on non-perishable items like canned goods and household supplies in anticipation of further price hikes.

Buyer Personas in the 2025 Tariff Environment

1. The Budget-Conscious Parent

- Goals: Stretch the household budget to cover essential needs for the family.

- Purchases: Bulk buys of diapers, generic brand groceries, and discounted children’s clothing.

- Product Positioning: Emphasize “Bulk Savings,” “Family Essentials,” and “Value Packs.”

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and Money2. The Small Indulgence Shopper

- Goals: Seek affordable luxuries to maintain morale without a significant financial impact.

- Purchases: Artisanal chocolates, scented candles, and specialty teas.

- Product Positioning: Highlight “Affordable Luxury,” “Treat Yourself,” and “Everyday Indulgence.”

3. The Prepper-Inspired Planner

- Goals: Prepare for potential shortages and future price increases by stockpiling essentials.

- Purchases: Emergency food kits, multipurpose tools, and first-aid supplies.

- Product Positioning: Use “Be Prepared,” “Emergency Essentials,” and “Long-Term Value.”

4. The Homebody Investor

- Goals: Enhance the home environment to compensate for reduced spending on external entertainment.

- Purchases: Home improvement tools, board games, and home workout equipment.

- Product Positioning: Focus on “Home Comforts,” “Staycation Upgrades,” and “Invest in Your Space.”

Product Categories Resilient to Tariff Impacts

1. Made-in-USA Goods

- Examples: Handcrafted furniture, domestically produced apparel, and local artisanal foods.

- Rationale: Avoidance of import tariffs makes these products more competitively priced.

- Consumer Appeal: Patriotic support for local businesses and assurance of quality.

2. Luxury and High-End Items

- Examples: Designer handbags, premium electronics, and high-end kitchen appliances.

- Rationale: Affluent consumers may remain less sensitive to price increases, sustaining demand.

- Consumer Appeal: Perceived long-term value and status associated with luxury goods.

3. Essential Goods

- Examples: Toiletries, over-the-counter medications, and staple food items like rice and bread.

- Rationale: Necessities maintain consistent demand regardless of economic conditions.

- Consumer Appeal: Indispensable nature ensures prioritized spending.

4. Sustainable and Eco-Friendly Products

- Examples: Reusable water bottles, biodegradable packaging, and solar-powered gadgets.

- Rationale: Growing environmental consciousness drives demand, and domestic production may mitigate tariff effects.

- Consumer Appeal: Alignment with personal values and potential long-term cost savings.

5. Digital Goods and Services

- Examples: Online streaming subscriptions, e-books, and virtual fitness classes.

- Rationale: Intangible products are not subject to import tariffs.

- Consumer Appeal: Immediate access and convenience.

Products Likely to Experience Price Hikes

Certain products are more susceptible to price increases due to their reliance on imported materials or components. Consumers may consider purchasing these items before tariffs fully impact retail prices:

- Electronics: Smartphones, laptops, and televisions often rely on imported components, making them vulnerable to price increases.

- Automobiles and Parts: Vehicles and replacement parts are facing higher tariffs, leading to increased costs for consumers.

- Appliances: Refrigerators, washing machines, and microwaves may see price hikes due to increased costs of imported steel and components.

- Furniture: Items such as sofas and dining sets, especially those manufactured overseas, are likely to become more expensive.

- Footwear and Apparel: Clothing and shoes imported from tariff-affected countries may experience price increases.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPStrategies for Ecommerce Sellers to Adapt and Sustain Their Businesses

In response to the tariff-induced economic shifts, ecommerce sellers can implement several strategies to maintain profitability and meet changing consumer needs:

1. Diversify Sourcing and Manufacturing

- Reshoring Production: Bringing manufacturing back to domestic facilities can mitigate tariff impacts and supply chain disruptions. While this transition requires significant investment and time, it offers long-term stability and control over production processes. However, it is important to note that reshoring efforts have historically faced challenges, including high domestic costs and infrastructure limitations. Analysts caution that without substantial policy support, significant reshoring remains unlikely.

- Nearshoring: Establishing manufacturing operations in neighboring countries with more favorable trade agreements can reduce tariff exposure and shorten supply chains. This approach balances cost-effectiveness with logistical advantages.

- Alternative International Suppliers: Identifying suppliers in countries less affected by the tariffs can help maintain competitive pricing. For instance, shifting sourcing from China to the Philippines or Malaysia may offer cost benefits. However, make sure to fully evaluate the reliability and quality standards of new suppliers.

2. Optimize Inventory Management

- Stockpiling: Increasing inventory levels of high-demand or tariff-impacted products can buffer against supply chain disruptions and price volatility. This strategy requires careful financial planning to manage the associated carrying costs.

- Just-in-Time (JIT) Inventory: Implementing JIT practices minimizes holding costs by aligning inventory levels closely with demand. While this reduces storage expenses, it necessitates a highly responsive supply chain to avoid stockouts.

3. Implement Strategic Pricing Adjustments

- Transparent Communication: Clearly informing customers about the reasons for price increases, such as tariff-induced costs, or how you’re making changes to improve efficiency so you can maintain pricing at this delicate time, can foster understanding and promote trust.

- Value-Based Pricing: Emphasizing the unique value propositions of products, such as superior quality or sustainability, can justify higher prices. Highlighting these aspects differentiates products in a competitive market.

- Bundling Products: Offering product bundles or value packs can enhance perceived value, encouraging customers to make purchases despite price increases. This strategy can also help move inventory more efficiently.

4. Enhance Supply Chain Resilience

- Supplier Diversification: Reducing dependence on a single supplier or region decreases vulnerability to disruptions. Building relationships with multiple suppliers ensures alternative options are available when needed.

- Supply Chain Visibility: Investing in technology that provides real-time tracking and analytics enhances the ability to anticipate and respond to potential issues promptly. Improved visibility aids in proactive decision-making.

- Collaborative Relationships: Strengthening partnerships with suppliers and logistics providers and collaborating on solutions to mitigate tariff impacts and streamline operations.

5. Leverage Technology and Automation

- Ecommerce Platforms: Utilizing advanced ecommerce platforms can optimize operations, from inventory management to customer relationship management, reducing overhead costs. Platforms like Cahoot offer technology-driven solutions to enhance efficiency.

- Automation Tools: Implementing automation in areas such as order processing and fulfillment can reduce labor costs and improve accuracy, contributing to overall cost savings.

- Outsourcing Fulfillment: Distributing inventory to support 1- and 2-day nationwide shipping using ground services lowers final-mile transportation costs while meeting customer delivery expectations. The improved margins often pay for the managed services.

6. Explore Alternative Product Offerings

- Domestic Products: Focusing on products manufactured domestically can circumvent tariffs and appeal to customers interested in supporting local businesses. This approach aligns with growing consumer preferences for locally sourced goods.

- Digital Products: Expanding into digital goods and services, which are not subject to import tariffs, can diversify revenue streams and reduce reliance on physical products.

7. Monitor and Advocate for Policy Developments

- Stay Informed: Keeping abreast of trade policies and tariff changes enables proactive adjustments to business strategies. Regularly consulting reliable news sources and industry reports is essential.

- Industry Advocacy: Participating in industry associations and advocacy groups can influence policy decisions and provide collective support in navigating trade challenges.

By implementing these strategies, ecommerce sellers can address the challenges posed by rising prices (COGS) due to the new reciprocal tariffs, maintain customer loyalty, and sustain revenue streams. Adaptability, informed decision-making, and strategic planning are crucial in turning these challenges into opportunities for growth and resilience.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkFrequently Asked Questions

How are the 2025 tariffs impacting ecommerce consumer behavior?

