Walmart 3PL Success: Why Most 3PLs Don’t Support Walmart Properly (And How to Vet Them)

If you sell on Walmart Marketplace, your 3PL can make or break your growth. Selling on Walmart Marketplace gives you the opportunity to reach millions of customers, expanding your potential audience significantly. The platform is surging, the buyers are trained on fast delivery, and Walmart’s physical stores quietly turbocharge the last mile. Most third-party logistics providers still operate with an “Amazon-only” mindset. That’s why so many Walmart orders get stuck, misrated, or delayed.

Here’s the playbook I use to evaluate a Walmart 3PL, so you get the upside of Walmart Fulfillment Services, cost savings on shipping, and a better customer experience without surprise hidden fees.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWalmart Marketplace Is A Different Animal

Walmart’s Marketplace isn’t a niche anymore. Seller count and volume have accelerated through 2025, with Marketplace Pulse tracking a 30 percent increase in sellers in the first five months alone and a rapid influx of international sellers. Translation, more competition, and a higher bar for fast delivery and customer expectations.

And Walmart keeps leaning into its superpower, stores. The company extended delivery coverage to 12 million more households in 2025 using geospatial routing, letting multiple Walmart stores fulfill a single order. That store network, rebranded as Accelerated Pickup and Delivery (APD), turns physical stores into fulfillment centers for real-time speed. Walmart fulfillment centers and warehouses are strategically located to enable fast delivery and efficient inventory management. These Walmart fulfillment centers and warehouses play a key role in storing products and supporting the fulfillment center network. Effective warehousing and storing inventory are essential for meeting Walmart’s delivery expectations and ensuring accurate, timely order fulfillment.

If your 3PL can’t plug into that ecosystem, or at least align to its service levels, your Walmart orders will lag.

Why Most 3PLs Miss The Mark On Walmart

1. They copy-paste Amazon SOPs. Routing rules, order management systems, and fulfillment process logic often assume Amazon’s cutoffs and zones. Walmart’s promise logic is different, and Walmart fulfillment windows require different carriers, shipping costs math, and cubic foot handling. If your 3PL doesn’t tune templates for Walmart, you eat hidden costs and miss same-day shipping promises. Understanding Walmart’s requirements is essential for 3PL success, as optimizing your supply chain and ensuring compliance are key to smooth operations. When evaluating a third-party logistics (3PL) provider, consider key factors like lead times, return processes, and pricing to ensure efficient order management and customer satisfaction. Choosing the right fulfillment partner can be a game-changer for Walmart sellers, enabling you to deliver products reliably and on time, and taking advantage of advanced 3PL services and technology can further optimize your operations.

2. They don’t model store-adjacent speed. Walmart’s network reduces zones for last-mile lanes. Your 3PL should steer Walmart Marketplace sellers toward regional carriers or local injection that mirrors APD pace, not default to national major carriers every time. Recent data shows Walmart customers leaned heavily into same-day during summer deal weeks, because stores are everywhere. When it comes to delivering orders quickly, fulfillment speed is critical; your 3PL must be capable of delivering orders quickly to meet customer expectations and ensure they are delivered accurately.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFP3. They skip WFS knowledge. Even if you don’t use Walmart Fulfillment Services (WFS), your 3PL should know the program’s fulfillment fees, storage rules, hazmat items policies, and routing guide, because those benchmarks anchor buyer expectations, and they’re often cheaper than you think. As of April–July 2025, Walmart publicized that WFS averages about 15 percent less than “the competition” with clear storage/optional fee tables and peak windows. Testing shipments with your 3PL before full rollout is important for quality and compliance, and helps ensure smooth scaling of your operations.

4. They don’t support Walmart-specific data flows. You need real-time tracking in Seller Center, clean inbound receiving for fulfillment centers, and order processing events that match Walmart’s performance scorecards. A 3PL that can’t expose these events reliably will ding your customer satisfaction and rank. It is also important to promptly mark orders as shipped once they are dispatched, maintaining transparency and trust with your customers.

5. They hide fees. Watch for “Walmart handling” surcharges, unexpected packaging materials fees, and shipping weight upcharges for large cube items. If you can’t audit fulfillment fees per order, you can’t scale. For large or bulk items, having freight options is essential to ensure efficient and cost-effective shipping.

The 12-Point Walmart 3pl Vetting Checklist

1. Native Walmart integration, not a connector-of-a-connector. Test order create, cancel, ship confirm, returns, and real-time tracking.

2. Walmart promises parity. Can they meet WFS-like SLAs on 1 – 2 days to core zip clusters, and do they simulate Walmart’s promise windows before you publish offers?

3. Regional carrier bench. Ask for their on-time performance across Zones 5 – 8 for your top five lanes. If they only quote national carriers, expect higher shipping costs.

4. Store-adjacent injection. Do they support scheduled late pickups or local injection to mirror APD speed near key Walmart stores?

5. Dim and cube handling. Walmart’s heavy and oversize rules differ; ensure cartonization and cubic foot billing are transparent.

6. Peak season plan. Can they surge headcount and dock space for peak season without “capacity caps”? Get last Q4’s throughput.

7. Hazmat and temperature control. If you sell aerosols or meltables, confirm temperature control zones and hazmat credentialing.

8. Returns and reverse logistics. How fast can they receive, grade, and restock?

9. Value-added services. Kitting, relabels, packaging materials swaps, and order management exceptions.

10. Inventory management maturity. Cycle counting, shrink reporting, and slotting tuned for your top SKUs.

11. Transparent pricing. Line-item fulfillment services by pick, pack, dunnage, storage; no “Walmart” surcharge.

12. Case studies on Walmart. Ask for references from marketplace sellers with your weight and cube profile.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkWhen To Mix WFS And A 3PL

WFS is compelling, especially for fast movers that fit the fee table. You still need a third-party logistics partner for multichannel work, oversized items, or SKUs that perform better outside WFS. WFS publishes current pricing, optional services, and routing guides. Use those to set target service levels for your 3PL.

A hybrid model works: let WFS carry your highest-velocity Walmart SKUs, and use a vetted Walmart 3PL for the long tail and multi-channel orders (Shopify, DTC, marketplaces). Walmart has also been investing in seller services and embedded finance to speed payouts, another reason volume is migrating. Your 3PL should be ready to ride that wave, not fight it.

Practical Takeaways

- Treat Walmart like Walmart, not Amazon. Different promise logic, different network, different fulfillment solutions.

- Build a carrier mix that prefers short zones and regional speed.

- Benchmark against WFS fees and SLAs, even if you don’t use them.

- Demand transparency on hidden costs and fulfillment operations.

- Use Walmart’s store network to your advantage; shorter delivery equals happier customers, higher sales, better rank.

Cahoot supports Walmart out of the box: multi-node routing, regional carriers, WFS-aware promise modeling, and transparent order fulfillment costs you can audit down to the SKU.

Frequently Asked Questions

What makes a Walmart 3PL different from an Amazon-only 3PL?

Walmart’s promise logic, store-adjacent fulfillment, and WFS benchmarks require different routing, carrier selection, and service windows. A Walmart-ready 3PL maps to APD coverage and WFS-like SLAs rather than cloning Amazon rules.

Should I use Walmart Fulfillment Services or a 3PL?

Use WFS for fast movers that fit the fee table. Pair a 3PL for oversized items, bundles, and multi-channel work. Many brands run both to balance cost savings, fast delivery, and control.

How fast is Walmart really growing in 2025?

Marketplace seller growth has accelerated through 2025, and Walmart reported strong ecommerce momentum into FY25. That means more competition and higher expectations on speed and price.

What hidden fees should I watch for in Walmart fulfillment?

Look for cartonization upcharges, “Walmart handling” adders, hazmat surcharges, peak storage, and mis-billed shipping weight on large cube items. Compare against WFS’s public rate card to catch anomalies.

How does Cahoot help Walmart Marketplace sellers?

We tune routing to Walmart’s speed map, leverage regional carriers to shorten zones, expose granular cost lines, and support hybrid WFS + 3PL strategies so you can fulfill orders faster, at lower total cost.

Turn Returns Into New Revenue

“Trade Enforcement” Crackdown: New Rules that Could Kill Your Ecommerce Business

In this article

11 minutes

11 minutes

- Why The Pressure Is Rising (And Why Ecommerce Feels It First)

- The Five Most Common Potholes I See In 2025 (And How They Escalate)

- What Actually Happens When You’re Flagged (Beyond The Fine Print)

- DDP: Keep It, Fix It, Or Sunset It?

