Both USPS and Amazon Experience Data Security Glitches

In this article

In the midst of the kickoff to the busiest shopping season of the year, news emerged that both the U.S. Postal Service and Amazon experienced data glitches that exposed customer information.

The USPS may have exposed the personal data of more than 60 million customers via a security hole, including access to information on when checks and other critical documents were set to arrive. Amazon meanwhile told an unknown number of customers their names and email addresses were exposed due to a technical error on its ecommerce site.

Turn Returns Into New Revenue

USPS Price Hikes on Jan. 27 to Cost Amazon More than $1 Billion

In this article

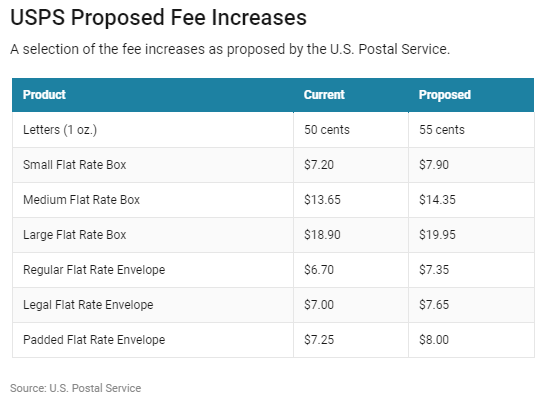

Amazon.com Inc.’s retail operating income could take a 5% hit from shipping cost inflation if the U.S. Postal Service’s proposed price hikes go into effect, according to calculations by Barclays analysts. The proposed uptick in shipping and mailing fees at the U.S. Postal Service could cost Amazon more than $1 billion in 2019, according to Credit Suisse, which cut its near-term estimates for operating profit on the e-commerce behemoth.

“As we roll forward the sensitivity analysis to 2019, we arrive at a potential incremental Shipping Expense range of $400 million to $1.1 billion range with the assumption that 40 percent to 50 percent of U.S. packages are shipped via the Postal Service,” analyst Stephen Ju wrote Monday. “Our math …suggests Amazon will have 5% lower retail operating income from this shipping cost inflation, if we assume there are no offsetting factors,” Barclays said. The changes would go into effect on Jan. 27, 2019.

“Specifically, the USPS shipping rates for small and medium boxes, typically used by e-commerce companies, are proposed to be increased by 10% and 5% respectively,” Barclays analysts led by Ross Sandler wrote. “[T]he price increases for packages suggested by USPS this year are higher than in prior years.”

“If other Amazon shipping partners like UPS, FedEx, On-Trac, etc. raise their prices, which has happened in the past (but we are currently not factoring in), every 5% hike for last mile would weigh down operating income by an additional 3%, all else constant,” the note said.

President Trump said the USPS is Amazon’s “delivery boy” in a tweet earlier this year, and blamed the e-commerce giant for its billion-dollar-plus losses in the second fiscal quarter. However, the USPS said it’s actually government policy that’s hurting the group’s finances. The USPS said “legislative and regulatory changes” would be necessary for financial stability.

“To be clear, our current estimates already factor in [a] shipping cost increase by a modest level, consistent with prior years,” Barclays said. “However, the steeper increase proposed for 2019 could weigh further on Amazon’s FY19 profitability.”

Barclays forecast that Amazon shares could take a hit after third-quarter earnings if they are in line with guidance and forecast below expectations. And in the fourth-quarter, the $15 minimum wage hike will add about $310 million to expenses.

Amazon will already see declines due to the $15 minimum wage hike, analysts say. Barclays analysts think the minimum wage hike is just one of a few coming initiatives that could impact operating margin expansion.

Turn Returns Into New Revenue

Free Shipping Becomes a Blessing and Curse at Amazon and Target

In this article

Amazon.com Inc. and Target Corp. have opened the floodgates on free shipping. Web orders with the free service have increased 13% in 2018. Offer can boosts sales but wreaks havoc with profit margins.

Recent moves by the two retailers to eliminate minimum-purchase amounts for free shipping have boosted the share of online orders that get delivered gratis, according to data from retail analytics company DynamicAction. Orders with the free service included have risen 13 percent so far this year through Nov. 16, including an 18 percent spike in the week that began Nov. 5., when Amazon unveiled its offer.

Free Falling

Amazon and Target have eliminated shipping fees for online holiday orders

“Free shipping is the new normal,” DynamicAction’s Chief Marketing Officer Sarah Engel said.

While free shipping can entice customers to buy, it can wreak havoc with retailers’ profit margins, which are typically razor-thin already during the holiday quarter due to rampant discounts and increased marketing costs. Web orders that included some sort of promotion since the end of October have risen 13 percent from the same period last year, DynamicAction found. It also doesn’t help that transportation costs were already soaring this year due to a shortage of truckers.

Target is offering two-day free shipping from Nov. 1 through Dec. 22 on hundreds of thousands of items with no minimum purchase, while Amazon said on Nov. 5 that shoppers without Prime memberships need not buy at least $25 to earn free regular shipping, which typically takes five to eight business days.

Walmart Inc. has thus far declined to match the offers, sticking with its $35 minimum purchase requirement. The world’s largest retailer has suffered from narrowing gross profit margins in recent quarters, even as its online sales have grown.

E-commerce sales overall will jump 17 percent this holiday season, according to data tracker EMarketer, and account for about 12 cents of every holiday dollar spent. Amazon garners just under half of all online sales in the U.S., EMarketer said.

This article was written and published at Bloomberg by Matthew Boyle

Turn Returns Into New Revenue

How to Win in an Amazon Prime World

In this article

A 5% increase in customer retention can improve a company’s profitability by 75%, according to Bain research. Yet most retailers are more focused on acquisition and conversion than retention. Despite investing billions in this pursuit, ecommerce has created a “customer experience gap” for retailers unable to engage customers at key post-purchase moments. Brands are learning the hard way that lackluster engagement and an afterthought communication strategy is a guaranteed way to lose loyalty.

To address this important issue Pulse Commerce conducted mystery shopping at nearly 500 leading U.S. online merchants prior to the 2017 peak holiday shopping season. The result is a picture of true behavior rather than survey feedback, and benchmarking by product category for comparison to peers as well as to Amazon.

Turn Returns Into New Revenue

The Prime Effect

In this article

How Amazon’s two-day shipping is disrupting retail. The quest to offer fast, free delivery has triggered an arms race among the largest retailers.

Amazon is already making up most of the US ecommerce sales. However, they rely heavily on 3rd party sellers. These sellers experience major pain related to shipping cost and time. Fast shipping is now an expectation, but it is expensive for most sellers. Sellers often limit fast shipping to veru=y samll items or to local addresses. This limits their buy box opportunities.

Alongside life, liberty and the pursuit of happiness, you can now add another inalienable right: two-day shipping on practically everything .

Amazon.com Inc. has made its Prime program the gold standard for all other online retailers, according to surveys of consumers. The $119-a-year Prime program—which now includes more than 100 million members world-wide—has triggered an arms race among the largest retailers, and turned many smaller sellers into remoras who cling for life to the bigger fish.

In the past year, Target Corp. , Walmart Inc. and many vendors on Google Express have all started offering “free” two-day delivery. (Different vendors have different requirements for no-fee shipping, whether it’s order size or loyalty-club membership.)

Optimizing Prime

Amazon’s shipping infrastructure isn’t used just by Amazon. As shoppers who read the fine print know, it’s also available to its retail partners through its Amazon Marketplace. Of the top 10,000 sellers on Amazon—collectively representing about half of Amazon’s Marketplace revenue—at least 90% have one product in the Fulfillment by Amazon program, says Juozas Kaziukėnas, chief executive of Marketplace Pulse, a business-intelligence firm focused on e-commerce. Almost 70% use it to stock and ship at least half of their products, he adds.

Competitors Great and Small

Amazon’s nominal competitor in online retail, Walmart, also offers a marketplace for third parties to sell their goods; the big difference is, it doesn’t assist them with fulfillment—and forbids them from using Amazon’s fulfillment services.

Scale is essential. Mom-and-pop shops and even midsize retailers can no longer assume buyers will put up with getting their goods days later via the U.S. Postal Service. In response, startups are trying to aggregate enough retail customers that they can offer the all-important fixed rates for nationwide two-day shipping.