The 2025 tariffs have caused a noticeable shift in consumer psychology. Shoppers are now prioritizing essential goods and cost-saving strategies while reducing discretionary spending. Many are stockpiling staples like canned food and household items in anticipation of future price increases, while others seek small indulgences or home improvements to maintain quality of life without overspending. Ecommerce sellers must understand these behavioral shifts to effectively reposition their offerings and messaging.

What types of products are most vulnerable to price hikes under the new tariffs?

Products that rely heavily on imported components or materials, such as electronics, appliances, automobiles and parts, furniture, and imported footwear or apparel, are particularly susceptible to price increases. Ecommerce merchants should anticipate rising COGS in these categories and consider both inventory planning and sourcing adjustments to stay competitive.

What can ecommerce sellers do to protect their margins and customer base amid rising COGS?

Sellers should take a multi-pronged approach:

- Diversify sourcing (e.g., explore nearshoring or alternative countries less affected by tariffs).

- Enhance inventory strategies, like stockpiling high-demand SKUs or implementing just-in-time models.

- Use value-based pricing and communicate price changes transparently.

- Introduce bundles and domestic alternatives to maintain customer loyalty.

- Leverage technology (like Cahoot’s advanced shipping and fulfillment platform) to reduce operating costs and improve delivery efficiency.

Why is reshoring or nearshoring worth considering despite the upfront costs?

Reshoring production or nearshoring to neighboring countries like Mexico can help ecommerce businesses mitigate future tariff risks, reduce lead times, and gain more control over their supply chains. While it involves higher initial investment, the long-term benefits include greater stability, increased brand trust from “Made in USA” labeling, and potential cost savings from improved logistics and reduced reliance on volatile overseas markets.

How can technology platforms like Cahoot help ecommerce sellers weather the tariff storm?

Cahoot goes beyond traditional shipping software by offering a peer-to-peer fulfillment network, multi-carrier rate shopping, predictive cartonization, hazmat compliance tools, and automated shipment monitoring—all designed to reduce shipping costs, improve fulfillment speed, and maintain customer satisfaction. These capabilities allow sellers to absorb rising COGS more effectively without compromising service quality or profitability.

Turn Returns Into New Revenue

Amazon Shipping Software: Boost Amazon Sales & Cut Costs with Smart Shipping Automation

In this article

10 minutes

10 minutes

- What is Amazon Shipping Software?

- The Importance of Sales Channel Integrations: Selling Beyond Amazon

- The Benefits of Multi-Channel Shipping Software

- How to Choose the Right Amazon Shipping Software

- Amazon’s Performance Metrics for Standard and Seller Fulfilled Prime (SFP) Orders

- What is Amazon Buy Shipping API? Benefits & Limitations

- Why Cahoot is the Best Software for Shipping Amazon Orders (Including Seller Fulfilled Prime)

- The Future of Amazon Fulfillment is Here

- Frequently Asked Questions

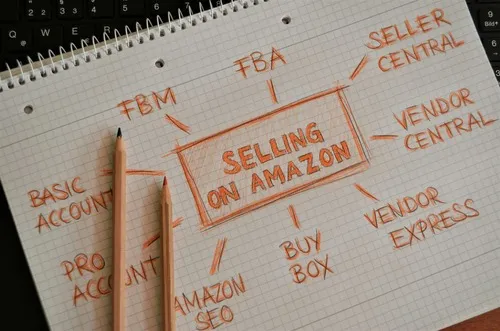

What is Amazon Shipping Software?

Efficient ecommerce order fulfillment and shipping is the backbone of success for Amazon Sellers. Amazon shipping software is a specialized tool designed to streamline Amazon order fulfillment while meeting strict performance metrics. The software assists Amazon Sellers in optimizing their operations, improving visibility, and streamlining logistics for better sales performance. Whether fulfilling standard Seller-fulfilled orders (FBM) or shipping in the Seller Fulfilled Prime (SFP) program, having the right software ensures seamless integration, cost savings, and customer satisfaction.

Modern shipping software integrates with multiple sales channels, (including Amazon Seller accounts), optimizes carrier selection, automates label generation, and ensures compliance with Amazon’s strict delivery expectations. It eliminates manual work, reducing errors and improving fulfillment speed—critical in today’s fast-paced ecommerce environment.

The Importance of Sales Channel Integrations: Selling Beyond Amazon

While Amazon is a dominant force in ecommerce, many Sellers operate across multiple platforms, in addition to their Amazon account, to maximize sales opportunities. Effective shipping software must support:

- Amazon (Marketplace & Seller Fulfilled Prime)

- Walmart

- Shopify

- eBay

- Etsy

- Other marketplaces and ecommerce platforms

Seamless integration ensures all orders—regardless of the platform—are processed from a single dashboard. Without proper integration, businesses face inventory mismatches, fulfillment delays, and operational inefficiencies. The right software centralizes data, syncing inventory and tracking across platforms and marketplaces, reducing manual updates, preventing overselling, and improving customer experience.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyThe Benefits of Multi-Channel Shipping Software

1. Centralized Order Management

Processing orders from multiple platforms in one place saves time and prevents fulfillment errors. A unified dashboard allows Sellers to efficiently manage shipping for Amazon, Shopify, Walmart, and beyond.

2. Cost Optimization Through Rate Shopping

Smart shipping software automatically compares carrier rates in real-time, helping businesses save money by ensuring they always get the lowest-cost shipping label without compromising delivery speed.

3. Carrier Diversification and Flexibility

Relying on a single carrier can be risky. Multi-carrier support lets Sellers choose from multiple shipping providers based on price, service level, and delivery region, reducing costs and improving reliability.

4. Automated Shipping Label Creation

Generating shipping labels manually is time-consuming and error-prone. Automated label creation and printing speeds up fulfillment, ensuring orders ship faster, more accurately, and at lower labor costs.

5. Reliable Tracking Customer Experience

A robust shipping solution provides efficient order tracking and management for shipping orders, offering real-time tracking updates and notifications that reduce customer inquiries and increases satisfaction by offering complete visibility into shipments.

How to Choose the Right Amazon Shipping Software

Choosing the right Amazon shipping software can be a daunting task, especially with the numerous options available in the market. However, by considering a few key factors, you can make an informed decision that meets your ecommerce business needs. Here are some tips to help you choose the right Amazon shipping software:

- Determine Your Shipping Needs: Consider the type of products you sell, the frequency of your shipments, and the destinations you ship to. This will help you identify the features you need in a shipping software.

- Check Compatibility with Amazon Seller Central: Ensure that the shipping software integrates seamlessly with your Amazon Seller Central account. This will enable you to manage your orders, inventory, and shipping processes efficiently.

- Evaluate Shipping Rates and Services: Compare the shipping rates and services offered by different software providers. Look for software that offers discounted rates, flexible shipping options, and reliable shipping carriers.

- Assess Inventory Management Capabilities: If you have a large inventory, look for software that offers robust inventory management features. This will help you track your stock levels, automate purchase orders, and optimize your inventory management processes.

- Consider Scalability and Flexibility: Choose software that can grow with your ecommerce business. Look for software that offers flexible plans, scalable infrastructure, and customizable features.

- Read Reviews and Ask for Referrals: Research the software provider’s reputation by reading reviews and asking for referrals from other ecommerce Sellers. This will give you an idea of the software’s performance, customer support, and overall user experience.

