Moving from Amazon 1P to 3P: What It Actually Takes to Succeed

In this article

24 minutes

24 minutes

- Introduction to Amazon Transition

- Benefits of the 3P Model

- Amazon Marketplace Opportunities

- The accountability shift from Amazon to brand operations

- FBA performance thresholds determine Prime eligibility

- Seller Fulfilled Prime requires infrastructure most brands lack

- Inventory forecasting becomes brand responsibility without safety net

- Pricing control requires active management, not just authority

- Buy Box competition determines revenue reality

- The Hybrid Option: Running 1P and 3P Concurrently

- The 6–9 month transition timeline and revenue dip

- When brands should not attempt the transition

- Frequently Asked Questions

The decision to move from Amazon Vendor Central (1P) to Seller Central (3P) usually follows months of frustration with pricing control loss, erratic purchase orders, and margin compression from chargebacks. In the 1P model, Amazon acts as the retailer, purchasing inventory from your brand and controlling pricing, brand experience, and profitability. Many brands are making the move from vendor to seller models as market trends show a shift toward greater flexibility and control. The appeal of 3P is straightforward: reclaim pricing authority, eliminate Amazon’s payment delays, access customer data for retargeting, and stop bleeding margin to deductions. Brands who successfully transition document margin improvements of 20-56%, MAP compliance increases from single digits to mid-90s, and revenue per unit gains of 30-50%. These outcomes are real and achievable, but they require operational capabilities most 1P vendors do not currently have.

The core mistake brands make is treating the 1P to 3P transition as a strategic pivot that simplifies operations. The reality is precisely opposite. Moving to 3P represents a significant change in your Amazon business model, shifting responsibilities and platform management. When you move from Vendor Central to Seller Central, you join the ranks of third party sellers, taking on complete accountability for fulfillment performance, inventory forecasting, Prime eligibility maintenance, and customer service execution from Amazon back to your brand. This vendor central to seller transition means Amazon’s enforcement standards for 3P sellers are explicit, measurable, and ruthlessly applied. Failing to meet Order Defect Rate thresholds below 1%, Late Shipment Rate below 4%, or Valid Tracking Rate above 95% triggers account-level warnings, Buy Box suppression, or outright suspension. Success on 3P depends less on your intent to regain control and more on whether your operating model can consistently meet Amazon’s performance standards without Amazon absorbing the operational risk. This article explains exactly what operational capabilities the transition requires, which failure modes cause the most damage, and what metrics determine whether your brand can succeed as a 3P seller, all while accessing Amazon’s vast audience of potential customers.

Introduction to Amazon Transition

Transitioning from Amazon’s 1P (first-party) vendor model to the 3P (third-party) seller model is a pivotal decision for brands looking to optimize their Amazon strategy. In the 1P model, brands sell products wholesale to Amazon through Vendor Central, allowing Amazon to control pricing, inventory management, and customer relationships. This approach offers simplicity and access to Amazon’s scale, but it comes at the cost of limited control over key aspects like pricing and customer data.

By contrast, the 3P model empowers brands to sell directly to customers on the Amazon platform via Seller Central. This shift gives brands more control over their pricing, inventory, and marketing, but it also requires hands-on management and a deeper understanding of the operational demands of the Amazon ecosystem. Brands moving from 1P to 3P must be prepared to take ownership of inventory management, set their own prices, and engage directly with customers. Understanding these differences is essential for brands considering the transition, as it impacts everything from profit margins to customer experience and long-term growth on Amazon.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyBenefits of the 3P Model

Adopting the 3P model on Amazon unlocks a range of benefits for brands seeking greater autonomy and profitability. One of the most significant advantages is direct control over pricing, allowing brands to adjust pricing in real-time in response to market trends and competitor actions. This flexibility supports more competitive pricing strategies and helps protect profit margins.

With the 3P model, brands also gain full oversight of their inventory levels, enabling them to manage stock more efficiently, avoid stockouts, and reduce excess inventory. This level of control extends to marketing efforts as well—3P sellers can create custom brand stores, run targeted sponsored ads, and implement marketing strategies tailored to their goals. By selling at their own set prices and only paying referral fees and fulfillment costs, brands can often achieve higher profit margins compared to the 1P model. Ultimately, the 3P approach gives brands the tools to optimize their marketing strategy, respond quickly to changes in demand, and maximize profitability on the Amazon platform.

Amazon Marketplace Opportunities

The Amazon marketplace represents a vast opportunity for brands leveraging the 3P model, offering access to millions of active customers worldwide. This expansive audience can drive significant sales growth, but success requires more than just listing products. Brands must master inventory management, accurately forecast demand, and adjust pricing to stay competitive in a dynamic environment.

Utilizing Seller Central, brands can tap into Amazon’s powerful platform tools, including Fulfillment by Amazon (FBA) and Amazon Advertising, to streamline operations and reach more customers. However, careful planning is essential—effective inventory management and pricing strategies are critical to maintaining sales momentum and avoiding costly stockouts or overstock situations. Brands that invest in understanding the Amazon marketplace and its unique requirements are best positioned to capitalize on its potential and achieve sustained growth as 3P sellers.

The accountability shift from Amazon to brand operations

In the 1P model, Amazon acts as the retailer by purchasing inventory wholesale and assumes responsibility for storage, fulfillment, customer service, returns processing, and Prime delivery performance. Brands face operational accountability only for supplying inventory on time, maintaining product quality, and complying with labeling requirements. Amazon absorbs the fulfillment risk. If a package arrives late, the customer blames Amazon. If inventory runs out, Amazon decides whether to reorder. If customer service fails, Amazon handles the complaint.

The 3P model inverts this structure completely. Brands become the merchant of record responsible for every aspect of the customer experience Amazon previously controlled. With this shift, brands gain greater control over pricing, inventory, and customer interactions, but also take on increased operational responsibilities. Using Fulfillment by Amazon (FBA), brands must forecast demand accurately enough to avoid both stockouts and excess inventory storage fees, ship inventory to Amazon’s fulfillment network meeting specific prep and labeling standards, maintain inventory health scores above 350 to avoid storage limits, manage returns and customer refunds within Amazon’s performance windows, and maintain seller performance metrics that meet or exceed Amazon’s minimum thresholds. Using Seller Fulfilled Prime (SFP), brands must deliver 99% of orders within the promised delivery window, maintain on-time shipment rate of 99% or higher, achieve valid tracking rate of 99% or higher, and respond to customer inquiries within 24 hours with resolution rates meeting Amazon’s standards. Moving to 3P also means less reliance on Amazon for operational execution, as brands must independently manage these critical functions.

The operational gap between what 1P vendors currently do and what 3P sellers must execute creates transition failure. A supplement brand selling through Vendor Central receives erratic purchase orders but doesn’t own demand forecasting or inventory positioning decisions. Moving to 3P, that same brand must accurately forecast demand 60-90 days ahead (accounting for manufacturing lead times), determine optimal inventory allocation across Amazon’s fulfillment network, monitor inventory health to avoid long-term storage fees accumulating on slow-moving stock, and react to demand shifts faster than Amazon’s algorithm previously did. The change in vendor relationship means the brand’s operations team must now build capabilities that Amazon previously owned, increasing the brand’s responsibilities and independence.

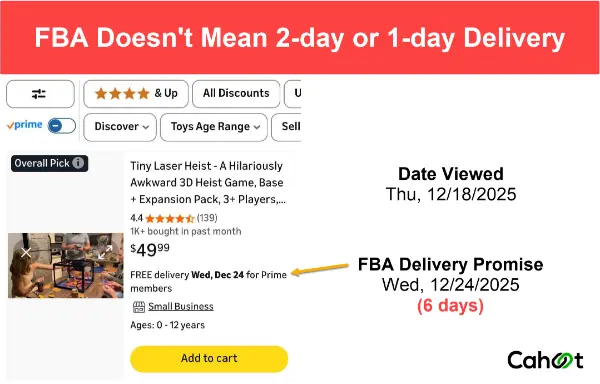

FBA performance thresholds determine Prime eligibility

Prime eligibility drives conversion rates that make or break Amazon sales velocity. Products without the Prime badge convert at significantly lower rates, lose Buy Box competitiveness, and rank lower in search results. For 3P sellers using FBA, Prime eligibility is automatic as long as inventory remains in stock at Amazon’s fulfillment centers. The operational challenge is maintaining that in-stock position through accurate demand forecasting and proactive inventory management. Monitoring stock levels is crucial to avoid both stockouts and overstock, ensuring consistent Prime eligibility and sales performance.