Turn Returns Into New Revenue

Amazon Will Spend $800M to Bring Free One-Day Shipping to Prime

In this article

At the company’s quarterly earnings call, CFO Brian Olsavsky disclosed that Amazon is working to shorten its promised two-day shipping on Amazon Prime to one day. It’s going to cost the company a lot of money, however.

At the company’s quarterly earnings call, CFO Brian Olsavsky disclosed that Amazon is working to shorten its promised two-day shipping on Amazon Prime to one day. It’s going to cost the company a lot of money, however.

Olsavsky said it would cost about $800 million, which will likely eat into Amazon’s bottom line in the coming quarters.

“We’re trying to take advantage of the fulfillment capacity and transportation capacity . . . that we have,” the CFO said. Amazon’s push for faster delivery has put a lot of pressure on other retailers to speed up their ecommerce order fulfillment.

As for a timeline, Amazon wouldn’t give too many specifics. “We expect to make steady programs quickly and through the year,” Olsavky said, but wouldn’t say whether it would be fully rolled out by the holidays.

Turn Returns Into New Revenue

Revolutionizing Order Fulfillment to Compete with Amazon’s Multi Channel FBA Operations

In this article

21 minutes

21 minutes

Listen to podcast here.

Ecommerce Wizards Podcast – What Are the Benefits of Fulfillment Networks With Manish Chowdhary of Cahoot

The podcast episode is an interview with Manish Chowdhary, founder and CEO of Cahoot, the world’s first peer-to-peer order fulfillment services network. Cahoot provides ecommerce brands and retailers with best-in-class order fulfillment services across multiple warehouses in the US, Canada, Mexico, and others, similar to Amazon FBA, but with a unique business model. Most of the warehouses belong to other brands and sellers who join Cahoot as order fulfillment partners to monetize their excess capacity. By passing the benefits onto their clients, Cahoot is able to offer lower costs and one-day two-day delivery nationwide. The episode focuses on DTC (direct-to-consumer) versus Amazon FBA, and how to compete with Amazon’s multichannel operations. As an experienced entrepreneur with over 20 years of e-commerce experience, Chowdhary shares his insights on the challenges and opportunities of DTC, multichannel operations, and direct order fulfillment. The episode is sponsored by MageMontreal, a certified e-commerce company specialized in the Adobe Magento platform.

Guillaume Le Le Tual:

Hello, everyone. Guillaume Le Tual here, host of the Ecommerce Wizards podcast, where I feature leaders in e-commerce and business.

Today’s guest is Manish Chowdhary, who’s the founder and CEO of Cahoot, which can be found at Cahoot.ai. Today, we’re going to talk about DTC, so direct-to-consumer. So DTC versus Amazon, how to try with multichannel operations. Quite a challenge right now at Amazon, how do you compete with them? So before we get started, our sponsorship message.

Audio:

This episode is brought to you by MageMontreal. If a business wants a powerful e-commerce online store that will increase their sales, or to move piled up inventory to free up cash reserves, or to automate business processes to reduce human processing errors, our company MageMontreal can do that. We’ve been helping e-commerce stores for over a decade.

Here’s the catch. We’re specialized and only work on the Adobe Magento e-commerce platform, also known as Adobe Commerce. We’re among only a handful of certified companies in Canada. We do everything Magento related. If you know someone who needs design, support, training, maintenance, or a new e-commerce website, email our team at support@magemontreal.com or go to magemontreal.com. That’s M-A-G-E, montreal dot com.

Guillaume Le Le Tual:

All right, Manish, thanks for being here today.

Manish Chowdhary:

Well, Guillaume, thank you very much for having me.

Guillaume Le Le Tual:

All right, so before diving main topic, I like to always spend a little bit of time, so you can tell us briefly, like a minute or two, your background as an entrepreneur.

Manish Chowdhary:

Yes, thank you, and thanks again for everyone tuning in. My name is Manish Chowdhary. I’m the founder and CEO of Cahoot. I have over 20 years of e-commerce experience, involved with building one of the first e-commerce platforms. This is going back to the days before Magento, Guillaume. So I’ve been involved in e-commerce for that long. And following that, I built an order management, inventory management platform. It’s a full-service solution. So I have seen and worked with SMB merchants, even large enterprise, for nearly two decades. And now, I’m running Cahoot, which was founded in, a few years ago in 2018. I can tell a little bit about Cahoot, if you like.

Guillaume Le Le Tual:

Yeah, go for it, because it’s very unique, the product you have. I think it’s something brilliant as the idea that it really stands out. That if I’m thinking what kind of business do I want to create, is the kind of idea I hope to have. So go for it.

Manish Chowdhary:

Thank you, Guillaume. That is very kind of you. It is indeed innovation. It is very innovative what we’re doing, Cahoot is the world’s first peer-to-peer, order fulfillment services network. What that means is Cahoot has multi-dozen warehouses throughout the US right now, and soon to be global, including Canada, Mexico, and others. And essentially, we provide brands and sellers, brands and retailers, with best-in-class fulfillment services, similar to Amazon FBA.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWhether you are targeting two-day delivery nationwide, in that case, Cahoot can distribute your inventory across multiple order fulfillment centers and pick the lowest-cost carrier to get the order delivered in one day, two-day, and we support that. We do this regularly for our clients who want Amazon Seller Fulfilled Prime (SFP). Which is, essentially, an Amazon Prime-like service, but for merchants who wish to do self-fulfillment. So that is what the service is for the ecommerce brands and retailers.

But there’s a very unique business model behind that, which I’m happy to share. Which is, most of these warehouses belong to other brands and sellers that have their own warehouse that they’re operating for themselves. And if they have excess capacity in that warehouse, they join Cahoot as an order fulfillment partner and they get to monetize that excess capacity for the very first time.

So if you know of a merchant, if you know of a seller who has a warehouse, let’s say 40, 50 or any size warehouse and they have sufficient space, vacant, that is going unutilized, you can come and apply to become a Cahoot order fulfillment partner.

And that’s where our capacity comes from, that allows Cahoot to beat the rates that allows Cahoot to, and pass them onto our clients, because it’s a win-win. It’s a win for the fulfillment partner, because they’re making extra cash, and that’s, of course, a win for the brand or the retailer, because they get lower cost by design, and that’s what makes Cahoot very unique and innovative.

Guillaume Le Le Tual:

All right, well, it is a brilliant system, because you’re more or less building an Airbnb or a Uber, but on the B2B side of things, to… everybody can use their excess capacity for warehouse. Because it’s always a problem. Within time, you buy hardware regardless if it’s additional server resources or if you’re buying warehouse space, you buy a full warehouse and maybe you’ll use half of it, two-third of it or whatever, and then it’s never optimized. And you plan on running out of warehouse space and you need to buy a second warehouse, and it’s never going to be a hundred percent capacity utilization. So it is quite brilliant.

There’s a lot of operational challenges, from [inaudible 00:05:20] point of view. I don’t know your business that would need to be solved to operate this, and it’s probably why you’re the first one that I have heard of to move forward with this kind of model. And well, you’re pulling it off, you’re making it work right now. So, for sure, I’m very interested to know more about this and we’ll see how you can perhaps explain it a bit more throughout the episode here. And it is directly with our topic.

So DTC versus Amazon, so direct-to-consumer versus Amazon, how to drive multichannel operations here, in the sense that well, shipping with Amazon, if you are selling on Amazon, is extremely competitive. Amazon has warehouse all across the country. We’ll ship way faster than you for most places. With the city, you can have your package same day, next day, more or less. But if you’re a small merchant or medium-size merchant even, you have to ship across the country, there’s no way to get the goods that quickly there.

Manish Chowdhary:

Yeah, you’re right, Guillaume. Because sellers, it’s very hard to pull this off. And Amazon-like order fulfillment is not easy. There’s a lot of operational complexity and so on, but Cahoot handles all that, just like Uber, where the rider, for example, is not trying to connect with the driver, trying to negotiate the price of the ride, trying to alert the driver when to come in and all of those. So Cahoot has created a fully-managed service for the seller. It’s super-duper simple, because they send the inventory to Cahoot order fulfillment centers and Cahoot takes care of everything from that point on.