- The Practical Compliance Stack (What High-Performing Merchants Are Already Doing)

- The Omnichannel Wrinkle Most Teams Miss

- Logistics Strategy As A Compliance Strategy

- A 30-Day Sprint To De-Risk (Without Pausing Growth)

- The Mindset Shift That Separates Survivors From Strugglers

- Frequently Asked Questions

Trade rules used to be a background task. In 2025, they’re a front-of-house risk. Customs is asking harder questions. Penalties are steeper. And the playbook that worked when duties were low and parcel flows were lightly scrutinized? That playbook is retired.

I’m speaking as a logistics operator who works with ecommerce brands every day. The short version: enforcement is up, tolerance for “close enough” is down, and the burden of proof sits squarely with importers and their vendors. Let’s review how tariff policy, country-of-origin rules, DDP flows, and forced-labor screening converge, and what smart teams are doing now to reduce risk without slowing growth.

Why The Pressure Is Rising (And Why Ecommerce Feels It First)

Multiple forces are pushing enforcement to the top of the agenda this year:

- Tariff exposure is higher. Broader and/or higher duties increase the incentive to under-value or misclassify, and regulators respond by tightening audits, detentions, and penalties.

- Country-of-origin (COO) is decisive. Origin dictates duty rate and eligibility under trade programs. Transshipment and “last-touch” assembly to disguise origin are specific enforcement targets.

- De minimis scrutiny is real. Small parcels are no longer invisible; regulators are watching for patterns that look like duty avoidance through under-valuation or routing.

- Forced-labor rules (e.g., UFLPA) bite. If CBP suspects a link to forced labor in the supply chain, they can detain shipments until you prove otherwise. For seasonal brands, a multi-week detention can be fatal to margin and cash flow.

- Data analytics at the border. Customs systems flag anomalies: repeated “just under” values, implausible tariff codes for the product type, and IORs with inconsistent histories.

For ecommerce, the pain shows up faster: detention of a few containers, a batch of small parcels flagged, or a post-entry demand for duties/penalties can erase a quarter’s profit. Even if you clear it up, the operational whiplash (stockouts, customer delays, returns surge) lingers.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyThe Five Most Common Potholes I See In 2025 (And How They Escalate)

1) Misclassification (the wrong HTS code)

It often starts innocently, copying a competitor’s code, reusing a legacy code, or “choosing the lower rate” when two codes seem plausible. When the rate delta is large, auditors assume motive.

How it escalates: Repeated misclassification can trigger penalties, prior-entry reviews, or a full audit. In worst cases, it becomes a False Claims Act issue (government alleging underpayment of duties over time).

What to do instead: Build a defensible classification file for each SKU: product specs, composition, function, classification logic, and ruling references. Require supplier spec sheets. Re-review codes when products change materials or features.

2) Undervaluation (declaring less than the true transaction value)

Under pressure, some suppliers propose “commercial” and “customs” invoices with different values, or omit “assists” (molds, artwork, free components you provide) from valuation.

How it escalates: If discovered, CBP (Customs and Border Protection) can assess duties on the real value plus penalties and interest. Repeat issues risk referral to the DOJ or civil False Claims Act (FCA) action. Banks and marketplaces also get spooked by headline violations.

What to do instead: Document the full consideration paid for the goods and include assists where applicable. Align finance, procurement, and logistics so the customs value precisely matches your books.

3) Country-of-origin errors (and transshipment)

Relabeling or “light assembly” in a third country doesn’t necessarily change origin. If the COO is wrong, the duty rate and program eligibility are wrong.

How it escalates: CBP can detain, demand proof of substantial transformation, and assess back duties. If they see intent, penalties rise.

What to do instead: Map your product’s transformation steps. Keep supplier affidavits and manufacturing records. When in doubt, ask a broker or attorney for a written origin determination.

4) DDP flows with opaque importers of record

Delivered Duty Paid (DDP) makes for a frictionless customer experience, but introduces blind spots. If a logistics intermediary is the Importer of Record (IOR) for many small parcels, you need to know exactly how they declare value, classification, and origin.

How it escalates: If the IOR under-declares or uses suspect codes, your parcels get detained or returned. Even if the IOR is legally liable, your brand takes the hit with customers and marketplaces.

What to do instead: Demand transparency from any DDP partner: who is IOR, what values/codes are used, and how compliance is monitored. Consider shifting to bulk import as your IOR (pay duties cleanly once), then fulfill domestically for speed and predictability.

5) Forced-labor concerns (UFLPA and beyond)

If any component is suspected of being made with forced labor, CBP can detain it. The hard part: the presumption flips, you must prove your goods are clean.

How it escalates: Weeks of detention, missed sales windows, and, in some cases, denial of entry. Apparel, textiles, electronics accessories, and categories with cotton or polysilicon content are frequent targets.

What to do instead: Collect supplier attestations and traceability data down to raw materials where feasible. Maintain a dossier you can furnish quickly if asked (bills of materials, chain of custody, and audit summaries).

What Actually Happens When You’re Flagged (Beyond The Fine Print)

Let’s demystify the play-by-play:

- Administrative delay: CBP requests information or issues a detention notice. Meanwhile, inventory is stuck.

- Clock starts: You provide documents within a short window. If you scramble for proof, your ops team scrambles too.

- CBP decision: Release, rework, re-export, or seizure, plus potential duty adjustments.

- After-action: Even if released, your IOR is put on a watch list; future entries see more scrutiny.

- Financial echo: Freight sits longer (demurrage/detention), promotions slip, cancellations rise. Your returns team gets slammed weeks later.

The tangible cost is bigger than the duty bill: missed velocity, customer trust, and internal time. That’s why prevention wins the ROI contest every time.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPDDP: Keep It, Fix It, Or Sunset It?

DDP shines for CX: no surprise charges, faster door-to-door. The problem isn’t DDP itself; it’s opaque DDP. If you can’t audit the IOR’s declarations, you’re borrowing risk at high interest.

Decision framework:

- Keep DDP if you can fully audit values, codes, and COO, and your categories are low-risk.

- Fix DDP by moving IOR to your entity (or a transparent partner), with your codes and values, and pre-agreed documentation standards.

- Sunset DDP for high-risk lines and import in bulk to U.S. facilities you control; ship domestically for reliability.

A lot of brands are landing on a hybrid: DDP for low-risk SKUs and bulk import for everything seasonal or compliance-sensitive.

The Practical Compliance Stack (What High-Performing Merchants Are Already Doing)

Think of this as your operating system for 2025. It’s not glamorous, but it’s how you keep selling when others get sidelined.

1) Governance: make someone the owner

Assign a trade compliance owner, often in ops or finance, with authority to set policy and say “no” when shortcuts are proposed. Publish a one-page policy: classification rules, valuation requirements (including assists), COO standards, and who can approve exceptions.

2) Product data discipline

Create (and maintain) a spec file for each SKU: materials, function, key dimensions, use case. Tie that to your HTS justification, COO evidence, and any rulings or broker memos. When product changes, the spec and code get reviewed. No exceptions.

3) Broker and partner alignment

Choose brokers who explain their reasoning and document it. Ask your freight forwarders and parcel partners how they monitor compliance. If anyone suggests “we can lower your duty with a different code,” you’ve found a weak link.

4) Documentation muscle

Keep clean records for five years: invoices, packing lists, purchase orders, payment proofs, supplier declarations, bills of lading, and correspondence. For UFLPA-sensitive goods, maintain traceability artifacts up front instead of chasing them later.

5) Internal controls and audit rhythm

Implement a pre-filing review on risky entries (new SKUs, new suppliers, tariff-sensitive lines). Run a quarterly mini-audit: sample 20 – 50 entries, verify codes/values/COO, and fix upstream root causes. Audit findings go to leadership, not to shame, but to fund fixes.

6) Sourcing strategy that respects reality

If duty rates spike on a core line, don’t just tweak codes; re-evaluate sourcing. Consider nearshoring or alternate suppliers with a cleaner COO and better documentation habits. Build that analysis into your gross margin planning, not as a last-minute emergency.

7) Plan for the worst (because it’s cheaper than the worst)

Draft a detention playbook: who compiles documents, what proof you provide for value/COO, what you’ll concede quickly to get goods released, and when you escalate to counsel. When hours matter, the team needs a script.

8) When to call a lawyer (and when to self-disclose)

If you discover past underpayments or suspect a systemic error, consider a voluntary disclosure through counsel. Penalties can be substantially reduced when you come forward first. This is not a sign of weakness; it’s how sophisticated companies fix problems before they become catastrophes.

