OpenAI ACP vs Google UCP: What’s the Difference?

AI commerce protocols are not all trying to solve the same problem. OpenAI ACP vs Google UCP is a useful comparison because it separates decision-making from transaction execution. As agentic commerce evolves, new protocols are emerging to address the unique challenges of AI-driven ecommerce, and there is a growing need for an open standard to ensure interoperability between agents, systems, and services. If you run ecommerce operations, that distinction matters more than the branding, because it determines where your systems will need to integrate and what you can expect to control.

The confusion happens because both protocols sit under the umbrella of agentic commerce, and both are described as enabling AI agents to buy things. But they operate at different layers of the commerce lifecycle. ACP focuses on enabling an AI assistant to act as the shopping interface and coordinate purchasing decisions with merchants. UCP focuses on creating a common language for checkout flows so consumer surfaces can execute transactions reliably across many retailers, payment providers, and business backends. There are real differences between ACP and UCP in terms of their underlying philosophies, ecosystems, and control mechanisms, which can significantly impact which protocol best aligns with a merchant’s strategy. Once you see the layering, the “protocol wars” framing becomes less useful. These are not mutually exclusive building blocks. They can coexist in the same shopping journey.

Despite their architectural differences, both protocols share the same goal: enabling secure, tokenized payments efficiently and reliably within agent-driven retail environments.

What is OpenAI’s Agentic Commerce Protocol (ACP)?

OpenAI’s ACP, or OpenAI’s Agentic Commerce Protocol, is a protocol shaped around the idea that an AI assistant can guide a user through product discovery, selection, and delegated purchase actions. OpenAI’s ACP is an open, cross-platform protocol released under the Apache 2.0 license, allowing businesses to implement the specification for any AI assistant or payment processor. Launched in September 2025, ACP powers ‘ChatGPT Instant Checkout’, enabling seamless transactions directly within ChatGPT. ACP is primarily concerned with enabling AI agents to do three things cleanly:

- Retrieve structured product data so the agent can recommend items without guessing

- Confirm user intent and finalize what is being purchased

- Send an order and payment authorization to the merchant in a way that is secure and bounded

Merchants using ACP must support high-quality, structured product data, product feeds, endpoints, and webhooks to enable agent-initiated checkout and agentic payments. ACP is designed for broad adoption, independent of any single user interface, platform, or distribution surface.

The key concept is the agent as the interface. ACP assumes the user is inside an AI assistant experience, and the assistant is actively participating in the buyer journey. That includes conversational discovery, comparisons, and narrowing options. In that world, the protocol is a way to translate the agent’s “decision” into an executable order that a merchant can fulfill.

For merchants, ACP is essentially a way to accept orders that originate from an AI agent while preserving the merchant’s core responsibilities: pricing, inventory truth, order management, fulfillment, returns, and post-purchase support. ACP is not a marketplace model where the agent becomes the seller. It is a protocol for agent mediated ordering.

Let AI Optimize Your Shipping and Boost Profits

Cahoot.ai software selects the best shipping option for every order—saving you time and money automatically. No Human Required.

See AI in ActionWhat is Google’s Universal Commerce Protocol (UCP)?

Universal Commerce Protocol is Google’s answer to the challenge of standardizing checkout and transaction execution across many consumer surfaces and merchant systems. UCP is primarily concerned with making the act of completing checkout less bespoke across the commerce ecosystem.

UCP is implemented within Google-owned surfaces, including Search AI Mode, the Gemini App, and Google Shopping. Google AI Mode plays a key role in enhancing product discoverability and visibility in these AI-powered environments. UCP is built on Merchant Center feeds and schemas, making it structured data-first and optimized for AI-enhanced discovery inside Google surfaces.

In practical terms, UCP is designed to create a common language between:

- Consumer surfaces such as search, shopping, and AI mode experiences

- Merchants and their business logic systems

- Payment providers and payment authorization flows

- Order management and status updates

UCP is compatible with existing protocols, including Google’s own Agent Payments Protocol (AP2), and was announced in January 2026. Merchants can customize their UCP integration and declare which payment methods they support, benefiting from reduced checkout friction. The model context protocol is also part of this open standard approach, enabling seamless shopping experiences across Google’s platforms.

Launch partners such as Lowe’s, Michaels, Poshmark, and Reebok have been early collaborators in deploying Google’s AI shopping assistants, helping to integrate UCP within Google Search and related surfaces.

The key concept is interoperability. UCP is not primarily about an agent making taste-based recommendations. It is about reliably completing checkout across different retailers and reducing integration complexity. It sits closer to the transaction layer than the preference formation layer.

For operators, UCP reads like a standardization effort that tries to make “complete checkout” and “complete transactions” consistent across platforms, rather than forcing every merchant to build a custom integration for every surface.

ACP is centered on the decision layer

When people say ACP is designed for AI agents making purchasing decisions, they are usually pointing to the workflow ACP prioritizes:

- The user expresses intent in an AI assistant

- The AI assistant discovers products using structured product data and user intent

- The AI assistant helps the user choose and confirms the purchase

- The AI assistant triggers a delegated payment and transmits an order to the merchant

ACP preserves merchant control over pricing, inventory, and fulfillment throughout this process, allowing merchants to maintain autonomy over their operations.

In other words, ACP optimizes the handoff from “the agent decided this is what you want” to “the merchant can now fulfill it.” It is closer to commerce discovery and conversational discovery than to generic payment rails. Structured product data is crucial here, as AI agents prioritize it over traditional SEO factors when making recommendations. Merchants should optimize their product data for agent consumption to improve visibility in AI-driven shopping. Agentic commerce opens new ways to connect with high-intent shoppers.

UCP is centered on the execution layer

When people say UCP focuses on standardizing checkout, they are usually pointing to the workflow UCP prioritizes:

- A consumer surface identifies a high intent shopper

- The surface needs to execute checkout with minimal friction

- The surface needs a consistent way to communicate with merchants and payment methods

- The merchant needs to execute order creation and update status through a standardized interface

UCP operates within a walled garden – a controlled, closed ecosystem tightly integrated with Google-owned platforms. Aggregator platforms may benefit from UCP’s omnichannel integration and the ability to leverage Google Shopping data.

In other words, UCP optimizes the handoff from “the user is ready to buy” to “the transaction is executed correctly across different merchants.” It is closer to the transaction data layer than to preference formation.

A simple mental model: who is the product interface?

A useful way to compare OpenAI ACP vs Google UCP is to ask: who owns the shopping interface at the moment of selection?

- With ACP, the AI assistant is explicitly the shopping interface. The user is talking to an agent. The agent is selecting products to show and guiding the decision. High-quality product feeds are essential for accurate product selection by AI agents.

- With UCP, the consumer surface is the shopping interface. The surface may have AI assistants embedded, but the core emphasis is that the surface can execute a purchase across many merchants consistently.

This is why the protocols can coexist. The agent can be where the user decides, and a standardized transaction protocol can be how the purchase is executed. Merchants need to prepare for both ACP and UCP, as they represent different demand channels in agentic commerce.

ShipStation vs. Cahoot: 21x Faster, Real Results

Get the inside scoop on how a leading merchant switched from ShipStation to Cahoot—and what happened next. See it to believe it!

See the 21x DifferenceDiscovery and consideration

ACP is more directly tied to discovery because it assumes the agent is helping the user discover products. That pulls in requirements around structured product data, product schema, and merchant feeds. Merchants should monitor product visibility, not just brand mentions, to understand their performance in AI shopping. It’s important for merchants to track product visibility across AI shopping surfaces, as the brands that win in agentic commerce will be those visible to AI agents during the discovery phase.

UCP can participate in discovery, but its clearer value is enabling commerce surfaces to transact. UCP is often discussed alongside consumer surfaces like search and shopping where high intent shoppers are already in motion.