And for our order fulfillment partners on the other side, just like I’ll continue to use that Uber analogy. As a driver, we’ve made it super-duper simple for fulfillment partners to fulfill orders on behalf of Cahoot, because we take away all the decision-making, all the complexity that would be associated, so that it’s not a distraction from the core business. And that’s all leveraging our technology, which is patented. We’ve got tons of experience doing this, and that is what makes Cahoot so special. So, we’d love to chat with ecommerce brands and fulfillment partners who may be interested.

Guillaume Le Le Tual:

So let’s say, so to be as clear as possible, where are we at so far with you be building this network and how competitive can you be with Amazon, let’s say, with the Prime same-day, next-day fulfilling that Amazon has? Or, is it per region of the United States? Or, how are things shaping up right now?

Manish Chowdhary:

Oh, yeah, I mean, this is a reality. I mean, Cahoot is one of the only fulfillment services networks of its size that offers, or offers Amazon’s Seller Fulfilled Prime (SFP). So I’ll use a client example. So we have a client called Cali’s Books. They are a leading ecommerce brand. They sell personalized children’s books. These are, imagine Cinderella in Spanish that also teaches the kid to read, and you can record voices on top of that. So that maybe it’s a grandfather reading the book to the kid and so on. So it’s a very, very special brand.

And they’ve been growing, doubling year over year. And prior to Cahoot, they were using a bunch of different services. But as we know, Amazon routinely changes the storage capacity for ecommerce brands, even the ones that have been selling on Amazon for a long time. And they needed access to Amazon Seller Fulfilled Prime (SFP), because that 150 million prime shoppers, that membership, is very crucial, because Amazon shoppers love the Prime membership.

So there’s a program called Seller Fulfilled Prime (SFP), where you have to achieve two-day and one-day delivery. The metrics are super-duper high, it’s very hard to meet those standards from Amazon. So Cahoot has placed this Cali’s Books inventory in six, seven, eight different warehouses throughout the country, in the US, from Southern California to Greater New York City area, to the south, where the Texas, and then in the upper Midwest and so on, and you can imagine. And then Cahoot processes orders, retrieves the orders dynamically in real time from all the leading channels, Amazon, Walmart, Shopify, eBay, and all of the others.

And then routes the order to the fulfillment center that will be the closest and cheapest, that can get the order to the customer within the promised SLA, which includes, in many cases we need, as part of Seller Fulfilled Prime (SFP), you need to achieve at least 20% of your orders must achieve one-day delivery, not just two-day. So the bar is really high and we’ve be doing exceedingly well. This ecommerce brand is doing really a fantastic job on execution and Cahoot is their primary order fulfillment partner. So that’s just to give you, by way of an example how this all this all thing works.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPGuillaume Le Le Tual:

Right, okay. And you’ve made your own study in this regard. If you have, regardless of which e-commerce platform, the Magento, a Shopify or something, versus selling on the marketplace, what the brand gives up, what the brand lose if they’re selling on the marketplace, or what they win, and how do you push back or fight back as a smaller brand versus the Amazon Marketplace.

Manish Chowdhary:

Yes, it is well understood, well known that marketplaces are growing faster than DTC sites. And I put marketplaces, Amazon, Walmart, eBay, Best Buy, Target Plus, all of these are marketplaces, because consumers love marketplaces. They trust the marketplaces, because the marketplaces offer a diversity of product. There’s a very large selection, and because it’s also competitive. Because multiple people are selling the same product, it creates a competition for the sellers to put their best foot forward, which means lower prices.

Not only do the customers get a large selection, a very competitive price. And then finally, where marketplaces really win is in shipping and order fulfillment. Because marketplaces, in order to get ranked high on, let’s say, Amazon, you not only have to offer a great price in order to win the buy box, but you also need to provide competitive shipping. Of course, if you’re using FBA, then FBA will target the Prime, one-day, two-day delivery. But if you’re shipping on your own, your shipping offer has to also be very competitive in order to rank high, which is where marketplaces shine.

And most DTC brands do not do that good of a job, and regardless of the platform that they operate, whether Magento or Shopify. We did a full study of top 50 DTC brands on Shopify and BigCommerce, and compared their offers to the ones on Marketplace. And I’m happy to share more if your audience is interested.

Guillaume Le Le Tual:

Yeah, sure. So what key findings did you have with that study?

Manish Chowdhary:

Yeah, so we actually studied the top 50 brands to our top 50 sites on Shopify and BigCommerce, and then looked for the same identical product on Amazon and Walmart marketplaces. And what we found, Guillaume, is that 60% of the time, 60% of the time, the products are found cheaper on marketplaces than the brand’s DTC site. And that is just one finding. Of course, on a marketplace there could be other sellers, resellers potentially selling.

But from a consumer perspective, if I want to buy a certain product, as long as it’s authentic, I really don’t care who’s selling it, because I want the best price and I’m protected, because Amazon ensures that my payment information, all the other personal information is safe. So, there’s a clear trend that marketplaces are performing better on prices.

Now, we also studied the shipping behavior on these marketplaces, and we found that three out of four times, you can not only get the products cheaper, but you can also get it faster on marketplaces than on the DTC site. So 73% of the time, you’ll get the product delivery faster, let’s say, on Amazon and Walmart than on the DTC sites. So clearly, the DTC sites have a lot to do in terms of catching up, if they want to compete with the Amazon and Walmarts of the world.

Guillaume Le Le Tual:

Agree with you. So more selection, cheaper, faster. And also, something that we take for more or less granted on many marketplaces and many sites, just an estimated date of arrival, there’s a lot of private website that don’t give you that option. So you’re like, okay, I’ll check out, but when do I get it? Do I get it in a week, two weeks, in one day, in two day? If you don’t offer that estimated date of arrival, I mean, that can lose your sales right there. I remember myself as a consumer sometime not placing the order, because I need to know when I get it, because I need it for a specific date for whatever, an event or something. So that does matter, for sure.

Manish Chowdhary:

Yep. You’re a hundred percent right. We call it date-certain shipping. And if you don’t, if you’re just putting up things like four- to seven-day delivery or two- to three-day delivery, the consumer cannot do that math or doesn’t want to do that math. I don’t know what that means, four- to seven-day delivery. Does it include weekends? When will the product ship? Is it counted from today? Is it counted from tomorrow? What’s your processing time? All of those.

So that’s another clear advantage, as you rightly said, that individual DTC sites, most of them do not offer that level of what we call visibility into “When will my product arrive if I pick this option?” In addition to, of course, marketplaces reward free shipping. So any seller that’s offering free shipping will have an edge on marketplaces. Of course, there’s no such body to govern on your DTC site, because you’re making the rules. But keep in mind that the winds of change are happening, and brands and retailers, they need to get serious about offering and leveling that playing field if they want to compete on their DTC sites.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkGuillaume Le Le Tual:

Yeah, exactly. Okay. And the model that you propose as a solution here, say, “Hey, let’s all group together, let’s band together. Let’s create a power of distribution and network by creating alliance with people that were previously not aligned together, not coordinated together.” So you’re coordinating the uncoordinated, so to speak, building a network, that then you can even compete with Amazon’s shipping and so on. Nothing’s perfect anymore. So there’s positive and negative. So we heard a lot about positive. What’s the downside of this approach or challenges or issues that someone might face?

Manish Chowdhary:

Well, I mean, ensuring quality is always a challenge in a warehouse, even with Amazon Prime. I’m a Amazon Prime subscriber in the US, and we, my family and I, we order quite a bit of stuff. And we know that Amazon Prime routinely fails on its delivery promise, even though they say, okay, the product is going to arrive, let’s say, on a Friday or Saturday. Many times, it doesn’t show up till Monday. But I know behind the scenes, Amazon is working feverishly to ensure that those promises are met.

And so, likewise, for Cahoot, the problems are very similar, that holding our order fulfillment partners and warehouses strictly accountable, which Cahoot does a fantastic job. My team is always on top of it, ensuring that products are delivered defect free, meaning product goes to the right customer at the right time. And of course, we need to work with carriers, UPS, FedEx, USPS, and many other regional carriers. Sometimes, they screw up, and it happens. Products do get damaged in transit, for no fault of the carrier and so on.