Amazon measures FBA seller performance through the Inventory Performance Index (IPI), a score from 0-1000 that combines excess inventory percentage, FBA sell-through rate, stranded inventory percentage, and in-stock rate for popular products. Sellers must maintain IPI scores above 350 to avoid storage volume limits and above 500 to access unlimited storage. Falling below 350 triggers inventory storage caps that can force stockouts on high-velocity products because Amazon limits how much inventory you can send. To maintain optimal inventory, forecasting demand accurately is essential for balancing stock levels and meeting FBA requirements.

The operational failure mode appears when brands treat FBA like 1P purchase order fulfillment. A kitchenware brand transitioning from 1P receives their first month’s sales data as a 3P seller, analyzes velocity, and ships 90 days of inventory to FBA to ensure stock availability. Three problems emerge: Amazon applies long-term storage fees (currently $6.90 per cubic foot) on inventory stored 271-365 days, killing margin on slower-moving SKUs; excess inventory reduces the FBA sell-through component of IPI score, potentially triggering storage limits; and capital is tied up in slow-moving inventory that could fund faster-turning products or other channels.

The success threshold requires demand forecasting accuracy that balances in-stock rates against inventory efficiency. Industry practice for established 3P sellers targets 60-90 days of stock for A-level SKUs (high velocity), 30-60 days for B-level SKUs (moderate velocity), and 15-30 days for C-level SKUs (low velocity), with weekly or bi-weekly replenishments instead of large quarterly shipments. Tools like RestockPro, Forecastly, or Inventory Lab automate restock recommendations, but the operational capability requirement is someone on your team monitoring daily, understanding the recommendations, and executing replenishment shipments 2-4 times monthly instead of quarterly like 1P purchase orders. These practices are essential for a successful transition from Amazon 1P to 3P, ensuring you meet FBA requirements and maintain sales momentum.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPSeller Fulfilled Prime requires infrastructure most brands lack

Seller Fulfilled Prime allows brands to fulfill orders from their own warehouse while maintaining Prime badge eligibility and conversion advantages. The appeal is obvious: avoid FBA fees averaging 15-20% of product price, maintain inventory at your facility for multi-channel fulfillment, and eliminate the IPI score constraints that limit FBA storage. However, handling fulfillment independently presents significant challenges, as brands must manage all logistics, order processing, and customer service without Amazon’s direct support. When managing orders, brands can choose from different fulfillment methods, such as Fulfilled By Amazon (FBA), Seller Fulfilled Prime (SFP), or leveraging order routing and splitting technologies to optimize delivery and control. There are also various fulfillment options available, including self-fulfillment, using FBA, or working with a third party logistics provider (3PL), allowing brands to select the strategy that best fits their operational capabilities and cost structure. The operational requirements are extreme and most brands underestimate them.

Amazon requires SFP sellers to deliver 99% of orders by the promised delivery date, maintain on-time shipment rate of 99% or higher (orders shipped by the commit time Amazon calculates), achieve valid tracking rate of 99% or higher with carrier-scanned tracking events, maintain cancellation rate below 2.5%, and achieve Order Defect Rate below 1% (combining late delivery rate, pre-fulfillment cancel rate, and customer return dissatisfaction rate). These thresholds are minimum requirements. Falling below any metric triggers warnings and potential Prime badge removal.

The 99% delivery performance standard means on a monthly volume of 1,000 Prime orders, you can have at most 10 late deliveries before risking SFP eligibility loss. A single carrier service disruption affecting 15 packages in one day consumes your entire month’s error budget with margin remaining. Most brands operating their own fulfillment centers achieve 95-98% on-time delivery rates, which is excellent for standard ecommerce but insufficient for SFP’s 99% requirement.

An apparel brand transitioning from 1P attempts SFP to avoid FBA fees on high-value items. Their warehouse operates at 97% on-time shipment during normal periods but experiences a 2-day carrier pickup delay during a winter storm affecting 35 orders. Amazon immediately issues a performance warning. The following month, a warehouse labor shortage causes 12 orders to ship one day late. Amazon suspends Prime eligibility, removing the badge from all listings. Conversion rates drop 40% overnight. The brand scrambles to appeal, provides a corrective action plan, and after 3 weeks regains Prime status. But the sales velocity loss during those 3 weeks permanently damages search ranking and quarterly revenue targets.

The infrastructure gap between standard warehouse operations and SFP requirements includes carrier integrations providing real-time tracking updates meeting Amazon’s scanning requirements, warehouse management systems with automated shipping workflows preventing late shipments, same-day processing for orders received by cutoff (typically 2 PM local time for next-day delivery), regional fulfillment centers or 3PL partnerships enabling 1-2 day delivery coverage to 95%+ of U.S. addresses, and automated performance monitoring alerting when metrics trend toward threshold violations. To meet Amazon’s strict requirements, brands need robust logistics infrastructure, including reliable warehousing, inventory management, and shipping capabilities. Brands operating single warehouses with manual pick-pack-ship processes almost never meet these requirements consistently. The capital investment in WMS, carrier partnerships, and potential multi-location fulfillment typically exceeds $50,000-150,000 before considering ongoing operational costs.

Inventory forecasting becomes brand responsibility without safety net

The operational capability requirement is statistical demand forecasting that accounts for seasonality, trends, promotional impacts, and new product velocity ramps. Minimum viable practice includes ABC classification segmenting inventory by velocity with different restock policies for each tier, sell-through rate monitoring with automatic alerts when velocity drops below forecast, seasonal adjustment factors based on 12-24 months of historical data, and promotional impact modeling that forecasts demand spikes from deals and adjusts inventory accordingly. Brands transitioning from 1P typically have none of these capabilities because Amazon’s purchase order system previously provided demand signals. Building internal forecasting competency takes 6-12 months and requires either dedicated personnel with supply chain expertise or investment in inventory management software with forecasting modules.

Additionally, listing optimization becomes critical in the 3P model. Expertly optimizing product titles, descriptions, and images is essential for maximizing product visibility and sales, as it directly impacts search rankings and conversion rates.

Pricing control requires active management, not just authority

Reclaiming pricing control is a primary motivation for moving to 3P, but operational reality requires distinguishing between pricing authority and pricing execution. In 3P, you have complete control over your pricing and listings, unlike 1P where Amazon sets retail pricing and you have limited influence. The 3P model offers more pricing control, allowing you to set your own prices and manage your listings independently. Amazon’s only constraint is that price plus shipping must be competitive enough to win the Buy Box against other sellers of the same ASIN. The execution challenge is that profitable pricing requires active management responding to competitive dynamics, not just setting a price and walking away.

Amazon’s Buy Box algorithm evaluates price, fulfillment method (FBA preferred over seller-fulfilled), seller performance metrics, and shipping speed. If your price is 5-10% higher than FBA competitors selling the same product, you lose the Buy Box regardless of your performance metrics. Losing the Buy Box suppresses conversion rates by 80-90% because most customers buy from the default Add to Cart option without checking other sellers.

