Why Holiday Returns Are Hitting Earlier Than Expected – and What That Means for Ecommerce Operations

In this article

37 minutes

37 minutes

- Introduction

- The Early Returns Trend: A New Holiday Season Pattern

- Gift Returns vs. Behavior-Driven Returns

- Why Returns Are Increasing Before Christmas

- Operational Impact: Returns Strain During Peak Season

- Return Policies and Fees: Shaping the Early Returns Landscape

- The Core Problem: Brittle Post-Purchase Systems

- Frequently Asked Questions

Introduction

Holiday returns still peak after Christmas, but a growing share of holiday-season returns is now occurring during the peak season itself. In other words, more shoppers are sending back items before Christmas Day than in years past. Many retailers have introduced an extended return window for holiday purchases, but are also increasingly implementing return fees. This shift in timing means ecommerce operations must handle significant return volumes in December, concurrently with fulfilling record outbound orders, straining fulfillment networks, carrier capacity, and reverse logistics processes.

According to Seel’s 2025 Returns and Refunds Report, return activity during November and December is 16% higher compared to other months. In short, consumers are buying earlier, returning sooner, and expecting faster refunds. The operational impact is compounded by the need to process returns under new fee structures and longer return windows. While the traditional post-holiday return rush (in the week after Christmas and early January) remains massive, a notable portion of returns is now hitting ahead of Christmas. This article explores what’s driving holiday returns to hit earlier, why it’s not just about gifts, and what it all means for ecommerce operations’ cash flow, inventory, and fulfillment systems.

The Early Returns Trend: A New Holiday Season Pattern

Not long ago, “holiday returns” essentially meant post-Christmas returns. Industry data shows nearly 18% of all holiday purchases are typically returned between December 26 and January 31. Retailers even coined events like National Returns Day in early January to brace for the flood of unwanted gifts. That peak still exists – but now another returns wave is swelling before Christmas.

Logistics insiders first saw this pattern emerging several years ago. UPS surprised many by predicting holiday returns would peak before Christmas in 2018 – and it did. On December 19, 2018 (a week before Christmas), UPS handled a record 1.6 million return packages that day. This was higher than the returns on the traditional early-January peak in prior years. UPS and others observed a two-peak returns season: one spike just before Christmas, then the usual surge right after New Year’s.

Most retailers now offer extended return windows for items purchased as early as October, with most major retailers extending their return windows to late January 2026 for the 2025 holiday season. Amazon allows most holiday purchases made between Nov. 1 and Dec. 31 to be returned until Jan. 31, 2026.

What caused that early return spike? A combination of shoppers buying earlier and returning earlier. In 2018, retail analysts noted that consumers had started shopping for holiday deals sooner – over 55% of shoppers had begun buying by early November – and consequently, some returns were initiated well before December 25. In effect, “buy earlier, return earlier” became a new behavior pattern. For the 2025 season, items purchased in October are often included in these extended holiday return policies offered by most retailers. Fast-forward to 2025, and that pattern has only grown. As one report summarizes, “shoppers are buying earlier, returning sooner and expecting faster refunds”. Holiday returns still spike after Christmas, but now much more return activity is pulled into December than anyone expected a decade ago.

Gift Returns vs. Behavior-Driven Returns

How can returns increase before Christmas without contradicting the obvious fact that people haven’t received their gifts yet? The key is understanding that not all holiday-season returns are gift returns. In fact, the early returns surge is largely driven by behavior-driven returns (from shoppers themselves) rather than recipients returning unwanted gifts.

Gift returns are essentially calendar-locked: Most gifts aren’t even unwrapped until Christmas, so any return or exchange by the recipient will naturally happen after December 25. Retailers accommodate this with extended holiday return windows – for example, Amazon, Walmart and others allow most items bought in October–December to be returned until late January. This means a sweater bought for Dad on Black Friday can still be returned after the holidays, so there’s no reason (and usually no ability) for the recipient to return it before Christmas. Historically, about 45% of gift returns happen in the week between Dec 26 and New Year’s, and roughly 50% more occur in January. Gift returns still follow that cadence, tied to the holiday calendar.

Many major retailers have specific extended holiday return windows for 2025-2026: Walmart extends its return policy for items purchased between Oct. 1 and Dec. 31 to Jan. 31, 2026; Target extends its return window for most Target purchases made between Nov. 1 and Dec. 24 to Jan. 24, 2026; Best Buy allows returns for items purchased between Oct. 31 and Dec. 31 until Jan. 15, 2026; Macy’s extends its return policy for items purchased between Oct. 6 and Dec. 31 to Jan. 31, 2026; Kohl’s extends its return policy for purchases made between Oct. 5 and Dec. 31 to Jan. 31, 2026; Sephora extends its return policy for purchases made between Oct. 31 and Dec. 30 to Jan. 30, 2026; and Ulta Beauty allows returns for purchases made between Nov. 1 and Dec. 31 until Jan. 31, 2026. Note that Target Plus items may have different return windows than most Target purchases, and some categories—such as Apple products and Beats products—may be excluded from these extensions or have shorter return periods. Retailers often specify exclusions for certain items, such as “excluding Apple,” and Beats products may have their own unique return policies.

Behavior-driven returns, on the other hand, follow a different logic. These are returns generated by the purchaser’s own decisions and shopping behavior during the season, not by gift recipients. Several modern trends have supercharged these returns during the holidays:

- Self-Gifting and Early Deals – Holiday sales now start early (think October Prime Days, Black Friday in early November), and shoppers often buy items for themselves alongside gifts. By mid-season, they may decide to return items they bought for personal use – for example, returning a splurge purchase or an upgraded gadget they second-guessed. The first wave of holiday returns “is thought to be more from people shopping for themselves… ‘It’s not just about shopping for gifts,’” noted one returns executive. Shoppers jump on early discounts and, if they experience buyer’s remorse or find a better deal later, they send those items back before Christmas.

- Bracketing and Try-Before-You-Buy – It’s increasingly common to order multiple variants (sizes, colors) of a product with the intention to keep one and return the rest. Shoppers treat generous return policies as a chance to “try before you buy.” For example, a customer might order three party dresses in early December, keep the one that fits best, and return the other two immediately. Nearly one-third of shoppers now return at least one item a year, and many see returns as a normal part of shopping. This behavior isn’t tied to gift-giving at all – it’s driven by the buyer’s own preference to sample and send back. As UPS’s Happy Returns noted, when people shop for themselves they often buy multiple sizes or options knowing they’ll return the extras, whereas for gifts they typically pick one item and wait (the gift “won’t be opened until Christmas and returned later”). The result? More returns mid-December from “change of mind” purchases and bracketing.

- Higher Expectations (Instant Refunds & Convenience) – Shoppers today expect frictionless and fast returns. Many retailers and fintech services now offer immediate refunds (or refunds upon package drop-off) and encourage quick turnaround. Knowing they can get their money back fast, consumers are quicker to initiate returns rather than holding onto an item. Seel’s research emphasizes that “fast and fair refunds” are now considered part of the product experience, and slow refund processes will push shoppers away. This has created a mentality of “buy with confidence – you can always return it”, which naturally boosts return volume during the season. Customers don’t feel the need to wait; if an item isn’t right, back it goes, even if it’s mid-December, because they trust they’ll get their refund promptly.

- Earlier Delivery Cutoffs & Missed Gifts – Many consumers try to avoid the last-minute shipping crunch (and the risk of gifts arriving late). Ironically, this can generate returns in December: if a shopper ordered a gift early but then discovers by mid-December that it’s not suitable, they might preemptively return or exchange it before Christmas. For instance, ordering a toy in November but then returning it in December upon realizing the child already has it, in order to buy a different gift. In the past, they might have waited to handle it post-holiday, but today’s free-and-easy return policies encourage resolving it now. Additionally, if a backup gift is purchased because of shipping uncertainty, the redundant item might be returned before year-end once the primary gift arrives on time.