The Omnichannel Wrinkle Most Teams Miss

Marketplace rules are converging with trade enforcement. Some platforms increasingly require accurate COO disclosure and will suspend listings that appear non-compliant. Meanwhile, retailers (B2B) push import reps and origin attestations into vendor standards. Translation: your sales channels are becoming compliance checkpoints. If you centralize product truth (specs, codes, COO, compliance docs), you’ll satisfy both customs and channels, and you’ll do it once.

Logistics Strategy As A Compliance Strategy

How you fulfill orders can raise or lower risk:

- Bulk import + domestic fulfillment reduces customs touchpoints and concentrates documentation into fewer entries you can control and defend. It also stabilizes lead times and avoids consumer-facing customs delays.

- Distributed inventory (multiple U.S. nodes) shortens zones and speeds delivery, but requires tighter inventory control and returns routing. Make sure your WMS/3PL can track lots/serials if you need that for audits.

- Returns processing should include basic QC and disposition rules. If you re-export returns or do cross-border returns, align those flows with customs filings to avoid mismatches.

Light Cahoot note: in our network work, we see brands move from risky DDP to bulk import with domestic 1 – 2 day coverage. It’s not just a shipping speed upgrade; it’s a compliance posture upgrade. You consolidate exposure, standardize documentation, and get predictable operations for peak.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkA 30-Day Sprint To De-Risk (Without Pausing Growth)

You don’t need a six-month overhaul to be safer by next month. Here’s a pragmatic sprint:

Week 1: Map the risk

- List the top 50 SKUs by revenue. Confirm codes, COO, and values.

- Flag sensitive materials (cotton, polysilicon) and high-duty categories.

- Identify DDP lanes and who is the IOR.

Week 2: Fix the easy stuff

- Correct obvious misclassifications; document logic.

- Update invoices to include assists where missing.

- Get supplier origin attestations for flagged SKUs.

Week 3: Partner alignment

- Brief your broker and forwarder on your policy; ask for their ideas.

- If DDP is opaque, demand transparency or begin shifting those SKUs to bulk import.

Week 4: Institutionalize

- Publish your one-pager compliance policy and assign an owner.

- Schedule the quarterly mini-audit and a tabletop “detention drill.”

- Add compliance checkpoints to your new product introduction (NPI) process.

You’ll come out with cleaner data, aligned partners, and a plan if a shipment gets flagged. That’s real insurance you can feel.

The Mindset Shift That Separates Survivors From Strugglers

The winners don’t treat customs as a form to fill; they treat it as an operating capability. They build product truth, choose partners who document, and rehearse the bad days so they aren’t bad for long. They also use trade reality to make better business calls, where to source, what to price, and which SKUs deserve expansion.

And they don’t wait for a notice of action to get with the program. They act now because the cheapest time to fix compliance is before anyone asks.

Frequently Asked Questions

What is driving the increase in trade enforcement in 2025?

Rising geopolitical tensions, tariff disputes, and renewed focus on supply chain transparency have prompted regulators to increase enforcement actions. Agencies are targeting misclassification, false country-of-origin labeling, and duty evasion more aggressively.

Which violations are ecommerce sellers most at risk for?

Common pitfalls include incorrect HTS codes, undervaluing shipments to avoid duties, failing to update country-of-origin information, and ignoring new tariff requirements. Even small oversights can trigger fines or shipment seizures.

How can ecommerce brands reduce compliance risk?

Maintain accurate product data, regularly review tariff classifications, and ensure all suppliers follow current labeling and documentation requirements. Investing in compliance audits and training can help prevent costly mistakes.

What happens if a shipment is found non-compliant?

Consequences range from delayed deliveries and financial penalties to the loss of import privileges. In severe cases, businesses can face reputational damage and long-term operational disruptions.

How does Cahoot help sellers stay compliant?

While Cahoot does not act as a customs broker, its fulfillment network and technology are built to support sellers’ compliance needs, including accurate order data, transparent shipping documentation, and partnerships with trusted logistics providers. Our network of freight forwarders are all experts and can consult with sellers one-on-one to clarify any questions they may have.

Turn Returns Into New Revenue

Flexport’s $5,000 Monthly Minimum: What It Really Means and How to Respond

In this article

6 minutes

6 minutes

- What Changed (And Why Timing Matters)

- Who’s Most Affected

- Why Flexport Would Make This Move (The Business Logic)

- The Part Nobody Says Out Loud: Indecision Is The Most Expensive Option

- How To Decide: A Quick Financial Model That Actually Helps

- What To Look For In A Modern Fulfillment Partner (A Practical Checklist)

- Migration Without The Mayhem (A Realistic 30/60/90)

- The Bigger Strategic Takeaway

- Bottom Line

- Frequently Asked Questions

Flexport’s shock move to a $5,000 monthly minimum fee has me, and a lot of ecommerce folks, doing double takes. When a fulfillment partner suddenly wants five grand a month just to play ball, you know something big is up. Is it a cash grab, a pivot to enterprise clients, or a bit of both? All I know is it’s making small and mid-sized sellers very nervous, right on the cusp of peak season. Let’s connect the dots on why the change is happening, who’s affected, and how to make a smart, low-risk pivot if it’s time to move.

What Changed (And Why Timing Matters)

Flexport previously introduced a lower monthly minimum ($500 that went into effect in July 2025); now the new floor is $5,000 per month starting in 2026. The practical effect: if total eligible fulfillment charges don’t hit $5K in a given month, the account pays the difference. For high-volume programs, this is noise. For long-tail or seasonal brands, it’s a budget line item that can overshadow margins, particularly in shoulder months before and after peak.

The timing matters. Q4 is when nobody wants to switch warehouses, yet Q1 is when many realize they can’t carry a $5K retainer through softer months. The risk isn’t just cost, it’s opportunity cost: funds tied up in minimums aren’t available for ad spend, inventory buys, or conversion optimization that actually drives growth.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWho’s Most Affected

This policy naturally favors enterprise and upper mid-market sellers with steady, diversified volume. Brands below that line face three predictable issues:

- Spend variability. Even healthy DTC brands can dip below thresholds off-peak. Paying to “top up” an invoice for unused capacity is hard to justify.

- Single-channel exposure. If most orders ride one channel (e.g., pure DTC), any seasonal dip increases the odds of missing the minimum.

- Complexity premiums. Niche products (oversize, hazmat, kitting) can already carry handling premiums; layering a high monthly minimum increases effective cost per order further.

In short: if your monthly spend frequently sits under $5K, the policy isn’t just a price, it’s a filter. Flexport is concentrating resources on larger programs that keep buildings and teams fully utilized.

Why Flexport Would Make This Move (The Business Logic)

Running a national fulfillment network is capital-intensive. Labor volatility, real estate costs, inventory carrying friction, and parcel rate dynamics put pressure on contribution margins. High minimums guarantee a revenue floor, simplify capacity planning, and prioritize “dense” accounts with smoother demand curves. There’s also a quality-of-service argument: fewer small accounts can mean more focus per large account, which can raise service consistency metrics that enterprises care about.

Zooming out, this aligns with a broader industry trend: many logistics providers are rationalizing their account portfolios, fewer logos, deeper relationships, tighter SLAs, better unit economics. It’s not inherently anti-small-business; it’s a statement about fit.

The Part Nobody Says Out Loud: Indecision Is The Most Expensive Option

Brands often wait until fees hit the P&L to explore alternatives. That delay compresses transition timelines and raises migration risk during high-velocity periods. A better approach is a two-lane plan:

- Lane A: Renegotiate or right-size with your current provider (if your growth path will soon exceed $5K consistently).

- Lane B: Stage a low-risk migration path now (parallel onboarding, dark launch, and ramp) so you’re not forced into a rushed move when an invoice surprises you.

Treat this as optionality engineering. You’re buying a real option to change providers without disrupting peak.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPHow To Decide: A Quick Financial Model That Actually Helps

Skip generic “compare pick/pack fees” spreadsheets. Build a simple model around the effective cost per shipped order across months:

- Inputs: projected monthly order count, average lines per order, weight/zone mix, storage needs, returns rate, value-added services (kitting, FBA prep, labeling), and expected surge weeks.

- Add provider terms: minimums (if any), onboarding fees, per-SKU fees, project work, storage tiers, and long-term storage thresholds.

- Output: blended cost per order by month, then a rolling 12-month view.

If the curve spikes in low months because of a high minimum, you have a structural mismatch. If a prospective partner shows a smoother curve, even if some unit rates are higher, that stability is often worth more than chasing the lowest headline fee.