Checkout and payment authorization

UCP is explicitly concerned with checkout execution and payment authorization across platforms and payment providers. If you think about the complexity of payment methods, fraud controls, tax calculations, and multi-item carts, this is where standardization offers real leverage.

ACP also deals with payment authorization, but typically through a delegated payments approach that keeps the user in control while letting the agent complete checkout. ACP’s payment posture is designed to be secure and bounded to the user’s intent.

Order management and post purchase support

UCP tends to extend naturally into order management, status updates, and post purchase support because a consistent transaction protocol often needs a consistent way to handle order state.

ACP can still support post purchase, but its defining feature is the agent driven decision and purchase initiation. The merchant still owns fulfillment and customer experience after the order is placed.

Transport and interoperability: how ACP and UCP connect with existing systems

When it comes to enabling agentic commerce at scale, the way protocols connect with existing systems – known as transport and interoperability – can make or break adoption. Both the universal commerce protocol (UCP) and agentic commerce protocol (ACP) are designed to let AI agents interact with merchants, products, and payments, but they take different technical paths to get there.

OpenAI’s Agentic Commerce Protocol (ACP) keeps things simple by relying exclusively on REST APIs for communication. This approach is familiar to most digital commerce teams and makes it straightforward to plug ACP into existing ecommerce stacks. For merchants and developers, this means less time spent wrestling with new integration patterns and more focus on providing clean product data and supporting agentic commerce. However, the REST-only approach can be limiting for organizations with more complex or modern architectures that might prefer gRPC or GraphQL for efficiency or flexibility.

Google’s Universal Commerce Protocol (UCP), on the other hand, is built for maximum adaptability. UCP supports multiple transport methods – including REST, gRPC, and GraphQL – so it can fit into a wider range of merchant and platform environments. This flexibility is especially valuable for larger retailers or platforms with diverse technical resources and legacy systems. The trade-off is that supporting multiple protocols can add complexity to implementation and ongoing maintenance, especially for teams less familiar with these technologies.

On the interoperability front, both protocols are designed to create a common language for commerce. ACP’s delegated payments system enables secure, tokenized transactions initiated by AI assistants, while UCP’s Agent Payments Protocol standardizes payment authorization and security across Google Pay, payment networks, and merchant systems. This ensures that, whether a user is checking out via an AI assistant or through Google Shopping, payment flows remain secure and consistent.

Structured data is another cornerstone of both protocols. ACP leans on product schema and structured product data to help AI agents understand and recommend products accurately, supporting robust commerce discovery and user intent matching. UCP leverages Google Merchant Center feeds, allowing merchants to provide detailed, up-to-date product information that powers Google Search, Google Shopping, and AI mode experiences. This structured approach is critical for AI shopping, as it ensures that product discovery and instant checkout are based on reliable, real-time data.

The visibility layer – how AI agents and surfaces discover and interact with merchants – also differs. ACP’s open web model allows AI assistants to discover products and merchants across the entire web, supporting a broad, decentralized approach to commerce discovery. In contrast, UCP’s integration with Google Search, Merchant Center, and the Gemini app creates a more curated, structured experience, where merchants can control how their products appear across Google’s AI surfaces and shopping journeys.

Ultimately, both the agentic commerce protocol and universal commerce protocol are designed to support the full commerce lifecycle, from product discovery to payment authorization and post-purchase support. The choice between them often comes down to your technical environment and strategic priorities: ACP offers simplicity and a direct path for AI assistants to interact with merchants, while UCP provides flexibility and deep integration with Google’s commerce ecosystem.

For merchants and developers, the key is to ensure your systems are ready to provide structured data, support secure payment flows, and integrate with the visibility layers that matter most for your audience. By understanding the transport and interoperability differences between ACP and UCP, you can make informed decisions about how to support agentic commerce and stay ahead in the evolving world of digital commerce.

Practical implications for ecommerce operators

If you are deciding where to invest attention, separate the integration problem from the operating problem.

Your product data becomes more critical, regardless of protocol

Both protocols depend on the merchant’s ability to provide accurate product data. In the AI shopping context, poor product data becomes a decision-quality problem, not just a listing quality problem. That includes:

- Consistent attributes and variation handling so the agent does not confuse options

- Accurate pricing, promotions, and availability

- Clear fulfillment promises and return policies

Shopify merchants, in particular, face unique analytics and attribution challenges when preparing for protocol pluralism and supporting high-quality product feeds. Addressing these challenges is essential to ensure accurate representation and performance tracking across multiple AI shopping protocols.

If your catalog is messy, the agent layer will make messy decisions. If your catalog is clean, agents and surfaces can represent you accurately.

Your fulfillment and post purchase execution still determines retention

Neither protocol fulfills orders for you. Operations leaders should treat these protocols as additional order sources, not as operational outsourcing. Your differentiation surface remains execution:

- Availability and inventory accuracy

- Fulfillment speed and reliability

- Exception handling and customer service throughput

- Returns, refunds, and post purchase trust

If agentic commerce increases the number of orders that happen without a user visiting your site, you will have fewer opportunities to correct misunderstandings. That raises the operational importance of accurate product data and predictable fulfillment.

Your channel mix may shift, but the constraints stay familiar

ACP aligns with the rise of AI assistants as a new discovery channel. For example, when a shopper asks an AI assistant to recommend running shoes, the AI can query product data and facilitate a direct purchase, making it crucial for merchants to optimize for this emerging channel. Merchants must also support product feeds and agent-initiated checkout for OpenAI’s ACP implementation, ensuring seamless order processing.

UCP aligns with large consumer surfaces reducing friction at checkout. If platforms can complete checkout without sending users through fragile handoffs, UCP style workflows change how you should think about conversion rate optimization.

In both cases, the core operator question is the same: can your stack accept orders cleanly and can your operations deliver the promise consistently.

Consider how you will measure performance without overclaiming visibility

Operators often ask what transaction data they receive and what visibility layer they lose. That depends more on the surface than the protocol. Protocols standardize how systems talk. They do not guarantee you will receive rich behavioral context. If the decision happened inside an AI assistant, you may not get the full shopping journey transcript. If the decision happened inside a platform surface, you may get aggregated signals rather than individual level pathing.

That is not a reason to avoid the channel. It is a reason to get comfortable measuring what you can reliably measure: order outcomes, return rates, cancellation drivers, and service performance.

Cut Costs with the Smartest Shipping On the Market

Guranteed Savings on EVERY shipment with Cahoot's AI-powered rate shopping and humanless label generation. Even for your complex orders.

Cut Costs TodayACP and UCP are not mutually exclusive

This is the most important clarification for reference use.

ACP and UCP can operate in different layers of the same journey:

- A user can discover and decide through an AI assistant using an ACP style interaction.

- The eventual checkout and transaction execution can still benefit from standardized execution patterns that look like UCP.

- A merchant can support both without treating them as a binary choice, because they address different moments in the commerce lifecycle.

In practice, you should expect multiple protocols in the ecosystem. That does not imply fragmentation is fatal. It implies you should design your commerce systems to be modular. A protocol is just a contract for how systems communicate. If your order management and checkout architecture is brittle, every new interface is painful. If it is modular, adding new order sources becomes manageable.

A grounded operator way to decide what matters

The best way to evaluate OpenAI ACP vs Google UCP is to start from your operating reality.

If your business depends on commerce discovery and customer acquisition, ACP matters because it represents the agent layer where discovery and selection happen. It is a new distribution surface for demand.

If your business depends on converting high intent shoppers efficiently, UCP matters because it targets checkout execution across platforms. It is a mechanism for reducing friction at the transaction point.