In summary, gift returns haven’t moved up – those still largely happen after the holidays (thanks to extended return periods and the nature of gift giving). It’s the non-gift returns that have “shifted left.” Shoppers’ proactive behaviors, personal purchases, and flexible buying tactics are generating early returns well before Santa’s sleigh departs. This explains how overall return volumes can climb in early/mid-December without defying the timing of gift exchanges. Retailers are essentially dealing with two waves of returns: one driven by consumer behavior (before Christmas) and one driven by gifts (after Christmas).

Make Returns Profitable, Yes!

Cut shipping and processing costs by 70% with our patented peer-to-peer returns solution. 4x faster than traditional returns.

See How It WorksWhy Returns Are Increasing Before Christmas

Several industry analyses point to root causes behind the rise in December return activity. It’s not just one factor – it’s a confluence of changes in consumer behavior and retail practices:

- Longer Holiday Shopping Season – The holiday shopping season has stretched out. With major sales starting as early as October, consumers are buying (and thus potentially returning) over a longer period. They are no longer concentrating all purchases in late December. A longer timeline naturally spreads out return events too. (Notably, in years when the calendar made the shopping period shorter, returns peaked more after Christmas; in longer seasons, some returns hit earlier.)

- “Buy Now, Decide Later” Mindset – Economic jitters and abundant options have made shoppers more indecisive during peak season. Seel’s 2025 report notes that recession fears, job uncertainty, and buyer’s remorse are influencing shoppers to think extra hard about purchases. Many will buy an item just in case (perhaps to lock in a deal or ensure they have something in time), then later return it if they change their mind. The rise of free returns has essentially turned many holiday purchases into conditional trials. This wasn’t the case years ago when more sales were final.

- Heightened Post-Purchase Standards – With retailers competing on customer experience, return policies have become very lenient (free return shipping, extended windows, no-questions-asked returns). Shoppers know this and hold retailers to high standards. If any issue arises – a product doesn’t meet expectations or a better alternative appears – they won’t hesitate to send an item back immediately. The vast majority of shoppers now say they wouldn’t even purchase an item if it lacked a return option. In short, easy returns are part of the deal, and consumers use them liberally during holiday season.

- Delivery Issues and Weather Glitches – One big driver of early returns is delivery problems during peak season. When an item is delayed in transit or a package goes missing in mid-December, customers often react by reordering a replacement or buying an alternative locally – and then returning/canceling the late shipment when it eventually arrives (or filing for a refund because it never arrived on time). Seel’s data shows that delivery failures (late or undelivered packages) have become the dominant driver of return requests, accounting for about three-quarters of all return reasons on its platform. During the holidays, shipping carriers are stretched thin and weather events can wreak havoc on timetables. For example, the 2017 Christmas season saw major snowstorms that delayed deliveries, which in turn prompted many returns and taught consumers a lesson about not waiting until the last minute. In 2023 and 2024, some regions experienced blizzards and severe weather in mid-December; when gifts didn’t arrive by Christmas, customers often returned or refunded those orders. However, weather alone is not the primary cause of the broad shift toward earlier returns – it’s more of an amplifier. A storm in one year might spike delivery-related returns regionally, but the overall trend of returns creeping into December is happening even in normal years. (Still, it’s worth noting: in categories like fashion, “delivered too late” returns jumped 124% year-over-year, and missing-package claims rose 42%, indicating how late deliveries can translate to return volume. Bad weather in peak season just pours fuel on that fire.)

- Consumer Awareness and Habits – Shoppers have become savvy about returns. Many people now plan for returns as part of holiday shopping. Surveys show consumers consciously factor in return options before purchasing, and many will initiate a return as soon as they decide an item isn’t working out, rather than procrastinating. There’s also a trend of immediate exchanges – for instance, buying two competing products (such as two different electronics) intending to return one once they compare. In years past, a customer might have waited until after the holidays to do this comparison and return; now it often happens in real time during December.

In essence, today’s holiday shopper is more flexible and less patient. If something’s not right, they’ll return it right away – peak season or not. As Laura Huddle of Seel puts it, retailers are facing shoppers who “be more thoughtful and take extra time thinking through purchases” and leverage trends like try-before-you-buy, which means more mid-season returns. All these factors have shifted some of the returns burden into the heart of the holiday period.

Operational Impact: Returns Strain During Peak Season

For operations and logistics teams, earlier holiday returns are a double whammy. Peak season (November through late December) is already the most intense time for fulfilling orders and managing inventory. Now, with returns hitting earlier, reverse logistics tasks overlap with the busiest outbound shipping weeks. To offset these operational costs, many retailers are adding fees or return fees, making it more expensive for customers to return items during the holiday season. This presents several challenges:

Shipping costs and certain fees are often non-refundable, meaning customers may not be reimbursed for these expenses when returning items. About 72% of retailers now charge for some returns, up from 66% last year. Many retailers charge return shipping fees for items returned by mail; for example, Macy’s charges a $9.99 return shipping fee unless the customer is a Star Rewards member. To avoid return shipping fees, customers should return items in-store whenever possible.

Fulfillment & Carrier Capacity Under Pressure

Warehouse and fulfillment centers that are calibrated to handle outbound order peaks in December are now seeing inbound return volumes at the same time. During a normal year, a retailer’s distribution center might shift focus to processing returns in early January, when order shipments slow down. But now those returns are arriving mid-December, when the facility is in full throttle picking, packing, and shipping mode for Christmas. The result is operational strain:

- Overwhelmed Facilities – Processing returns (inspecting items, repackaging, updating inventory systems, etc.) requires labor and space. In December, both are at a premium. Many retailers simply lack the capacity to triage returns immediately during peak – leading to backlogs of unopened return packages piling up in corners of the warehouse. The influx can overwhelm return processing stations that were staffed for normal volumes. In 2025’s holiday season, many retailers discovered that their return systems, which functioned fine most of the year, broke under the peak load. As one analysis noted, 2025’s record online sales created a “tsunami of returns that exposed weaknesses in fulfillment systems”. Under the stress of simultaneous outbound and inbound surges, normal quality controls start to slip. There are reports of warehouse staff so busy rushing to meet ship deadlines that they make mistakes – sending wrong items, mislabeling packages – which in turn generate even more returns to process. It’s a vicious cycle: returns volume creates strain, strain causes errors, errors create more returns.

- Carrier Networks Handling Returns – Shipping carriers (UPS, FedEx, USPS, etc.) also feel the impact. Their trucks and hubs in December are geared toward delivering gifts to customers; handling return pickups and shipments at the same time adds load. UPS observed that during the 2018 holiday push, returns doubled alongside outbound volume. In 2025, we’re seeing similar patterns. Carriers must allocate space for millions of return packages even as they race to get new orders delivered by Christmas. Most mailed returns may incur fees, as some retailers charge for mail-in returns, but many offer free in-store or designated drop-off options to help customers avoid these costs. This can lead to delays in return shipments (return packages moving slower through the network), which in turn slows down the refund process and can frustrate customers expecting fast refunds. It’s a delicate balance for carriers trying to optimize routes for both directions. In short, the reverse logistics pipeline goes into overdrive just when the forward logistics pipeline is at peak capacity.

- In-Store Returns Lines – For retailers with physical stores, an earlier return trend means more people showing up to return items before Christmas. Customer service counters in December traditionally handle only sales and gift-wrapping, but now they may see customers bringing back online purchases or unwanted items in the middle of the holiday rush. This requires extra staffing and coordination at stores, which again is challenging when those same stores are crowded with shoppers. Some major retailers encourage bringing online returns to stores (to drive foot traffic or expedite processing), but in December that can backfire by adding to store staff workload during the critical sales weeks.