By considering these factors, you can choose the right Amazon shipping software that meets your ecommerce business needs and helps you streamline your shipping workflow.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPAmazon’s Performance Metrics for Standard and Seller Fulfilled Prime (SFP) Orders

Amazon holds Sellers to strict performance standards, especially for those participating in Seller Fulfilled Prime (SFP). To meet Amazon’s strict performance standards, Sellers must ensure their shipping processes are efficient and reliable. Here are the key requirements:

Standard Amazon Orders

To maintain good standing, Sellers must:

- Maintain an On-Time Delivery Rate of 90% or higher

- Late Shipment Rate must not exceed 4%

- Keep the Pre-fulfillment Cancellation Rate below 2.5%

- Provide Valid Tracking for 95%+ of orders

- Ensure Order Defect Rates (negative feedback, A-to-Z claims, chargebacks) remain under 1%

Seller Fulfilled Prime (SFP) Orders

For Sellers enrolled in Seller Fulfilled Prime, the requirements are even stricter:

- Maintain an On-Time Delivery Rate of 93.5% or higher

- Provide Valid Tracking for 99%+ of orders

- Keep the Pre-fulfillment Cancellation Rate ≤ 0.5%

- 1-day Page Views >30%, 2-day Page Views >70% for standard-size products

- 1-day Page Views >10%, 2-day Page Views >45% for oversize products

- 2-day Page Views >15% for extra large products (there is no 1-day requirement for this size tier)

- Same-day handling for Prime orders (orders must ship out the same day if received before the cut-off time)

- Weekend fulfillment capability to match Amazon’s weekend delivery expectation

- Strict delivery speed adherence—late deliveries can result in suspension from SFP

- Sellers must provide free returns for all eligible items weighing less than 50 lb, for any reason

Meeting these requirements requires exceptional shipping efficiency, which is where next-generation shipping software comes into play.

What is Amazon Buy Shipping API? Benefits & Limitations

Amazon provides the Buy Shipping API to Sellers, either when buying postage directly through Seller Central, or as a tool for Sellers looking to ensure compliance with its stringent shipping standards.

Benefits of Amazon Buy Shipping API:

- Guaranteed Valid Tracking: Ensures every order includes a valid tracking number.

- Seller Protection: Orders shipped through Buy Shipping are eligible for Amazon’s Seller protection against A-to-Z claims.

- Automatic Performance Tracking: Amazon monitors compliance and reduces the risk of penalties.

- Multi-Carrier Rate Shopping: Sellers can compare rates across Amazon’s partnered carriers and select the best shipping option.

- Late Delivery Exceptions: Orders that are delivered late can be exempted from performance metrics as long as they were shipped on time.

Limitations of Amazon Buy Shipping API:

- Limited Carrier Choices: Not all carriers are available through Amazon’s Buy Shipping service, which can prevent access to better rates elsewhere.

- Support for 1 Carrier Account Each: Sellers that have multiple carrier rate cards from the same carrier for different size, weight, and/or shipping zone products cannot rate shop across them; Seller Central only supports the use of 1 negotiated account per carrier.

- Potentially Higher Costs: Rates may not always be the lowest available, making third-party rate shopping essential.

While Buy Shipping API has some nice benefits, merchants looking to maximize cost savings and flexibility often pair it with an advanced shipping platform that optimizes fulfillment and reverse logistics beyond Amazon’s system.

Why Cahoot is the Best Software for Shipping Amazon Orders (Including Seller Fulfilled Prime)

Not all shipping software is created equal. Cahoot is purpose-built to meet Amazon’s demanding requirements, ensuring seamless SFP compliance and cost-optimized standard fulfillment.

1. Purpose-Built for Seller Fulfilled Prime (SFP)

Unlike generic shipping solutions, Cahoot was designed from the ground up to handle Seller Fulfilled Prime orders. With automated compliance to Amazon’s performance requirements, weekend fulfillment support, and same-day shipping automation, Cahoot ensures Sellers maintain their Prime eligibility without penalty risks.

2. Automated Rate Shopping for Maximum Savings

Cahoot intelligently compares real-time shipping rates for all the carriers and services you support and creates the cheapest labels that will deliver on time, ensuring all orders always ship at the lowest cost without compromising delivery speed.

3. Multi-Channel Fulfillment Beyond Amazon

Cahoot seamlessly integrates with Walmart, Shopify, eBay, TikTok Shop, and more, providing a centralized dashboard for fulfilling orders across all platforms.

4. Intelligent Order Routing for Faster Fulfillment

Cahoot’s advanced AI-driven order routing automatically assigns orders to the nearest warehouse with stock availability, minimizing transit time and reducing shipping costs.

5. Bulk Label Printing and 1-Click Shipping

With Cahoot, Shipping Labels are created autonomously, no human, so Sellers can print labels for thousands of orders in minutes, eliminating repetitive manual work and improving warehouse efficiency.

6. Effortless Weekend and Same-Day Fulfillment

By automating fulfillment workflows and ensuring weekend processing capabilities, Cahoot helps Sellers stay compliant with Amazon’s Prime-level shipping expectations.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkThe Future of Amazon Fulfillment is Here

Shipping on Amazon has never been more complex, and Sellers who rely on outdated tools risk falling behind. Cahoot’s next-generation shipping software ensures merchants can meet Amazon’s performance metrics, reduce shipping costs, and streamline multi-channel fulfillment—all from a single platform.

For businesses looking to scale efficiently, grow into or maintain Seller Fulfilled Prime eligibility, and optimize fulfillment operations, Cahoot provides a game-changing advantage.

Are you ready to take your Amazon fulfillment to the next level? It’s time to ditch legacy shipping tools and embrace automation, intelligence, and efficiency with Cahoot.

Frequently Asked Questions

What is a shipping solution?

Shipping solutions are a combination of services, strategies, and tools aimed at managing and streamlining the process of sending products from one location to another.

What’s the difference between Cahoot’s network and Cahoot’s shipping software?

Cahoot’s platform is a peer-to-peer order fulfillment services network where top-rated merchants share warehouse space and fulfillment services with one another. Cahoot’s shipping software is next-generation ecommerce shipping software that can support any size merchant, including high-volume merchants shipping millions of parcels per year. Merchants can use either or both. Our fastest-growing clients use both.

What are the carriers for ecommerce shipping?

The most common national carriers are UPS, USPS, and FedEx, while popular regional carriers include OnTrac, Courier Express, and PITT OHIO, among others. Amazon Shipping will soon be matching the last mile delivery reach of the national carriers. For international shipments, DHL Express and GlobalPost are most common, however, UPS, USPS, FedEx and many other carriers also support international deliveries.

How to ship items you sell online?

To ship products from your house, you can use a shipping carrier like USPS, FedEx, or UPS. First, package your product securely and weigh it to determine the shipping cost. Then, create a shipping label online and schedule a pickup or drop off at a carrier location. You can also purchase shipping and dropoff packages at the same time at any post office, The UPS Store, and/or FedEx Office location.

How can I reduce shipping costs?

To reduce shipping costs, optimize packaging for weight and size, utilize flat-rate shipping options for heavy items, explore discounted shipping rates, offer local delivery or pickup, and consider prepaid shipping. Many platforms like Cahoot and ShipStation offer discounted shipping rates through their carrier relationships that can save many thousands of dollars.

Turn Returns Into New Revenue

Shopify vs Amazon: Which Ecommerce Platform Suits Your Business Best?

In this article

13 minutes

13 minutes

- Understanding Amazon FBA Prep Service Requirements

- What Are FBA Prep Services?