So, those are all the things that impact customer experience. Because the customer may or may not be privy to all that information that, hey, did the UPS damage the product or was the product damaged at the warehouse? Did the product come damaged from the factory in China to begin with? Because we can’t see all that. So the problems are real, but Cahoot maintains a very, very high standard of accountability and only lets the best in the business join as order fulfillment partners. And that’s why we have a very strict vetting process to make sure that we are only bringing in the best and holding them accountable every single day.

Guillaume Le Le Tual:

Even Amazon with all their, I don’t know how many millions or billions they’ve invested in robotics, probably billions. So, for sure, actually billions. They lose packages, they lose inventory. I speak with so many merchants that are selling on Amazon, and yeah, you have to claim lost merchandise from the Amazon warehouse, that Amazon has no clue. They’ve misplaced your package. So that happens everywhere, no matter how much AI and robotic you put in place, and especially the Amazon warehouse.

It’s messy, it’s not sorted out, alphabetically or numerically. The robot knows where it is. So if the robot goes, pick the package there and it’s not there, you’re screwed. Package is lost in chaos, basically. So that happens everywhere, that that’s for sure. And the other important thing to remember when you’re talking your own shop or direct-to-consumer versus selling on marketplaces, on marketplaces, you do not own the relationship with the customer. You do not own your customer’s list.

Somebody buys from you from Amazon, but you don’t know who is buying from you. You cannot send them an email and a text message, and you cannot market to them after, do some remarketing and so on. So this is huge, because you’re losing the ability to build an asset, which is a customer base. So it’s really like a money transactional relationship with Amazon. You say, “Thank you for the transaction. Thank you for helping me grow my business,” but this could dry out and I don’t own the relationship with the customers.

And very critical point to keep in mind, to always diversify away from marketplaces so that you can own your own customer list and your own relationship with customer, that you can send texts and emails to. So, to wrap up with this topic here, anything else top of mind that you think that merchants should know about how to drive in this kind of multichannel operation and DTC versus Amazon?

Manish Chowdhary:

Yeah. In summary, on this topic, Guillaume, I would urge every seller to target an Amazon-like order fulfillment. And I know that many sellers that I speak with, sometimes they’re not fully sold on the idea, because many of them will say, “Oh, my customers don’t demand it.” No, of course they don’t. They’re not going to come and tell you that, they just going to go elsewhere. They’ll buy it on Amazon, they’ll buy it on other places.

I think, especially with… Amazon just recently launched this program called Buy With Prime, which I know we will cover later on, either in this podcast or another session. The consumer expectations are not getting any reduced or is not getting tempered. If anything, customers want their products faster and they want their products free and fast shipping. And solutions exist. I think sellers and brands and retailers should not think that they cannot do it affordably.

I would invite them to come talk to Cahoot. We can do some analysis, we can tell you. And if there are merchants who have warehouses, whether it’s Canada or in the US, that have spare capacity, that run a tight ship, I’ll encourage them to also contact us, if they’re looking to make some extra cash. So, the world is moving to distributive order fulfillment. My parting thoughts is that everybody should embrace it, because if you’re not, you’re going to find yourself in a tight spot sooner than later.

Guillaume Le Le Tual:

Right. Well, thank you for sharing all that information, Manish. If somebody wants to get in touch with you, what’s the best way?

Manish Chowdhary:

Well, hop over to cahoot.ai, that’s www dot Cahoot, singular, dot AI and fill out the contact us form. And if you want to connect with me directly, please find me on LinkedIn. I’m very active. Just search for my name and Cahoot, that’s C-A-H-O-O-T. And please connect with me, message me. I’d love to chat with you.

Guillaume Le Le Tual:

Awesome. Well, thanks for being here today, Manish.

Manish Chowdhary:

Thank you for having me.

Turn Returns Into New Revenue

How to Prepare for Amazon Prime Day: Order Fulfillment Options and Beyond

In this article

12 minutes

12 minutes

- Understanding Amazon Prime Day

- Preparing for Prime Day

- Optimizing Your Listings

- Marketing and Promotion

- Order Fulfillment Options Offered by Amazon

- Advantages of Using Amazon for Order Fulfillment

- Drawbacks of Using Amazon for Order Fulfillment

- Advantages of Using a 3PL for Order Fulfillment

- Drawbacks of Using a 3PL for Order Fulfillment

- Conclusion

- Frequently Asked Questions

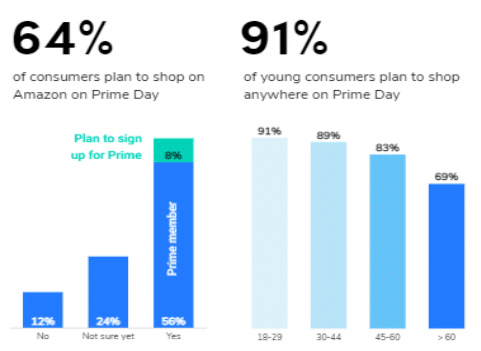

Typically, peak shopping season begins late in the year for the US – during Thanksgiving, Black Friday, Cyber Monday and the Christmas holidays that follow. Elevated order volumes during these times occur for obvious reasons; these are festive occasions, and there’s lots of shopping people need to get done. In recent years, all of those occasions trail behind two days in July – Amazon’s Prime Day, known as Amazon’s biggest deal event.

Prime Day represents an opportunity to get in front of many buyers – but especially the young consumer whose purchasing power and influence continues to grow all the time.

Customers do not shop on Prime Day with the intention of gifting things to their loved ones for a festive occasion – rather, it is about the thrill of the treasure hunt, where many products are available at sharp discounts and there are deals which may not come around again. Forbes reported that 48% of Prime Day shoppers make purchases they never actually planned for – largely driven by the fear of missing out on a great deal.

However, as an online merchant, if you’re expecting people to only be shopping on Amazon, you’d be wrong – Forbes goes on to say that as many as 58% of people compare prices on other websites before checking out on Amazon. And why wouldn’t they? Many of Amazon’s competitors, such as Walmart and Target, now run their own competing programs at the same time as Prime Day.

Many of these competing programs center around the premise of free and fast “Prime-style” shipping – like Walmart’s TwoDay and ThreeDay programs.

While the surge in order volumes means an opportunity to acquire new customers and boost sales, it brings with it increased order fulfillment complexity – due in large part to Amazon themselves, customers now expect free, fast same or next day shipping on nearly any online purchase they make.

In Amazon’s own words, Prime Day boosts sales both on and off their website. As an online seller, navigating the avalanche of orders flooding in from many different channels while managing to delight customers with free, ultra-fast shipping can seem overwhelming and expensive. But merchants do have a number of options that help them manage the logistical complexity and deliver on customer expectations, many offered by Amazon themselves.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyUnderstanding Amazon Prime Day

First introduced in 2015 to celebrate Amazon’s 20th birthday, it has since evolved into one of the biggest online shopping events of the year. Prime Day offers a wide range of deals and discounts on various products, including electronics, fashion, home goods, and more. This event is designed to reward Prime members with exclusive access to exciting deals and significant savings, making it a prime opportunity for shoppers to score big on their favorite products. Whether you’re hunting for the latest tech gadgets or looking to refresh your wardrobe, Prime Day has something for everyone.

Preparing for Prime Day

To make the most of Prime Day, it’s best to prepare in advance. Here are some tips to help you get ready:

- Ensure Your Prime Membership: Make sure you have an active Amazon Prime membership or sign up for a free trial to access Prime-exclusive deals.

- Create a Wishlist: Compile a list of the products you want to purchase and check their prices in advance to ensure you’re getting the best deal.

- Download the Amazon App: The app can send you notifications about upcoming deals and allows you to shop on the go.

- Stay Informed: Follow Amazon’s social media accounts to stay updated on upcoming deals and promotions.

- Set Price Alerts: Consider setting up price alerts for your desired products to ensure you don’t miss out on any good deals.

By following these tips, you can navigate the Prime Day event with ease and make the most of the exclusive offers available to Prime members.

Optimizing Your Listings

As a seller, optimize your listings to make the most of Prime Day. Here are some tips to help you optimize your listings:

- Use Relevant Keywords: Incorporate relevant keywords in your product titles and descriptions to improve visibility.

- High-Quality Images: Use high-quality images to showcase your products and make them more appealing to customers.

- Detailed Descriptions: Ensure your product descriptions are accurate and detailed to help customers make informed purchasing decisions.