Cash Flow and Financial Timing

A less obvious but critical impact of returns shifting earlier is on cash flow and revenue recognition for retailers. In a typical cycle, many holiday purchases would be returned in January, effectively hitting the books in the next fiscal period (for many, Q1 of the new year). Now, with more returns in December, retailers are having to issue refunds before the year’s end, which can squeeze cash flow at a precarious moment:

- Refund Outflows in Q4 – The holiday season brings a huge inflow of revenue in November and December. But if 10-15% (or more) of those sales are already boomeranging back as returns within December, that means a chunk of revenue is being reversed before year-end. Retailers must refund customers’ money (or credit their accounts) right when they are also spending heavily on marketing, shipping, seasonal labor, etc. For smaller ecommerce sellers, this can be a real liquidity crunch. They’ve paid to acquire the customer and ship the order, and now the sale falls through earlier than expected. One guide for Amazon sellers warns that the extended holiday return period can create “cash flow issues”, because Q4 sales aren’t truly settled until late January. When returns happen earlier, the uncertainty hits in Q4 itself. Retailers have less net cash from holiday sales on hand in December, which can disrupt buying budgets and year-end financial metrics.

- Inventory and Revenue Uncertainty – Earlier returns also mean retailers have to account for potential markdowns and lost sales within the holiday quarter. For instance, an item returned on December 20 might be put back in stock (if processed quickly), but if it’s not resold by Christmas, it likely goes into clearance. The revenue loss or reduction from that return will hit Q4’s results, not Q1. This can make holiday quarter earnings less predictable. Retail finance teams now need to forecast return rates during the peak season and adjust revenue expectations accordingly. Essentially, the tidy separation where Q4 was “sales boost” and Q1 was “returns hit” is blurring. As a result, profit margins for Q4 can erode more than before due to earlier refunds and restocking costs.

- Operational Expenses – Processing returns costs money: labor, inspection, repackaging, sometimes return shipping fees or disposal fees. If these costs ramp up in December, they add to an already expensive season (overtime wages, expedited shipping fees, etc.). Retailers might find their holiday operational costs increasing because they’re now doing both outbound fulfillment and reverse logistics concurrently. This dual burden can shrink the profitability of holiday sales. Many retailers count on the holiday spike to be their “black ink” period of the year – but heavier returns in-season chip away at that.

From a cash management perspective, businesses need to plan for higher reserve funds to cover refunds during December. Marketplaces like Amazon often hold a larger reserve from seller payouts in Q4 specifically to cover potential returns. Similarly, brands need enough liquidity to weather returns coming in early. If unprepared, a merchant could face a cash crunch fulfilling new orders while refunding others simultaneously.

Convert Returns Into New Sales and Profits

Our peer-to-peer returns system instantly resells returned items—no warehouse processing, and get paid before you refund.

I'm Interested in Peer-to-Peer ReturnsInventory Recovery and Availability

One potential silver lining of earlier returns is the chance to get merchandise back in stock for resale during the holiday rush – but in practice this benefit is hard to capture with brittle systems. Ideally, if a customer returns a popular item on Dec 15, the retailer could quickly process it and have it available to sell to someone else by Dec 20 (still in time for last-minute shoppers). This would be great for recovering revenue and avoiding stockouts. However, the reality is that many retailers’ reverse logistics can’t move that fast in December. The result is a lot of valuable inventory tied up in return bins until January, which is effectively lost sales.

Key issues with inventory and earlier returns include:

- Processing Speed – During off-peak times, a returned product might be inspected and restocked in a few days. During peak, that process can stretch to weeks. Each extra day a return sits unprocessed is margin lost on that item. For seasonal items or gifts, the time value is even higher – a toy or sweater returned on Dec 20 and not back on the shelf by Dec 24 is essentially missed opportunity. As one expert put it, “A seasonal item sitting unprocessed becomes unsellable” if it misses the window. Retailers with brittle systems might find themselves liquidating those items later at a huge discount, whereas if they had processed the return faster, they could have sold it at full price pre-Christmas.

- Inventory Accuracy – The chaos of concurrent returns can mess with inventory tracking. Items in return limbo might not be counted correctly in stock systems. Some retailers have reported inventory “black holes” where returned units are in transit or sitting in a corner and therefore not available for sale on the website, even though there is demand. This inaccuracy hurts order fulfillment – e.g. overselling an item because the system didn’t account for a bunch of pending returns marked as back in stock, or conversely not selling an item because the returned stock wasn’t recorded. The lack of real-time visibility into returns in motion (coming back from customers or between stores and warehouses) leads to either lost sales or customer service headaches.

- Storage Space – Returns take up physical space. During peak, warehouses are already bursting with outbound stock and incoming new inventory. A surge of returns can clog hallways and receiving docks, effectively reducing capacity for regular operations. If returned items aren’t immediately processed, they start occupying shelf space that could be used for fulfilling current orders. Some warehouses resort to renting additional storage or trailers to hold returns until January, adding cost and complexity.

- Refurbishment and Repackaging – Many returned products require some prep before they can be resold (e.g., checking for damage, repackaging neatly, resetting electronics). Doing this work in December requires diverting skilled staff or setting up separate lines. If retailers lack bandwidth to do it, those returned items won’t make it back to stock in time. This particularly affects electronics and high-value items which often need testing before resale. The net effect is fewer available units to sell during the final sales surge. In contrast, those who can rapidly triage returns might win extra sales. For example, a returned tablet processed on Dec 22 can be sold on Dec 23 to a last-minute shopper. But without an efficient system, that tablet might sit until January and then be sold as open-box at a loss.

In summary, earlier returns expose how inflexible many inventory and returns systems are. Legacy post-holiday returns processes weren’t built to “turn on” until after Christmas, so they buckle under the ask of quick recovery in-season. Some leading retailers are investing in automations and forward-deployed return centers to improve this, but industry-wide it’s a challenge.

Customer Experience and Service Load

From the customer perspective, the ability to return early is a positive – but only if the retailer can handle it smoothly. During December, customer service teams are fielding inquiries about orders, and now also about returns (status of return, refund not yet issued, etc.). This adds to the support load at a critical time. Retailers have to ensure their return portals, RMA systems, and support scripts are up to the task:

- System Uptime and Errors – With more customers initiating return requests in December, return management systems face peak traffic too. Any outages or glitches (e.g. a returns portal crashing) will frustrate shoppers at the worst time. IT teams need to monitor these systems just as closely as the e-commerce checkout systems during peak. Some metrics like return portal uptime and median time to issue refund become important to track in December, not just January.

- Customer Support Training – Support agents must be prepared to handle questions like “Where’s my refund?” or “How do I return this gift I bought early?” even as they handle sales-related questions. Retailers who assumed those questions would mainly come in January might be caught understaffed or unprepared in December. This can lead to longer wait times and lower service quality, right when customer satisfaction is paramount (nobody wants an angry customer two days before Christmas because their return label email didn’t arrive).

- Fraud and Policy Enforcement – Longer return windows and concurrent returns also open the door for return fraud during the holidays. With so much volume, it’s easier for fraudulent returns to slip in (e.g. wardrobing, returning used items, etc.). Retailers have to be vigilant even while overwhelmed. Some have implemented stricter checks or restocking fees on certain categories (for example, electronics or luxury items) to deter abuse. But enforcing those policies consistently in the holiday rush is tough – it can create conflict with customers in-store or confusion online. A delicate balance must be struck to prevent fraudulent or excessive returns without souring the experience for honest customers.

Return Policies and Fees: Shaping the Early Returns Landscape

The holiday season is a pivotal time for both shoppers and major retailers, and return policies play a central role in shaping the early returns landscape. As the National Retail Federation reports, the volume of returned items surges during the holidays, prompting many retailers to adapt their return policies to meet customer expectations and operational realities.