For most mid-market operators, the correct answer is not “pick one.” The correct answer is:

- Make your product data, inventory truth, and order handling robust enough to plug into both

- Treat each protocol as a potential order source, and focus on operational readiness

- Stay neutral and factual about what each protocol claims to do, and avoid assuming maturity until your partners confirm it for your exact stack

That is how operators avoid getting distracted by branding and stay focused on where AI actually intersects with commerce execution.

Frequently Asked Questions

What is OpenAI ACP?

OpenAI ACP is a protocol designed to let an AI assistant coordinate product discovery and a delegated purchase flow so an AI agent can place an order with a merchant on the user’s behalf.

What is Google UCP?

Google UCP is a protocol designed to standardize checkout and transaction execution across consumer surfaces, merchants, and payment providers using a common commerce language.

What is the main difference between OpenAI ACP vs Google UCP?

ACP is primarily oriented around the agent layer that helps users decide what to buy and then initiates a purchase. UCP is primarily oriented around standardizing how checkout is executed across platforms and merchants.

Do ACP and UCP solve the same problem?

They overlap in enabling AI driven commerce, but they solve different problems. ACP focuses on agent mediated buying decisions and order initiation. UCP focuses on transaction execution standardization and interoperability.

Are ACP and UCP mutually exclusive?

No. ACP and UCP are not mutually exclusive because they can operate in different layers of the same shopping journey, with an agent handling decision-making and a standardized protocol handling checkout execution.

What do ecommerce operators need to change to support these protocols?

Operators should focus on accurate structured product data, inventory truth, reliable order management integration, and fulfillment execution that can meet the promises represented by AI assistants and commerce surfaces.

Do these protocols replace a merchant’s existing checkout and OMS?

No. They are communication standards that connect external surfaces and agents to merchant systems. Merchants still own pricing, inventory, order processing, fulfillment, returns, and post purchase support.

Turn Returns Into New Revenue

What Is Rithum? A Practical Guide for Ecommerce Operators

In this article

21 minutes

21 minutes

- The merger created a connected commerce ecosystem, not just another software tool

- Core modules orchestrate data and orders, not physical goods

- Operational workflows reveal what brands actually do with the platform

- Rithum is orchestration software, not a logistics operation

- More channels means exponentially more fulfillment complexity

- The platform makes sense at specific complexity thresholds

- Implementation requires months, not weeks, of committed resources

- Product Listings Management: Controlling Your Catalog Across Channels

- Inventory Management: Keeping Stock Synced and Sales Flowing

- Private Marketplaces: Expanding Beyond Public Channels

- Delivery Performance: Meeting Customer Expectations at Scale

- Integration with Other Platforms: Connecting Your Commerce Stack

- Insights and Analytics: Turning Data into Actionable Strategy

- Frequently Asked Questions

Rithum is the commerce operations platform created to solve a fundamental scaling problem: brands and retailers drowning in the complexity of managing dozens of marketplace connections, each with unique requirements for product data, order processing, and compliance. Rithum was formed when two industry pioneers, CommerceHub and ChannelAdvisor, joined forces—following CommerceHub’s acquisition of ChannelAdvisor in November 2022 and the combined company’s rebrand as Rithum in December 2023—along with acquired technologies DSCO and Cadeera. The platform now connects 40,000+ companies processing $50 billion in annual GMV across 420+ marketplaces and retail channels.

Rithum’s bold vision is to build the world’s most connected commerce ecosystem, empowering brands and retailers to operate seamlessly at scale. This vision drives the company’s strategy to innovate and transform global commerce operations.

For operators considering enterprise commerce platforms, understanding what Rithum actually does (and critically, what it doesn’t do) separates informed decisions from expensive mistakes.

The merger created a connected commerce ecosystem, not just another software tool

The strategic logic behind Rithum begins with understanding its parent companies. CommerceHub, founded in 1997 in New York, built its business helping major retailers like Home Depot, QVC, and Nordstrom manage dropship supplier networks without holding inventory. ChannelAdvisor, founded in 2001 in North Carolina, took the opposite approach, helping brands like Samsung, Crocs, and Under Armour sell across marketplaces and manage digital advertising. In November 2022, the two companies joined forces when CommerceHub purchased ChannelAdvisor for $23.10 per share in a take-private transaction. This merger created a powerful connection between their systems and networks, integrating their complementary viewpoints.

The combined entity solves the problem IDC analyst Heather Hershey identified: “Leaders from brands and retailers need a partner that is thinking holistically across different partnership models in the connected commerce ecosystem.” DSCO, acquired in 2020, added distributed inventory visibility and B2B networking capabilities. Cadeera, acquired alongside the 2023 rebrand, brought multi-modal AI for product onboarding automation and channel mapping. The result positions Rithum as a platform covering the entire ecommerce lifecycle from product listing through fulfillment coordination, though that description requires significant caveats.

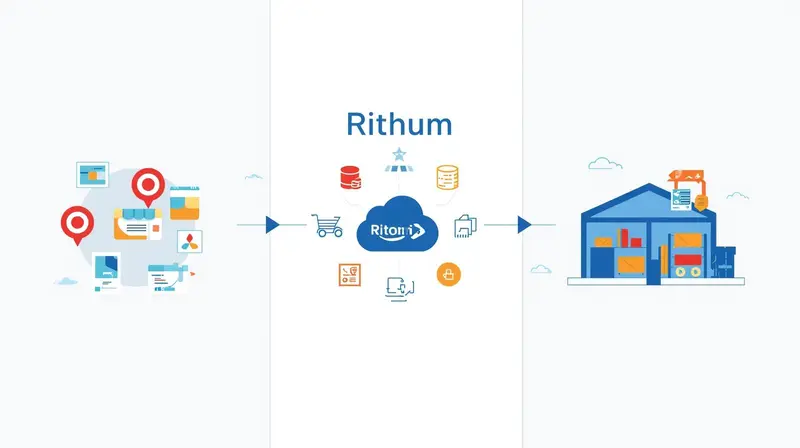

Core modules orchestrate data and orders, not physical goods

The platform operates through interconnected modules serving distinct functions. Marketplace listings management centralizes product catalog distribution to 420+ channels, with data transformation engines adapting content to each platform’s unique specifications. Amazon requires different attribute structures than Walmart or TikTok Shop. The Magic Mapper AI tool auto-categorizes products to marketplace taxonomies, reducing manual mapping work. Rithum uses AI through RithumIQ to automate product categorization and provide pricing recommendations, helping brands and retailers optimize products for each channel. Error detection systems flag broken or non-compliant listings with suggested fixes. Rithum’s AI engine accelerates growth, boosts margins, and simplifies operations.

Inventory management synchronizes stock levels in real-time across all connected channels. When a product sells on Amazon, quantities decrement everywhere (Walmart, eBay, Target Plus, and retailer dropship connections) within minutes. The platform supports up to 600,000 inventory items per account, with quantity buffers, safety stock settings, and automatic bundle management that adjusts availability across components and assembled products. Critical limitation: Rithum doesn’t hold inventory. It provides visibility into inventory you store elsewhere (warehouses, 3PLs, FBA) but requires external feeds from WMS or ERP systems.

Order management and routing provides centralized visibility across marketplaces, DTC sites, and wholesale channels. Smart routing rules evaluate fulfillment options (geographic proximity, cost optimization, inventory availability, supplier performance) and direct orders to optimal locations. The system integrates with Amazon FBA/MCF, Walmart Fulfillment Services, and third-party warehouses. For retailers operating dropship programs, this module routes orders to appropriate suppliers and monitors SLA compliance.

The delivery suite (primarily retailer-facing) handles shipping label management, delivery date prediction, and rate shopping across carrier contracts. Retail media advertising management consolidates campaign execution across Amazon, Walmart, and other retail media networks with automated bidding strategies. Analytics and reporting consolidates performance metrics across all channels into customizable dashboards with product-level profitability tracking. Rithum also helps users manage paid search and shopping ads, including automated bidding strategies and connecting ad spend to sales. Rithum improves fulfillment costs while providing customers with accurate shipping and delivery timeframes.