What To Look For In A Modern Fulfillment Partner (A Practical Checklist)

Use this as your RFP backbone and internal scorecard:

- Network fit: Facilities where your customers are. Can they reach 95%+ of orders in 2 days with sane parcel spend?

- Peak playbook: Documented surge staffing, cutoffs, capacity reservations, blackout dates, and comms cadence. Ask for their last peak postmortem.

- Omnichannel readiness: Shopify/Commerce (Formerly BigCommerce) + marketplaces (Amazon, Walmart, Target, TikTok Shop), retail EDI, wholesale/B2B, and basic FBA prep capability.

- Returns & exchanges: Prepaid flows, disposition rules, refurbishment, grading photos, automated refunds/credit rules.

- SLA clarity: Receiving, pick/pack cutoffs, same-day rate, weekend ops, accuracy guarantees, and what credits actually apply if they miss.

- Billing transparency: Line-item detail and self-serve reporting so finance isn’t decoding mystery charges at month’s end.

- Data & visibility: Order status, inventory aging, serial/lot support, backorder handling, and webhooks for your downstream systems.

- Integration effort: Native connectors and implementation timeline. Weeks, not months, is realistic for most DTC stacks if the provider is organized.

- Change management: Dedicated onboarding PM, sample test plan, SKU audit, packaging standards, and go-live rollback plan.

- Cultural fit: How they escalate issues, how often they proactively communicate, and whether leadership shows up when it counts.

Light Cahoot note: Cahoot operates a collaborative network model focused on fast, affordable DTC fulfillment and omnichannel support. Sellers we work with often care most about nationwide 2-day coverage, reliable peak performance, transparent billing, and a straightforward and quick onboarding path. If you’re evaluating options, those are useful criteria, regardless of which partner you pick.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkMigration Without The Mayhem (A Realistic 30/60/90)

Days 0–30: Plan

- Freeze the SKU list (rationalize variants, confirm barcodes, set carton & case specs).

- Export the order/inventory history you need for demand planning and slotting.

- Lock packaging standards (mailers vs. cartons, dunnage, sustainability requirements).

- Schedule sandbox connections and a sample order test plan.

Days 31–60: Parallelize

- Ship seed inventory to 1–2 nodes; run dark orders (live picks that don’t ship) to test SLAs and WMS events.

- Turn on 5–10% of live traffic for a clearly labeled subset (e.g., West Coast orders <3 lbs).

- Run daily scorecards: receiving time, pick accuracy, scan compliance, carrier performance, support responsiveness.

Days 61–90: Ramp

- Shift 50–80% of traffic. Keep some volume with the legacy provider as a safety valve through the first cycle of returns.

- Migrate remaining nodes/regions.

- Conduct a post-go-live review and lock Q4 surge capacity in writing (dates, volumes, incentives).

This staggered approach lowers risk and gives you real performance data before you bet the brand on a new setup.

The Bigger Strategic Takeaway

Flexport’s $5,000 minimum isn’t an indictment of small brands; it’s a portfolio strategy decision. For many sellers, it’s the nudge to step back and ask: Is my fulfillment model aligned with how my business actually grows? If you’re subsidizing unused capacity to hit a line on an invoice, it’s a mismatch. If you’re locked into a footprint that doesn’t match your demand map, it’s a mismatch. You get the idea.

Use this moment to build a fulfillment stack that earns its keep every month, transparent, resilient, scalable, and tied to outcomes you can measure: faster delivery, higher conversion, lower WISMO, fewer cancellations, better post-purchase NPS, and cleaner financials. If Flexport’s new structure fits that vision for you, great. If not, now you’ve got a plan to move, thoughtfully, not frantically.

Bottom Line

This policy sets a high bar. Some brands clear it; many won’t. What matters is not reacting with frustration but responding with structure: model the costs honestly, pressure-test alternatives, and stage a migration path that protects Q4 while setting you up for a steadier 2026. The logistics market is big. There’s room to find the right fit, and to make fulfillment a strategic advantage, not a fixed cost you have to explain every month.

Frequently Asked Questions

Why did Flexport raise its monthly minimum fee to $5,000?

Flexport has not publicly detailed the exact reasoning, but industry watchers speculate the move aligns with a strategic shift toward larger, higher-volume clients that can meet the new threshold consistently. It may also be aimed at improving profitability and operational efficiency as fulfillment costs rise.

Who will be most affected by the $5,000 minimum fee?

Small and mid-sized ecommerce brands that don’t generate enough volume to justify the new fee will feel the most impact. Many of these sellers will now explore alternative fulfillment solutions ahead of peak season to avoid margin erosion.

What should sellers consider before switching from Flexport?

Evaluate potential fulfillment partners on cost structure, geographic network coverage, service level agreements, technology integrations, and scalability. Sellers should also consider the provider’s track record with on-time delivery, returns handling, and peak season performance.

Could this signal a trend among other fulfillment providers?

While most providers have not announced such steep minimum fee hikes, the move could prompt competitors to reevaluate pricing models, especially if labor, real estate, and transportation costs continue to climb.

Can Cahoot help sellers affected by Flexport’s new policy?

Cahoot works with brands of all sizes to create flexible, cost-efficient fulfillment strategies. While every seller’s needs differ, Cahoot’s distributed network model often provides competitive alternatives for those no longer a fit for Flexport’s pricing.

Turn Returns Into New Revenue

How to Manage USPS Peak Season 2025 Rate Hikes and Protect Margins

In this article

10 minutes

10 minutes

Brace yourselves, USPS is doing it again with a holiday “temporary” rate hike for shipping. As an ecommerce operator, you’ve probably learned to bake these annual USPS surcharges into your peak season planning (even if they still sting). For USPS Peak Season 2025, the Postal Service will levy extra charges on most package shipping services from October 5, 2025 through January 18, 2026 (pending Postal Regulatory Commission approval). That means for the entirety of Q4 and the early January return season, you’ll be paying more for USPS Priority Mail, Priority Mail Express, USPS Ground Advantage, and Parcel Select packages. How much more? On average, about 4% – 6% more per package, according to USPS, roughly a 5.1% surcharge on Ground Advantage and 4.1% on Priority Mail shipments. In practice, the surcharges are flat dollar amounts by weight and zone. A lightweight local package might only cost an extra $0.30 to $0.40 (for commercial vs. retail customers), but a heavier box going cross-country could see around a $6 – $7 hike. And if you’re shipping big stuff via Priority Mail Express, brace for up to a $16 increase on the heaviest long-distance parcels. In short, every domestic parcel shipped with the Postal Service during the holidays will cost more, with the exact pain determined by package weight and distance.

USPS isn’t doing this just for fun; they have their reasons (even if we don’t love it). The Postal Service says the temporary price change is needed to cover extra handling costs and to keep its rates in line with private competitors during the holiday surge. Essentially, UPS and FedEx slap peak surcharges on shippers each year, and USPS doesn’t want to leave money on the table. In the USPS press release, they explicitly stated that this peak pricing aligns with “competitive practices” and is part of their Delivering for America plan to restore financial stability. And boy, does USPS need the money; they reported a $3.1 billion loss in the quarter leading up to this announcement. Rising costs and lower mail volumes have put them deep in the red, so hiking package rates is one way to claw back revenue. It’s worth noting that these holiday surcharges have become a yearly tradition since 2020 (with a brief pause in 2023). Even though USPS calls them “temporary,” often some of that increase sticks around or gets baked into the next general rate increase. As a longtime fulfillment provider, I’ve seen those postage costs ratchet up year after year. So while USPS wants a successful peak season operationally, they also want to make sure we shippers are sharing the burden of all those extra trucks, overtime hours, and elf hats (okay, maybe not the hats) that come with the holidays.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyImpact on Ecommerce Sellers and Shippers

So, what does this mean for those of us sending out tons of packages during the holidays? In a nutshell: higher shipping costs and tighter margins. If you offer “free shipping” to customers, these surcharges eat directly into your profit per order. For example, if you normally spend $8 to ship a medium parcel and now it’s $9, that dollar is coming out of your bottom line unless you adjust prices. For merchants who charge customers for shipping, there’s a decision to make: do you raise your rates at checkout to pass on these extra fees? You might have to, especially on heavy items where an extra $5 – $7 is non-trivial. The challenge is doing so without scaring off potential customers. Holiday shoppers are price-sensitive, and a sudden jump in shipping costs could lead to cart abandonment. It’s a delicate balance.