A consumer electronics brand moves from 1P to 3P specifically to control pricing and protect margin. They set prices at MSRP across their catalog. Within two weeks, unauthorized sellers listing the same ASINs at 15-20% below MSRP capture the Buy Box. The brand’s conversion rates drop from 12% to 2% despite identical traffic. They discover seven unauthorized sellers sourcing products from distributors and liquidators. The brand must either match the lower prices (sacrificing the margin they moved to 3P to protect), invest in brand gating enforcement to remove unauthorized sellers (requiring trademark registration, brand registry, and aggressive reporting), or accept 2% conversion rates and revenue collapse.

The operational requirements for profitable pricing include competitive price monitoring checking competitor prices 1-2 times daily with automated alerts on undercutting, repricing rules that automatically adjust prices to maintain Buy Box competitiveness within margin guardrails, MAP policy enforcement for brands with authorized reseller networks (requires legal documentation, monitoring, and violation response process), and brand registry + transparency or Project Zero to remove unauthorized sellers systematically. These capabilities require either dedicated personnel managing pricing and enforcement or investment in repricing tools like RepricerExpress, Informed.co, or similar platforms charging $50-500 monthly plus percentage fees on repriced sales.

Buy Box competition determines revenue reality

The Buy Box is the default purchase mechanism on Amazon product pages. Approximately 83-90% of Amazon sales occur through the Buy Box. If your listing doesn’t win the Buy Box, you’re competing for the remaining 10-17% of customers who manually click “Other Sellers” and comparison shop. For 1P vendors, Amazon Retail typically owns the Buy Box by default. Moving to 3P, you must compete for it.

Amazon evaluates Buy Box eligibility based on multiple factors with the following hierarchy: price competitiveness (within ~5% of lowest FBA offer), fulfillment method (FBA strongly preferred), seller performance metrics (ODR < 1%, Late Shipment Rate < 4%, Valid Tracking >95%), and shipping speed (Prime eligibility nearly essential for consumer products). You need all factors working together. Excellent performance metrics don’t compensate for prices 20% above competitors. FBA fulfillment doesn’t overcome a 5% ODR from customer complaints.

The failure scenario appears when brands assume they’ll own the Buy Box because they’re the brand owner. A supplement brand lists their products as 3P seller, prices at MSRP, uses FBA, and maintains excellent metrics. They discover five other FBA sellers listing the same ASINs at 12-18% below MSRP. These sellers source products from distributors, liquidators, or gray market channels. The brand owner only wins the Buy Box 15-20% of the time based on Amazon’s rotating algorithm. The other 80-85% of time, sales go to sellers offering lower prices.

The operational requirement is proactive supply chain control preventing products from reaching unauthorized sellers, or aggressive enforcement removing them after they appear. When moving to 3P, it is essential to manage a dedicated seller account to streamline operations and avoid conflicts, especially during the transition from 1P. All product listings, inventory, and performance metrics are managed through Amazon Seller Central, which gives brands direct control over their data and optimization strategies. Supply chain control tactics include MAP policies with distributor agreements requiring compliance, selective distribution limiting which wholesalers can purchase, and minimum order quantities or terms that make small-scale reselling unprofitable. Enforcement tactics require Amazon Brand Registry enrollment (requires USPTO trademark registration), IP infringement reporting to remove counterfeit or unauthorized listings, test buys to verify authenticity and gather evidence, and for brands meeting requirements, enrollment in Transparency (unique serialized codes on each unit) or Amazon Project Zero (direct listing removal authority).

Brands transitioning from 1P rarely have these controls in place because Amazon was the primary purchaser. Building supply chain discipline and enforcement programs takes 6-12 months and ongoing operational overhead managing compliance and monitoring violations. Additionally, transitioning to 3P not only increases control but also opens opportunities to expand into other marketplaces beyond Amazon, such as international platforms, further diversifying your sales channels.

The Hybrid Option: Running 1P and 3P Concurrently

For some brands, a hybrid approach—operating both Vendor Central (1P) and Seller Central (3P) accounts simultaneously—can offer the best of both worlds. This strategy allows brands to launch new products as 3P sellers, building demand and testing the market with direct control over pricing and marketing. Once products are established, brands can transition select SKUs to 1P, leveraging Amazon Retail’s purchase orders and fulfillment scale for high-volume items.

A hybrid model can provide flexibility, combining the operational advantages of direct selling with the reach and reliability of Amazon’s wholesale infrastructure. However, it’s important to note that Amazon generally prefers a single selling model per ASIN to prevent channel conflict, and may suppress or penalize listings that appear in both Vendor Central and Seller Central. Brands considering a hybrid strategy should carefully coordinate their approach to avoid operational issues and ensure compliance with Amazon’s policies, while maximizing the benefits of both 1P and 3P selling.

The 6-9 month transition timeline and revenue dip

The actual transition mechanics require careful sequencing to minimize sales disruption. Most brands experience a 15-35% sales velocity dip during transition that recovers over 2-4 months post-completion. The revenue impact is structural to the transition process, not a failure, but brands must plan cash flow and inventory to survive the trough.

The recommended transition sequence begins with establishing Seller Central account and completing Brand Registry enrollment (requires USPTO trademark registration, 4-6 weeks if not already complete). You then create new listings or gain control of existing ASINs (may require Amazon support intervention if ASINs were created by Vendor Central), and implement FBA by sending initial inventory shipments to Amazon fulfillment centers with typical 2-3 week inbound processing time. You need to notify Amazon Vendor Manager of intention to transition and negotiate wind-down terms (typically 60-90 day notice required), then coordinate the final vendor purchase orders and sell-through timing to avoid both stockouts and stranded inventory.

The revenue dip occurs during the window when Amazon’s 1P inventory depletes but before 3P FBA inventory is fully live and ranked. A skincare brand provides 90-day notice to their Vendor Manager in August targeting November transition. Amazon reduces purchase orders in September-October, allowing inventory to naturally deplete. By late October, several SKUs stock out. The brand has FBA inventory in transit and being received, but processing delays mean some products aren’t available for sale until mid-November. During the 3-week gap, those SKUs generate zero revenue. Even after restocking, organic search ranking has dropped from stockout impact and takes 4-6 weeks to recover. Total revenue for November and December runs 25-30% below prior year despite Q4 seasonality typically increasing sales.

The mitigation tactics include timing transitions during slower sales periods (avoid Q4 at all costs), building 60-90 days of safety stock before starting wind-down to cover any gaps, using Amazon’s “Close Account” transition option if Amazon proposes it (allows immediate 3P setup without wind-down), and front-loading advertising spend during and immediately post-transition to rebuild search velocity and ranking faster. Even with perfect execution, expect 2-4 months of suppressed sales that must be planned into cash flow projections and inventory financing.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkWhen brands should not attempt the transition

The 1P to 3P transition is not universally beneficial. Several brand profiles face higher failure risk or negative economics post-transition. Brands with average selling prices below $15-20 often find FBA fees (typically 15-20% of selling price plus per-unit pick-pack fees of $3-4) consume margin gains from pricing control. Brands without dedicated operations personnel to manage daily FBA inventory monitoring, restock decisions, and performance metric tracking struggle to maintain the discipline 3P requires. Brands with widely distributed wholesale channels creating unauthorized seller proliferation cannot control the Buy Box without extensive enforcement infrastructure.

Brands in these categories should either accept 1P’s structural constraints as preferable to 3P’s operational demands, invest 6-12 months building the operational capabilities 3P requires before attempting transition, or implement a hybrid model using 3P for high-margin or brand-controlled products while maintaining 1P for commodity items where Amazon’s purchasing power and fulfillment network provide value despite pricing control loss.

Frequently Asked Questions

What are the minimum performance metrics required for 3P sellers?

Amazon enforces minimum performance thresholds for all Seller Central accounts: Order Defect Rate below 1% (combining negative feedback rate, A-to-Z Guarantee claims, and credit card chargebacks), Late Shipment Rate below 4% for seller-fulfilled orders, Pre-Fulfillment Cancel Rate below 2.5%, Valid Tracking Rate above 95% (orders with carrier-scanned tracking), and for Seller Fulfilled Prime specifically, on-time delivery rate of 99% or higher with 99% on-time shipment rate. Falling below these thresholds triggers account-level warnings, Buy Box suppression, or account suspension. These metrics are measured over rolling 30-day or 90-day windows depending on metric type. Brands must monitor daily and implement corrective action immediately when trending toward violations.