Analytics and reporting consolidates performance metrics across all channels into customizable dashboards with product-level profitability tracking. Rithum also helps users manage paid search and shopping ads, including automated bidding strategies and connecting ad spend to sales. Rithum simplifies complexity with insights to improve supplier performance and protect customer experience.

Rithum’s user experience and dashboard are designed for simplicity and user-friendliness. The platform does not require an additional app for setup or operation, making it easy for users to get started and manage their workflows efficiently.

Let AI Optimize Your Shipping and Boost Profits

Cahoot.ai software selects the best shipping option for every order—saving you time and money automatically. Learn more about Amazon Buy Shipping integration and how it enables error-free order fulfillment. No Human Required.

Operational workflows reveal what brands actually do with the platform

DSW migrated its dropship operations to Rithum in 2019 after outgrowing a previous solution. The footwear retailer integrated 152 connections and 250 brands, maintaining approximately 100% fill rate while monitoring click-to-porch delivery speed through visibility tools. Their Senior Manager of Fulfillment Operations noted that rapid and easy supplier onboarding made them a strong partner in the growth of their network. This illustrates the core retailer use case: expanding product assortment without holding inventory.

Boardriders (Quiksilver, Billabong, ROXY) added 50 new sales channels in one year using the platform’s automated marketplace onboarding. The action sports company fixed channel fragmentation issues and managed fulfillment routing across expanded distribution. Superdry moved from spreadsheet-based marketplace management to centralized operations, enabling faster launches across 21 international websites serving 100+ countries.

For brands expanding to new marketplaces, the typical workflow involves uploading product catalogs via data feed or API, applying transformation tools to adapt content for each destination’s requirements, launching listings, and managing real-time inventory synchronization. Rithum allows you to expand into new sales channels and manage product listings centrally across 420+ marketplaces. When orders arrive, they flow through the centralized dashboard with routing rules directing them to designated fulfillment locations. A Forrester study found this approach saves approximately 600 technical labor hours per marketplace per year, reducing daily feed management from 5+ hours to largely automated operation.

With Rithum, users can expect convenient and efficient control over their marketplace operations, making it easier to manage multiple channels and streamline workflows.

Dropship program workflows follow a structured sequence: suppliers upload inventory to Rithum, updates sync automatically to connected retailers, orders match SKUs to suppliers and export based on defined schedules, and the system monitors SLA performance while validating tracking codes. Suppliers onboard in days rather than weeks using centralized portals with built-in templates. Forrester documented a 66% reduction in supplier onboarding time for retailers using the platform.

Rithum is orchestration software, not a logistics operation

The critical boundary every operator must understand: Rithum does not pick, pack, or ship orders. It does not operate warehouses, store inventory, negotiate carrier rates, or manage carrier relationships. These functions require entirely separate infrastructure. Speed Commerce’s analysis states the distinction clearly: “CommerceHub specializes in streamlining dropshipping and marketplace operations, connecting retailers and suppliers for efficient order fulfillment, a focus that is different from the warehousing and physical distribution services offered by 3PLs.”

Operators using Rithum remain responsible for physical order fulfillment execution (picking, packing, shipping), warehouse operations or 3PL partnerships, carrier account management and shipping relationships, customer service for order inquiries, returns processing and reverse logistics, and maintaining inventory accuracy in source systems.

According to Rithum’s service terms, customers must handle buyer customer service and perform all work necessary to appropriately integrate with Rithum’s API. The platform expects inventory feed updates at minimum weekly (real-time recommended) with one-to-one SKU/inventory number relationships.

This means a complete tech stack typically includes an ERP system (Rithum offers managed integrations with SAP, NetSuite, Microsoft Dynamics 365, Sage Intacct, Acumatica), a WMS or 3PL partnership, shipping software (ShipStation, ShipWise), carrier accounts (FedEx, UPS, USPS), and ecommerce platform connections (Shopify, BigCommerce, Magento). Official 3PL partners include DCL Logistics, Speed Commerce, Fulfyld, and Bleckmann Logistics, indicating the expectation that fulfillment happens through external partners.

More channels means exponentially more fulfillment complexity

Adding retail channels through Rithum doesn’t simplify fulfillment. It compounds complexity. Research shows 22% of ecommerce decision makers cite logistical challenges as the main barrier to marketplace expansion. Each marketplace has unique fulfillment requirements: different shipping timeframes, packaging standards, labeling rules, and compliance penalties.

Retailer SLA requirements illustrate the challenge. Nordstrom requires 98% of orders fulfilled before defined due dates. Stage Stores specifies 48 business hours for fulfillment lead-time. EDI compliance violations (late or inaccurate ASNs, incorrect labeling, shipping errors) trigger chargebacks ranging from hundreds to tens of thousands of dollars per violation. The most common chargeback cause: problems with EDI 856 Advance Ship Notices.

Inventory accuracy requirements intensify at scale. Stockouts and overstocking cost U.S. retailers $1.75 trillion annually according to industry data. Real-time synchronization across channels is essential. Overselling leads to cancellations, chargebacks, and damaged seller scorecards. Multi-location fulfillment adds coordination complexity, particularly for multi-unit orders sourced from different warehouses. Strategic warehouse placement becomes critical for meeting delivery SLAs without excessive shipping costs.

This is precisely why Rithum is powering the orchestration layer of commerce operations, ensuring seamless coordination of order routing and data flow. Rithum dynamically routes orders to the best fulfillment centers to maximize margins, helping brands and retailers meet complex requirements efficiently. By powering the future of commerce operations, Rithum enables businesses to adapt and thrive as fulfillment demands evolve. Execution happens elsewhere. Operators who don’t already have fulfillment infrastructure (either owned warehouses with WMS systems or 3PL partnerships) face significant additional buildout before Rithum becomes useful.

ShipStation vs. Cahoot: 21x Faster, Real Results

Get the inside scoop on how a leading merchant switched from ShipStation to Cahoot—and what happened next. See it to believe it!

The platform makes sense at specific complexity thresholds

Rithum is typically appropriate for mid-market to enterprise operations. Users report monthly costs of $2,000+ after initial periods, with GMV percentage fees, per-channel integration charges, and EDI transaction fees adding to base costs. The pricing model uses progressive GMV/ad spend tiering that resets monthly or annually. Two-year contract lock-ins are commonly reported.

Complexity indicators suggesting Rithum may be appropriate: selling across 5+ major marketplaces requiring centralized listing management, operating dropship or 3P commerce programs requiring supplier-retailer coordination, managing retail media advertising across multiple platforms, pursuing international expansion across diverse marketplaces, facing EDI requirements from major retailers (Home Depot, Lowe’s, Target, Kroger), or needing intelligent order routing across multiple fulfillment locations. Rithum helps brands and retailers list, market, and optimize their products across various commerce channels through its retailers list functionality, enhancing sales, fulfillment, and delivery capabilities. Additionally, Rithum enables retailers to launch curated third-party marketplaces while maintaining control over sales.

Rithum is likely overkill for single-channel Amazon or Shopify sellers, operations with under 1,000 SKUs, businesses generating under $1M annually, dropshippers with simple operations, or companies needing only basic inventory synchronization. For these scenarios, direct marketplace tools (Seller Central, Seller Hub) or lighter multichannel platforms (Linnworks at ~$449/month, SellerActive for SKU-heavy operations, Sellercloud at $1,199/month with included WMS functionality) offer more appropriate starting points.

The competitive landscape includes Feedonomics (feed management without order/inventory modules, owned by BigCommerce), ChannelEngine (1,300+ channels with stronger European focus), Productsup (global localization), and Sellercloud (full backend with WMS at lower cost but steeper learning curve). Feedonomics receives higher ratings for support and ease of setup; Sellercloud offers more included infrastructure for budget-conscious operations.