- Leverage Amazon Advertising: Utilize Amazon’s advertising options, such as Sponsored Products and Sponsored Brands, to increase visibility and drive sales.

- Monitor Inventory Levels: Keep an eye on your inventory levels and ensure you have enough stock to meet demand during Prime Day.

By optimizing your listings, you can enhance your product’s visibility and appeal, leading to increased sales and a successful Prime Day event.

Marketing and Promotion

Marketing and promotion drives sales and success during Prime Day. Here are some tips to help you promote your products:

- Social Media Engagement: Use social media to promote your products and deals, and to engage with your customers.

- Amazon Marketing Tools: Utilize Amazon’s marketing options, such as Amazon Giveaways and Amazon Coupons, to drive sales and increase visibility.

- Run Lightning Deals: Consider running a Lightning Deal or a Deal of the Day to drive sales and increase visibility.

- Email Marketing: Use email marketing to promote your products and deals to your subscribers.

- Partner with Influencers: Collaborate with influencers or other sellers to promote your products and reach a wider audience.

By implementing these marketing and promotional strategies, you can maximize your product’s exposure and drive significant sales during Prime Day, ensuring a successful and profitable event.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPOrder Fulfillment Options Offered by Amazon

In recent years, Amazon has become as much a logistics company as a retailer, offering merchants different options through which they can have orders fulfilled. During Prime Day, Amazon often operates with extended hours to manage the increased order volumes.

- Fulfilled By Amazon (FBA): The vast majority of SKUs on Amazon are shipped by the company itself, where merchants send their inventory to its warehouses, and then have their orders picked, packed and shipped for them.

- Amazon Multi Channel Fulfillment (MCF): In recent years, Amazon has expanded its reach significantly – its Multi Channel Fulfillment (MCF) offering allows merchants to have Amazon fulfill all of their orders across various channels – such as their own website or Shopify / BigCommerce storefronts.

- Buy With Prime (BWP): Prime shipping standards have become the norm for everyone, on and off the Amazon marketplace. Amazon’s most recent and noticeable step in normalizing these high standards is Buy With Prime, which enables merchants to offer the Amazon Prime shipping experience on their own website. Customers login to their Amazon accounts and checkout and orders are fulfilled by Amazon.

These options come with significant advantages and drawbacks, a few of which we outline below:

Advantages of Using Amazon for Order Fulfillment

- Picking, packing and shipping are taken off your plate as a merchant – there’s not a lot of work to be done, except sending the inventory in time to Amazon warehouses.

- FBA makes products automatically eligible for the Amazon Prime badge, which is a filter many shoppers on Amazon apply while searching for items.

- Amazon (in most cases) is able to meet the gold standard of shipping items by the next day – which can elevate customer satisfaction and prompt repeat purchases. This efficiency is particularly beneficial during holiday shopping seasons when order volumes are at their peak.

- For MCF purchases made outside Amazon, buyer confidence may be increased if they see that Amazon is fulfilling their order.

- For small D2C merchants looking to make a mark and establish themselves, Buy With Prime can provide a lot of trust in the buyer’s mind about the quality of not just their shipping, but the larger brand they’re engaging with.

While these are definitely strong positives, the programs do have a few significant drawbacks for merchants to keep in mind and weigh when making a decision.

Drawbacks of Using Amazon for Order Fulfillment

- While Amazon has decided to freeze FBA fees in 2025, the charges and fees associated with FBA have climbed by as much as 96% over time.

- Research and analysis performed using Marketplace Pulse data by Cahoot shows that while the new Buy With Prime program can offer merchants savings of as much as 43% compared to Multi Channel Fulfillment, it can still be twice as expensive as FBA (where sales are restricted just to the Amazon marketplace).

- Possibly most importantly, when merchants use the Buy With Prime program, they send the customer to Amazon to checkout – where marketing or promotions may divert the buyer to an alternative (possibly cheaper) option.

- Lastly, with BWP, merchants do not have access to data about the customers on their very own website because the customer logins to their Amazon account to checkout, not through the merchant’s gateway.

Many merchants seeking to regain control of their customer data and improve their margins have tried to pivot away from Amazon FBA towards using a 3rd Party Logistics provider (3PL). 3PLs bring some of the same convenience that FBA does to merchants, but come with their own sets of limitations:

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkAdvantages of Using a 3PL for Order Fulfillment

- Using a 3PL offers merchants a more cost-effective way to manage orders outside of Amazon, rather than using a program like MCF.

- 3PLs might offer merchants possibilities for kitting and customization, which are not possible when shipping with Amazon.

- 3PLs simply take care of shipping and stay out of the engagement between you and your customers, unlike a program like Buy With Prime.

However, the staple source of revenue for a 3PL lies in shipping, and that has unfortunately become a more and more expensive activity.

Drawbacks of Using a 3PL for Order Fulfillment

- 3PLs are in the business of shipping, and various activities of the shipping lifecycle have gotten more expensive – leasing warehouses, shipping costs and the cost of labor.

- The General Rate Increases of the shipping carriers has consistently exceeded the prevailing inflation rate, while it now costs $19 / hr to hire workers for warehouses with quit rates at an all-time high. Additionally, warehouse availability is low, driving leasing costs higher.

- All these mean that 3PLs are forced to pass on increased costs to customers, eroding margins.

Conclusion

As a merchant, you might be prompted to wonder whether there’s no solution that can both help you delight your customers while costing you less and allowing you to extract more margins. Consider order fulfillment solutions with differentiated models such as Cahoot that distribute your inventory strategically in warehouses across multiple locations in the country.

By placing your product closer to the customer, it is possible to achieve same or next day shipping, while deriving cost efficiencies. Oh, and it uses ground shipping – which is better for the environment than air cargo!

Already working with a traditional 3PL but want to switch to a better network, like our peer-to-peer model? We know migrating fulfillment partners can be an uncertain and stressful process which prevents merchants from exploring superior alternatives. To make that process simpler, check out our 3PL migration guide which provides you step-by-step details on how to make a smooth, seamless switch.

The mid-year shopping season brings with it new customers and supercharged sales but also logistical complexities to overcome. It is essential for merchants to have a solid game plan for order fulfillment across all of their channels, with a strategic order fulfillment partner that offers both savings and operational excellence. It might just be the decision that provides your ecommerce rocket ship its fuel.

Frequently Asked Questions

What are some tips for optimizing my listings for Prime Day?

Optimize your listings by using relevant keywords, high-quality images, detailed descriptions, leveraging Amazon advertising options, and monitoring inventory levels to ensure you have enough stock to meet demand during Prime Day.

What are the advantages of using Amazon for order fulfillment?

Advantages of using Amazon for order fulfillment include taking care of picking, packing, and shipping, automatic eligibility for the Amazon Prime badge, meeting the gold standard of next-day shipping, increased buyer confidence for MCF purchases, and providing trust for small D2C merchants through Buy With Prime.

What are the drawbacks of using Amazon for order fulfillment?

Drawbacks include rising FBA fees, higher costs for Buy With Prime compared to MCF, potential diversion of buyers to alternative options during checkout, and lack of access to customer data for merchants using Buy With Prime.

What are the advantages of using a 3PL for order fulfillment?

Advantages of using a 3PL include cost-effective management of orders outside of Amazon, possibilities for kitting and customization, and maintaining direct engagement between merchants and customers without interference.

What are the drawbacks of using a 3PL for order fulfillment?

Drawbacks include increased costs for shipping activities, higher leasing and labor costs, and the need to pass on increased costs to customers, eroding margins.

Turn Returns Into New Revenue

Overcoming Amazon’s Inventory Limits: Order Fulfillment Alternative

In this article

22 minutes

22 minutes

Listen to podcast here.

Podcast Episode 185 – Avoiding FBA Limits with an Alternative Order Fulfillment Network with Cahoot

The Smartest Amazon Seller Podcast discussed the issue of warehouse inventory limits, which is becoming a major challenge for all Amazon sellers. Amazon’s warehouse inventory limits are getting lower as Q4 ramps up, leading to difficulty for sellers to send everything into FBA – Fulfilled By Amazon. The problem is exacerbated by Amazon’s challenge in hiring order fulfillment workers across its warehouses. The podcast host, Scott Needham, invited Manish from Cahoot to discuss an alternative solution. Cahoot is a company that has created a peer-to-peer network for order fulfillment, allowing sellers to use its warehouses to store their products and deliver them to customers. Cahoot was first trying to do a co-mingled Fulfilled By Merchant (FBM) solution, but has now pivoted to an order fulfillment services network. Its order fulfillment services are intended to create efficiency, reduce order shipping costs and transit time, and make it easy for sellers to operate in a highly profit-challenged environment. The podcast discussed how Cahoot’s order fulfillment service can help sellers overcome the problem of Amazon’s strict inventory limits.