Marketplace sellers face an extra wrinkle: platforms like eBay and Etsy charge their commission (final value fee) on the total transaction, including shipping. That means whenever USPS raises shipping rates, marketplaces get an automatic fee boost from your higher shipping charge. Ouch. It’s like a tax on top of a tax. For eBay sales, I know that a $0.50 postage increase might only marginally affect buyers, but it will also slightly increase the fee eBay takes. Multiply that across hundreds of orders, and it adds up. Postal Service surcharges can also influence shipping strategy. Some sellers might shift more volume to UPS or FedEx if those carriers turn out cheaper for certain weights, though keep in mind UPS and FedEx have their own peak surcharges (often targeted at large volume shippers or oversized packages) rather than a blanket increase on all parcels. So definitely compare rates on a case-by-case basis. Sometimes USPS will still be the most cost-effective even with the surcharge, especially for light packages and/or short distances. But for heavy boxes or Zone 8 shipments, UPS Ground might beat USPS Ground Advantage this year, depending on negotiated rates.

One often overlooked impact: package weight and dimensions optimization. With these flat surcharges kicking in at weight breakpoints, it’s a good reminder to optimize packaging. If you can reduce a package’s weight below 11 lbs (where a big jump occurs) or keep it in a lower zone by shipping from a closer warehouse, you should. For instance, the surcharge for a Ground Advantage package 0 – 3 lbs going far (Zones 5 – 9) is $0.50, but 4 – 10 lbs is $1.00. That’s double. If you can shave a pound or two off through smarter packing or split shipments by region to use nearer fulfillment centers, you can save that $0.50 per package. Over thousands of orders, it matters. This is where having a fulfillment partner like Cahoot with a nationwide network helps; you can forward-position inventory so that most customers are in Zones 1 – 4, where surcharges are much lower (e.g., $0.40 instead of $0.90 for a small parcel). It’s a strategy of “ship shorter distances” to mitigate costs. And you can quickly scale outsourced fulfillment up or down to match your real-time demand.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPStrategies to Mitigate the Surcharge Surge

We can’t avoid the USPS hikes, but we can get creative to lessen the impact. Here are a few tactics either we (Cahoot) or our clients are using and recommending this peak season:

- Plan Pricing and Promotions Thoughtfully: Knowing shipping will cost more, consider adjusting your pricing or promo strategy. This might mean raising product prices a tad or setting a higher free shipping threshold to cover the difference. Alternatively, you could run a holiday sale on items but make it conditional on buying two or more units, that way you get more revenue per shipment (and effectively dilute the shipping cost per item).

- Use Multiple Carriers: Rate-shop every order through your shipping software. If UPS or FedEx can deliver a package cheaper (accounting for their surcharges too), use them. USPS is often best for small parcels, but as weight increases, the calculus can change. Having all three major carriers enabled offers flexibility. And don’t forget regional carriers; they sometimes don’t add surcharges or have lower base rates for nearby zones.

- Optimize Packing: This is a great time to review packaging. Can you use a smaller box or poly mailer to reduce dimensional weight? Can you remove unnecessary packing weight (without compromising product safety)? Even a few ounces off might keep you in a lower weight tier for the surcharge. Also, if you sell bundles, see if splitting into two lighter shipments (to avoid a heavy surcharge band) makes sense cost-wise, or vice versa, combining items to ship fewer packages.

- Leverage Fulfillment Centers in Strategic Locations: As mentioned, if you have the capability to ship from multiple warehouses, do it. The shorter the distance a package travels, the lower the zone and usually the lower the surcharge. My company Cahoot, for instance, places inventory in different regions, so an order to California ships from our West Coast node, arriving faster and incurring, say, a Zone 2 or 3 surcharge (just cents) instead of Zone 8 ($$$). If you’re FBA-only, you can’t control from which warehouse Amazon ships each order, but for your own site orders or Seller Fulfilled Prime, consider a fulfillment partner or 3PL network to distribute inventory.

- Communicate with Customers: This might not reduce costs, but it can preserve trust. If you do have to increase shipping fees or product prices due to carrier rates, be transparent. Customers remember how a company handles things during the crunch. A small note like “Due to seasonal USPS postage increases, our shipping rates will be slightly higher from Oct–Jan” can help manage expectations. Some sellers even encourage customers to order before a certain date to “beat the holiday shipping rush,” indirectly getting them to purchase early, before surcharges kick in on October 5.

Lastly, don’t forget that these surcharges will end (at least this round). Come mid-January, rates should revert to normal (or whatever the new normal is after any general increases). I always mark my calendar for the end date so I can monitor the new state of things. But I won’t be shocked if USPS announces that, say, certain “temporary” increases will roll into a permanent rate hike soon after. It’s happened before. The Postal Service knows that once we adjust to paying a bit more, we barely notice when it becomes the new baseline. Cynicism aside, the best approach is to adapt and control what we can. By optimizing our shipping processes and maybe tightening our belt elsewhere during peak, we can absorb this hit. After all, everyone is facing the same USPS surcharges, so in a way it’s a level playing field. If you manage them smarter than the next guy, that becomes a competitive advantage.

Bottom Line

The USPS peak season rate hike is a headache, but it’s not a show-stopper. As a shipper, treat it as a cost of doing holiday business and use it as motivation to streamline everything you can. And when you see those mail trucks hauling away your piles of Q4 orders, it’s okay to grumble a little about the extra fees, but then get back to work making sure your customers get their packages on time. Happy (expensive) holidays!

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkFrequently Asked Questions

When will the USPS peak season 2025 temporary price change take effect?

The Postal Service will apply temporary price changes from October 5, 2025, through January 18, 2026, pending Postal Regulatory Commission review, affecting multiple package shipping services.

Which USPS services are affected by the 2025 peak season rate hikes?

Priority Mail, Priority Mail Express, USPS Ground Advantage, and Parcel Select will all see surcharges, impacting commercial domestic competitive parcels and package services by weight and zone.

Why is the Postal Service raising rates for peak season 2025?

USPS says the temporary price change is needed to cover extra handling costs during high-volume periods and to keep rates in line with competitive practices used by other major carriers.

How much will USPS peak season 2025 surcharges cost shippers?

Surcharges range from around $0.30 for lightweight local USPS Ground Advantage parcels to as much as $16 for heavy Priority Mail Express shipments traveling long distances.

How can ecommerce sellers reduce the impact of USPS peak season rate hikes?

Sellers can optimize package weight, forward-position inventory to lower zones, use multiple carriers for package shipping services, and adjust pricing to cover extra handling costs while maintaining a successful peak season.

Turn Returns Into New Revenue

Tips for Combatting Higher Ground Shipping & Delivery Costs

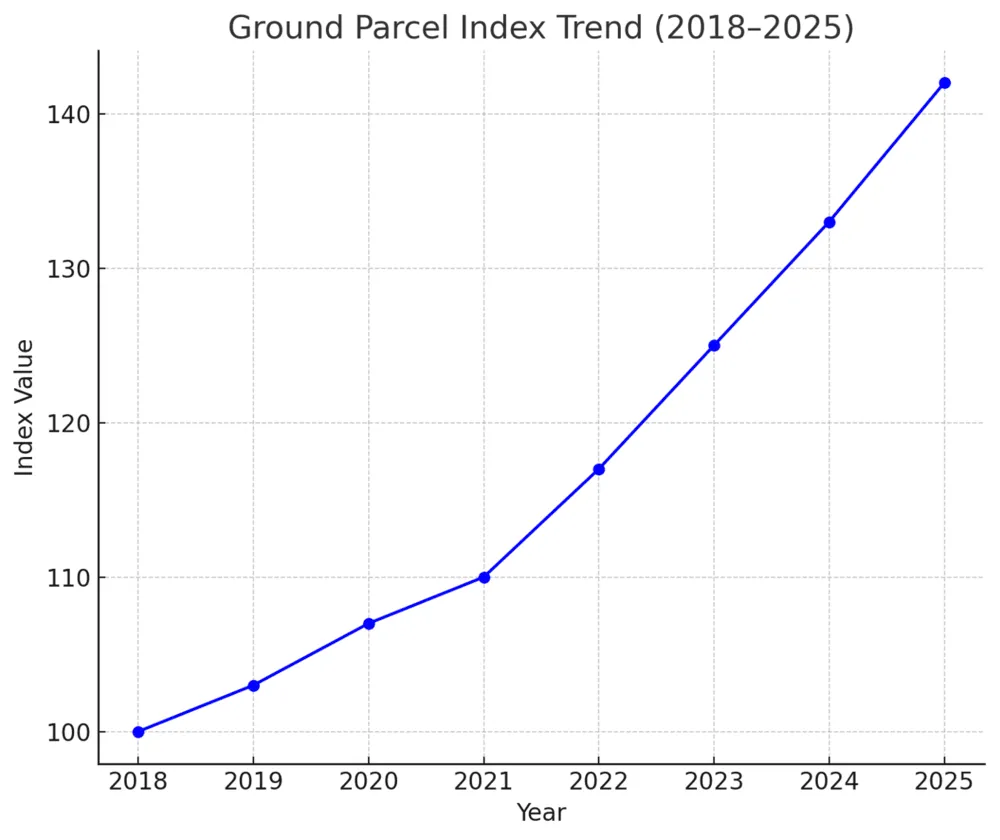

Let me say it plainly: Ground shipping is no longer cheap. Not in 2025. The economy-tier services ecommerce brands relied on to keep costs down are rising faster than any other mode. And the kicker? You probably didn’t notice because they rose quietly. Just a few cents here, a new surcharge there. But it’s compounding…fast.