Implementation requires months, not weeks, of committed resources

Official implementation follows five phases: solution overview and account creation, account configuration and API integration, content enhancement and data optimization, training and soft launch, then full product rollout and ongoing management. Rithum’s approach to commerce technology and implementation is rooted in innovation, aiming to advance retail operations through cutting-edge solutions. Reported timelines range from weeks for basic setups to 6-9 months for complex implementations. One competitor claims customers launch 30,000 SKUs on TikTok in under a week versus months on Rithum, highlighting the tradeoff between platform comprehensiveness and speed.

Rithum recently launched the 2026 Commerce Readiness Index, a benchmark report for retail executives, further demonstrating its commitment to providing innovative resources for the industry.

Customer responsibilities before implementation begins include providing acceptable inventory feeds in required formats (CSV with headers, one SKU per item), establishing seller accounts on target marketplaces, staffing launch teams familiar with each platform’s requirements, completing API integration work, and designating a single point of contact for decisions. Image URLs must be hosted and accessible; product data requires Global Trade Identification Numbers (UPCs, EANs) for most marketplaces.

Common post-implementation challenges reported by users include product delistings due to platform bugs (takes weeks to fix), integrations that only work 90% of the time, billing on cancelled orders counted toward GMV-based fees, and slow support response on unresolved tickets. The platform’s rigidity (adapting workflows to Rithum rather than customizing Rithum to existing workflows) frustrates operators expecting flexibility.

Success factors from experienced users emphasize clean, well-structured product data before implementation, realistic timeline and cost expectations, internal champions with ecommerce/technical expertise, backup plans for capabilities Rithum doesn’t provide (shipping software, WMS, customer service), and budget buffers for unexpected costs including EDI transaction fees that add up quickly.

Product Listings Management: Controlling Your Catalog Across Channels

Managing product listings across a growing number of major commerce channels can quickly become overwhelming for brands and retailers. Rithum’s product listings management solution puts you back in control, allowing you to seamlessly manage, optimize, and expand your catalog across marketplaces, social platforms, and ecommerce websites—all from a single, unified dashboard. By leveraging the power of the Rithum network, you can ensure your products are accurately represented, easily discoverable, and consistently updated wherever your customers shop.

This end-to-end solution empowers brands and retailers to redefine commerce operations by automating the adaptation of product data to each channel’s unique requirements. Whether you’re launching new SKUs or updating existing listings, Rithum streamlines the process, helping you maintain a seamless commerce experience and unlock infinite possibilities for growth. With built-in tools for bulk editing, error detection, and AI-driven optimization, you can drive scalable business results while supporting cost-effective fulfillment and sustainable growth.

By maintaining control over your product listings and expanding your reach to new channels, Rithum enables you to tap into new markets, connect with more customers, and ensure your brand stands out in a crowded digital landscape. The result is a more agile, responsive, and profitable commerce operation—ready to meet the demands of today’s connected consumers.

Inventory Management: Keeping Stock Synced and Sales Flowing

In the fast-paced world of commerce, inventory accuracy is non-negotiable. Rithum’s inventory management solution is designed to keep your stock levels perfectly synced across every channel, ensuring that sales keep flowing and customers always find what they’re looking for. By integrating with the Rithum network, brands and retailers gain access to a connected commerce ecosystem that delivers real-time visibility into inventory, no matter how many warehouses, 3PLs, or fulfillment partners you use.

This advanced solution streamlines order fulfillment by automatically updating stock levels as sales occur, reducing the risk of overselling or stockouts. With Rithum, you can focus on driving your business forward, confident that your inventory data is accurate and up-to-date across all platforms. The platform’s robust integration capabilities mean you can connect your existing systems and processes, unlocking new levels of innovation and operational efficiency.

Rithum’s mission and vision center on empowering limitless growth for brands and retailers. By providing the tools to manage inventory with precision and agility, Rithum helps you achieve sustainable growth, improve customer satisfaction, and stay ahead in a rapidly evolving market. With enhanced visibility and control, your business is positioned to capitalize on every opportunity the connected commerce ecosystem has to offer.

Private Marketplaces: Expanding Beyond Public Channels

For brands and retailers looking to go beyond traditional public marketplaces, Rithum’s private marketplaces solution offers a powerful way to create curated, exclusive shopping experiences. By leveraging the Rithum network, you can connect directly with suppliers and partners to build a private marketplace tailored to your unique business goals and customer needs.

This approach allows you to tap into new sales channels, expand your reach, and increase revenue—all while maintaining full control over your brand, product assortment, and customer experience. With Rithum, creating a private marketplace is easy and efficient, enabling seamless commerce that delights customers and strengthens supplier relationships.

Private marketplaces also support sustainable growth by allowing you to curate offerings, manage access, and ensure quality, all within a secure and scalable environment. Whether you’re looking to offer exclusive products, launch a B2B portal, or create a specialized retail experience, Rithum empowers brands and retailers to unlock infinite possibilities and drive long-term success—while maintaining the flexibility to adapt as your business evolves.

Delivery Performance: Meeting Customer Expectations at Scale

In the era of instant gratification, delivery performance can make or break the customer experience. Rithum’s delivery performance solution is designed to help retailers and brands meet—and exceed—customer expectations for speed, reliability, and convenience. By integrating with the Rithum network, you gain access to a wide range of delivery options, including cost-effective fulfillment and sustainable shipping solutions that scale with your business.

Rithum empowers you to optimize delivery operations, monitor performance in real time, and quickly adapt to changing market demands. This ensures that your customers receive their orders on time, every time, fostering loyalty and driving repeat business. With seamless commerce at the core, Rithum helps you maintain high standards of service while expanding your reach and unlocking infinite possibilities for growth.

By leveraging advanced analytics and automation, you can identify bottlenecks, improve delivery speed, and reduce costs—all while maintaining control over your operations. Rithum’s delivery performance tools are built to empower brands and retailers to drive scalable growth, enhance customer satisfaction, and stay competitive in a rapidly evolving commerce landscape.

Cut Costs with the Smartest Shipping On the Market

Guaranteed Savings on EVERY shipment with Cahoot’s AI-powered rate shopping and humanless label generation. Even for your complex orders.

Integration with Other Platforms: Connecting Your Commerce Stack

A truly connected commerce ecosystem requires seamless integration across all your platforms and channels. Rithum’s integration solution enables retailers and brands to connect their entire commerce stack—including ecommerce platforms, major marketplaces, and social media channels—through the Rithum network. This unified approach streamlines commerce operations, improves performance, and empowers your business to innovate and grow.

With Rithum, integrating with other platforms is easy and efficient, allowing you to create a seamless commerce experience for your customers. Whether you’re looking to expand into new markets, launch on additional channels, or connect with new partners, Rithum provides the tools and flexibility to make it happen. The platform’s robust integration capabilities ensure that your data flows smoothly between systems, unlocking infinite possibilities for operational efficiency and business growth.

By empowering your commerce operations with Rithum, you gain the visibility, control, and agility needed to achieve your mission and vision of limitless growth and innovation. To learn more about how Rithum can help you connect, integrate, and expand your business, visit www.rithum.com and discover the future of seamless, connected commerce.

Insights and Analytics: Turning Data into Actionable Strategy

In today’s fast-moving commerce landscape, data is the key to unlocking infinite possibilities and driving sustainable growth. Rithum’s connected commerce ecosystem empowers brands, retailers, and suppliers to redefine commerce operations by transforming raw data into actionable strategy. With end-to-end solutions and the expansive Rithum network, businesses gain the speed, visibility, and control needed to thrive across all major commerce channels.