Scott Needham:

Welcome to the Smartest Amazon Seller Podcast, your host, Scott Needham. I am an Amazon seller for 10 years, and in my 10th year, I’m actually literally about to wrap up, hit 10 years. Something has happened again, that’s become an issue for all Amazon sellers, that if you’re really paying attention, inventory limits are, they’re getting lower as Q4 ramps up, which is kind of, it’s the opposite of what we want. Usually you want your limits to go up when you, because right now you want to spend all your money to buy inventory to bulk up for the next eight weeks. I’m recording this right before November. So a lot of people are getting challenged. They can’t send everything into FBA, and if you don’t have an alternative solution, you’re kind of stuck. So I’ve got with me someone that has an alternative solution that I actually think is quite scalable. I’ve got Manish from Cahoot. Manish, welcome.

Manish:

Scott, thank you for having me.

Scott Needham:

So let’s just chat through this. If we’re talking big picture, how I see things, Amazon, because of COVID and 2021 and 2020, they increase their capacity considerably. Actually, I’m seeing reports that they increased it too much, but they also have a different problem. If you increase your capacity, they also have to have employees to do that, and they have hired hundreds of thousands of people, but they’ve also had huge turnover, lots of turnover. So much that they do have a business challenge in that they are exhausting the number of people that are available for employment across some of the warehouses that they serve in different markets. So that leads me to think, inventory limits, they’re going to be around. It’s going to be cyclical. Who knows? We’re fighting against market forces, bigger market forces. Are there a hundred thousand people that can work in this capacity in this market? And that’s either a yes or no, and if not, then they can’t receive everything. So that’s how I would set the stage. And why, again, a year after the worst of these inventory limits, we’re seeing this again. How do you see this?

Manish:

Well, that’s a great question, Scott. And you said it right. Half of Americans of the available workforce has either applied or worked at Amazon or has worked and quit at Amazon. So Amazon is running out of order fulfillment workers to hire, and that’s no secret. I mean, everybody knows that. So you have a bit of a dichotomy. On one hand, two quarters ago, Amazon came out and blamed their excess build, they actually added more warehouses in 2020 and 2021 than they had done in the previous 18 years of their operation. So they went all in, and then of course they came back and they said, “Oh, we made less money because we overbuilt. We have tons of excess capacity. We’re going to go rent out or sublease, hundred million or so square feet of space.”

And then you as a seller, and many others that I speak with regularly, are complaining that their stock limits are down. So it’s highly confusing for the seller because they’re getting news from both sides of their mouth, and that’s not… So the reality is, what we believe and suspect, that while the facilities might have been built, they are not online. So you could count them as overbuilding, but they’re not enough. They’re not online. They don’t have enough order fulfillment workers to make those facilities work. And that’s why the sellers are continually facing strict inventory limits at FBA. So it’s a real problem.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyScott Needham:

I’ve got two selling businesses that I check in on every day. One of them does have limits, and the other one actually has the opposite of the problem, has actually more space than we need. So it affects people at different sizes in different ways. And every business model is slightly different. And some people can transition to FBM on their own and some people can’t. Just like I do think one of the benefits of E-commerce is you can work out of your house and you don’t have to ever touch inventory if you are using, if you’re being creative, if you’re aware of either prep centers or 3PLs, whatever.

I’ve been aware of Cahoot for a while, and if I get anything wrong about your background, but you guys have slightly pivoted in that Cahoot was first trying to do a co-mingled FBM solution. Where if I was selling Head & Shoulders shampoo and I had it in my warehouse, in my backyard in Utah, but the customer was in New Jersey, if someone else had that same product, that same skew in New Jersey, they could satisfy the customer for about half the price. And now you created this peer-to-peer network for order fulfillment. And that’s a really creative and interesting solution, kind of a hard problem to solve because of all the different variables. But that’s how Cahoot started, right?

Manish:

Yes, we are… We’ve been fanatically focused on optimization. And the idea is how do you reduce the shipping costs, the transit time, and make it easy for sellers to operate in a highly profit challenged environment? So all our solutions are intended to create efficiency. And yes, you’re right about our history.

Scott Needham:

You had to create a lot of tech, tech that you actually still use, but you guys now lean in a little bit more to an order fulfillment services network. So basically an alternative to FBA. And if say someone wants to sell 10,000 units of Head & Shoulders shampoo, they get to utilize your network as opposed to FBA. And I actually think there’s a few cool things that we’re going to talk about with the Cahoot network that are kind of different, never heard of before. And I was like, “Okay, this is a worthwhile conversation and worth exploring.”

Manish:

Absolutely. I mean, sellers can, we believe in supporting the sellers wherever they sell. Cahoot takes a full service approach to fulfillment. So we support, if the merchants want to send some inventory to FBA, we also support the highest standard in fulfillment, which is Seller Fulfilled Prime (SFP). Which is very, very hard to find a solution for because of the extremely stringent metrics. So if you are listening, and if you’re a seller that has Seller Fulfilled Prime (SFP), you should hang onto it.

And if you wanted to do FBM and if you were affected by FBA restock limits or you are unhappy with the receiving delays, which we know there’s a long receiving delay at FBA, or other challenges. Like returns, so that’s a big problem because your return rate is 20% generally higher with FBA than FBM or if you’re selling on other marketplaces and channels, whether Shopify, your website, on Walmart, eBay, other places, because every seller ought to be selling on multiple channels. So you can come to Cahoot and Cahoot can provide an Amazon FBA like service, and it’s an alternative to FBA so that you can continue selling regardless of whether you can get your inventory into FBA or not.

Scott Needham:

I mean, Seller Fulfilled Prime (SFP), it’s tough. I’ve done it, seen it work out, seen us get kicked off a few times as you need to get stuff out the door fast. So right now people need space, they need alternatives to FBA. And you guys, very straightforward, kind of offer your network. And you could even make some comparison to an Uber model for shipping and FBM and so much that you actually have some sellers that join the network and make their warehouse available, whether it’s space-

Manish:

That’s right.

Scott Needham:

And fulfillment.

Manish:

Right. That’s right. I mean, what’s unique about Cahoot is it’s a peer-to-peer network. So essentially it’s a peer-to-peer collaboration platform. So on one side of our network, the demand side, which is ecommerce brands and retailers that are looking for affordable fulfillment services, akin to if you were looking to outsource your fulfillment, some are part of it. So we would support that and we would place our client’s inventory at one or more warehouses in the Cahoot network. And Cahoot provides a very, a technologically advanced solution. So we connect directly with the sales channels, we have deep integrations with every popular channel out there. And then we provide a very simple pricing to our clients so that they don’t have to deal with the complexities of, “Hey, what’s the SLA in California? And what’s the storage fees at California versus New York or versus Miami?” Or what have you.

Because sellers are looking for simplicity, they’re looking for predictability, and they’re looking for one throat to choke, so as to speak, when it comes to holding people accountable. And that’s what Cahoot provides. And that’s the only reason why Cahoot is able to achieve Amazon Seller Fulfilled Prime (SFP) metrics, which is frankly very difficult to achieve through traditional 3PLs. So that’s a demand side of our network. And on the supply side, these are warehouses that belong to other ecommerce brands and retailers that have excess capacity in their warehouse. So right now, if you are running your own warehouse and you’ve got five, 10, 20,000 square feet of excess space, it’s literally sitting idle. You’re not making any money. Your rent, your mortgage, your utilities are the same. So you have the opportunity for the very first time to join the order fulfillment services network and make some extra cash.