According to the latest TD Cowen/AFS Freight Index, economy ground parcel rates rose nearly 7.5% year-over-year in Q2 2025. That’s faster than air. Faster than LTL. And definitely faster than most brands can react.

Also, ground parcel rates hit 32% above the January 2018 baseline in Q2, an all-time high, even though average diesel prices fell. That tells you rate increases aren’t tied to fuel, they’re strategic margin plays.

Why is ground shipping getting more expensive?

FedEx and UPS aren’t running charities. In 2025, both carriers quietly inflated their accessorial fees, extended delivery-area surcharges (DAS), and repriced how they interpret “residential” addresses.

UPS, for example, now applies a Remote Area Surcharge to 15% more ZIP codes than in 2024. Combine that with the standard rate increases, and you’re looking at a 10–15% total effective increase for some DTC brands shipping to suburbs.

What’s driving it?

- FedEx’s network restructuring under its “Network 2.0” initiative

- UPS’s post-Teamsters contract cost recovery

- Fewer economy packages post-COVID peak = lower density = higher per-package costs

- Carriers are padding revenue per stop while demand softens

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyThe Hidden Cost Curve: What the Data Tells Us

The logistics world has been quietly boiling, and most ecommerce operators don’t even realize how cooked they are until the Q4 freight invoices hit like a hammer. That’s why I wanted to step back and show what’s really going on with ground shipping costs, both over time and across weight and zone variables.

When you zoom out, the real story isn’t just one rate hike or another DAS update; it’s the slow, compounding weight of cost acceleration over time. That’s why we analyzed both the long-term parcel index trend and current 2025 rate tables from UPS and FedEx to show what’s happening beneath the surface.

Ground Parcel Index Trend (2018–2025): The Slow Burn That’s Now a Blaze

First, we charted the TD Cowen/AFS Ground Parcel Index from 2018 to 2025. This isn’t just any index; it’s an aggregated pulse check on ground parcel shipping costs across major carriers (UPS, FedEx, and USPS), normalized for inflation, fuel surcharges, and accessorial fees.

If you look at the trendline, you’ll see a gentle incline in the early years. Then 2020 hits. COVID disruptions + ecommerce boom = a sharp climb in rates. What’s surprising, though, is what happened next. You might expect some post-pandemic relief. Nope. The index kept climbing. By Q2 2025, it’s at its highest level ever, driven not by pandemic chaos, but by calculated carrier pricing strategies, DIM weight enforcement, and fewer carrier incentives for SMBs.

Takeaway: If you’re budgeting based on 2022 assumptions, you’re underwater. Index data shows that ground rates have structurally shifted up, and the new normal is…not normal at all. There’s a new silent tax on every ecommerce order, especially for brands that haven’t updated their logistics strategies in years.

Chart 1: FedEx and UPS Ground Parcel Index (2018–2025).

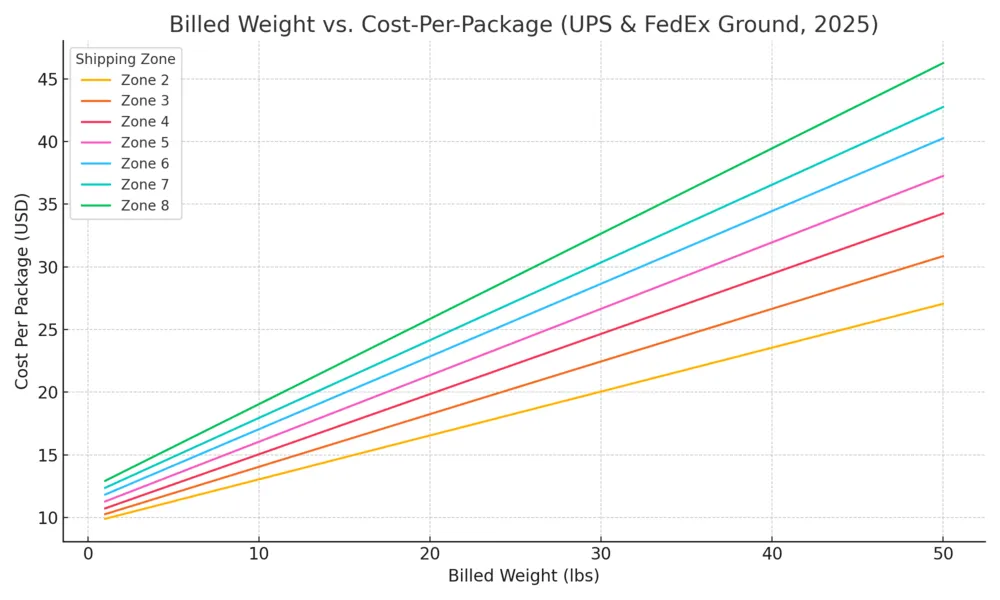

Billed Weight vs. Cost-Per-Package (Multi-Zone): The Hidden Geometry of Shipping Pain

The second chart shows the cost curve for shipping a package via ground, depending on billed weight and destination zone. This was derived by synthesizing rate tables from the official 2025 UPS and FedEx rate guides you can download right now. We simulated realistic pricing across Zones 2 through 8, for packages up to 50 lbs.

What becomes clear fast is this:

- Zone distance has a nonlinear impact. The same 10 lb box costs nearly 30–40% more to ship to Zone 8 than Zone 2.

- Weight-based costs aren’t flat. Each extra pound adds more than just weight; it multiplies cost, especially past the 10–15 lb range where rate brackets steepen.

- You’re probably getting crushed on midweight, long-zone shipments. That 18 lb box going to Zone 7 is silently eroding your margin every time you offer free shipping.

Takeaway: The average ecommerce merchant is overpaying because they’re not engineering for zone or weight efficiency. They’re just printing labels and hoping for the best. Big mistake.

Chart 2: Billed Weight vs. Cost-Per-Package by Zone (FedEx & UPS, 2025).

Key insights include:

- Zone escalation is brutal. The same 3 lb package can cost 2× as much going to Zone 8 versus Zone 2. A single-warehouse model is bleeding you dry on long-haul orders.

- Billed weight ≠ actual weight. Dimensional weight pricing inflates cost, especially when packaging isn’t optimized. A 2 lb item in a 12 × 12 × 10 box can be billed at 8+ lbs.

- Carrier policies diverge fast. USPS Ground Advantage offers strong pricing in Zones 2–5 for lightweight packages, while UPS’s negotiated discounts become more competitive at higher weights and volumes. FedEx Ground Economy still has a niche in deferred delivery, but fewer merchants rely on it due to limitations on delivery speed and flexibility (e.g., cannot deliver to PO Boxes).

- Flat rate isn’t always flat. Priority Mail Flat Rate boxes are convenient, but often more expensive than zone-based pricing for 2–5 lb packages going to Zones 2–4.

Takeaway: Don’t just look at average shipping cost. Build a dynamic model that accounts for zone distribution, dimensional weight risk, and carrier behavior. It sounds scarier than it really is: modern technology can help. For the rest of 2025 and into 2026, optimizing for billable weight and fulfillment geography isn’t a “nice-to-have.” It’s a survival strategy.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPPractical Advice for Q3/Q4 2025 and Into 2026

So what’s the fix? Firstly, we’re seeing that brands are shifting lower-value, lightweight shipments to slower, economy service tiers, like FedEx Ground Economy or UPS Ground Saver, to soften cost spikes. But while slowing down your low-value shipments can help, it shouldn’t be the only lever you pull. You still have customer expectations to meet. Let’s dig into how you can keep up, fiercely and intelligently.