Rithum’s advanced analytics and reporting tools provide deep visibility into every aspect of your commerce operations. Real-time insights reveal customer behavior, emerging market trends, and performance across marketplaces, enabling you to make informed decisions with confidence. Personalized recommendations help you optimize product listings and marketing campaigns, ensuring your products stand out and perform at their best on every channel.

Seamless integration with the world’s leading marketplaces and commerce platforms means you can create, manage, and optimize your product catalog from a single, unified dashboard. This not only streamlines operations but also empowers fast, cost-effective fulfillment and helps maintain a consistent brand experience—no matter where you sell.

By joining forces with Rithum, you tap into a network built by industry pioneers, designed to power the future of commerce. Our mission is to empower brands and retailers to drive scalable growth, innovate with confidence, and stay ahead in a limitless, ever-evolving market. Whether you’re looking to expand your reach, improve performance, or gain deeper insights into your business, Rithum provides the tools and expertise to help you succeed.

Stay connected with the latest trends, insights, and best practices by following our page and accessing our library of informative posts, features, and software tutorials. For deeper industry knowledge, watch our expert-led video where we explain key insights about product visibility and AI shopping platforms. Discover how the Rithum network can help you unlock infinite possibilities and achieve your business goals. Visit www.rithum.com today to learn more, download our latest report on the future of commerce, and join a community dedicated to empowering fast, seamless, and sustainable growth in the world of connected commerce.

Frequently Asked Questions

What exactly is Rithum?

Rithum is a commerce operations platform that connects brands and retailers to 420+ marketplaces and retail channels. It manages product listings, synchronizes inventory across channels, routes orders to fulfillment locations, and provides analytics. Rithum’s vision centers on enabling seamless commerce, creating an integrated and highly connected ecosystem for smooth, efficient, and scalable retail operations across multiple channels. The platform was formed in December 2023 from the merger of CommerceHub and ChannelAdvisor, along with acquired technologies DSCO and Cadeera. It processes $50 billion in annual GMV for 40,000+ companies but does not handle physical fulfillment.

Rithum also offers smart home technology, including a sleek, wall-mounted touchscreen device that acts as a central hub for controlling lighting, audio, and climate. The Rithum Switch is a smart home control panel that combines lighting, audio, and climate control into one intuitive touchscreen interface.

Does Rithum fulfill orders or handle warehousing?

No. Rithum is orchestration software, not a logistics operation. It does not pick, pack, ship orders, operate warehouses, store inventory, or manage carrier relationships. All physical fulfillment happens through your own warehouses, 3PL partners, or services like Amazon FBA. Rithum routes orders to these locations and ensures data flows correctly, but execution responsibility sits entirely with your fulfillment partners.

How much does Rithum cost?

Users report monthly costs starting at $2,000+ with additional fees based on GMV percentage, per-channel integrations, and EDI transactions. The pricing model uses progressive tiering that resets monthly or annually. Two-year contract commitments are commonly reported. Actual costs vary significantly based on GMV volume, number of connected channels, and specific features used. Budget above the baseline for transaction fees and integration charges.

When does a business actually need Rithum versus simpler tools?

Rithum makes sense for operations selling across 5+ major marketplaces, managing dropship or supplier programs, running retail media campaigns across multiple platforms, facing EDI requirements from major retailers, or needing intelligent order routing across multiple fulfillment locations. It’s typically overkill for single-channel sellers, operations under 1,000 SKUs, businesses under $1M annually, or companies needing only basic inventory sync. Lighter alternatives like Linnworks, SellerActive, or direct marketplace tools serve these simpler scenarios better.

How long does Rithum implementation take?

Implementation timelines range from weeks for basic setups to 6-9 months for complex deployments depending on number of channels, integration complexity, and product catalog size. The process requires clean product data, API integration work, marketplace seller accounts, dedicated internal resources, and realistic timeline expectations. Common delays include data formatting issues, integration troubleshooting, and marketplace-specific compliance requirements.

What’s the difference between Rithum and competitors like Feedonomics or ChannelEngine?

Feedonomics focuses primarily on feed management and product data optimization without order management or inventory modules. ChannelEngine offers 1,300+ channel connections with stronger European marketplace coverage. Sellercloud includes WMS functionality at lower cost but has a steeper learning curve. Rithum’s advantage lies in its comprehensive suite covering listings, inventory, orders, advertising, and analytics in one platform, plus its network of retailer connections from the CommerceHub legacy. The tradeoff is higher cost and longer implementation versus more focused alternatives.

Turn Returns Into New Revenue

DSCO Fulfillment Explained: What Sellers Still Get Wrong

In this article

15 minutes

15 minutes

- What DSCO actually does vs what it does not do

- Why sellers confuse EDI compliance with fulfillment readiness

- Order Fulfillment Strategies

- Retailers that rely heavily on DSCO

- Cancellation and late-shipment penalties tied to DSCO metrics

- Real operational examples sellers underestimate

- The role of 3PLs in DSCO success

- What “DSCO readiness” actually looks like in practice

- Strategic takeaway for operations leaders

- Frequently Asked Questions

DSCO fulfillment is where strong EDI still loses to weak execution. DSCO can standardize retailer communication, but it cannot make your warehouse hit SLAs. If you are onboarding to retailer drop shipping, the most common failure mode is treating EDI compliance as the finish line instead of the starting gun.

DSCO’s commitment to operational excellence and providing reliable, innovative logistics solutions sets it apart in the fulfillment landscape.

DSCO is valuable because it creates a common language between retailers and suppliers: order routing, inventory integrations, shipment confirmation, and tracking updates are standardized so a retailer can scale drop ship without custom one-off connections for every brand. That standardization is real. DSCO’s features, such as real-time validations and robust data standardization, further enhance order fulfillment efficiency and accuracy. It is also the reason the operational gaps show up so fast. Once DSCO orders start flowing, retailers judge you on what customers actually experience: ship speed, cancellation rate, tracking reliability, and whether returns and post-purchase support work cleanly.

DSCO provides 100% data standardization with over 70 real-time validations to ensure inventory, product, and shipping data accuracy.

The hard truth is simple. Sellers fail DSCO programs when their warehouse operations cannot meet retailer SLAs, not because of EDI issues.

What DSCO actually does vs what it does not do

DSCO sits in the “communication and compliance” layer of drop shipping. It helps retailers and suppliers manage the entire process of order processing across channels without relying on manual email threads and spreadsheets. In practice, dsco order fulfillment typically includes:

- Receiving sales orders from retail channels in a standardized format

- Passing updates back to the retailer on acknowledgments, cancellations, shipments, and tracking

- Synchronizing inventory levels so a retailer site can decide what to sell

- Supporting consistent status events that feed vendor scorecards and customer service workflows

The integration manager feature of DSCO allows users to track inventory levels and order status in real-time.

That is what DSCO does.

What DSCO does not do is what most sellers secretly need it to do:

- It does not pick, pack, and ship orders

- It does not control your fulfillment centers, labor planning, or cutoffs

- It does not prevent inventory mismatch between your systems and what is physically on the shelf

- It does not force a carrier scan to happen on time

- It does not protect you from shipping costs caused by poor cartonization or service level mistakes

- It does not fix reverse logistics or improve your returns disposition process

DSCO can streamline the connection and make data flow faster. It cannot make execution better. If your warehouse can only ship in two to three business days, DSCO will not change that. If your inventory accuracy is weak, DSCO will not magically reconcile it. DSCO is a mirror. It reflects your operation back to the retailer with timestamps.

Efficient logistics integration with DSCO ensures that product data, order fulfillment, and inventory levels are accurately synchronized across all sales channels.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyWhy sellers confuse EDI compliance with fulfillment readiness

This is the single most common operational misunderstanding in dsco fulfillment.