One of the most significant trends is the widespread adoption of extended return windows. Many major retailers now allow items purchased as early as October to be returned well into January, giving customers extra flexibility during the holiday shopping rush. This extended return period is especially important for gift-givers, but it also encourages early returns from those making in-store purchases or online buys for themselves. However, the details can vary widely—especially when it comes to electronics and entertainment items.

Electronics and entertainment items often come with stricter return policies, including restocking fees or specific requirements for original packaging. For example, Best Buy may charge restocking fees on certain electronics, and mailed returns can incur additional return shipping fees. In contrast, in-store returns are typically more straightforward and cost-effective. Many major retailers, including Target, offer free in-store returns for most items, making it easier for customers to avoid extra costs. For online purchases, some retailers provide free return shipping, while others may deduct return shipping fees from the refund, especially for mailed returns or marketplace items.

Understanding the fine print is crucial. Return windows, restocking fees, and return shipping fees can all impact the total cost of a return. Some retailers require items to be unopened and in their original packaging to qualify for immediate refunds, while others may only offer store credit or an even exchange for certain categories. To prevent fraud and abuse, many retailers now require receipts and original packaging for returns, particularly for high-value electronics and entertainment items.

Loyalty programs can also make a difference. Many stores offer loyalty members perks such as extended return windows or waived return shipping fees, providing added value during the holiday season. For example, Target’s loyalty program may offer free return shipping for online purchases, while other retailers might extend the return window for frequent shoppers.

Ultimately, return policies and fees are a key part of the holiday shopping experience. By reviewing the fine print before making a purchase—especially for electronics and entertainment items—customers can avoid unexpected costs and ensure a smooth return process. As many retailers continue to refine their return policies to balance customer satisfaction with operational efficiency, being informed about return windows, fees, and in-store versus online return options is more important than ever. This proactive approach helps shoppers make confident purchases and enjoy a hassle-free holiday season, even if some items end up back at the store.

No More Return Waste

Help the planet and your profits—our award-winning returns tech reduces landfill waste and recycles value. Real savings, No greenwashing!

Learn About Sustainable ReturnsThe Core Problem: Brittle Post-Purchase Systems

All the above impacts point to a deeper, systemic issue: Many retailers’ post-purchase and returns systems are brittle and outdated, designed for a different era. They were built with the assumption that returns happen after the holiday frenzy, in a nice separate window when you can clean up the mess. That assumption no longer holds. Peak season now exposes the weaknesses in those systems in real time.

For example, a retailer might have a single returns processing center that was fine handling off-season returns, but come December, it becomes a bottleneck. Or an online merchant might discover their returns authorization software can’t handle the volume of concurrent requests, causing delays and errors. In 2025, many retailers have learned the hard way that their “post-holiday cleanup” approach is too rigid for today’s continuous cycle of sales and returns.

A post-mortem analysis of Holiday 2025 returns by one industry group noted that the season “revealed fundamental vulnerabilities” in fulfillment operations and “problems that normal operations hide”. In plain terms, systems that seemed OK most of the year broke under the pressure of simultaneous outbound and inbound surges. Some common failure points include:

- Poor Integration – Returns data often isn’t integrated in real-time with inventory and order systems. During peak, these integration gaps become glaring. Items authorized for return might not be properly marked in inventory, leading to phantom stock counts. Or refund systems might not sync with the e-commerce platform, causing customers to get return confirmations late. The manual workarounds that teams use during slower periods don’t scale in December, leading to confusion and mistakes. Many retailers are now investing in better system integration after seeing these cracks.

- Lack of Forecasting for Returns – Retailers have gotten better at forecasting holiday sales, but few rigorously forecast holiday returns. Peak season return rates can approach 25-30% in e-commerce, especially in categories like apparel. Without forecasting, warehouses were caught off-guard by how many returns showed up early. This meant insufficient labor allocated to returns and no space set aside. Going forward, operations teams are realizing they need to plan for returns spikes just as they plan for order spikes – including having contingency space, extra return merchandise authorizations (RMAs) capacity, and maybe even staggered return shipping incentives to smooth the flow.

- Rigid Staffing and Processes – Many returns departments operate Monday-Friday, 9-5, even during peak, whereas fulfillment teams go 24/7. This misalignment caused returns to pile up untouched for days during the height of season. Some companies simply shut off returns processing in mid-December to let warehouses focus on outbound – effectively deferring the problem but at the cost of delays and customer frustration. Such rigid approaches aren’t sustainable as early returns become the norm. The systems need to be flexible – e.g., cross-training staff to pivot to returns processing when needed, or using automation for returns (like scan-and-sort systems) to handle volume quickly.

Ultimately, the deeper takeaway is that returns can no longer be treated as an afterthought or “January’s problem.” The holiday peak now has to be managed as a holistic cycle that includes both sales and returns concurrently. Retailers that failed to adjust have felt the pain in lost sales, higher costs, and customer dissatisfaction. Those that are adapting – by strengthening their post-purchase infrastructure – are better positioned to thrive even as returns rise.

Frequently Asked Questions (Preparing for Peak-Season Returns)

Why are holiday returns happening earlier than before?

A growing portion of holiday returns are occurring in December due to changes in consumer behavior and retail policies. Shoppers are buying earlier in the season (often starting in October/November) and thus returning items sooner if they change their mind. Many are purchasing for themselves during holiday sales and will return those personal buys before year-end. Trends like buying multiple items to try at home (“bracketing”) and expecting instant refunds encourage people to initiate returns immediately, rather than wait. Additionally, delivery delays or issues on pre-Christmas orders can trigger returns or refund requests in mid-December. All these factors mean that while gift returns still happen after Christmas, non-gift returns have “shifted left” into the peak season.

Do gift returns still mostly happen after Christmas?

Yes. Returns of gifts (items given during the holidays) overwhelmingly occur after Christmas, since recipients generally can’t return gifts until they’ve received and opened them. Retailers support this by offering extended return windows through January for holiday purchases. For example, an item bought in November as a gift might be returnable until Jan 31. Historically, about half of all gift returns occur in the week after Christmas and the other half in January. This pattern remains true – gift timing hasn’t changed. What’s changed is the volume of self-initiated returns during December (unrelated to gift receipt). So, gift returns still peak post-holiday, but overall return activity now has a “two-peak” shape, with a significant bump before Christmas as well.

How can returns increase before Christmas if people haven’t received their gifts yet?

The returns happening before Christmas are largely not gifts being returned by recipients – they are items returned by the original buyer. Many shoppers return items they bought for themselves or as potential gifts before the holiday. For instance, a person might buy two competing products as possible gifts and then return one in mid-December after deciding which to give. Or someone might order a gift early, then return it pre-Christmas upon realizing it wasn’t suitable (and get an alternative). Also, any “try and return” behavior (such as ordering clothes to try on) will lead to returns in December. The ability to return online makes it easier for shoppers to initiate returns before Christmas, but while many retailers offer free in-store returns, they may charge return shipping fees for online purchases. These returns don’t contradict gift-giving timelines; they are a result of earlier shopping habits and generous return policies that let buyers change course on purchases prior to Christmas.

What role does weather play in holiday returns coming early?

Severe winter weather can amplify early returns but isn’t the primary cause of the overall shift. For example, a blizzard or storm in mid-December might delay thousands of packages, prompting customers to cancel orders or request refunds before Christmas (since the items didn’t arrive in time). This will spike returns activity in that region for that season. In 2017, for instance, heavy snow led many to shop earlier the next year and returns peaked before Christmas. However, the broader trend of earlier returns is driven more by consumer behavior (earlier shopping, try-before-you-buy, etc.) than by one-off weather events. In short, weather can trigger more “package not delivered” returns in a given year, but the reason returns have generally moved into December is not just because of weather – it’s because of how people shop and return now. Retailers should plan for early returns every year, with weather-related surges as a possible extra factor.

How do earlier holiday returns affect ecommerce operations?