- The Benefits of Using FBA Prep Services

- Common Services Offered by FBA Prep Companies

- How to Choose the Right FBA Prep Service

- Understanding Amazon FBA Prep Services Pricing

- Top Amazon FBA Prep Centers for Ecommerce Fulfillment

- Amazon FBA Fulfillment Costs and Strategies

- Setting Up Your FBA Prep Service Relationship

- Potential Challenges and Solutions

- Conclusion

- Frequently Asked Questions

Deciding between Shopify vs Amazon for your ecommerce business? Shopify lets you create a custom online store, while Amazon provides instant access to millions of customers. This article will compare their differences, costs, and benefits of each to help you choose the right platform in the Shopify vs Amazon debate.

Key Takeaways

- Shopify offers greater customization and branding options, allowing you to create a unique online store, while Amazon is a marketplace with a uniform design that limits individual branding.

- Setting up a store on Shopify involves a guided process, making it beginner-friendly, whereas Amazon allows quicker product listing but requires strict adherence to selling standards.

- Shopify has a more flexible pricing model without transaction fees on its payment system, while Amazon imposes referral fees that can eat into Seller profits; understanding these costs is key to choosing the right platform.

Key Differences Between Shopify and Amazon

When it comes to selling products online, both Amazon and Shopify are giants in their own right, but they serve different purposes. Shopify is an ecommerce platform that allows you to sell online and create your own online stores, providing a blank canvas for your brand. In contrast, Amazon is a vast online marketplace where multiple Sellers list their products, akin to owning a stand at a busy market. In the debate of Shopify vs Amazon, each platform has its unique strengths.

Listing products on Amazon can be a bit more cumbersome as it requires Sellers to provide documentation for account approval, which can delay the setup process. On the other hand, Shopify offers more freedom in entering product information, making it easier to get your shop up and running quickly.

Customization is another area where Shopify shines. Amazon’s layout significantly influences a merchant’s store page design, limiting how much you can personalize your shop. Shopify, however, allows for extensive branding and customization options, letting you create a cohesive brand experience that stands out. Whether you’re a small business or a larger enterprise, Shopify provides the tools to build a unique online presence.

New Amazon merchants often face challenges such as strict requirements for product descriptions and listings, which can be daunting. In contrast, Shopify offers a more flexible and supportive environment, making it a preferred choice for many online Sellers.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyEase of Setting Up Your Online Store

Setting up an online store should be as straightforward as possible, and both Shopify and Amazon offer different experiences in this regard. Shopify’s setup process includes a comprehensive 8-step guide, ensuring users receive support while customizing their online store. This guide, combined with Shopify’s user-friendly tools like the AI assistant for writing product descriptions and the drag-and-drop website builder, makes it an excellent choice for individuals without technical skills.

Amazon allows users to start listing products almost immediately after creating an account, streamlining the process significantly compared to Shopify. This immediate access to a huge customer base can be a major advantage for Sellers looking to start selling online quickly. However, selling on Amazon resembles operating a booth in a crowded market, whereas Shopify allows you to create your own branded online storefront.

Shopify’s pricing structure allows selling an unlimited number of products without incurring additional listing fees, making it a cost-effective option for growing businesses. Whether you want to build your own online store with customizable templates or leverage Amazon’s vast marketplace, understanding these differences can help you choose the best platform for your business.

Branding and Customization Options

Branding is crucial for any business, and this is where Shopify truly excels. Shopify offers extensive brand customization, allowing you to create a unique and cohesive brand experience. From customizable themes to HTML/CSS modifications, Shopify provides the tools to personalize every aspect of your online store. This means you can build your very own brand and customer experience that stands out in the crowded ecommerce space.

In contrast, Amazon’s marketplace design emphasizes uniformity, limiting individual Seller branding opportunities. While this can ensure a consistent shopping experience for customers, it restricts Sellers from fully expressing their brand identity. Selling on Shopify allows for complete ownership of your own store, providing more control over branding and pricing.

With Shopify, Sellers can build direct relationships with customers, gaining valuable information like names and emails that can be used for personalized marketing efforts. For businesses aiming to establish a strong brand presence, Shopify’s customizable templates and extensive branding tools are a major benefit. This flexibility allows you to tailor the customer experience to align with your brand values and goals.

Marketing Tools and Capabilities

Effective marketing is the key to driving traffic and sales, and Shopify and Amazon offer different ecommerce tools to help Sellers reach prospective customers. Shopify users can utilize a variety of marketing and SEO tools to enhance the visibility of their own website. From targeted advertising campaigns on platforms like Meta and Google to email marketing and marketing automation tools, Shopify provides a comprehensive suite of tools to help you grow your business online.

Shopify’s SEO tools guide users on improving their search engine rankings, aiding in better visibility for their online stores. Additionally, Shopify allows users to run targeted advertising campaigns across various platforms, only charging when conversions occur. This means you can reach your prospective customers more effectively and maximize your marketing budget.

Amazon Sellers must optimize for the Amazon search engine specifically, which requires a different approach to SEO. While Amazon provides immediate access to a wide range of customers, it also means Sellers need to invest in promotions to ensure visibility.

Shopify, on the other hand, requires more active marketing efforts since it does not benefit from the same built-in traffic that Amazon has. This means businesses on Shopify need to be more proactive in their marketing strategies to drive traffic and sales.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPPricing and Fees Comparison

Understanding the pricing and fees associated with each platform is essential for making an informed decision. Different types of fees to consider when comparing Amazon and Shopify include subscription fees, transaction fees, referral fees, and fulfillment fees.

Let’s break down these fees to see how each platform stacks up.

Subscription Fees

Shopify offers four main plans: Basic Shopify at $29 per month, Shopify at $79 per month, Advanced Shopify at $299 per month, and an enterprise plan for more complex businesses called Shopify Plus, starting at $2,300 per month for 36 months. These plans cater to businesses of varying sizes, providing flexibility and scalability as your business grows. The Basic Shopify plan is perfect for new and small businesses, while the Advanced Shopify plan offers more advanced features for larger enterprises.

Amazon, on the other hand, offers a simpler pricing structure with two plans. The Individual plan is suitable for casual Sellers who don’t need advanced features, ($0.99 per item sold, separate from other fees), while the Professional plan is recommended for business owners or professional retailers ($39.99 per month). This straightforward approach can be easier for Sellers to navigate but may not provide the same level of flexibility as Shopify’s tiered pricing plans.

Transaction and Referral Fees

One of Shopify’s significant advantages is that it does not impose transaction fees when users utilize Shopify Payments; you only pay the credit card rate, which covers the cost of processing the payment. This means Sellers can keep nearly all their profits without worrying about additional costs per transaction.

Amazon’s referral fees vary by product category and can range from 6% to as high as 45% depending on the item sold, but the most common by far is 15%. Shopify does not impose referral fees, which can lead to higher profits for sellers.

Additionally, Amazon charges a per-item fee for Sellers on the Individual plan, while Shopify allows unlimited products without additional listing fees. This can lead to substantial savings for Sellers using Shopify, making it a more cost-effective option in the long run.

Fulfillment Fees

Using Amazon FBA incurs various fulfillment fees based on the size and weight of the products, which can significantly impact overall expenses. These fees include storage and handling fees, which can add up quickly, especially for larger or heavier items.

Shopify, on the other hand, allows Sellers to manage shipping with customizable rates, weights, rules, and options to connect with third-party fulfillment services. This flexibility can help Sellers optimize their shipping process and reduce costs.