Sellers spend weeks or months getting certified, validating test transactions, and proving the connection works. The integration feels like the “hard part” because it involves outside teams, project plans, and unfamiliar concepts. Once the platform connection is live, everyone wants to believe the account is ready to scale.

But EDI compliance is about message correctness. Fulfillment readiness is about outcome reliability. Efficiently and reliably fulfilling orders is critical for successful dsco fulfillment, as it ensures customer satisfaction and supports business growth.

You can be perfectly compliant and still fail a drop shipping program in your first week if:

- You acknowledge orders on time but ship late

- You send inventory feeds on schedule but oversell due to bad counts. Real-time inventory synchronization is essential for DSCO users to avoid overselling products.

- You generate labels quickly but miss carrier pickup windows

- You provide tracking numbers that do not scan for 24 hours

- You ship partials or substitute SKUs to “save the sale” and trigger chargebacks

Retailers do not grade you on how clean your integration looks. They grade you on the DSCO metrics tied to customer experience: ship on time, ship complete, ship accurately, and keep cancellations low. DSCO makes these metrics measurable, not negotiable.

Order Fulfillment Strategies

Order fulfillment is the backbone of any successful ecommerce business. In the world of DSCO order fulfillment, the right strategy can mean the difference between scalable growth and operational headaches. For ecommerce stores, the challenge isn’t just about getting products out the door—it’s about doing so cost effectively, with real-time tracking, and without hidden fees eating into your margins.

One of the most impactful moves is partnering with a third party logistics (3PL) provider. Companies like LMS Logistics Solutions have demonstrated that leveraging a comprehensive suite of fulfillment services—such as those offered by 3PL Central—can drive efficiency and accuracy. With inventory integrations that automatically update inventory levels and real-time tracking numbers, businesses can maintain near-perfect inventory accuracy and keep customers informed every step of the way.

When evaluating a fulfillment partner, look beyond the upfront cost. Scrutinize for hidden fees, reverse logistics capabilities, and the ability to scale with your business. Cost savings aren’t just about the cheapest rate—they’re about the total cost of ownership, including support, integration, and the flexibility to adjust as your operations grow. Solutions like Extensiv’s DSCO integration offer step integration specific instructions, making it easier to connect your ecommerce order sources, manage inventory, and streamline the entire process from order to delivery.

Drop shipping is another strategy that can help ecommerce businesses expand their assortment without the burden of holding inventory. By working closely with suppliers and retailers, you can fulfill orders directly from the source, reducing shipping costs and allowing your business to focus on sales and growth. This model is especially useful for businesses with limited storage or those looking to test new products without a large upfront investment.

Shipping labels and tracking numbers play a pivotal role in customer satisfaction. Providing real-time tracking and clear communication builds trust and reduces customer service overhead. Whether you’re using your own fulfillment centers, a 3PL, or leveraging Amazon FBA to tap into Amazon’s distribution network, the ability to offer reliable shipping and tracking is non-negotiable.

Distribution strategy matters, too. By creating a network of fulfillment centers—either through your own operations or with a 3PL—you can reach customers faster and more cost effectively, no matter where they are. This is especially important for high-volume products or when serving a wide geographic area.

Ultimately, the most successful ecommerce businesses treat fulfillment as a core competency, not an afterthought. They work closely with their fulfillment partners, suppliers, and retailers to ensure seamless integration and communication. They commit to going the extra mile for customers, providing real-time support, and adjusting their processes as the business scales.

In summary, order fulfillment strategies are not one-size-fits-all. Whether you’re leveraging DSCO integrations, drop shipping, 3PLs, or Amazon FBA, the key is to build a flexible, cost-effective operation that prioritizes customer experience. By focusing on the right partnerships, technology, and processes, your ecommerce store can fulfill orders efficiently, support growth, and stay ahead in a competitive market.

Retailers that rely heavily on DSCO

You do not need a long list to understand the implication, but it helps to name the pattern.

Several large retail programs use DSCO or DSCO-connected infrastructure to run drop ship at scale, particularly in categories like apparel, footwear, accessories, home, and specialty retail. DSCO also supports e-commerce and digital sales channels, enabling smooth management and fulfillment of online orders. You will often see DSCO in the background for retailers that run high-SKU catalogs and rely on brands to fulfill orders directly to consumers under tight standards. Integration with various e-commerce order sources allows for streamlined fulfillment and efficient inventory tracking. The operational theme is consistent across these programs: the retailer owns the customer experience, and you are expected to execute like a first-party warehouse.

DSCO connects to over 60 order destinations, including major retailers like Nordstrom and Kohl’s, simplifying data exchange.

If your team is used to marketplace fulfillment or slower B2B shipping cadences, DSCO-based drop shipping can feel unforgiving. That is because it is.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPCancellation and late-shipment penalties tied to DSCO metrics

DSCO is often described as “communication standardization,” but the commercial teeth are in the scorecard.

Retailers use DSCO metrics to calculate:

- Cancellation rate

- Late shipment rate

- On-time carrier scan adherence

- Tracking timeliness and validity

- Sometimes, defect proxies like returns, customer contacts, or delivery exceptions

When you miss, the consequences are usually economic before they are relational.

Common penalty mechanisms include:

- Per-order chargebacks for late shipments or cancellations

- Fee schedules tied to repeat SLA misses

- Removal from drop ship eligibility after sustained underperformance

- Reduced assortment visibility or limited product eligibility for high intent shoppers

Transparent pricing models are crucial in dsco fulfillment, as they help eCommerce businesses clearly understand the cost structures and avoid unexpected or hidden fees.

This is why dsco fulfillment problems rarely show up as an “EDI error.” They show up as margin erosion. A program can look profitable on paper until you layer in hidden fees from late shipments, expedited shipping used to recover SLAs, and cancellations that create customer service overhead.

DSCO validates supplier invoices for accuracy before routing them to retailers for payment, helping ensure financial accuracy and cost control.

The operational lesson is not “avoid penalties.” It is to understand that DSCO makes your fulfillment performance legible to the retailer. If your operation is not already built to hit strict shipping and accuracy targets, the fees are a symptom, not the disease.

Real operational examples sellers underestimate

Most DSCO failures are boring. They are also expensive. These are the patterns that repeatedly sink accounts. To avoid these common DSCO fulfillment failures, it is essential to integrate systems and processes between your e-commerce platform and third-party logistics providers, ensuring seamless data synchronization and operational efficiency.

Integrating DSCO with third-party logistics services helps to save time and money.

Late ship caused by warehouse reality, not system timing

A DSCO order arrives at 2:10 PM. Your warehouse cut-off for same-day picking is 1:00 PM. Your team treats the order like any other ecommerce order and plans to pick it tomorrow.

From the retailer’s perspective, that order is already aging. If the program expects shipment within 24 hours, you are now living inside a clock you did not design. Your integration might be flawless, but you are operationally late before anyone touches a box.

This is why operations leaders should treat dsco orders as a distinct order class with its own routing rules, labor priority, and exception escalation.

Inventory mismatch that turns into cancellations

Your inventory integration sends 42 units available. The warehouse actually has 19, because:

- Cycle counts are infrequent

- Damaged inventory is not quarantined properly

- Returns are not reconciled quickly

- Multiple order sources are drawing from the same pool without real time locking

The retailer sells 10 units. You can ship 8. You cancel 2.

That might feel like “normal ecommerce.” In a DSCO program, it is a scorecard hit. Repeat it often enough and you look unreliable. Retailers care about cancellation rate because cancellations are customer pain and customer service cost. DSCO simply makes that pain attributable.

Carrier scans that do not happen when you think they do

A seller prints labels and sends tracking in time. The packages sit on the dock until the carrier arrives the next morning. Tracking shows “label created” but no acceptance scan.

Some retailers treat the first carrier scan as the real shipment event. Your DSCO status says shipped, but the carrier data says not yet. This gap can trigger late shipment flags even when your team believes they complied.