Scott Needham:

Yeah. I’ve definitely had a facility where we’ve had tens of thousands of square feet and I’m like, if you push us, yeah, we could actually set aside 10,000 and utilize the space better. And especially… Certain parts of the season, there’s always more ways to utilize space better. We’re not always great at that. But if there’s an economic incentive, like what you guys have, to be able to rent some of the space, basically take your rental costs down, that’s very interesting. And obviously there’s some areas of the country that are just more in demand, California and the northeast coast, because that’s where most ships are coming in. So that’s really interesting. And I like seeing what solutions work for some people. People ask me frequently, and sometimes there’s just always trade-offs. What would you describe, how expensive is it to fulfill Seller Fulfilled Prime (SFP) through your network? Because I think people still want the Prime badge, but they don’t want to, we can’t pay $30 for every single shipment.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPManish:

No, nobody does, Scott. I think that is not a economically viable solution for vast majority of the sellers. So what Cahoot does is, you’re utilizing the economy ground shipping to ship the items and still meet that one-day, two-day delivery requirements of Seller Fulfilled Prime (SFP).

Scott Needham:

Is that because you guys are, because you’re distributing the inventory across the network?

Manish:

That’s right. In order to achieve two-day delivery target, Scott, you need at least four to five strategically placed warehouses. And in order to achieve one-day delivery target using economy ground like a UPS ground or FedEx ground, you need nine locations. And so what Cahoot does is places the inventory based on the demographic of your customers so that we can continue, one, meeting the SFP metrics that is needed in order to protect your account. And number two, do it affordably using the ground service. So you actually pay less than you would pay from your single warehouse.

Scott Needham:

Do you have sellers split up the shipment? Obviously that happens at the beginning, but do you ever do any transshipping yourselves or is that kind of like you’d rather replenish through having the seller replenish one at a time?

Manish:

I mean, both options are available on the Cahoot network. So essentially sellers can ship directly to the warehouses that they have been assigned based on the data. So we are very, very data driven. So that’s how we are able to minimize cost. Or in many cases, we would have a hub location that would act as your primary reservoir for inventory, and then we would trickle in the inventory across the nation as the demand warrants. So it’s the model behind the scenes is not fundamentally much different than how Amazon runs its own FBA network.

Scott Needham:

Yeah, that sounds exactly like that. You must have some pretty big warehouses.

Manish:

We have large and small because Cahoot was always designed to level the playing field. So if you had a warehouse that had 10,000 square feet, we don’t want to exclude that because there is power in numbers. There is a power in working with entrepreneurs, and some of them are absolutely top-notch. I mean, they do phenomenal job. And that’s probably the reason, or one of the very important reasons why Cahoot is able to offer the industry’s highest order fulfillment standards at a lower cost.

Scott Needham:

You know what? You make me feel like the world is just bigger. I just keep learning and just figuring out there’s this whole network going on and I haven’t even been… Keenly aware of it. I don’t know. It means there’s a ton of sellers that need this and then there’s a ton of warehouses that can meet Seller Fulfilled Prime (SFP). That’s not easy. And to make that, to get, like you said, nine different locations across the US and this was happen-

Manish:

It may look daunting to others, but it is business as usual at Cahoot. This is what we do, and we have been doing this for several years and we are the best in class when it comes to that level of accountability. Because I think there’s another big development that you may or may not be familiar with, Scott, is this Amazon Buy with Prime. So this concept of Seller Fulfilled Prime (SFP) is coming to every channel. And if your sellers are not aware, the audience is not aware, I’ve got a really awesome presentation on Buy with Prime and how that is going to affect the consumer expectation on every channel because this whole Seller Fulfilled Prime (SFP), or Prime-like delivery is going to be expected on every channel, on and off Amazon. And there’s a whole presentation, if people are interested, they can check it out on our resource library at www.cahoot.ai.

Scott Needham:

Interesting. So I mean, obviously some of your clients are multichannel, not just Amazon. Sure, there was a few different ways to go with that. What do you think someone that’s brand new, starting out, selling on anywhere, what would their experience be like? This is where I’m actually going to is you talked about accountability and that you, accountability to me means that you kind of need a web portal. You need to be able to see a view of your inventory and receiving and all things that are going on through hopefully what is on your website. Can you run me through that?

Manish:

Yeah, I mean, we have a best in class software. Everything is on the web. So the seller can pretty much access, if you’re familiar, akin to Amazon Seller Central, you know, will log in, you’ll see the movement of your orders. Orders are coming in from all the integrated channels, then your current inventory position at each of the locations where your inventory is currently situated. So you have realtime visibility into that and also realtime visibility into how orders are being picked, packed, and shipped. And additionally, you can also stay on top of the delivery to make sure that the orders are being delivered on time. In fact, we go one step further because we hold the carriers accountable as well. So if the carriers, they miss the SLA or if Cahoot misses the SLA, we like to expose that to our audience, to our sellers. Because for us, it’s a network, which is you are, we are in it together, and therefore it’s very important that we are making that information available so that all parties are holding each other accountable.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkScott Needham:

Love it. That’s awesome. And is there any part of this network? I feel like we’ve covered the very immediate need that a lot of people have. I do think that having an FBM alternative to FBA is good diversity, especially in Q4. What part of what you guys do, do you feel like we haven’t covered yet?

Manish:

Well, one, I think the whole net impact of this innovation is lower cost, higher quality. People think that if you need higher quality, you need to pay more. And Cahoot is turning that on its head that because of this peer-to-peer network, we’re able to lower cost than the traditional options that you may have available. Number two, it’s a myth that FBA is cheaper or cheapest for everything. That is a big myth that is not true. FBA fees have gone up 30% in the last two years, so you should look at your rates today, not two weeks from now, not two months from now. So you would be shocked that FBA is not cheap and certainly not for multichannel fulfillment. So if you’re using FBA to fulfill your website orders or Walmart orders, you should look at that again. And Cahoot is able to offer something very affordable. Besides that, we also have the best in class shipping software, which-

Scott Needham:

Well-

Manish:

So if you have a warehouse… sorry about that.

Scott Needham:

No, you win me over with pricing. Pricing matters. If people were to take a loan, yeah, the interest rate matters. Money is money. So 6% is a higher interest rate than 3%. But in similar, shipping is shipping. Where if you’re paying a dollar extra in one spot versus another, you can’t ignore that over time.

Manish:

And this is the benefit of the network, as you know, is it just keeps getting stronger by the day. And then our goal is to return the additional benefit back to our members, back to our, on both sides of the aisle. So we welcome anybody who is listening, who has a warehouse that is either thinking about utilizing their excess capacity, they should come check us out at www.cahoot.ai, fill out the contact us form, we’ll get in touch. And if you are a seller that is reliant exclusively on FBA, my strong advice to you would be that you should have an option, you should have a backup. It’s just like your computer hard drive. You always want a backup. You don’t want all your eggs in one basket. Even if it is the best basket in the world, you need, you must have a backup to protect your business.

Scott Needham:

In some situations, it’s not the best basket. But I mean, I do love FBA. They’ve kind of created something awesome, but it doesn’t work in every situation, especially the multichannel, like you were saying.

Manish:

And we recognize that, Scott, unlike our competition, that takes probably a hard line. I mean, we support FBA, we support the seller. For us, it’s about supporting the seller. So what’s best for the seller is how we like to empower them and how we like to support them.

Scott Needham:

Awesome. Well, Manish, tell me what is the most important tool that you use that helps you do your business? I mean, I will accept any answer other than Gmail.

Manish:

Well, Scott, we use a number of technologies and tools internally. I mean, the few things that comes to my mind is from a… We use Marketo as our email sales intelligence software. That is-

Scott Needham:

As I understand, Marketo is like, that’s enterprise grade. That’s a pretty robust tool.

Manish:

It is owned by Adobe now. It is a competitor to HubSpot. It is an enterprise grade technology that allows us to communicate with our-

Scott Needham:

I did not expect that. And you might be one of the first people I’ve ever met that’s actually used it. Why is it better than HubSpot?

Manish:

Well, I haven’t done the deep comparison with HubSpot. I think it just plays, I think Marketo existed prior to HubSpot. Certainly it has a very strong integration with salesforce.com, which is our CRM.

Scott Needham:

Okay.

Manish:

And we live in this new world where sales intelligence plays a huge role, that if I’m trying to contact you, what time would be ideal to contact you? Things like that can make or break, let’s say, depending on your routine, you may be a evening person versus somebody else may be a morning person. So if you send the wrong, even if you send the best message at the wrong time, it may not get noticed and things like that. So that’s one of the tools we use.