How does FBA inventory management differ from 1P purchase order fulfillment?

In 1P, Amazon generates purchase orders based on their algorithm and assumes inventory forecasting responsibility. Brands simply fulfill POs when received. In FBA, brands own complete demand forecasting, determining how much inventory to manufacture, when to ship to Amazon’s fulfillment network, and how to balance in-stock rates against inventory storage fees. Amazon measures performance through the Inventory Performance Index (IPI score 0-1000) combining excess inventory percentage, sell-through rate, stranded inventory, and in-stock rate. Scores below 350 trigger storage limits preventing inventory replenishment. Successful FBA management requires statistical forecasting accounting for seasonality, ABC inventory classification with different restock policies per tier, and proactive monitoring to avoid both stockouts (which damage ranking) and overstock (which incurs $0.83-6.90 per cubic foot monthly storage fees).

What infrastructure is required for Seller Fulfilled Prime eligibility?

SFP requires 99% on-time delivery and 99% on-time shipment rates, which demand infrastructure most brands lack. Required capabilities include warehouse management systems with automated shipping workflows preventing late shipments, carrier integrations providing real-time tracking updates with carrier-scanned events meeting Amazon’s requirements, same-day order processing for orders received by cutoff time (typically 2 PM local), regional fulfillment centers or 3PL partnerships enabling 1-2 day delivery to 95%+ of U.S. addresses, and automated performance monitoring alerting when metrics trend toward threshold violations. Single warehouse operations with manual processes typically achieve 95-98% on-time rates, which is insufficient for SFP’s 99% requirement. Capital investment in systems and multi-location fulfillment often exceeds $50,000-150,000 before ongoing operational costs.

How do brands control the Buy Box after moving to 3P?

The Buy Box algorithm evaluates price competitiveness (within ~5% of lowest FBA offer), fulfillment method (FBA strongly preferred), seller performance metrics (meeting all thresholds), and shipping speed (Prime eligibility). Winning requires all factors together. Brands must implement competitive price monitoring 1-2 times daily with repricing rules maintaining competitiveness within margin guardrails, use FBA for consistent fulfillment advantage, maintain perfect seller metrics, and enforce supply chain control preventing unauthorized sellers from undercutting. This requires either MAP policies with distributor agreements, selective distribution limiting wholesale access, Brand Registry enrollment enabling IP enforcement, or Transparency/Project Zero programs requiring serialized codes or providing direct listing removal authority. Brands without supply chain discipline face perpetual Buy Box competition from unauthorized sellers sourcing through gray market channels.

What causes the revenue dip during transition and how long does it last?

Revenue dips occur during the window when Amazon’s 1P inventory depletes but before 3P FBA inventory is fully live and ranked. Typical sequence: brand provides 60-90 day vendor wind-down notice, Amazon reduces purchase orders allowing natural depletion, some SKUs stock out before FBA inventory processes through inbound (2-3 weeks), stockouts damage organic search ranking requiring 4-6 weeks post-restock to recover, and conversion rates suppress during ranking recovery period. Most brands experience 15-35% sales velocity reduction lasting 6-12 weeks with full recovery taking 2-4 months. Mitigation includes timing transitions during slower periods (never Q4), building 60-90 days safety stock before wind-down starts, and front-loading advertising spend post-transition to rebuild velocity faster. Even perfect execution typically produces 2-4 months suppressed sales requiring cash flow planning.

When should brands not attempt moving from 1P to 3P?

Brands should avoid transition or delay until capabilities develop if: average selling price is below $15-20 making FBA fees (15-20% of price plus $3-4 per unit) consume margin gains from pricing control; no dedicated operations personnel exist to manage daily inventory monitoring, restock decisions, and performance metric tracking; widely distributed wholesale channels create unauthorized seller proliferation without enforcement infrastructure to control it; or forecasting accuracy, WMS capabilities, and supply chain discipline are insufficient to meet Amazon’s 3P performance standards. These brands should either accept 1P constraints as preferable to 3P operational demands, invest 6-12 months building necessary capabilities before attempting transition, or implement hybrid models using 3P only for high-margin products where control benefits justify operational overhead.

Turn Returns Into New Revenue

Why Amazon 1P Feels Out of Control — and Why That’s Not Your Fault

In this article

23 minutes

23 minutes

- How pricing authority disappears and why it costs more than you think

- How inventory forecasting becomes production planning chaos

- How extended payment terms strain working capital during growth

- When DTC and wholesale channels conflict with Amazon's pricing

- Why reasonable operators dismiss problems until they compound

- The role of Brand Registry in protecting your brand on Amazon

- What the economics reveal about 1P model sustainability

- Frequently Asked Questions

When your Amazon Vendor Central account starts generating problems faster than your team can fix them, the instinct is to treat each issue as a separate operational failure. Pricing drops without warning, purchase orders arrive erratically, payments delay beyond projections, and wholesale partners complain about being undercut. Operations leaders naturally assume these problems have solutions, that better processes or stronger vendor manager relationships will restore control. This assumption is wrong. The loss of pricing authority, inventory visibility, and cash flow predictability is not a bug in the Amazon 1P model. It is the model itself, working exactly as designed to optimize Amazon’s economics rather than yours. This article is an amazon 1p vs 3p comparison, highlighting the different selling options available to an amazon seller, and how each model impacts control, branding, and operations.

The distinction matters because it changes what you should do. Operational problems have operational fixes. Structural problems require strategic decisions about whether the economics still work for your business. Choosing the best path among the available selling options—whether a first party relationship (1P) or a third party relationship (3P)—is crucial for your brand’s growth and success on Amazon. In a first party relationship, you act as a vendor selling products directly to Amazon, while in a third party relationship, you sell products directly to consumers on Amazon’s marketplace, retaining more control over pricing and branding. This article explains exactly how control erodes in Amazon 1P, why reasonable operators dismiss early warning signs, when each issue becomes material enough to require strategic response, and what the downstream consequences mean for brand economics and multi-channel strategy. Amazon’s algorithmic systems, driven by artificial intelligence, play a significant role in these processes, impacting pricing, inventory, and operational decisions.

How pricing authority disappears and why it costs more than you think

Amazon’s algorithmic pricing system operates on three inputs that collectively strip vendors of pricing control. The algorithm matches competitor prices across both third-party sellers on Amazon and major external retailers including Walmart and Target. Price changes by other sellers on the Amazon platform can also trigger algorithmic adjustments, further eroding your ability to maintain consistent pricing. When a distributor liquidates old inventory at 40% off your minimum advertised price to a small ecommerce site, Amazon’s crawlers detect the discount within hours and match it. The algorithm also discounts products when Amazon holds excess inventory, dropping prices to accelerate sell-through velocity regardless of your wholesale cost. Finally, when Amazon’s margin on your product exceeds category averages, the system may reduce retail price even without competitive pressure.

The operational scenario plays out predictably. A premium kitchenware brand sells mixing bowls to Amazon at $25 wholesale with a suggested retail price of $60. Amazon initially prices at $55, yielding healthy margin. Three months later, a discontinued color variant appears on a discount site at $35. Amazon matches within 24 hours. Target sees Amazon’s price and drops to $34. Amazon adjusts to $33. Within a week, the product that should sell for $55-60 has a new market price of $33, generating losses for Amazon on every sale at the $25 wholesale cost.

Reasonable operators initially dismiss this as temporary. “It’s just one SKU with unusual competitive activity. Our core products maintain pricing.” The problem becomes material when the pattern repeats across the catalog. Research shows that among popular products from 50 top Shopify brands selling on both channels, Amazon prices lower than the brand’s own DTC site 49% of the time. The pricing erosion spreads through two mechanisms: the market perceives the new lower price as the true value, making $60 seem overpriced everywhere, and wholesale partners who cannot match Amazon’s algorithmic discounting stop carrying the product entirely.