1. Shift Volume Strategically, Don’t Just Rant About Rates

The index shows that shippers are diverting lightweight parcels to slower service levels this quarter. That shift drove down cost per package but raised average billed weight, leading to surprising rate hikes in the index data.

Here’s what to test:

- Pilot deferred services for small items (under 2–3 lbs) and see if the slower ETA is worth the savings.

- Never just blanket shift—test geographically. Maybe shift East Coast to Ground Saver and keep West on Priority.

That data-backed nuance lets you stay lean without tanking delivery promises.

2. Audit Surcharges Like a Hunter, Because Carriers Are Hunting Yours

UPS raised its ground fuel surcharge by 15%, FedEx by 12%, even though diesel dropped by 8% YoY. That’s not cost pass-through, it’s revenue arbitrage.

And surcharges aren’t limited to fuel. UPS added fees for:

- Print services

- Payment processing

- Paper invoices

- Zone realignment errors

Every surprise fee is a profit leak if you don’t audit. Run monthly invoice audits using a service such as Refund Retriever or Cahoot’s Carrier Invoice Report to claw back charges and prevent reoccurrence. Benchmark your rates quarterly for visibility over time.

3. Optimize Packaging: Because Every Inch Costs

Don’t ignore the weight/zone multiplier. Carriers LOVE dimensional weight. As zones shift and surcharges rise, oversized packages are now a double penalty. Smart brands:

- Use polybags or bubble mailers for soft goods

- Right-size boxes using cartonization logic

- Use postage scale logs to track size variance

It’s: smaller box → less DIM weight → fewer zones crossed → lower shipping expenses across your program.

4. Leverage USPS When It Makes Sense

With FedEx/UPS squeezing margins, USPS Ground Advantage and Media Mail suddenly look powerful again. They’re slower, yes, but for low-cost items, the trade-off can be entirely worth it.

USPS even rolled out Priority Next-Day service in over 60 markets (and growing), blurring the line between economy and faster options. That’s something to pinch-test.

Note: Priority Mail Next-Day is a separate, contract-only service for businesses with negotiated service agreements that offers next-day delivery to locations within 150 miles of participating USPS locations. Minimum volumes may apply.

5. Customer Communication = Margin Protection

Don’t hide slower service under a free shipping flag. Instead:

- During checkout, call out “Delivered in 4–7 business days via Economy Ground” with real-time tracking links.

- Offer delivery upgrades at purchase for fast-moving or high-value SKUs.

- Use delivery expectations as a conversion tool, not a surprise to the customer.

Clear language prevents complaints, WISMO cases, and refund requests that eat margins.

6. Regional Carriers & Hybrid Last-Mile Models

Major carriers aren’t always cheaper. Some brands are partnering with regional carriers or using local couriers in high-density zones. That often cuts costs without sacrificing delivery time.

Examples I’ve seen work:

- A local carrier picks up in NYC or LA, then delivers packages in bulk to FedEx/UPS/USPS for the final mile.

- A hybrid mix of FedEx/UPS + USPS for rural zones.

This strategy especially helps when mode-shifting lightweight volume away from big carriers. When you’re shipping high volume and low-margin items — think apparel, small electronics, beauty, or anything lightweight — every few cents saved per shipment adds up. These hybrid models help:

- Lower cost-per-package

- Improve delivery coverage in tricky zones

- Avoid rate hikes from major carriers

7. Explore Hybrid Fulfillment

If your 3PL is stuck in one location, you’re likely hitting long zones by default. Spreading inventory closer to customers can drastically reduce the average shipping zone and cost.

8. Re-evaluate your free shipping threshold

If your AOV is $42 and your average shipping cost is $14, you’re giving away margin with every “free” shipment.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkFinal Thoughts: Deep Insights You Won’t Hear at Conferences

With national carrier surcharges climbing again, regional and hybrid carrier strategies aren’t a “nice-to-have”; they’re an edge. More brands will shift this way as delivery economics get tighter, especially for free shipping models or returns.

1. Carriers aren’t passing through costs, they’re engineering margin. Fuel surcharge hikes even as diesel drops prove the point.

2. Volume shifting is the insurer of margin in a hypercharged rate environment. But it demands smart segmentation; customers are willing to wait, until they aren’t.

3. Invoice audits deliver net margin boosts. Often reclaiming unseen dollars if you missed subtle new fees.

4. Packaging isn’t just aesthetics, it’s your Zone Minimizer 2.0. Even an inch past the threshold can break the unit cost math.

5. Communication is your invisible margin guardrail. Customers who understand delivery trade-offs don’t return orders or create customer service tickets; they convert quietly and joyfully.

Look, this isn’t a temporary blip; it’s a pricing realignment. There’s blood in the water. And those who treat it like a rounding error are the ones who’ll be squeezed hardest. With carriers shifting to aggressive surcharge strategies and volume declines ongoing, the brands that survive (and thrive) are those that pivot fast, audit hard, and control the conversation.

And you don’t need to choose between slow, cheap shipping and fast, expensive shipping. You need better shipping math. The brands winning in 2025 aren’t necessarily paying less; they’re paying smarter. Every package is a micro-optimization opportunity. And in this new era of quiet cost creep, your bottom line depends on seeing and solving for the full picture.

Frequently Asked Questions

Should I always redirect lightweight shipments to economy services?

If you’re scaling shipping and have many items under 3 lb, testing slower economy options like FedEx Ground Saver or USPS Ground Advantage is smart, especially when rate drops are significant and customer expectations can be managed.

How often should I audit shipping invoices?

Monthly or quarterly audits work best to catch fuel surcharge hikes, zone realignment fees, and other hidden charges that carriers apply mid-cycle without warning.

Are regional carriers worth the complexity?

Yes, in high-density zones they can cut costs by up to 20%, while reducing reliance on large-carrier surcharges. But you need solid tracking and exception management controls in place.

How can I package smarter to reduce DIM weight?

Use cartonization software to right-size boxes, choose bubble mailers or polybags for lightweight items, and keep a log of package size variances, especially if you’re using automated packing stations.

Will shifting ground volume hurt customer satisfaction?

Not if it’s communicated correctly. By clearly labeling delivery expectations and offering optional upgrades at checkout, most customers see slower ground as an acceptable trade-off for free or lower-cost shipping.

Turn Returns Into New Revenue

How to Choose the Best Walmart 3PL

I’ve spent the past eight years helping ecommerce businesses grow, ship faster, and adapt to Walmart’s ever-changing fulfillment demands. I work hand-in-hand with warehouse operators and 3PL partners every day. And if there’s one thing I’ve learned, it’s this: not all 3PLs are built to handle Walmart. The right Walmart 3PL should align with your business model and support your long-term goals for growth and efficiency.

So let’s break down how to choose the best Walmart 3PL, whether you’re evaluating Walmart Fulfillment Services (WFS), looking to optimize order fulfillment, or just want to avoid hidden costs that quietly eat your margins. Remember, your choice of fulfillment partner can directly impact your business’s success on the Walmart platform, affecting everything from delivery speed to customer satisfaction.

Let’s dive into what matters most when finding the best fulfillment partner for your needs.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWhat Makes Walmart Fulfillment So Different?

Walmart’s ecommerce ecosystem isn’t plug-and-play like Amazon’s FBA. Their fulfillment process is strict, yet flexible, if you know what you’re doing. Sellers need to meet exact fulfillment requirements, comply with shipping speed standards, and deliver a seamless customer experience that rivals their physical stores.

That’s where a solid 3PL comes in.

But what you really need is one that understands the nuances of Walmart Marketplace, offers real-time inventory tracking, and doesn’t vanish when something goes wrong. It’s crucial to choose a 3PL that can seamlessly integrate with Walmart’s systems and your ecommerce platform for efficient operations.

WFS vs. Walmart-Compatible 3PLs

Walmart Fulfillment Services (WFS) is the default choice. It’s streamlined and deeply integrated. But WFS doesn’t work for every ecommerce seller. In these cases, outsourcing fulfillment to a third-party logistics provider (3PL) can address specific business and fulfillment needs, offering greater flexibility and control.

Why? Because you give up control—over your inventory management, your branding, and sometimes even your pricing flexibility.

A great 3PL, on the other hand, gives you:

- Multi-channel fulfillment

- Fulfillment solutions tailored to your unique needs, ensuring compliance and efficiency

- Flexible shipping options beyond WFS’s constraints

- Lower fulfillment fees (in many cases)

- More control over packaging materials and branding

Many of the sellers I’ve worked with start with WFS, but graduate to a more customized 3PL when their business outgrows the box. As your business evolves, matching different fulfillment solutions to your changing needs drives optimal growth.