In a word: strain. When returns hit during the peak sales period, it creates additional workload for warehouses, shipping carriers, and customer service at the busiest time of year. Warehouses must process inbound returns (inspect, restock, etc.) even as they’re frantically shipping out new orders – this can overwhelm systems and staff, sometimes resulting in errors and delays. Carriers have to carry return packages in December on top of deliveries, squeezing capacity. Financially, issuing lots of refunds in December can pinch cash flow and erode holiday revenue margins sooner than expected. Inventory-wise, retailers have valuable products coming back early, but if they can’t process them quickly, they miss the chance to resell those items during peak demand.

Overall, operations become more complex: there are more moving pieces (literally, goods moving in two directions), and any weak link – whether in IT systems, forecasting, or staffing – gets exposed under the dual pressure of outbound and inbound logistics. Returns for certain product categories, such as mobile phones and other electronics, often have stricter conditions. For example, Best Buy charges a 15% restocking fee on opened electronics and a $45 fee on activatable devices. To avoid these restocking fees, items must generally be unworn, unwashed, and in their original box with tags intact. Many retailers learned that their returns processes were too brittle for this concurrent stress, leading to process breakdowns in some cases.

What can retailers do to handle the returns surge during peak season?

Preparation and agility are key. Retailers should forecast returns volume for December using historical data and plan capacity for it, just as they plan for order volumes. This might mean scheduling additional labor or shifts dedicated to returns processing in mid-December, instead of waiting until January. Improving reverse logistics automation can help – for instance, using barcode scans and software to quickly route returned items to where they need to go (back to stock, to refurbishment, etc.) without manual bottlenecks. Another strategy is to encourage or incentivize some returns to happen slightly later (if manageable) to spread out the load – e.g. some retailers might subtly ask gift recipients to “wait until after Dec 25” for returns in their return policy messaging (though most early returns are not gifts, so this has limited effect).

On the inventory side, having a system to rapidly triage returns is crucial: identify items that can be resold immediately and get them back online within days (especially hot sellers that might be sold out otherwise). For example, some advanced operations use separate “fast lane” processing for high-value returned items during December, so they’re back on virtual shelves in time for last-minute shoppers. Retailers also benefit from stronger integration between returns and inventory systems – so that as soon as a return is initiated, the system accounts for it (perhaps even allowing buy-online-return-in-store (BORIS) for faster turnaround).

Additionally, ensure customer service training and tools are in place for the returns surge: quick refund processing, clear communication of return status, and perhaps self-service return portals that can handle high traffic. Monitoring metrics like refund turnaround time and keeping them at acceptable levels even during peak will help maintain customer trust. Some retailers enlist third-party returns management services during holidays to offload some of the strain.

In short, retailers must treat returns as part of the peak game plan. Those who invest in resilient, scalable post-purchase systems – from software to staffing – will handle the earlier returns trend far more smoothly than those who try to bolt it on last-minute. The goal is to make returns efficient and even leverage them (e.g., getting inventory back for resale, using the return interaction to upsell or build loyalty) rather than simply viewing them as a January clean-up chore.

Is the shift to earlier returns here to stay?

All signs point to yes, the trend is likely permanent and growing. Consumer habits formed over recent years – like shopping early, expecting easy returns, and bracketing purchases – are now ingrained. E-commerce continues to grow, and online orders have higher return rates than in-store (often 2-3× higher), which means as holiday e-commerce expands, returns will increase in volume and come sooner (since online shoppers tend to return faster via mail or drop-off). Moreover, Gen Z and younger shoppers are very comfortable with the cycle of ordering and returning as part of finding the right product. Retailers are also further refining omnichannel returns (like buy online, return in store), which removes friction and can speed up returns. Unless retailers significantly tighten return policies during holidays (an unlikely move in a competitive market, and one that could hurt sales), consumers will continue to take advantage of leniency – which means return boxes on porches well before Santa arrives.

Going forward, we may see the “early returns peak” become an expected part of holiday logistics. For example, carriers might routinely plan a “Returns Day” in mid-December to rival the traditional post-Christmas returns rush. UPS did exactly this in 2018 and may do so again as volumes dictate. It’s important to note that unopened items in new condition are generally eligible for refunds or exchanges within specific timeframes, such as 90 days for Target and 30 days for Target Plus. So, retailers should build the infrastructure and processes assuming that holiday returns are no longer just a January phenomenon. Peak season now extends from fulfilling the order to handling its possible return, all within the holiday timeline. Embracing that reality is crucial for operational success and customer satisfaction in modern ecommerce.

What sources were leveraged for the key holiday returns metrics cited in this article?

The data points referenced in this article, including the reported 16% increase in holiday-season returns, were sourced from publicly available industry research. The primary source was Seel’s 2025 Returns and Refunds analysis, published via Prosper Show, which examines shifts in return timing and underlying drivers during the holiday season.Seel 2025 Returns and Refunds Report summary (Prosper Show):

https://prospershow.com/media/prosper-blog/holiday-returns-increase-by-16/

Turn Returns Into New Revenue

How to Increase Amazon Product Rankings Before Peak Season 2025

Peak season 2025 is looming, and boosting your Amazon product rankings should be at the top of your agenda. In the ultra-competitive Amazon marketplace, a higher Amazon sales rank can make all the difference between a blockbuster Q4 and being buried on page 5 of the search results. I’m not talking about shallow tricks or quick hacks, but sustainable, semantic-rich ranking gains that stick. Over the years, we’ve all watched Amazon’s search algorithm evolve (hello A9, A10, and now an AI-powered engine nicknamed COSMO in 2025). What worked a couple of years ago, like simple keyword stuffing, just doesn’t cut it anymore. Now it’s about genuinely optimizing for the customer’s search intent and customer satisfaction, while still checking the technical SEO boxes. Here, I’ll break down our recommended strategy for increasing Amazon product rankings ahead of the holiday rush, blending proven best practices with some fresh 2025 perspectives.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyOptimize Your Listing Keywords and Content

First things first: keyword research. To rank well, your product has to earn relevance for the right search terms. That means doing the homework on relevant keywords, both the obvious high-volume ones and the long-tail keywords that specific customers use. Dive into Amazon’s own data (the Search Query Performance dashboard in Brand Analytics) to see which search terms are driving impressions and conversions for your products. Those are gold. Sprinkle these valuable keywords strategically in your product title, bullet points, description, and backend keywords (hidden search terms). The key is balance; include important specific keywords, but don’t go overboard and trigger keyword stuffing penalties. As one Amazon expert puts it, Amazon matches your listing to searches by assessing the keywords in titles, bullet points, descriptions, and backend search terms. So, ensuring keyword relevance across these elements is critical for visibility.

Beyond keywords, make your product detail page as compelling as possible. Amazon’s algorithm increasingly uses natural language processing (the new COSMO AI) to assess content quality and search intent alignment. So write for humans first. Use bullet points that highlight key features and benefits, not just specs. Try to answer common customer questions right in the description. If someone is searching “durable kids water bottle BPA free,” your listing better say “BPA-free” and speak to durability in a conversational tone. This not only improves Amazon SEO but also conversion. And conversion (how many shoppers click buy after seeing your page) is a key factor for ranking. Amazon’s older A9 algorithm rewarded relevant keywords, but the newer A10 and COSMO reward behavioral signals, meaning if customers click your listing and actually buy (i.e., a high conversion rate), Amazon takes that as a sign your product was a great match and will rank it higher. So, optimizing the listing isn’t just about appeasing the algorithm; it’s about convincing customers you have what they need.

Don’t forget high-quality images and other media. Ensure your images are high-resolution, zoomable, and show the product from all angles (and in use-case scenarios). Images don’t directly contain keywords (aside from the alt text you can input), but they do impact sales. A set of crisp, informative images and even a video can increase conversion rates, and as mentioned, conversion feeds ranking. I focus on creating visuals that not only look good but also educate the customer (like infographics pointing out key features). The bottom line: optimize product listings with both the search algorithm and the customer in mind. Use keyword optimization to get them in the door, and quality content to keep them there.