The downstream consequences compound beyond immediate margin loss. Your Shopify conversion rate drops as customers comparison shop and find Amazon 20-30% cheaper. Google Shopping ads become unprofitable because your ad costs reflect higher DTC pricing while Amazon’s lower price captures the conversion. Wholesale partners issue ultimatums about MAP policy enforcement, not understanding that once you sell wholesale to Amazon, MAP policies become legally unenforceable under price-fixing statutes. Multiple brands have documented losing brick-and-mortar retail distribution specifically because stores cannot compete with Amazon’s algorithmic discounting on products those retailers helped build market for.

The brand economics shift fundamentally. A product with 55% gross margin at $60 retail becomes a 24% gross margin product at $33 retail, assuming Amazon still pays $25 wholesale. In addition to margin compression from price drops, sellers must also account for marketplace fees, referral fees, and additional fees such as advertising, co-ops, and chargebacks, all of which further impact profitability. Except Amazon frequently doesn’t maintain purchase orders when products become unprofitable for them, introducing the second control problem.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyHow inventory forecasting becomes production planning chaos

Amazon’s purchase order system operates through algorithmic forecasting that provides vendors zero visibility into ordering logic. The algorithm analyzes sales velocity, seasonal patterns, and fulfillment center inventory across Amazon’s network, then generates purchase orders that vendors must confirm within 24-48 hours or risk auto-cancellation. The system delivers POs in patterns that initially seem data-driven but reveal volatility at scale.

A supplement brand manufacturing in 90-day production cycles receives the following PO sequence: July orders 5,000 units, August orders 4,200 units, September orders 8,500 units (Amazon building inventory for Q4), October orders 2,100 units (existing inventory still clearing), November orders zero (no PO generated), December orders 11,000 units (panic reorder after Black Friday stockout). The brand’s production planner cannot reliably forecast because Amazon’s algorithm optimizes for Amazon’s network-wide inventory efficiency, not the vendor’s manufacturing constraints.

Reasonable operators initially treat this as a demand forecasting problem. “We need to get better at predicting Amazon’s ordering patterns.” The issue becomes material when you realize you cannot predict the algorithm because it incorporates variables you cannot see, including competitive pricing changes, category-level inventory targets, fulfillment center capacity planning, and promotional calendar impacts across Amazon’s entire marketplace. Amazon introduced a Sell-In Forecast feature in 2024 giving some vendors 3-month projections, but it remains limited to select accounts and updates infrequently.

The costly consequence appears in two opposite scenarios. Scenario one: Amazon orders 70% more than normal in August-September for Q4 inventory buildup, depleting your warehouse stock. Your manufacturing pipeline cannot accelerate fast enough to meet the surge. Amazon’s fulfillment centers stock out in early November despite your production running at capacity. Research across 240 sellers found that Amazon stockouts resulted in average revenue loss of $18,000 per event from ranking drops, lost Buy Box time, and slow velocity recovery even after restocking.

Scenario two: Amazon overestimates demand and orders 10,000 units of a new product launch through the Born to Run program. The product doesn’t perform as expected. Amazon stops ordering after the initial shipment. You now hold 7,000 units of inventory you manufactured for Amazon that Amazon won’t purchase. Your only customer for this production run has unilaterally decided to stop buying. Unlike 3P selling where you control inventory shipments to FBA, 1P vendors cannot send inventory without a purchase order. Your inventory sits idle while Amazon’s listing shows out of stock.

The multi-channel implications create additional complexity. Because you cannot reliably predict Amazon’s ordering, you cannot confidently promise inventory to other retail channels. Maintaining accurate stock levels across all sales channels is critical to prevent overselling and optimize fulfillment processes. A wholesale partner places an order expecting delivery in 30 days, but Amazon unexpectedly generates a large PO that consumes your available inventory. You either short your wholesale partner (damaging that relationship) or short Amazon (risking chargebacks and PO cancellations). The working capital tied up in inventory manufactured for Amazon but not yet purchased (or purchased but not yet paid for) constrains your ability to fund inventory for other channels.

How extended payment terms strain working capital during growth

Standard Amazon vendor payment terms have extended from Net 30 to Net 60 (now most common) to Net 90 (increasingly requested) to Net 120 (now appearing in some vendor agreements). The cash conversion cycle creates a predictable math problem that becomes acute during growth. You receive a purchase order from Amazon, pay your manufacturer immediately or within Net 30, ship to Amazon’s fulfillment network within 1-4 weeks, then wait 60-90 days for Amazon’s payment, which is then reduced by various deductions and chargebacks.

A vendor on Net 90 terms shipping $500,000 per month to Amazon has $1.5 million in receivables outstanding at any moment before accounting for deductions. Amazon offers Quick Pay Discounts (QPD) for faster payment in exchange for 1-3% invoice discounts. One analysis found vendors on Net 60 with 2% QPD waiting 64 days to receive 93% of invoice value after repeated deductions.

Reasonable operators initially accept extended terms as industry standard wholesale practice. “Target and Walmart also have Net 60 terms. This is normal for large retailers.” The issue becomes material when growth acceleration requires increased inventory investment but delayed payment recovery limits capital availability for that investment. A brand growing 30% annually must increase inventory purchases proportionally, but if Amazon comprises 60% of revenue, the capital required to fund Amazon’s inventory sits in receivables for 90+ days while shorter-term working capital needs go unfunded.

The operational scenario creates a growth trap. Q4 requires significant inventory investment in August-September. You finance production using operating capital or debt. Amazon pays for September shipments in late December (Net 90). January and February become tight cash months because you collected Q4 revenue too late to fund Q1 inventory purchases at the growth rate the business requires. Brands in this position either slow growth to match cash availability, secure external financing to bridge the working capital gap, or face stockouts that damage marketplace performance.

Research shows 93% of Amazon vendors experience deductions that can consume up to 7% of total revenue across more than 100 different chargeback types. Shortage claims (Amazon claims fewer units received than invoiced) comprise approximately 75% of deductions by volume. These deductions appear only when invoices become due for payment, 60-90 days after shipment, when vendors may not remember shipment details well enough to dispute effectively. Recovery specialists report 97% success rates disputing shortage claims, indicating most are Amazon warehouse errors, but the dispute process consumes operational resources and delays payment recovery another 30-60 days.

The downstream consequence for brand economics is straightforward. Extended payment terms plus 7-15% deductions plus dispute recovery time means effective payment cycles of 90-150 days at 85-93% of invoice value. This working capital burden is sustainable at stable volumes but becomes a growth constraint when expansion requires increased inventory investment that cannot be funded from delayed receipts. Brands commonly discover this constraint only after committing to growth targets that the cash conversion cycle cannot support without external financing.

Looking for a New 3PL? Start with this Free RFP Template

Cut weeks off your selection process. Avoid pitfalls. Get the only 3PL RFP checklist built for ecommerce brands, absolutely free.

Get My Free 3PL RFPWhen DTC and wholesale channels conflict with Amazon’s pricing

The multi-channel implications of pricing control loss extend beyond immediate margin compression. When Amazon’s algorithm prices your product at $33 while your Shopify store lists the same item at $60, customer perception shifts fundamentally. The $60 price appears as overpricing rather than premium positioning. Your own website’s conversion rate drops as shoppers abandon carts to buy from Amazon. Google Shopping ads become unprofitable because your acquisition costs reflect $60 pricing economics while Amazon captures conversions at $33.

Research found that among customers who encounter the same product on both a brand’s DTC site and Amazon, 49% find Amazon cheaper with faster delivery. This price discovery damages DTC economics even for customers who ultimately purchase through your site, because Amazon’s visibility establishes the price reference point that makes your DTC pricing appear expensive.