Scott Needham:

Awesome. Cool. All right. Well Manish, thank you so much. This is a really timely thing. If people want to learn more and maybe get pricing, figure out if this is a solution that works for them, it’s cahoot.ai, right?

Manish:

Yes. www.cahoot.ai. That’s C-A-H-O-O-T.ai. And just fill out the contact us form, and we’ll, a live human will be in touch very quickly.

Scott Needham:

Okay. Awesome. All right. Well thank you, Manish. This is very illuminating. Hopefully everyone, the quantity limits aren’t killing your business too much. They’re a little ugly at times. It’s cost us plenty of money in years past and fought some awkward situations. So figure it out, if you ever have any questions, you could reach out to Manish, you could reach out to me. It’s an interesting thing other than how to get your inventory limits higher? I don’t always know because Amazon’s not very consistent.

Manish:

And there are some tools that I’ve got a nice webinar on how to clean up your account on Amazon so that you make the most of your limits that you already have. So I encourage people to check out the resource library because many times there are many things you could do and you should be doing in order to make the most of the limits you have, rather than letting the limit be underutilized or wasted. So there are things that you could do and you should do.

Scott Needham:

Yep. Awesome. All right, well we’ll wrap up there. Manish, thank you for coming on so much.

Manish:

Scott, thank you for having me.

Scott Needham:

Okay. And to everyone else, have a good Q4. Stay listening. So happy. I’ve been doing this podcast for three years and we’re only getting… I enjoy it. It’s fun. It’s great. Okay, hopefully everyone have a great day. We’ll see you.

Turn Returns Into New Revenue

Amazon FBA Fees to Increase in 2022

In this article

6 minutes

6 minutes

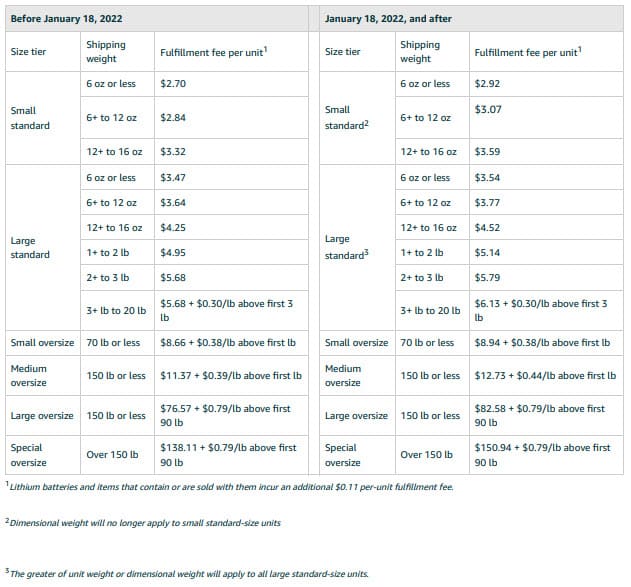

On January 18, 2022, Amazon will increase FBA fees for fulfillment, removal, and disposal. It will then follow up on those changes with increases to storage fees on February 1st, along with a brand-new long-term storage fee that will kick in on inventory sooner than the current 365 days.

Many Amazon FBA sellers struggle with the slim margins imposed by fierce competition, so even seemingly small changes have an outsized impact on a business plan. Read on to make sure that you know exactly how much more you’ll have to pay Amazon in 2022 in FBA fees, and decide whether it’s time to come up with an Amazon FBM backup plan.

How are Amazon FBA Fees Changing in 2022?

Unsurprisingly, Amazon FBA fees in 2022 will increase across the board. All of the biggest categories will see increases – fulfillment fees, storage fees, and removal and disposal. So – what are those changes?

Amazon FBA Fulfillment Fee Changes

Amazon will hit every size tier with a fulfillment fee increase, and percentage increases will range from 2% on the low end to as much as 12% on the high end.

Source: Amazon Seller Central

Notably for many sellers, each of the Small Standard categories will see an increase of 8%. For the smallest items, that will result in a $0.22 increase, and for the larger items in that range, the fee will go up by $0.27. It sounds like a small increase, but sellers know how much even ten cents matters for small, low-margin products. This change will cut already-thin margins and likely force some sellers into the unenviable choice of either dropping part of the product line or raising prices and risking a severe drop in sales.

An Amazon FBA seller on r/FulfillmentByAmazon sums up the dilemma well: “If I was assessed the [2022] FBA fees retroactively for the past 4 months it would average out to a cut of 22.5% at the unit level net profit. All you can do is raise prices, but when Amazon is your competitor, that’s not always possible. Great.”

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyAmazon FBA Storage Fee Changes

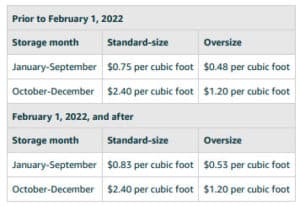

Of course, Amazon isn’t stopping at raising fulfillment fees. They will make two separate changes to FBA Storage Fees – 1) they’ll raise rates and 2) they’ll institute a new, more punishing long-term storage fee.

FBA Storage Fees will increase by $0.08 per cubic foot, or 10.6% on February 1st, 2022. Like the fulfillment fee rate increase, this is a seemingly small change, but given that Amazon FBA sellers are already operating in a cutthroat, low-margin environment, the overall effect of a few small changes to fees can be punishing.

On top of that, Amazon is also tightening their definition of long-term storage. On May 15th, 2022, they will introduce a brand-new “aged inventory surcharge” to units that have been in Amazon’s fulfillment centers for 271 to 365 days. While that time period used to accrue zero additional storage fees, it will now add $1.50 per cubic foot on top of regular storage fees, nearly tripling storage cost.

There’s simply more demand for FBA than Amazon can fulfill, so they’re able to make changes like this to squeeze more out of sellers and cut all but the best sellers out of their network. This is the logical extension of changes like their April 2021 adjustment to FBA inventory limits, which are designed to optimize what inventory sellers place with FBA and punish those who don’t adhere to their ever-stricter standards.

Amazon FBA Removal and Disposal Fee Changes

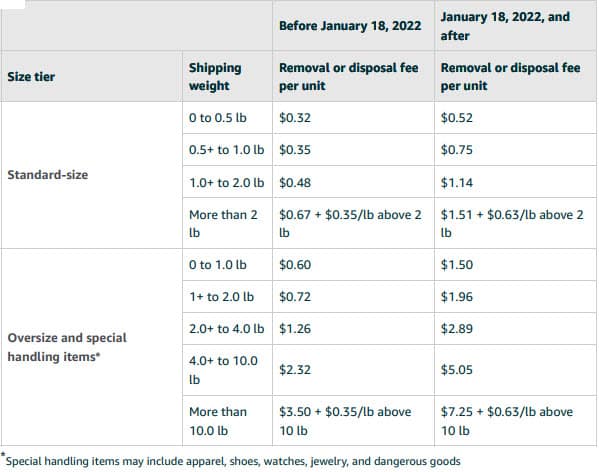

Finally, Amazon is more than doubling the Removal or Disposal Order Fee for most SKUs. Missing on a new product, or getting undercut and outcompeted is about to become a lot more expensive. If you keep trying to sell a struggling product, you’ll face the early kick-in to long-term storage fees as detailed above. If you decide to cut the product, you’ll pay much more per unit.

In fact, every product size except for the smallest will see its Removal or Disposal Order Fee more than double. A SKU between 1-2 lbs, for instance, will increase for $0.35 to $0.75 per unit – a 114% jump.

As mentioned above, this change is aimed squarely at removing all but the fastest-moving SKUs from Amazon FBA. If you’re uncertain about how a new product will perform, or you see existing products getting undercut and pushed out of the Buy Box by cheap competition (or competition from Amazon itself), then you need an efficient Amazon FBM solution to keep selling.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPCahoot’s Alternative to Amazon FBA

Cahoot’s excellent FBA alternative can fully replace FBA or serve as an affordable backup. And it’s much more than that – it’s the most flexible solution in the marketplace and easily integrates and ships orders for every eCommerce sales channel. With our innovative peer-to-peer fulfillment network, multi-channel fulfillment with nationwide 1-day and 2-day delivery is the norm.