Key Factors to Consider

If you’re serious about choosing the right fulfillment partner, here’s what to prioritize:

- Walmart compliance: Can your 3PL fulfill Walmart orders on time and according to spec?

- Fulfillment operations: Do they support fast delivery, accurate order processing, and smooth returns? Look for reliable fulfillment and ensure orders are processed efficiently to meet Walmart’s strict standards.

- Order tracking & shipping carriers: Does the 3PL offer real-time order tracking and integrate with major shipping carriers to provide timely updates and enhance transparency and customer satisfaction?

- Cost savings: Watch out for hidden fees and opaque pricing. Ask for transparency, and consider how shipping rates and weight affect costs.

- Peak season readiness: Can they scale with your volume during Q4 and beyond?

- Technology stack: Are they using order management systems that give you visibility and control?

A strong 3PL partner should also provide value-added services such as custom packaging or kitting, backed by deep supply chain expertise.

I’ve seen sellers burn through 3PLs simply because they didn’t ask the right questions early on. The best ones feel more like partners than vendors, supporting your growth every step of the way.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPInventory Management for Walmart Sellers

Inventory management is the backbone of any successful ecommerce business, and for Walmart sellers it’s even more critical. With customer expectations for fast delivery and reliable service at an all-time high, having the right products in the right place at the right time can make or break your Walmart Marketplace performance.

To stay ahead, Walmart sellers should invest in advanced technology solutions—real-time tracking and robust order management systems that integrate with your ecommerce platform and 3PL.

Outsourcing inventory management to a reliable 3PL unlocks cost savings and efficiency. A trusted partner handles everything from receipt and storage to shipping and returns, freeing your team to focus on customer engagement and growing your business.

Implement best practices like just-in-time replenishment, demand forecasting, and regular audits to fine-tune stock levels, reduce waste, and stay ready to fulfill Walmart orders at a moment’s notice.

In today’s competitive marketplace, effective inventory management is a must for Walmart sellers seeking high customer satisfaction, competitive pricing, and scalable growth.

Cahoot: A Walmart 3PL Built for Marketplace Sellers

Our network is built with Walmart sellers in mind. We help clients meet aggressive same-day shipping SLAs, reduce shipping costs, and avoid chargebacks due to fulfillment mistakes.

Here’s what sets Cahoot apart:

- Walmart-optimized workflows and shipping logic

- Strategically located nationwide fulfillment centers to ensure fast, accurate order processing, and support Walmart’s performance requirements.

- Integrated order routing across channels

- Full transparency with real-time tracking

- Ability to provide temperature control for perishable goods, ensuring compliance with Walmart’s standards

We’re not just managing shipments, we’re helping brands run leaner, faster, and more profitably inside the Walmart ecosystem.

Cahoot’s fulfillment centers are designed to meet Walmart’s requirements for shipping, labeling, and inventory management. Our customer service team efficiently handles inquiries, including order tracking and returns, to enhance the overall customer experience.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkFinal Thoughts

Choosing a Walmart 3PL isn’t about picking the biggest name—it’s about aligning your operations with a partner that understands Walmart’s expectations and your growth goals.

If you want a 3PL provider that actively improves your margins, Cahoot’s worth a look.

Frequently Asked Questions

What is a Walmart 3PL and how is it different from Walmart Fulfillment Services (WFS)?

A Walmart 3PL is a third-party logistics provider that helps Marketplace sellers fulfill orders outside of WFS. Unlike WFS, you retain control over inventory, branding, and pricing.

Does Walmart allow sellers to use their own fulfillment partners?

Yes. While Walmart promotes WFS, third-party sellers can use their own 3PLs as long as they meet Walmart’s fulfillment and shipping performance standards.

What are the benefits of using a Walmart 3PL over WFS?

Benefits include more flexible pricing, better control of multi-channel inventory, branded packaging, and scalable peak-season capacity.

How does a Walmart 3PL impact customer satisfaction and shipping speed?

The right 3PL boosts speed and accuracy by reducing processing delays, leading to better reviews and fewer complaints.

How can Cahoot help with Walmart fulfillment?

Cahoot offers Walmart-compliant 3PL services with fast shipping, nationwide coverage, and cost-effective rates, supporting both WFS-alternative and hybrid models.

Turn Returns Into New Revenue

Amazon Expands FBA Box Size: What Sellers Need to Know

In this article

4 minutes

4 minutes

The content of this article covers Amazon’s recent FBA box‐size update, the AWD implications, pros and cons of the change, smart questions to ask, seller feedback, Cahoot’s solution, and FAQs—all in one place.

What Really Changed, and Why It Matters

As of June 20, 2025, Amazon raised the maximum allowable carton length for FBA shipments from 25 inches to 36 inches. Width, height, and the 50-pound weight limit remain unchanged. If you’re wondering whether this move is a big deal, the answer is yes, but with caveats.

This change opens the door for smarter packaging strategies. Think: better product bundling, reduced outer box count, and possibly some cost savings on inbound shipping if you optimize correctly. But before you go redesigning every carton, hold up—this doesn’t necessarily extend to AWD (Amazon Warehousing and Distribution), where size restrictions still apply in most cases.

The AWD Confusion Factor

A lot of sellers on Amazon forums and LinkedIn have been asking: “Does this apply to AWD too?” The short answer is: no, not really. AWD still enforces its own packaging criteria, especially around conveyable cartons. One seller summed it up well: “FBA might let me go long now, but AWD’s still playing by the old rulebook.”

The takeaway? Don’t assume this is a one‐size‐fits‐all update. Multichannel sellers and anyone using AWD for upstream storage should keep using separate carton spec templates.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWhy Amazon Made This Move Now

This isn’t random. 2025 has been packed with changes to FBA and AWD capacity policies, fees, and prep requirements. This latest shift comes after Amazon:

- Reduced peak storage limits to ~5 months of forecasted sales

- Rolled out smart storage rate tiers for AWD

- Cracked down on inventory performance metrics

In that context, the 36-inch change looks less like a gift and more like an efficiency nudge. Amazon wants you to ship smarter, not bigger. But if bigger helps you ship smarter, you now have the green light.

The Pros, and the Not-So-Obvious Cons

The Good:

The Gotchas:

Smart Questions to Ask Right Now

- Which of my ASINs can benefit from the 36-inch allowance?

- Are my 3PLs or prep centers even aware of the change?

- Do I need to maintain separate carton rules for FBA vs AWD?

- Is my packaging team trained to avoid dimensional-weight traps?

What Sellers Are Saying

One seller on the forums wrote, “It’s about time… my standard lamps have been costing me extra for repackaging for years.” Another added, “Unless AWD follows suit, this just adds another layer of complexity.”

We’re seeing the same split across LinkedIn: half of the brands are optimistic, the other half are cautious. Everyone wants more flexibility, but not at the cost of downstream penalties or confusion.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPCahoot’s Edge: No Length Caps, No Guesswork

Here’s where we come in. At Cahoot, we don’t impose arbitrary box-length limits. Whether you ship 12 inches or 42 inches, our peer-to-peer fulfillment network accommodates your carton, not the other way around.

And because we operate channel-agnostic, there’s no need to split inventory or set up redundant prep processes just to comply with Amazon’s shifting rules. When Amazon changes the rules, we don’t scramble. Our systems are already built for flexibility.

Final Thought

Amazon’s carton-length change is an opportunity, if you know how to use it. It’s not a magic solution, but for the right SKUs, it can open up serious efficiency. Just make sure your fulfillment strategy isn’t relying on assumptions. Because at Amazon, the rules always change.

Frequently Asked Questions

What’s the new FBA box length limit?

The new maximum is 36 inches in length. Weight (50 lbs max), width, and height restrictions remain the same.

Does this apply to Amazon AWD?

No. AWD still enforces a 25-inch limit for conveyable cartons. Check your spec sheets before making changes.

Will this reduce shipping costs?

It can, especially if you bundle multiple units in one carton. But watch for dimensional weight traps.

Can Cahoot handle boxes over 36 inches?

Yes. Cahoot imposes no size limits on cartons, making it ideal for larger or irregularly shaped products.

Do I need to update my packaging workflows?

Probably. Most sellers will benefit from revisiting their pack plans and checking how their software handles the new dimensions.

Turn Returns Into New Revenue

Cahoot vs Veeqo: A Value-Driven Comparison for Modern Ecommerce Sellers

In this article

9 minutes

9 minutes

- At a Glance: Cahoot vs Veeqo

- Pricing Models & Carrier Rates

- Order Routing & Workflow Automation