Operationally, this is solved by pickup discipline, dock processes, and cutoffs aligned to scan reality. “Label printed” is not “shipped” in retailer math.

Wrong service level or routing details that create downstream cost

Retailer drop ship programs often specify service levels, label formats, and packing requirements. Sellers sometimes treat these as administrative details, then discover the penalties later.

A common example is selecting a shipping method that is too slow to meet delivery expectations, then paying to upgrade shipments reactively. Another is failing to include the required packing slip or return label, triggering customer contacts and chargebacks.

None of this is fixed by DSCO. DSCO will happily transmit the shipment confirmation for a shipment that will arrive late.

The role of 3PLs in DSCO success

For brands onboarding to drop shipping, the 3PL question is not about convenience. It is about capability. Strategic partnerships and tailored services for clients are essential in DSCO fulfillment, as ongoing communication and understanding each client’s unique needs foster trust and deliver value.

A strong third party logistics partner can make dsco fulfillment viable because they already operate at the tempo retailers expect. Choosing a 3PL for DSCO orders requires evaluating their industry experience and technological capabilities. The right partner can help with:

- Cutoffs and labor models designed for rapid order processing

- Warehouse discipline around scan compliance and dock flow

- Inventory accuracy through tighter cycle counting and location control

- Standard operating procedures for pack rules, labels, and routing requirements

- Exception handling when a carrier misses pickup or an order needs intervention

A reliable 3PL should also offer modern integration technology to ensure efficient order fulfillment.

This does not mean “use a 3PL and you are safe.” Retailers hold the seller accountable, not the warehouse vendor. If your 3PL misses SLAs, your account takes the hit. The practical implication is that DSCO success requires operational governance regardless of who runs the building.

Operations leaders should treat the 3PL relationship like a program, not a purchase order. You need:

- Shared SLA definitions that match retailer requirements

- Daily visibility into backlog, late risk, and cancellation drivers

- A process for inventory reconciliation and dispute resolution

- Escalation paths for carrier issues and peak volume planning

Flexibility in scaling services is also important when selecting a 3PL for DSCO orders.

If you are running your own warehouse, the same governance still applies. The only difference is who you can fire.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkWhat “DSCO readiness” actually looks like in practice

Most sellers think readiness means the connection is stable. Retailers think readiness means the order experience is stable.

DSCO readiness in operations terms looks like:

- Warehouse cutoffs aligned to retailer ship windows

- Order processing that prioritizes DSCO orders without starving other channels

- Inventory levels that reflect reality, not accounting optimism

- Tracking that scans fast and stays valid through delivery

- Clear playbooks for exceptions: backorders, damages, carrier misses, address issues

- Reverse logistics that does not collapse customer confidence

Notice what is not on that list. It is not a step integration specific instructions document. It is not a deep dive into EDI schemas. The challenge is execution.

This is also why sellers get surprised by DSCO. DSCO makes it easy to start. It does not make it easy to be good.

Strategic takeaway for operations leaders

If you want one mental model for dsco fulfillment, use this:

DSCO standardizes communication. Retailers evaluate execution.

Treat DSCO like a spotlight, not a shield. It will highlight where your operation is strong and where it is fragile. If you are fragile, you will see it first through cancellation and late shipment penalties, then through lowered assortment access, then through program risk.

The correct posture is not to obsess over the integration. It is to build a fulfillment operation that can meet retailer SLAs consistently, even during peak demand, even when a carrier misses a scan, even when inventory is tight. That is what retailers are buying from you when they approve you for drop shipping.

Frequently Asked Questions

What is DSCO fulfillment?

DSCO fulfillment refers to operating a retailer drop ship program where DSCO standardizes order, inventory, and shipment communications, while the seller still performs the physical fulfillment work.

What does DSCO do in drop shipping?

DSCO standardizes retailer and supplier communication for orders, inventory updates, shipment confirmations, and tracking so retailers can scale drop ship programs without custom integrations.

What does DSCO not do for sellers?

DSCO does not execute fulfillment. It does not pick, pack, ship, manage carrier pickups, correct inventory accuracy, or ensure you meet retailer SLAs.

Why do sellers fail DSCO programs even when EDI is working?

They confuse EDI compliance with fulfillment readiness. Retailers score performance based on cancellations, late shipments, and tracking quality, which are operational outcomes.

What DSCO metrics typically trigger penalties?

Retailers commonly penalize high cancellation rates, late shipment rates, missing or delayed tracking, and shipment events that do not meet required timing thresholds.

How do carrier scans impact DSCO performance?

Many retailers treat the first carrier acceptance scan as the proof of shipment timing. A label can be created and tracking sent, but if the package is not scanned promptly, it can still count as late.

How can a 3PL help with DSCO success?

A capable 3PL can improve ship speed, inventory accuracy, scan discipline, and exception handling. The seller must still govern the partnership to meet retailer SLAs.

What operational changes matter most for DSCO readiness?

Tight cutoffs, prioritized order processing, accurate inventory levels, consistent carrier pickups, reliable tracking, and strong exception handling matter more than integration effort.

Turn Returns Into New Revenue

How Rithum Fulfillment Works (And How to Choose the Right 3PL)

In this article

15 minutes

15 minutes

- How Rithum evolved from two competing platforms into commerce middleware

- The order lifecycle from retailer purchase to customer delivery

- Retailer SLAs demand near-perfect execution with significant financial penalties

- Why sellers struggle after Rithum implementation

- What qualified 3PLs need to handle Rithum-connected orders

- Integration architecture connects WMS to retail channels

- Selecting the right fulfillment partner determines retail dropship success

- Frequently Asked Questions

Rithum is the middleware providing the orchestration and data routing needed for seamless order fulfillment, routing orders between retailers like Target Plus, Nordstrom, and Walmart to your fulfillment operation. However, it won’t pick, pack, or ship a single product—those physical actions are handled by your 3PL, in-house warehouse, or Amazon’s Multi-Channel Fulfillment service. By accurately managing inventory levels and order quantities, sellers can feel confident in the reliability of their integrated ecommerce solution, knowing that Rithum orchestrates the entire order fulfillment process.

This distinction matters because retailers like Walmart require 99% on-time shipping with $5-per-order penalties for violations, while Nordstrom cancels orders entirely if shipment doesn’t occur within one business day. When inventory sync fails or carrier performance drops, Rithum’s orchestration capabilities become irrelevant. Rithum maintains real-time inventory levels across all connected channels to prevent overselling and automatically syncs your Amazon inventory quantities with your channels. Your 3PL relationship determines whether you meet these unforgiving standards or face suspension from programs that took months to join. Rithum uses machine learning to provide accurate delivery dates at the time of purchase, accounting for variables like carrier performance, but successful implementation also depends on having the needed information, configuration, and support in place.

How Rithum evolved from two competing platforms into commerce middleware

Rithum emerged in December 2023 when CommerceHub and ChannelAdvisor unified under a single brand following CommerceHub’s $23.10 per share acquisition of ChannelAdvisor in November 2022. The combined company also absorbed DSCO, a distributed inventory platform acquired in 2020, and Cadeera, an AI company. This consolidation brought together CommerceHub’s enterprise retailer integration strengths (primarily EDI-based connections with major retailers) and ChannelAdvisor’s marketplace listing and advertising platform serving 40,000+ companies globally.

The platform now operates three core systems under the Rithum umbrella. OrderStream from the CommerceHub legacy handles enterprise dropship and retailer integration through EDI and SFTP connections. DSCO provides a modern API-first architecture supporting dropship, marketplace, and buy-online-pickup-in-store workflows. The original ChannelAdvisor platform manages multichannel marketplace listings and digital marketing across 420+ marketplace integrations, allowing users to list products across multiple marketplaces and efficiently manage their catalog.