Shipping and Fulfillment Options

Shipping and fulfillment are central to any ecommerce business. Amazon FBA offers Sellers the advantage of leveraging Amazon’s extensive logistics network for handling inventory and shipping. This means businesses can benefit from Amazon’s fast and reliable shipping options, enhancing the customer experience.

Shopify provides users the flexibility to integrate with various order management systems and third-party logistics (3PL) providers for efficient fulfillment operations. Sellers on Shopify can set up shipping rates based on weight, destination, and specific conditions to customize their shipping process.

Additionally, integrating Shopify with Amazon Multi-Channel Fulfillment (MCF) can enhance the speed of order fulfillment, allowing customers to receive their orders more quickly. Shopify Buy with Prime is also an MCF solution, but adds a special buy button to Shopify checkout pages to allow customers to choose FBA fulfillment rather than Sellers deciding for them. These integrations can reduce manual labor by outsourcing the processing of customer orders and while optimizing logistics.

Payment Options

Payment options are a fundamental part of the ecommerce experience. Shopify Payments allows users to accept payments directly through their store without additional fees for credit card processing. This integrated payment gateway simplifies the checkout process and can improve conversion rates. Moreover, Shopify users can also integrate third-party payment processors, offering more flexibility in payment acceptance, and the Shop Pay app enables a quick 1-click checkout experience for shoppers.

Amazon supports various payment methods, including gift cards, bank account transfers, and mobile payments. The primary payment gateway for Amazon is Amazon Pay, which provides a seamless and secure payment experience for customers.

While both platforms offer robust payment options, Shopify’s flexibility and lack of additional fees make it a more attractive choice for many Sellers.

SEO and Organic Sales

SEO is crucial for enhancing online visibility and reaching potential customers in ecommerce. Optimizing product pages effectively can significantly improve a Shopify store’s visibility in search results, attracting more customers. Content marketing through blogging can further increase organic traffic, helping to establish authority and relevance in your category.

Sales on Amazon often require continuous promotion, as organic visibility is not guaranteed. This means Sellers need to invest in Amazon SEO and other promotional strategies to maintain a competitive edge.

While Shopify requires more active marketing efforts, the potential for building long-term organic sales through effective SEO and content marketing can be highly rewarding.

Integrating Amazon with Shopify

Integrating Amazon with Shopify can expand your reach and enhance your sales opportunities. This integration allows you to synchronize inventory and product information between Shopify and Amazon, streamlining the management of your online store. The process can involve using a built-in Amazon app, third-party applications, or custom APIs depending on your business needs.

Once integrated, users can create Amazon offers and listings directly from their Shopify store. Onboarding for integration can vary in time, with simpler setups taking as little as 15-30 minutes. This synergy between the two platforms can significantly enhance your ecommerce results, offering the best of both worlds.

Pros and Cons of Selling on Both Platforms

Selling on both Shopify and Amazon can allow businesses to maximize their reach and conversions. Amazon provides immediate access to a wide range of customers, which is crucial for driving sales. However, competition on Amazon is intense, requiring Sellers to invest in promotions to ensure visibility to sell products.

With over 1.75 million merchants using Shopify, businesses can avoid referral fees by using this platform, offering better marketing flexibility and control. Amazon’s strict policies can lead to account bans if compliance is not maintained, adding an element of risk for Sellers. ReSellers doing wholesale or retail arbitrage may find Amazon more suitable due to its vast marketplace.

A successful online business ecommerce platform presence should ideally include both an official website and a presence on platforms like Amazon for maximum impact. Balancing the strengths of both platforms can help businesses achieve their sales and branding goals more effectively by creating their own ecommerce website.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkBeyond the Basics

Beyond the basics, both Shopify and Amazon offer unique features that can enhance your ecommerce experience. Shopify Capital provides merchant cash advances and loans to eligible store owners, a financial service many people don’t associate with the platform.

Amazon’s A9 Algorithm, which differs significantly from Google’s algorithm, plays a crucial role in how products are ranked on the site. Understanding these unique features can help you leverage each platform’s full potential.

Summary

Both Shopify and Amazon offer powerful tools for selling products online, but they cater to different needs and business models. Shopify provides extensive branding and customization options, making it ideal for businesses looking to build a unique online presence. Its flexible pricing plans and lack of transaction fees further enhance its appeal. Amazon, with its vast marketplace and immediate access to millions of customers, is perfect for Sellers looking to reach a large audience quickly.

Ultimately, the choice between Shopify and Amazon depends on your business goals and needs. For many Sellers, using both platforms can be the best strategy, combining the strengths of each to maximize reach and sales. By understanding the key differences and benefits of each platform, you can make an informed decision that sets your business up for success.

Frequently Asked Questions

Can I use both Shopify and Amazon to sell my products?

Absolutely, you can use both Shopify and Amazon to sell your products! By integrating them, you can sync your inventory and easily manage listings, giving your business the best of both worlds.

What are the main differences between Shopify and Amazon?

The main difference is that Shopify lets you build a customized online store where you control branding and customer relationships, while Amazon is a vast marketplace where many Sellers can reach a large audience, but have very little control. So, choose Shopify for brand control or Amazon for quick access to customers.

How do the fees compare between Shopify and Amazon?

Shopify generally offers more predictable and lower fees, especially if you use Shopify Payments and avoid additional transaction fees. In contrast, Amazon has varying referral fees by product category and additional fulfillment costs with FBA.

Which platform is easier to set up for a new business?

Shopify is generally easier to set up for a new business because it offers a comprehensive setup guide and user-friendly tools, perfect for those without technical skills. However, Amazon allows for immediate product listing, giving Sellers a quick start if speed is a priority.

What are the advantages of integrating Shopify with Amazon?

Integrating Shopify with Amazon expands your reach and boosts sales by synchronizing inventory and product information. This means you can easily manage your listings and improve your visibility across both platforms.

Turn Returns Into New Revenue

Related Blog Posts

Amazon FBA Prep Services: What Sellers Need to Know

In this article

12 minutes

12 minutes

- Understanding Amazon FBA Prep Service Requirements

- What Are FBA Prep Services?

- The Benefits of Using FBA Prep Services

- Common Services Offered by FBA Prep Companies

- How to Choose the Right FBA Prep Service

- Understanding Amazon FBA Prep Services Pricing

- Top Amazon FBA Prep Centers for Ecommerce Fulfillment

- Amazon FBA Fulfillment Costs and Strategies

- Setting Up Your FBA Prep Service Relationship

- Potential Challenges and Solutions

- Conclusion

- Frequently Asked Questions

Selling on Amazon through the Fulfillment by Amazon (FBA) program offers tremendous opportunities for ecommerce entrepreneurs. The ability to leverage Amazon’s vast fulfillment network allows sellers to focus on growing their businesses rather than handling logistics. However, before products can enter Amazon’s fulfillment centers, they must meet specific preparation requirements. This is where FBA prep services come into play, offering a crucial intermediary step that can streamline operations and prevent costly mistakes, ultimately supporting the success of your Amazon business.

Understanding Amazon FBA Prep Service Requirements

Amazon maintains strict standards for products entering their fulfillment centers. These requirements ensure efficient processing, storage, and shipping of items to customers. Typical preparation needs include proper packaging, labeling, bundling, and protection measures tailored to different product categories.

For instance, fragile items require additional cushioning, while clothing might need polybags with suffocation warnings. Electronics often require special static-free packaging, and items with expiration dates must have visible labeling. Amazon can reject improperly prepared inventory, leading to returns at the seller’s expense, storage fees, or even inventory disposal.