The wholesale channel faces even more severe disruption. Brick-and-mortar retailers cannot match Amazon’s algorithmic pricing because their economics require the full margin structure. When Amazon discounts your mixing bowls to $33, the specialty kitchenware store paying $25 wholesale cannot profitably sell at $33 after accounting for rent, labor, and inventory carrying costs. Multiple vendor accounts document this progression: wholesale partners complain about Amazon pricing, initially accept assurances that it’s temporary, then issue MAP enforcement ultimatums, then discover MAP policies cannot legally constrain Amazon as a wholesale buyer, then ultimately discontinue the product line.

One documented vendor experience captures the trajectory: “I told them they are going in the wrong direction when dealers were dropping their product lines because of Amazon ignoring MAP. At first, they said the volume that Amazon generated was too great to ignore. Then they complained about the huge amount of returns from Amazon they had to deal with. Eventually, they told me they are stuck in this relationship where they constantly lose money, but too deep to get out.”

The strategic consequence is channel conflict that undermines omnichannel strategy coherence. You cannot simultaneously build a premium DTC brand at $60 while Amazon sells the same product at $33. You cannot maintain wholesale partnerships with specialty retailers when Amazon undercuts them by 40%. You cannot invest in brand positioning and premium market perception when the largest sales channel presents your products as discount items. However, selling branded items through the 3P model on Amazon gives you more control over pricing and brand identity, helping to protect your premium positioning. These conflicts are not operational problems with operational solutions. They are structural conflicts between Amazon’s algorithmic pricing optimization and your brand strategy.

Why reasonable operators dismiss problems until they compound

The Amazon Vendor Central invitation creates psychological factors that delay recognition of structural problems. Being invited to Vendor Central is framed as validation, a recognition that Amazon sees strategic value in your brand. The invite-only model creates prestige that emotionally anchors operators to the relationship before understanding its constraints. The initial growth velocity reinforces commitment. Amazon’s marketplace typically generates higher sales volume than most brands previously experienced, and operations teams focus on fulfilling increased purchase orders rather than analyzing unit economics.

The wholesale framework creates false comfort because the 1P model resembles traditional relationships with Target or Walmart. Operations teams apply existing wholesale frameworks that don’t account for Amazon’s algorithmic pricing, extended payment terms, or chargeback complexity. Amazon’s recruitment language references “joint business plans” and “collaborative growth,” positioning the relationship as strategic partnership rather than wholesale supply arrangement where Amazon holds unilateral control over pricing, inventory timing, and payment terms.

Problems compound slowly enough that each individual issue seems manageable. Pricing drops on one SKU feel like temporary competitive activity. Erratic purchase orders appear as normal demand volatility. Extended payment terms match industry trends toward longer cycles. Chargebacks and deductions seem like operational details to optimize through better compliance. Each issue in isolation has a plausible operational explanation, delaying recognition that these issues collectively represent structural features of how the 1P model allocates risk and control.

The inflection point where issues become material rather than operational occurs at different thresholds for different businesses. Financial signals include margin compression exceeding 5-10% annually without recovery path, cumulative deductions reaching 5-10% of shipped costs, and working capital strain from extended payment terms limiting growth investment. Relationship signals include Vendor Manager non-responsiveness persisting across multiple escalations and major wholesale partners issuing ultimatums about Amazon pricing. Strategic signals include DTC channel building becoming a priority but Amazon pricing undermining it, and premium brand positioning eroding as products appear perpetually discounted.

The test for whether problems have become structural rather than operational is whether escalation paths work. When Vendor Manager escalations fail repeatedly, when margin erosion continues despite compliance optimization, when purchase order volatility persists regardless of forecasting improvements, the constraint is structural. One former Amazon Vendor Manager observed: “These combined with the ever-unresponsive Vendor Managers leave usually no reliable path to turn the profitability and revenue uncertainty around.”

The role of Brand Registry in protecting your brand on Amazon

For brands navigating the complexities of Amazon Vendor Central and Seller Central, the Amazon Brand Registry stands out as a critical tool for regaining and maintaining control in an environment where control is often elusive. The Brand Registry is designed to empower both first party sellers (1P) and third party sellers (3P) with greater authority over their brand presence, product listings, and customer experience on the Amazon platform.

At its core, Brand Registry gives brands the ability to protect their intellectual property and ensure that their product listings—across all sales channels—accurately reflect their brand identity. This is especially vital in a marketplace where unauthorized sellers and counterfeiters can quickly erode brand equity and customer trust. By enrolling in Brand Registry, brands can proactively monitor and remove counterfeit listings, unauthorized third party sellers, and inaccurate product descriptions, helping to safeguard their reputation and maintain a consistent brand image.

One of the most significant advantages of Brand Registry is the increased control it offers over product listings and visual listing elements. Brands can directly manage product data, images, and enhanced content, ensuring that customers see accurate, compelling information that drives conversions. This level of listing optimization is essential for both 1P and 3P sellers, as it helps differentiate authentic products from unauthorized or low-quality alternatives, and supports a premium brand presence even in a crowded marketplace.

Brand Registry also plays a pivotal role in pricing strategy. While 1P vendors often face limited control as Amazon assumes control over retail prices, Brand Registry provides tools to help monitor and enforce minimum advertised price (MAP) policies and maintain consistent pricing across channels. This is crucial for protecting profit margins and preventing price erosion, especially when selling through multiple sales channels, including other retailers and other marketplaces. For brands using a hybrid approach—selling both directly (3P) and via wholesale supplier relationships (1P)—Brand Registry helps coordinate pricing and messaging, reducing the risk of channel conflict and supporting a unified go-to-market strategy.

Operational capabilities are another area where Brand Registry delivers value. With access to advanced inventory management and inventory forecasting tools, brands can better track inventory levels, anticipate demand, and avoid costly stockouts or overstock situations. The centralized dashboard streamlines order management and fulfillment, making it easier to manage multiple sales channels and maintain high service levels for customers. For brands scaling their Amazon business, these actionable insights are invaluable for making data-driven decisions about production, replenishment, and marketing.

Advertising tools available through Brand Registry further enhance a brand’s ability to drive sales and build customer loyalty. Brands gain access to exclusive advertising campaigns, such as Sponsored Brands and A+ Content, which can boost visibility, improve conversion rates, and reinforce brand messaging. These tools are especially important for brands looking to stand out in the Amazon marketplace and maximize the return on their advertising spend.

Perhaps most importantly, Brand Registry provides brands with access to richer customer data and analytics. This actionable insight into customer behavior, preferences, and feedback enables brands to refine product development, optimize marketing strategies, and deliver a better customer experience. In a landscape where direct access to customer data is often restricted—particularly for 1P vendors—Brand Registry helps bridge the gap, giving brands the information they need to make smarter business decisions.

For brands considering enrollment, key steps include securing a registered trademark, preparing detailed product information and images, and actively monitoring product listings and customer reviews. By leveraging the full suite of Brand Registry tools, brands can maintain greater control over their Amazon presence, protect against counterfeiters, and unlock new opportunities for growth—regardless of whether they sell as first party or third party sellers.

In the ongoing debate of 1p vs 3p, the biggest difference remains how much control a brand can maintain over pricing, inventory, and customer relationships. While 1P sellers may face limited control as Amazon assumes control over key aspects of the business, Brand Registry helps level the playing field by giving all brands—regardless of selling model—greater control over their product listings, brand presence, and operational capabilities.

As the Amazon platform continues to evolve and competition intensifies, Brand Registry is no longer optional for brands serious about protecting their profit margins, optimizing their sales channels, and building a sustainable Amazon business. Whether you’re selling directly, through wholesale, or using a hybrid model, Brand Registry is the foundation for maintaining control, driving growth, and ensuring your brand stands out in the world’s largest online marketplace.

Scale Faster with the World’s First Peer-to-Peer Fulfillment Network

Tap into a nationwide network of high-performance partner warehouses — expand capacity, cut shipping costs, and reach customers 1–2 days faster.