Drive Sales Velocity with Pricing and Promotions

Sales drive rank, and rank drives sales; it’s a flywheel. One reliable way to boost your Amazon sales rank is to crank up your sales volume. Sounds obvious, but how to do it? Two words: price and promo. Take a hard look at your pricing strategy ahead of peak season. Is your price competitive for the category? If not, I might consider a strategic price drop or a coupon during the early phase of the holiday season to stimulate more sales. Amazon’s algorithm monitors sales performance and rewards products that show strong sales velocity and momentum. A product that suddenly starts selling faster than its peers can climb in rankings quickly (and conversely, running out of stock or slowing down can tank your rank). So I may suggest sacrificing a bit of margin short-term by setting competitive prices (or offering a lightning deal) to drive volume and increase sales, knowing it can pay off in organic visibility.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPPromotions and Advertising are the other levers. Plan to unleash some Amazon PPC ads (Pay-Per-Click campaigns) to boost visibility for important keywords. Sponsored Products ads can put you on page 1 even before your organic rank is there, and those ad-driven sales indirectly boost your organic rank over time. Use keyword-targeted campaigns for your main keywords to get incremental sales. But do this carefully, focusing on relevant terms so you don’t blow money on clicks that don’t convert. The goal is to improve organic standing, not just pay for sales. Also, leverage deals or Amazon coupons to entice shoppers; those little green badges can improve click-through rate. A higher click-through and conversion rate from such promos signals to Amazon that shoppers are interested. It’s worth noting, Amazon’s A10 algorithm (and presumably COSMO) gives weight to external traffic and overall performance, not just pure PPC. Some of my clients run targeted Google Ads or social media campaigns pointing to their Amazon listings. This can drive a burst of external traffic that, if converting, might give a rank bump (Amazon loves when you bring in new shoppers from outside).

Crucially, avoid any black-hat tricks that could get you penalized. Instead, focus on real customer engagement: maybe an email to your past customers saying “Check out our holiday sale on Amazon” to drive legitimate traffic. By combining smart pricing, promotions, and advertising, you should generate a steady surge in sales. Industry experts note that products with a strong sales history and high conversion rates tend to rank higher, so that’s exactly what you’re trying to cultivate going into peak season.

Prioritize Reviews and Customer Satisfaction

No surprise here: positive reviews play a huge role in Amazon rankings. They are both a direct factor (Amazon knows that products with higher ratings and more reviews tend to convert better) and an indirect one (they improve conversion, which improves rank). Make it a priority to keep the customers searching for your products satisfied at every step, so that you naturally accumulate more positive reviews. How? Start with product quality; nothing kills your rank faster than a swath of bad reviews due to a flimsy product. Perform quality checks like crazy and set realistic expectations in the listing to avoid negative feedback. During peak season, ensure your customer service is on point: fast responses to questions, helpful communication, and if there’s an issue, making it right. Happy customers = happy customers who might leave a good review and are less likely to return the product.

Amazon has cracked down on review shenanigans, so only use legit methods to get reviews. For instance, use Amazon’s “Request a Review” button (or an automated tool to trigger it) for each order, which sends an official email to buyers politely asking for a review. Even a modest 1–2% of buyers leaving reviews is great when volume spikes. More reviews (and recent ones) not only improve rank but also make Amazon shoppers more likely to purchase, feeding the cycle. Keep an eye on the customer reviews you’re getting, both star rating and content. The new Amazon algorithm (COSMO) even analyzes review content for sentiment and to see if the reviews match the product claims. This is next-level stuff: if your listing says “ultra quiet blender” and a bunch of reviews say “this blender is noisy,” I suspect Amazon will ding you in search for over-promising. So use that as feedback to improve the product or copy.

Importantly, customer experience after the sale matters too. Returns, order defects, and late shipments reflect dissatisfaction. Amazon’s algorithm might indirectly penalize listings with a high return rate or poor seller metrics (especially if you’re FBM or SFP). Aim for a smooth ride for customers from click to delivery. In fact, at Cahoot, we’ve seen that fast, reliable fulfillment leads to happier customers and better reviews. If you can offer Prime-like shipping speeds (whether via FBA or a Seller Fulfilled Prime model), customers are delighted, and you reduce negatives. Every bit of inventory management and fulfillment excellence feeds back into positive outcomes like good reviews and low returns.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkManage Inventory and Fulfillment Meticulously

It would be a shame to do all this work to boost rank, only to go out of stock when demand hits. So inventory planning is absolutely part of ranking strategy. An OOS (out-of-stock) product loses its sales momentum and its ranking can plummet, and often takes time to recover even after restock. To avoid that, analyze last year’s sales and current trends to forecast how much stock you’ll need for the season (plus a safety buffer). Make sure to send inventory into FBA well in advance of the rush, so it’s checked in and ready to ship when orders pour in. If Amazon has restock limits for your SKUs, consider using a backup like a multi-channel fulfillment partner or 3PL to hold overflow inventory and drip-feed Amazon as needed, or even fulfill some FBM (Fulfilled by Merchant) orders if your FBA sells out. The key is never saying “Currently unavailable” during the peak! That’s a fast-track to losing the rank gains you fought so hard for.

Fulfillment speed and reliability also count toward customer happiness and indirectly affect ranking. If you fulfill via FBA, you’re generally good. Prime shipping gives you a conversion edge. If you’re doing FBM or Seller Fulfilled Prime, ensure you meet those shipment and delivery promises. Late deliveries can hurt seller metrics, and while Amazon’s search algorithm mostly focuses on product performance, extreme lateness or cancellations could impact your Buy Box and indirectly your visibility. Consider leaning on Cahoot’s network of warehouses to achieve 1–2 day delivery across the country for non-FBA orders, which helps you compete with FBA sellers in terms of shipping. It’s something many Amazon sellers overlook; fast shipping can improve customer satisfaction and thus your product’s success metrics, both FBA and non-FBA.

Another aspect of inventory management is staying on top of your catalog. If you have variations (sizes, colors), keep stock healthy on all the popular variants. Amazon can sometimes rotate the “main” child ASIN that shows up in search based on availability and sales. You don’t want your one variant that’s ranking well to go OOS and be replaced by a less attractive variant in search results. Also, consider whether you need to throttle ads if stock is running low; no point paying for rank only to run dry. In summary, a well-stocked, well-distributed inventory with robust fulfillment processes is the backbone of maintaining a good sales rank during peak season. Inventory is tied to sales performance: no inventory, no sales; and no sales, no rank. So treat inventory planning as part of your SEO work in a sense.

To me, the recipe is clear: optimize like a human (use good keywords and content), deliver great value (through price and service), keep customers happy, and the rankings will follow. It’s many moving parts, but when it all comes together, you set yourself up to dominate Amazon’s search results during the holiday frenzy.

Frequently Asked Questions

What factors most influence how to increase Amazon product rankings?

Keyword relevance, sales volume, sales velocity, conversion rates, customer satisfaction, and positive reviews all play key roles in improving Amazon’s sales rank and search results placement.

How can keyword research improve my Amazon sales rank?

Using keyword research tools to identify relevant keywords and long-tail keywords, then placing them in the product title, bullet points, backend keywords, and product detail page increases keyword relevance and visibility in Amazon’s search algorithm.

Do customer reviews affect Amazon search rankings?

Yes. Positive reviews play a major role in improving conversion rates and customer trust, which increases sales performance. More positive reviews signal to Amazon that your listing matches customer search intent, helping to rank on Amazon for targeted keywords.

What role does pricing play in Amazon SEO?

Competitive pricing helps drive more sales and sales velocity. Combined with keyword optimization, this can improve Amazon’s sales rank in the same category, especially during peak season when shoppers compare offers closely.