These requirements can become overwhelming, especially for new sellers or those expanding their product lines. Meeting Amazon’s specifications demands time, knowledge, specialized materials, and dedicated workspace. This complexity has given rise to specialized FBA prep services that bridge the gap between manufacturers and Amazon’s fulfillment centers.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWhat Are FBA Prep Services?

FBA prep services are third-party operations that handle the preparation of inventory according to Amazon’s guidelines before sending products to fulfillment centers. These specialized services act as intermediaries between suppliers or manufacturers and Amazon, ensuring products meet all requirements before entering the FBA ecosystem.

These services typically offer comprehensive solutions for the Amazon FBA seller, including receiving inventory from suppliers, inspecting for quality issues, preparing according to Amazon’s category-specific guidelines, labeling with Amazon barcodes, and finally shipping to designated fulfillment centers. Many also provide additional services such as photography, bundling, kitting, and removal of supplier packaging.

The primary goal of prep services is to ensure products comply with Amazon’s requirements, preventing costly rejections or penalties while saving sellers valuable time and resources.

The Benefits of Using FBA Prep Services

Outsourcing preparation tasks to specialized services offers numerous advantages for FBA sellers of all sizes.

Time savings represent one of the most significant benefits. Properly preparing inventory for Amazon can be labor-intensive and time-consuming. By delegating these tasks to professionals, sellers can redirect their energy toward strategic activities like product sourcing, marketing, and business growth.

Cost efficiency also plays a crucial role. While prep services charge fees, they often prove more economical than handling preparation in-house, especially when considering the expenses of warehouse space, packaging materials, equipment, and labor. For many sellers, the economies of scale achieved by prep services translate to lower per-unit costs.

Professional expertise is another key advantage. Established prep services stay current with Amazon’s frequently updated requirements and possess the knowledge to handle various product types correctly. Their experience minimizes the risk of costly mistakes that could lead to inventory rejections, returns, or customer dissatisfaction.

Scalability benefits become apparent as businesses grow. Using prep services eliminates the need to expand physical workspace or hire additional staff during growth phases or seasonal peaks. These services can typically accommodate fluctuating inventory volumes without requiring sellers to adjust their infrastructure.

Geographic advantages also merit consideration. Strategically located prep services can reduce shipping costs and transit times to Amazon’s fulfillment centers. Some services maintain facilities near major Amazon hubs, optimizing the final delivery leg of the supply chain.

Common Services Offered by FBA Prep Companies

The scope of fulfillment services offered varies between providers, but most cover fundamental preparation needs while offering specialized options for specific requirements.

Inspection serves as the foundation of quality control. Prep services examine incoming inventory for manufacturing defects, shipping damage, or inconsistencies before proceeding with preparation, potentially saving sellers from customer returns and negative reviews.

Packaging and protection ensure products arrive at customers in perfect condition. Services apply appropriate packaging materials according to Amazon’s guidelines and product vulnerability, which may include bubble wrap, air pillows, polybags, or custom solutions.

Labeling represents a critical compliance element. Prep services print and apply Amazon-compliant FNSKU labels, ensuring proper inventory tracking within Amazon’s system. Some also handle hazmat labels, expiration dates, or country of origin markings as required.

Bundling and kitting capabilities allow sellers to create multi-product offerings without handling the assembly themselves. Prep services can combine separate items into cohesive packages according to sellers’ specifications, creating value-added product bundles.

Inventory management features often include real-time tracking systems that allow sellers to monitor their products throughout the preparation process. Many services offer online portals where sellers can view inventory status, preparation progress, and shipping confirmations.

How to Choose the Right FBA Prep Service

Selecting an Amazon prep center requires careful consideration of several factors to ensure alignment with business needs.

Location considerations should account for proximity to suppliers and Amazon fulfillment centers. Strategic positioning can minimize shipping costs and transit times, accelerating inventory availability and reducing logistics expenses.

Pricing structures vary significantly between providers. Some charge per unit, others by weight, and some use hybrid models that include storage fees or minimum monthly charges. Understanding the fee structure and comparing total costs based on your specific product profile is essential.

Service capabilities should match your product requirements. Some prep services specialize in certain categories like apparel or electronics, while others provide broader support. Confirming they can handle your specific preparation needs prevents potential complications.

Technological integration capabilities merit evaluation, particularly for high-volume sellers. Services offering integration with inventory management systems, Amazon Seller Central, or other e-commerce platforms can streamline operations and reduce manual data entry.

Reputation and reliability should be thoroughly vetted. Reading reviews, requesting references, and testing services with small shipments before committing to larger volumes can prevent costly partnerships with underperforming providers.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPUnderstanding Amazon FBA Prep Services Pricing

Amazon FBA prep services pricing can vary widely depending on the provider and the specific services offered. Typically, these services charge either by the item or by the volume of products being prepped. Some providers may also impose storage fees if products are held at their facility before being shipped to Amazon’s fulfillment centers.

When selecting an FBA prep service, it’s crucial to consider the pricing options and ensure they align with your business needs. Some providers offer discounts for bulk orders or long-term contracts, which can be beneficial for high-volume sellers. Others may charge extra for specialty services like kitting or bundling, so it’s important to understand all potential costs upfront.

To get the best value for your money, research and compare the pricing of different FBA prep services. Look for providers that offer transparent pricing, flexible payment options, and a clear breakdown of their services and costs. This due diligence can help you avoid unexpected expenses and ensure that the prep service you choose supports your business’s financial health.

Top Amazon FBA Prep Centers for Ecommerce Fulfillment

Choosing the right Amazon FBA prep center is crucial for the success of your ecommerce business. Here are some top Amazon FBA prep centers known for their reliability and comprehensive services:

- AMZ Prep: A full-service FBA partner with a global reach, AMZ Prep offers a wide range of services including FBA prep, shipping, and storage. Their extensive network and expertise make them a strong choice for sellers looking to streamline their operations.

- ShipMonk: Known for its strong focus on customer service, ShipMonk provides services such as opening and repackaging goods, labeling, and shipping. Their attention to detail and customer-centric approach make them a popular choice among Amazon sellers.

- Fulfillment by Amazon (FBA): Amazon’s own fulfillment service offers numerous benefits, including fast and reliable shipping, customer service, and returns handling. Leveraging Amazon’s infrastructure can provide significant advantages in terms of efficiency and customer satisfaction.

- Cahoot: While FBA Prep isn’t Cahoot’s primary business model, we do have an entire business unit and fully automated workflow within the Cahoot software that guides users on exactly how to request prep and forwarding to FBA fulfillment centers.

When choosing an FBA prep center, consider factors such as their experience with Amazon, understanding of FBA prep requirements, pricing, and customer service. Look for providers that offer flexible services, transparent pricing, and a strong focus on customer satisfaction to ensure a smooth and efficient fulfillment process.

Amazon FBA Fulfillment Costs and Strategies

Amazon FBA fulfillment costs can be a significant expense for ecommerce businesses, but with the right strategies, you can minimize these costs and maximize your profits. Here are some tips to help you reduce your Amazon FBA fulfillment costs:

- Optimize Your Product Packaging: Proper packaging can help reduce shipping costs and prevent damage to your products. Using the right materials and packaging techniques can also ensure compliance with Amazon’s guidelines.

- Use Amazon’s Fulfillment Centers: Amazon’s fulfillment centers are strategically located to minimize shipping costs and ensure fast delivery. By utilizing these centers, you can take advantage of Amazon’s logistics network to improve efficiency and reduce expenses.