Explore Fulfillment NetworkWhat the economics reveal about 1P model sustainability

Multiple brands who transitioned from 1P to 3P documented specific economic outcomes that quantify the structural constraints. An apparel brand increased net revenue per unit from $30.19 to $47.76, a 56% improvement, by eliminating wholesale discount and 1P-specific fees. A U.S. electronics brand reclaimed up to 20% in margin with a 40% drop in unauthorized listings within three months. Panasonic documented MAP compliance improving from single digits to mid-90s after transitioning. An accessories brand saw 604% growth in Amazon sales over 12 months after switching to Seller Central with enforcement strategy.

These outcomes indicate that 1P’s structural constraints created 20-56% margin disadvantages and MAP compliance failures that were not operational failures but inherent features of the model. The brands did not get better at executing within 1P. They changed to a model where they controlled pricing, inventory timing, and customer relationships. In the 3P model, the third party relationship allows brands to retain greater control and flexibility over branding, pricing, and marketing, selling directly to consumers on Amazon’s platform.

Amazon’s own behavior confirms the economic trajectory. In 2024, Amazon terminated vendors generating under $5-10 million annually, signaling that only enterprise-scale brands remain strategic 1P partners. Third-party sellers now account for 62% of paid units on Amazon’s marketplace. This shift reflects Amazon’s economic calculation that 3P seller fees (typically 15% referral fee plus FBA fulfillment fees) generate better returns than 1P wholesale margin minus operational costs of buying, storing, and discounting inventory. For 3P sellers, fulfillment fees and Prime eligibility are key components of the cost structure and value proposition—fulfillment fees are incurred when using Amazon’s logistics, while Prime eligibility through FBA boosts product visibility, customer trust, and sales.

For brands between $1-10 million in Amazon revenue, the structural constraints of margin compression from fees averaging 15-25%, payment delays of 60-120 days, complete loss of pricing authority, and customer data blindness create compounding problems that operational excellence cannot solve. The prestige of Vendor Central invitations and the wholesale framework familiarity mask these dynamics initially, but scale amplifies rather than resolves them.

Frequently Asked Questions

What is Amazon 1P and how does it differ from 3P?

Amazon 1P (first-party) through Vendor Central is a wholesale model where brands sell inventory to Amazon at wholesale cost, and Amazon becomes the retailer who controls pricing, inventory, listings, and customer relationships. Products display “Ships from and sold by Amazon.com.” Amazon 3P (third-party) through Seller Central is a marketplace model where brands sell directly to customers, maintain pricing control, manage inventory levels, and access customer data. Products display “Sold by [Brand Name] and Fulfilled by Amazon” when using FBA. The biggest difference is control: 1P vendors surrender pricing authority, inventory visibility, and customer data in exchange for Amazon handling operations, while 3P sellers maintain control but assume increased responsibility for operations and customer service.

Why does Amazon control pricing in the 1P model?

When brands sell wholesale to Amazon through Vendor Central, Amazon purchases inventory and becomes the legal owner who then retails it to consumers. As the retailer, Amazon has legal authority to set retail prices independent of wholesale cost. Amazon’s algorithmic pricing system adjusts prices based on competitor matching (both 3P sellers and external retailers), overstock situations requiring faster sell-through, and margin optimization against category averages. Brands cannot enforce MAP (minimum advertised price) policies against Amazon because once products sell wholesale, dictating retail prices violates price-fixing laws. This pricing authority loss is structural to the wholesale relationship, not a policy Amazon could change.

When does pricing control loss become a material problem?

Pricing control loss becomes material when it creates downstream consequences beyond immediate margin compression. The inflection point occurs when Amazon’s algorithmic discounting is 20-30% below your DTC pricing, reducing Shopify conversion rates as customers comparison shop; wholesale partners issue MAP enforcement ultimatums or threaten to discontinue product lines because they cannot compete; Google Shopping and paid acquisition become unprofitable because ad costs reflect higher DTC pricing while Amazon captures conversions at lower prices; and premium brand positioning erodes as products appear perpetually discounted across the largest sales channel. Financial materiality thresholds include margin compression exceeding 5-10% annually and pricing erosion spreading from isolated SKUs to 30%+ of catalog.

How do extended payment terms affect growing brands specifically?

Extended payment terms (Net 60-90-120) create working capital constraints during growth acceleration. A vendor on Net 90 shipping $500,000 monthly has $1.5 million in receivables before deductions. Growth requires proportional inventory investment, but capital recovery delays limit funding availability. The growth trap appears when Q4 inventory purchases in August-September require immediate payment while Amazon’s payment arrives in late December, leaving January-February with insufficient cash to fund Q1 inventory at continued growth rates. Deductions consuming 7-15% of revenue plus 90-150 day effective payment cycles mean brands must fund growth from external capital or slow expansion to match cash availability. This constraint appears only after committing to growth targets the cash conversion cycle cannot support.

Why do wholesale partners drop brands selling through Amazon 1P?

Wholesale partners discontinue products when Amazon’s algorithmic pricing makes them uncompetitive. When Amazon discounts a product 30-40% below retail partners’ wholesale cost plus required margin, brick-and-mortar stores cannot profitably carry the item. The progression follows a pattern: partners initially complain about Amazon pricing, accept temporary reassurances, issue MAP enforcement demands, discover MAP cannot legally constrain wholesale buyers, then ultimately discontinue the product. Multiple documented cases show specialty retailers who helped build brands dropping those products specifically because Amazon 1P pricing made their inventory unsellable. This channel conflict is structural because Amazon’s algorithmic optimization prioritizes marketplace velocity over brand distribution strategy.

How do you know if 1P problems are structural rather than operational?

Problems become structural rather than operational when escalation paths fail repeatedly. Operational problems respond to process improvements and vendor management. Structural problems persist regardless of optimization. Key indicators include: Vendor Manager escalations producing no resolution across multiple attempts over 3+ months; margin erosion continuing despite compliance optimization, better shipping processes, and reduced chargebacks; purchase order volatility persisting regardless of forecasting improvements and demand planning; and retail partnerships deteriorating despite MAP policy documentation and partner communication. The decisive test is whether the constraint is solvable within the existing model’s mechanics. If better execution within 1P cannot restore control over pricing, inventory timing, and cash flow, the constraint is structural to the model itself.

Turn Returns Into New Revenue

Amazon AWD vs FBA: What’s the Difference and Which One Should You Use?

In this article

23 minutes

23 minutes

- Introduction to Amazon Services

- AWD provides low-cost bulk storage with automatic FBA replenishment

- FBA delivers end-to-end fulfillment with Prime badge access

- The fundamental distinction determines when each service applies

- The combined AWD-FBA workflow creates a scalable inventory system

- Decision criteria depend on inventory velocity, volume, and risk tolerance

- Operational realities require contingency planning for AWD delays

- Practical implementation requires testing and backup plans

- Strategic recommendations from experienced sellers emphasize redundancy

- Frequently Asked Questions

Amazon Warehousing and Distribution (AWD) and Fulfillment by Amazon (FBA) serve fundamentally different purposes, and using them correctly can slash storage costs by up to 80% during peak season while eliminating capacity constraints. AWD launched in September 2022 as an upstream bulk storage solution that feeds inventory into FBA, not as a replacement for it. The critical insight most sellers miss: AWD cannot ship directly to customers, making it purely a warehouse solution while FBA handles the actual fulfillment to Prime customers. Both services operate within the Amazon fulfillment network, which manages the placement and movement of inventory across Amazon’s fulfillment centers to optimize delivery speed and reduce fees. This guide provides operations leaders with the complete framework for deciding when to use each service or both together.