Why is inventory management important for improving Amazon rankings?

Consistent inventory management prevents stockouts, maintains strong sales history, and ensures customers see fast delivery options. This supports customer satisfaction and protects rankings in Amazon’s search results.

Turn Returns Into New Revenue

Amazon FBA Peak Season Fees: A Deep Dive

In this article

3 minutes

3 minutes

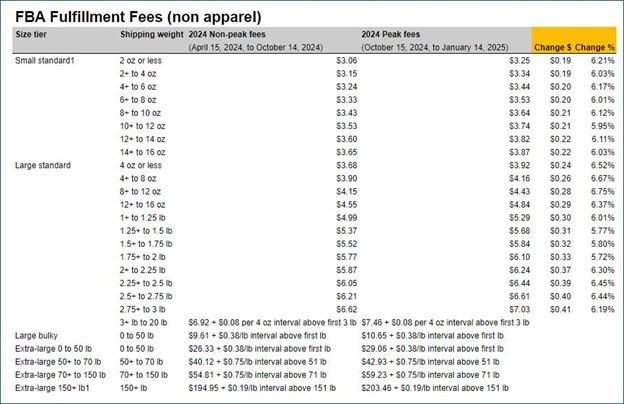

Amazon’s FBA peak season fees have become a significant factor for sellers operating on the platform. With fulfillment fees increasing by 6% and storage fees nearly tripling during peak periods, it’s essential to understand the implications and explore alternative strategies.

A Historical Perspective

Peak season fees on Amazon have been a recurring phenomenon for several years. As the platform’s popularity has grown, so has the demand for its fulfillment services. To accommodate the increased volume of orders, Amazon has implemented peak surcharges to offset the additional costs associated with hiring seasonal workers, expanding warehouse capacity, and optimizing logistics.

Comparing to Competitors

While Amazon’s peak season fees might seem steep, comparing them to other e-commerce marketplace platforms is worth it. Walmart Fulfillment Services, for instance, also increased its storage fees during peak periods but did not raise fulfillment fees. This suggests that Amazon is more aggressive in passing the costs to sellers.

Peak Season Surcharges

Given Amazon’s reliance on seasonal workers to handle the peak demand, peak season surcharges will likely continue for the foreseeable future. As long as the platform experiences significant growth during holiday periods, Amazon must ensure it can efficiently fulfill orders.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyStrategies for Managing Peak Season Fees

While peak season fees can be a challenge for sellers, there are several strategies to mitigate their impact:

- Optimize Inventory Levels: Carefully forecast demand and adjust inventory levels accordingly. Overstocking can lead to higher storage fees, while understocking may result in lost sales.

- Consider Alternative Fulfillment Options: Explore options like Seller Fulfilled Prime (SFP) or outsourcing to third-party logistics (3PL) providers. SFP allows you to fulfill orders yourself while offering Prime benefits to customers. 3PL providers can often offer competitive rates and flexible solutions, especially during peak seasons.

- Negotiate with Amazon: If you have a significant sales volume on Amazon (8 figures or more), consider negotiating with the platform to secure more favorable terms or discounts.

- Diversify Sales Channels: Reducing your reliance on Amazon can help mitigate the impact of its peak season fees. Explore other sales channels, such as your website or marketplaces like eBay.

- Offer Promotions and Discounts: Encourage early purchases by offering promotions or discounts during non-peak periods. This can help reduce the inventory you need to store during peak season.

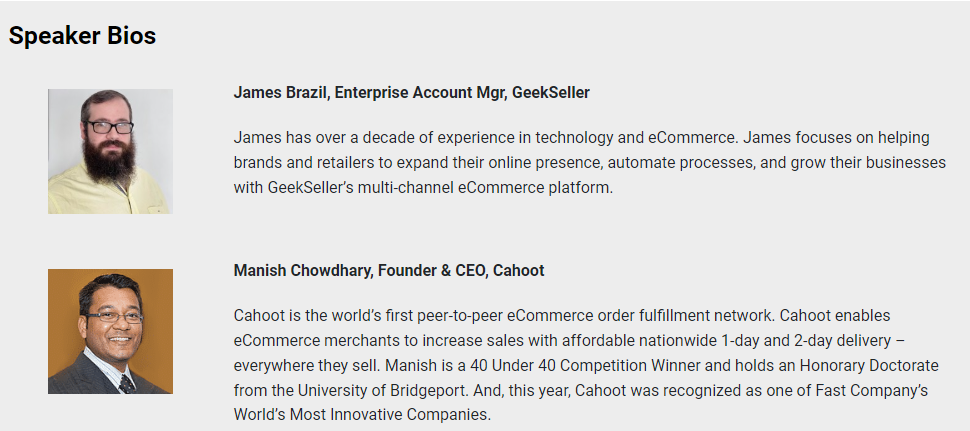

The Role of 3PL Providers

Third-party logistics providers can be valuable for sellers looking to reduce peak season fees. By outsourcing fulfillment to SFP-ready 3PL providers like Cahoot, you can offer free, fast delivery of your products on Amazon and other channels while avoiding additional peak season surcharges. 3PL providers can also help with inventory management, order fulfillment, and returns processing.

Conclusion

Amazon’s peak season fees are a reality that sellers must navigate. By understanding the factors driving these fees and implementing effective strategies, you can minimize their impact on your business. Whether you choose to optimize your inventory, explore alternative fulfillment options, or negotiate with Amazon, it’s essential to proactively address these challenges and ensure your long-term success on the platform.

Turn Returns Into New Revenue

Avoiding Critical E-commerce Mistakes This Peak Holiday Season

The holiday shopping season accounts for approximately 30% of annual retail e-commerce revenue, which represents enormous potential. Success during this crucial period demands meticulous preparation and strategic execution across multiple operational areas. To capitalize fully, businesses must avoid critical e-commerce mistakes in website performance, marketing, inventory, fulfillment, and overall strategic planning.

Website Performance and User Experience

The backbone of holiday sales lies in seamless website functionality. Shoppers expect pages to load within milli-seconds, and delays can drive potential customers to competitors. To optimize performance, businesses must conduct thorough load testing to prepare for traffic surges, ensuring infrastructure stability. Streamlining the checkout process by simplifying forms, enabling guest checkouts, and optimizing mobile experiences is crucial. Enhancing trust by prominently displaying security badges and providing competitive shipping options, such as 2-day delivery, can reduce cart abandonment. All development updates should be concluded by early to mid-November to allow for stability testing, ensuring the site operates flawlessly as peak demand ramps up over the Black Friday/Cyber Monday weekend and through the end of the year.

Craft a Comprehensive Marketing Strategy

A successful holiday campaign starts long before the season peaks, not just during BF/CM. Effective marketing strategies should begin early, launching email campaigns months ahead to build anticipation and engage shoppers. Leveraging exclusive offers through pre-sale codes, early deal announcements, and limited-time discounts fosters loyalty. Expanding social media outreach with shareable promotions and influencer collaborations amplifies brand visibility organically. Overreliance on major shopping days like BF/CM can lead to unnecessary operational strain. Staggering promotions throughout the season, however, captures both early planners and last-minute buyers while spreading out the workload.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyAvoid Stockouts and Overstock

Inventory mismanagement is one of the most detrimental holiday mistakes. Both stockouts and excess inventory pose financial and reputational risks. Retailers should analyze historical data to forecast demand accurately and use real-time tracking systems to monitor stock levels across all sales channels. Early communication with suppliers ensures adequate inventory procurement and avoids last-minute (expensive) shortages.

Streamlining Fulfillment Processes

Fulfillment challenges often peak during the holiday season due to increased order volumes. Early preparation is essential to mitigating risks such as late shipping that leads to late deliveries and fulfillment defects. Establishing fulfillment partnerships and distributing inventory well before October ensures adequate capacity and rapid scalability. Multicarrier shipping solutions can optimize shipping costs and delivery timelines by comparing real-time rates across carriers and services.