- Take Advantage of Amazon’s Free Services: Amazon offers a range of free services, including free storage for a limited time and customer returns handling. Leveraging these services can help you save money and streamline your operations.

- Monitor Your Inventory Levels: Keeping track of your inventory levels can help you avoid additional costs for aged inventory and ensure you’re not overstocking. Regularly reviewing your inventory can also help you make informed decisions about restocking and managing your supply chain.

- Use Amazon’s Revenue Calculator: Amazon’s revenue calculator can help you estimate your FBA costs and compare them to your own fulfillment method. This tool can provide valuable insights into your cost structure and help you identify areas for improvement.

By implementing these strategies, you can reduce your Amazon FBA fulfillment costs and increase your profits, ensuring a more efficient and profitable ecommerce business.

Setting Up Your FBA Prep Service Relationship

Establishing a smooth working relationship with your chosen prep service involves several key steps.

Initial onboarding typically requires creating an account with the prep service and providing essential business information. This process often includes completing seller profiles, specifying preparation instructions, and setting up billing arrangements.

Amazon permissions must be properly configured to allow the prep service to work on your behalf. This usually involves adding them as users to your Seller Central account with appropriate permission levels or sharing specific access credentials required for inventory management. Properly configuring Amazon permissions ensures that the prep service can manage your FBA shipments efficiently and in compliance with Amazon’s standards.

Communication protocols should be clearly established, defining primary contact methods, response timeframes, and escalation procedures for urgent issues. Regular check-ins and feedback sessions can help optimize the partnership over time.

Standard operating procedures documentation proves invaluable for consistent operations. Developing clear instructions for how products should be handled, special preparation requirements, and quality standards ensures the prep service understands your expectations.

Performance monitoring should be ongoing, tracking key metrics like processing times, error rates, and overall cost-effectiveness. Regular performance reviews help identify improvement opportunities and ensure the service continues meeting business needs.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkPotential Challenges and Solutions

While Amazon prep centers offer significant benefits, certain challenges may arise that require proactive management.

Quality control inconsistencies can occur, especially with high-volume operations or staff turnover. Establishing clear quality standards, conducting random inspections, and providing feedback on issues can help maintain consistent preparation quality.

Communication breakdowns represent another common challenge. Maintaining open channels, documenting instructions clearly, and establishing regular update mechanisms can prevent misunderstandings and ensure timely problem resolution.

Seasonal capacity constraints may affect service levels during peak periods like Q4. Planning ahead, providing volume forecasts to your prep service, and potentially distributing inventory across multiple services for critical periods can mitigate these challenges.

Conclusion

For Amazon sellers seeking to optimize their operations, FBA prep services offer a valuable solution that balances efficiency, compliance, and scalability. By understanding the range of services available, carefully selecting the right partner, and establishing clear working relationships, sellers can leverage these specialized intermediaries to streamline their supply chains and focus on strategic business growth.

Some prep services also offer multi-channel fulfillment, enabling sellers to expand their reach beyond Amazon to other platforms like Walmart and eBay. Whether you’re a new seller looking to avoid the learning curve of Amazon’s requirements or an established business seeking to scale without expanding infrastructure, the right prep service can transform your FBA operations. As with any business partnership, success depends on careful selection, clear communication, and ongoing management – but with these elements in place, prep services can become a cornerstone of an efficient, profitable Amazon selling strategy.

Frequently Asked Questions

What is Amazon FBA prep?

Amazon FBA prep refers to the process of preparing products for sale on Amazon, including packaging, labeling, and shipping. This ensures that products meet Amazon’s requirements and are ready for fulfillment.

What are the benefits of using an FBA prep service?

Using an FBA prep service can help you save time, reduce costs, and ensure compliance with Amazon’s guidelines. These services handle the intricate details of preparation, allowing you to focus on growing your business.

How do I choose the right FBA prep service?

When choosing an FBA prep service, consider factors like their experience with Amazon, understanding of FBA prep requirements, pricing, and customer service. Look for providers that offer transparent pricing and flexible services tailored to your needs.

What are the costs associated with FBA prep services?

FBA prep services typically charge by the item or by the volume of products being prepped. Some providers may also charge storage fees if products are held at their facility before being shipped to Amazon. It’s important to understand all potential costs upfront.

Can I use an FBA prep service for specialty products?

Yes, many FBA prep services offer specialty services like kitting, bundling, and custom packaging for products that require special handling. These services can help ensure that your products are prepared correctly and meet Amazon’s specific requirements.

Turn Returns Into New Revenue

Top 8 Amazon 3PL Shipping Companies for Reliable Fulfillment

In this article

12 minutes

12 minutes

- Key Takeaways

- Cahoot: Leading Amazon Fulfillment Partner

- ShipBob: Well-Rounded

- Red Stag Fulfillment: Precision and Reliability

- ShipMonk: Full-Service Fulfillment Solutions

- ShipNetwork: Flexible Logistics Options

- Shipfusion: Tech-Driven Fulfillment Services

- MyFBAPrep: Enterprise-Level Fulfillment

- AMZ Prep: Comprehensive Fulfillment Solutions

- Choosing the Right 3PL Provider for Your Amazon Business

- The Role of Technology in Modern 3PL Services

- Benefits of Using Third-Party Logistics for Amazon Sellers

- How 3PL Providers Enhance Customer Experience

- Cost Management with 3PL Services

- Ensuring Data Security and Privacy with 3PLs

- Summary

- Frequently Asked Questions

If you’re an Amazon seller looking to improve your logistics, whether by fully outsourcing fulfillment or keeping some of it in-house, finding the right 3PL provider is essential. This article reviews the top 8 Amazon 3PL shipping companies. You’ll learn about providers that offer faster shipping, reduced costs, and specialized services to meet your fulfillment needs.

Key Takeaways

- Cahoot’s peer-to-peer order fulfillment model allows for faster and more cost-effective logistics, making it ideal for small businesses competing with larger retailers.

- Advanced technology plays a crucial role in optimizing 3PL services, enhancing order accuracy and efficiency while allowing for real-time tracking and management.

- Partnering with a 3PL provider offers significant cost management benefits, as businesses can convert fixed costs to scalable expenses and access transparent pricing models.

Cahoot: Leading Amazon Fulfillment Partner

Cahoot stands out with its innovative peer-to-peer order fulfillment model that leverages merchant-operated warehouses. This approach not only offers faster and more cost-effective fulfillment compared to traditional 3PLs but also allows businesses to tap into unused space at merchant warehouses across the country. This unique model enables Cahoot to provide ultrafast order fulfillment services, making it a game-changer for ecommerce companies. And Cahoot has demonstrated that fulfillment accuracy is unmatched when Sellers fulfill for other Sellers because they care, they “get it”, they understand the complexities and importance of performance metrics and how they impact the livelihoods of online businesses.

Small businesses benefit from Cahoot’s scalable logistics support, allowing them to compete with larger retailers. The platform integrates seamlessly with major ecommerce marketplaces and shopping carts such as Amazon, eBay, Shopify, and BigCommerce, making order fulfillment more efficient. Cahoot also provides nationwide 1-day and 2-day shipping through its network of over 100 fulfillment centers, enabling merchants to meet high consumer expectations.

Furthermore, Cahoot’s participation in Amazon’s Seller Fulfilled Prime (SFP) Program sets it apart. Partnering with Cahoot allows merchants to meet Amazon’s stringent SFP requirements, such as same-day fulfillment and weekend shipping. The advanced fulfillment technology and software provided by Cahoot enhance order accuracy, provide real-time visibility, and reduce operational costs, ensuring a smoother and more efficient fulfillment process. And with Cahoot, merchants can participate as a fulfillment warehouse from their own location, adding and removing Cahoot locations as needs change; not the case with any other 3PL.

Cahoot also supports all the expected additional services such as FBA prep, inventory barcoding and bundling, B2B fulfillment, returns management, and distribution services, among others. With exceptional customer support ratings and awards and hundreds of 5-star reviews across all the major customer confidence sites like G2, Google, Trustpilot, even Shopify and Amazon app stores, Cahoot is one of the leaders in warehousing and streamlined fulfillment services.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyShipBob: Well-Rounded

ShipBob is a solid choice for Amazon fulfillment, providing a range of services tailored for Amazon Sellers. They offer FBA prep services, which help businesses navigate Amazon’s specific requirements. Their pricing model is flexible enough to accommodate the diverse needs of Amazon businesses.

ShipBob employs advanced technology to support efficient order fulfillment and inventory management, making logistics operations straightforward. Their customer service is accessible through phone, email, and chat, providing support for logistical needs.

Overall, ShipBob is a dependable fulfillment partner for Amazon Sellers, focusing on customer satisfaction and operational efficiency without overpromising. They offer reliable services that can help streamline your logistics processes.

Red Stag Fulfillment: Precision and Reliability

Red Stag Fulfillment is a reputable choice known for its dedication to delivering precise and reliable order fulfillment, warehousing, and shipping solutions. Their pricing structure is designed to be straightforward, ensuring clients only pay for the services they actually use, which makes it a sensible option for businesses conscious of costs. While their promise of 100% order accuracy and zero loss or damage is commendable, it’s important to remember that no system is entirely foolproof.

A notable aspect of Red Stag Fulfillment is their capability to handle bulky or oversized items, which can be a significant advantage for businesses with unique logistical challenges. They offer a supportive onboarding process, helping new clients transition smoothly and establishing a fulfillment process that aligns with their specific needs.

Red Stag Fulfillment’s emphasis on precision and reliability contributes to a positive customer experience and helps streamline the fulfillment process at their centers. While they set high standards in logistics, businesses should evaluate whether their specific offerings align with their unique requirements and expectations.

ShipMonk: Full-Service Fulfillment Solutions

ShipMonk brings a variety of fulfillment services to the table, including order fulfillment, FBA prep services, and support for the Seller Fulfilled Prime program. Their pricing model is designed with Amazon Sellers in mind, aiming to provide cost-effective solutions that align with business operations.

A notable feature of ShipMonk is its swift order processing. This efficiency helps in getting orders to customers promptly, which can enhance the shopping experience. This efficiency, combined with its comprehensive fulfillment solutions, makes ShipMonk a formidable partner for ecommerce businesses looking to streamline their logistics operations.

ShipNetwork: Flexible Logistics Options

ShipNetwork offers logistics options that are adaptable to the specific needs of Amazon Sellers. Their services, which include inventory management and order shipment, are a good choice for maintaining smooth logistics and fulfillment operations. They provide customer support through various channels like phone, email, and online case submission, which can be handy when you need assistance.

One of ShipNetwork’s interesting offerings is their customized packaging solutions. These can help maintain brand identity during fulfillment, adding a personalized touch to orders. With such flexible and customer-focused services, ShipNetwork stands out as a versatile logistics partner.

Shipfusion: Tech-Driven Fulfillment Services

Shipfusion is a tech-oriented 3PL provider offering end-to-end fulfillment services, mainly for high-volume ecommerce and wholesale businesses. With locations in Chicago, Los Angeles, Las Vegas, and Toronto, they provide specialized storage solutions, including temperature-controlled and cold-chain shipping, to accommodate diverse product needs. Shipfusion’s software allows for real-time tracking and management, adding a layer of control over fulfillment operations. This technology-driven approach ensures efficient and reliable operations in order fulfillment.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPMyFBAPrep: Enterprise-Level Fulfillment

MyFBAPrep caters to large brands with its enterprise-level logistics services. Their extensive network of warehouses facilitates efficient distribution, aiming to position inventory for quick delivery. This setup can help reduce shipping times and costs, a crucial factor in maintaining strong margins.

Their integration with Amazon’s FBA program is a plus, as it allows Sellers to leverage Amazon’s extensive fulfillment network while maintaining control over their inventory and logistics processes through an FBA prep service and consolidated inventory visibility.

AMZ Prep: Comprehensive Fulfillment Solutions

AMZ Prep is a tech-enabled 3PL provider offering services like inventory management, warehousing, order processing, and shipping. Their solutions are crafted to be efficient and affordable while providing comprehensive solutions that cater to the diverse needs of ecommerce businesses. Their reliability makes them a valuable partner for brands aiming to optimize logistics strategies.

Choosing the Right 3PL Provider for Your Amazon Business

Selecting the right 3PL provider is a critical decision for any Amazon business. Choosing a provider with a long-term vision is crucial for overcoming current logistics challenges and preparing for future growth. Ecommerce companies should begin by analyzing their reasons for needing a 3PL, such as operational challenges or business structure changes.

Cost-efficiency plays a significant role in this decision. Businesses should seek providers offering efficient operations without hidden fees that could inflate costs. Evaluating the global reach of a 3PL is also important for powering international expansion, making advanced technology a central consideration. Providers using state-of-the-art technology can optimize logistics operations through automation, offering scalable solutions that grow with your business. This blend of cost-efficiency, global reach, and advanced technology will ensure that your chosen 3PL provider can meet your evolving needs.

The Role of Technology in Modern 3PL Services

In the modern 3PL, technology plays a pivotal role in 3PL services. Quality 3PL providers invest in advanced technology systems, and the best are proprietary warehouse management systems (WMS) and transportation management systems (TMS), that improve their competitive edge. These systems enhance order accuracy, optimize resource use, and reduce operational costs through automation and data capabilities. The savings get passed onto their clients.

Cloud-based WMS integrates with existing technologies, offering comprehensive visibility across the supply chain. This integration enables real-time data tracking, minimizes errors, and accelerates processes, allowing teams to focus on core tasks. Employing technology for warehousing and inventory management helps businesses reduce overstocking and related costs, boosting overall efficiency.

AI and ML are transforming 3PL operations by enabling smarter inventory management and route optimization. These technologies allow for predictive analytics, helping businesses anticipate demand and streamline their logistics operations. Technology’s role in 3PL services drives efficiency and innovation in the industry.

Benefits of Using Third-Party Logistics for Amazon Sellers

Collaborating with a third-party logistics provider offers numerous benefits for Amazon Sellers. Optimizing logistics operations leads to significant cost savings and improved customer service. Cahoot and ShipBob, for instance, use a nationwide network of fulfillment centers to minimize shipping times and costs, creating an exceptional customer experience.

Quick preparation times are another advantage, with some providers ensuring items are ready for fulfillment within 24 to 72 hours, and more modern solutions providing same-day fulfillment late into the day. This speed is crucial in supporting high customer satisfaction and loyalty. Likewise, automation in the picking, packing, and shipping workflow improves delivery speed and accuracy.

3PL providers also offer specialized services like kitting, subscription box fulfillment, and comprehensive returns management. These value-added services enable businesses to focus on core competencies while the 3PL manages logistics complexities, making them indispensable to ecommerce Sellers.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkHow 3PL Providers Enhance Customer Experience