Pricing and Product Presentation

Holiday shoppers demand clear, compelling product details and competitive pricing. Dynamic pricing tools allow businesses to adjust prices based on market trends and competitor activity while maintaining profit margins. Product listings must use high-quality images, multi-angle photography, and detailed descriptions that convey value and utility. Accuracy in these areas prevents abandoned carts and unnecessary returns.

Leveraging Technology for Operational Efficiency

The integration of advanced technologies transforms holiday operations enabling scalability and precision. Warehouse Management Systems streamline and optimize the movement of goods within a warehouse, ensuring efficient and cost-effective management of inventory by tracking its location, quantity, and movement throughout the receiving, storage, picking, packing, and shipping workflows, ultimately enabling overall warehouse productivity and fulfillment accuracy. Inventory and Order Management Systems are the central nervous system of your omnichannel retail operations, providing visibility and control of orders, inventory, customers, products, and more. Analytics platforms provide real-time insights into traffic, sales, and operational performance. Regular maintenance of automation systems and software minimizes downtime, ensuring uninterrupted operations.

Communication and Customer Support

Transparent communication builds trust any time of the year, but getting to trust quickly during the holiday rush increases the chances that customers buy from the well-prepared brands. Clearly displaying shipping cutoff dates and/or date-certain delivery dates, as well as making return policies easy to find and clear, using simple language, effectively manages customer expectations and increases conversion. Post-purchase, providing real-time updates about shipping delays, stock issues, or delivery changes reassures customers and demonstrates brand accountability and commitment to the customer relationship. Expanding support channels with chatbots, live agents, and comprehensive FAQs ensures customers have access to assistance when needed, and how they like to engage.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPSummary

To thrive during the holiday season, retailers must adopt proactive measures. Monitoring competitor advertising, promotions, and pricing allows businesses to adapt dynamically. Ensuring seamless experiences across channels (webstores, marketplaces, apps), social media, and physical stores through omnichannel integration, including normalized product data using current high-resolution images and descriptions, encourages a delightful customer journey.

Time should be spent on building brand awareness and trust long before fourth quarter. Time should be spent analyzing data, procuring sufficient inventory, and finalizing marketing strategies. Software systems should be soak tested (especially if any parts of the tech stack are new) and fulfillment partner relationships established prior to the October start to the season. Seasonal staff need to be hired and trained to address the increased fulfillment and customer service demand.

The holiday season presents an exciting growth opportunity for ecommerce businesses. Not just a higher volume of one-time transactions, but the opportunity to create long-term relationships with loyal customers that may bear fruit for many years to come.

Turn Returns Into New Revenue

Preparing for Peak Holiday Season: A Guide for Sellers

In this article

9 minutes

9 minutes

- Understanding Peak Season

- Important Holiday Dates for Peak Season

- Strategic Demand Analysis, Forecasting, and Marketing Execution

- Ecommerce Trends to Watch

- Optimizing Fulfillment, Logistics, and Inventory Management

- Fulfillment Services

- Leveraging Technology

- Elevating the Customer Experience

- Preparing Customer Support Teams

- Managing Returns Effectively

- Contingency Planning for Unforeseen Challenges

- Ensuring Scalability and Sustainability

- Converting Challenges into Strategic Wins

- Frequently Asked Questions

The peak holiday season is the most critical time of the year for ecommerce businesses, characterized by intense order volumes, high consumer expectations, and operational complexities. In particular, ecommerce sellers that fully outsource their fulfillment operations require different preparations that retailers and brands that own their fulfillment workflows don’t have to consider. A proactive approach focused on forecasting and planning for logistics needs, customer service demand, and supportive technologies is essential for navigating this high-stakes period effectively.

Understanding Peak Season

Peak season is a critical period for online retailers, typically occurring in the months leading up to and including the holiday season. During this time, ecommerce businesses experience significant shifts in sales and revenue, with certain periods, such as the holiday season, being pivotal for growth. Understanding peak season trends and statistics is crucial for ecommerce businesses to effectively prepare and meet customer demand. By analyzing past performance and anticipating future trends, online retailers can strategically plan their inventory, marketing, and customer service efforts to maximize their success during this high-stakes period.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyImportant Holiday Dates for Peak Season

The holiday peak season typically spans from October to December, encompassing key shopping events like Black Friday, Small Business Saturday, and Cyber Monday. There are about 30 days between Thanksgiving and Christmas, but the actual range is 27 to 33 days, so the holiday shopping season varies for shoppers who don’t start browsing or buying until Black Friday.

Daily shipment volumes can increase by 1,000% or more in ‘normal’ years, placing significant strain on fulfillment operations. However, some industries see even higher spikes in demand based on the holiday shopping season’s start after Thanksgiving Day. Ecommerce retailers will want to be more conservative with their delivery promises to customers needing to receive their orders before holiday events than normal.

Make sure to review each Carrier’s Published Shipping Deadlines to Ensure Delivery on or Before Christmas Eve:

Carrier / Service |

Contiguous U.S. (lower 48 states) |

Alaska, Hawaii, International, Military |

|---|---|---|

USPS Ground Advantage |

7 days before Christmas |

|

USPS Priority Mail |

6 days before Christmas |

|

USPS Priority Mail Express |

4 days before Christmas |

|

UPS 3 Day Select |

6 days before Christmas |

|

UPS 2nd Day Air |

5 days before Christmas |

|

UPS Next Day Air |

2 days before Christmas |

|

FedEx Ground Economy |

13 days before Christmas |

|

FedEx Express Saver |

6 days before Christmas |

|

FedEx 2Day & 2Day AM |

5 days before Christmas |

|

FedEx SameDay |

1 day before Christmas |

Strategic Demand Analysis, Forecasting, and Marketing Execution

Accurate forecasting is the foundation of successful holiday operations. Analyzing historical sales data to identify trends, understanding seasonal consumer behavior, and mapping inventory needs help prevent both stockouts and overstock situations. Collaborating with suppliers well in advance to secure production and delivery schedules is critical. Factoring in extended lead times for manufacturing and transportation ensures inventory is positioned where it is most needed.

Taking the time to carefully plan promotions, new listings for bundle and/or kit SKUs, multi-packs, etc. can all help online businesses increase revenue opportunities.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPEcommerce Trends to Watch

Several ecommerce trends are expected to shape peak seasons. Online shoppers increasingly use their smartphones to make purchases, with mobile commerce sales projected to account for 78% of total ecommerce sales; over $490 billion. This shift underscores the importance of optimizing for mobile shopping experiences.

Social commerce continues to drive growth and influence purchase behavior, with social media platforms accounting for an estimated 18.5% of all online sales and this percentage is only expected to continue to grow.

Additionally, streamlining returns management can be a major differentiator for ecommerce businesses, with online order returns at 20 – 30% and costs exceeding $800 billion a year. Staying ahead of these trends can help ecommerce businesses enhance customer satisfaction and boost sales during the peak season.

Optimizing Fulfillment, Logistics, and Inventory Management

Meeting increased demand during the holiday season requires a well-structured fulfillment strategy. Distributing inventory across multiple warehouses using fully outsourced fulfillment partners such as Cahoot can significantly reduce shipping costs and transit times and increase on-time delivery performance. Fulfillment partners offer advanced tools and infrastructure to rapidly scale operations while delivering exceptional customer experiences for the brand.

Make sure to review third-party receiving deadlines and blackout dates and plan to have inventory inbounded and fulfillment-ready long before it needs to be. Communicate emergency contact info, volume forecasts (especially if any big spikes are expected from special promotions or sales from far-reaching sources such as Good Morning America Deals & Steals), and most importantly, make sure providers have enough stock on hand (including a buffer) to ship all orders on time, including any specialty items such as inserts or branded packaging materials.

Fulfillment Services