The strategic question isn’t AWD versus FBA, but rather how to orchestrate them as complementary systems. High-volume sellers storing $250,000 in inventory report paying just $80/month in AWD storage fees, compared to thousands in FBA storage. However, seller feedback reveals a critical caveat: AWD auto-replenishment can take 20-30+ days during peak seasons instead of the stated 10-14 days, leading some sellers to experience stockouts despite having abundant inventory sitting in AWD warehouses.

Introduction to Amazon Services

Amazon provides a robust suite of services designed to help sellers manage inventory and fulfill customer orders efficiently. Two of the most important solutions in Amazon’s ecosystem are Amazon Warehousing and Distribution (AWD) and Fulfillment by Amazon (FBA). Each service addresses different needs within the supply chain, and understanding their unique roles is essential for optimizing inventory management, controlling storage costs, and maximizing customer satisfaction.

Amazon AWD is tailored for bulk storage and distribution, allowing sellers to store large quantities of inventory in Amazon’s dedicated warehousing and distribution network. This service is ideal for managing bulk inventory, especially for products with longer storage duration or seasonal demand. AWD stores inventory in a dedicated storage space at lower storage fees compared to FBA, making it a cost-effective solution for long-term storage and managing overflow inventory. One of AWD’s standout features is its ability to automatically replenish FBA fulfillment centers, ensuring inventory levels remain healthy and reducing the risk of stockouts. Additionally, AWD supports multi-channel distribution, enabling sellers to use the same inventory pool for Amazon orders and other sales channels, streamlining the supply chain and improving overall inventory management.

In contrast, FBA is a more comprehensive fulfillment service that goes beyond storage. FBA handles the entire fulfillment process, including picking, packing, shipping, customer service, and returns. By leveraging Amazon’s extensive fulfillment center network, sellers can offer fast, reliable shipping and access the Prime badge, which is a major driver of sales on Amazon’s marketplace. FBA is a comprehensive fulfillment solution that is particularly well-suited for sellers who prioritize customer experience and want to benefit from Amazon’s trusted brand and logistics expertise. However, FBA storage fees are typically higher than AWD, especially during peak seasons, and sellers may incur additional costs such as inbound placement fees, fulfillment fees, and aged inventory surcharges.

When evaluating AWD vs FBA, sellers should consider their inventory management needs, sales volume, and fulfillment goals. AWD is best for storing large quantities of inventory at lower storage costs, managing long-term or seasonal stock, and supporting multiple distribution channels. FBA, on the other hand, is ideal for sellers seeking a more comprehensive fulfillment solution that includes fast shipping, customer service, and seamless integration with Amazon’s marketplace. The choice between AWD and FBA often comes down to balancing storage fees, fulfillment fees, and the need for a scalable, reliable distribution solution.

Both AWD and FBA have distinct pricing models. AWD charges storage fees based on the cubic footage of inventory stored, with additional transportation fees for moving inventory from AWD warehouses to FBA fulfillment centers. This model is particularly advantageous for managing bulk inventory and reducing overall storage costs. FBA, meanwhile, calculates storage fees based on product size and weight, and adds fulfillment fees for each order processed, as well as potential surcharges for aged inventory or low inventory levels.

Ultimately, Amazon’s warehousing and distribution services offer sellers flexible options for storing and shipping inventory. By understanding the differences between AWD and FBA, and considering factors like storage space, inventory pool management, and total storage costs, sellers can develop a fulfillment strategy that supports business growth and customer satisfaction. Whether you need to store large quantities of inventory for long-term distribution or require a more comprehensive fulfillment solution for fast-moving products, Amazon AWD and FBA provide the tools to succeed in today’s competitive e-commerce landscape.

AWD provides low-cost bulk storage with automatic FBA replenishment

Amazon Warehousing and Distribution operates as a third-party logistics solution offering bulk inventory storage at significantly lower costs than FBA. Launched at Amazon Accelerate in September 2022, AWD emerged from Amazon’s excess warehouse capacity built during the pandemic ecommerce boom. VP Gopal Pillai identified three pain points AWD addresses: high storage prices, complicated fee structures, and insufficient storage capacity.

The service works through a straightforward flow: sellers ship bulk inventory to AWD distribution centers (using LTL or truckload shipments only, no small parcel), Amazon stores and manages the inventory, then automatically or manually transfers stock to FBA fulfillment centers when inventory runs low. AWD facilities, also referred to as AWD warehouses, are optimized for bulk storage while FBA centers are optimized for picking, packing, and fast delivery. AWD provides dedicated storage space in Amazon’s fulfillment centers for sellers’ inventory. Crucially, inventory cannot move backward from FBA to AWD.

AWD’s pricing structure offers substantial savings over FBA storage. AWD offers significantly lower storage fees compared to FBA, especially for long-term storage, and AWD offers cheaper storage options for sellers managing bulk or seasonal inventory. The base storage rate is $0.48 per cubic foot monthly, with a Smart Storage Rate of $0.43 for sellers maintaining 70%+ auto-replenishment ratios, and an Amazon Managed Rate of $0.38 for those using Amazon Global Logistics or Partnered Carrier Program. However, significant changes effective October 2025 introduce peak season fees of $2.40 per cubic foot for Q4 and non-peak rates of $0.78, a departure from AWD’s original “no seasonal surcharges” value proposition.

When considering AWD cost, it is influenced by storage fees, fulfillment fees, and additional surcharges. AWD’s pricing model is designed to provide cheaper storage for long-term inventory.

Processing fees run $1.35 per box as an inbound processing fee for both inbound and outbound handling, while transportation from AWD to FBA costs $1.15 per cubic foot at base rates or $1.04 with managed service discounts. AWD charges transportation fees to cover the cost of moving inventory from an AWD warehouse to Amazon’s fulfillment network. A key benefit: AWD pricing includes FBA inbound placement fees, eliminating the $0.16-$3.32 per unit charges sellers face when shipping directly to FBA with minimal location splits. AWD can help sellers avoid high peak season surcharges and inbound placement fees while reducing bulk storage costs.

Eligibility requires an active Amazon seller account in good standing, with most retail categories supported including apparel, electronics, beauty, and home goods. Recent additions in 2024-2025 expanded coverage to shoes, expiration-dated products, and non-sort conveyable items. Ineligible products include Amazon devices, hazmat items, meltable products, refrigerated goods, and lithium-ion batteries. Size limits cap individual SKUs at 18” × 14” × 8” and under 20 pounds per carton.

AWD imposes no capacity limits, a stark contrast to FBA’s storage restrictions. AWD does not have seasonal surcharges, which can lead to lower overall storage costs compared to FBA during high-demand periods. Combined with the auto-replenishment system that bypasses FBA capacity limits, this creates a powerful solution for sellers constantly battling restock limits.

Using AWD for storing inventory offers several advantages, such as eliminating peak season storage fees and additional surcharges associated with traditional FBA storage, thereby reducing overall storage costs and avoiding surprise expenses.

Slash Your Fulfillment Costs by Up to 30%

Cut shipping expenses by 30% and boost profit with Cahoot's AI-optimized fulfillment services and modern tech —no overheads and no humans required!

I'm Interested in Saving Time and MoneyFBA delivers end-to-end fulfillment with Prime badge access

Fulfillment by Amazon remains the cornerstone of Amazon seller logistics, providing complete end-to-end fulfillment: storage, picking, packing, shipping, customer service, and returns handling. FBA warehouses handle the customer-facing logistics such as picking, packing, and shipping, ensuring a seamless experience for both sellers and buyers. The service automatically qualifies products for Prime, accessing over 200 million Prime members who actively filter for Prime-eligible products. FBA also offers options for branded packaging as part of its comprehensive fulfillment service, allowing sellers to enhance brand visibility and customer experience with custom packaging, labeling, and inserts.

Current FBA fulfillment fees for non-apparel standard-size items range from $3.06 for small items under 2 ounces to $6.27 plus $0.16 per half-pound for items over 3 pounds. Apparel commands higher fees, typically $0.30-$1.00 more per tier. Large bulky items start around $9.73 plus $0.42 per pound, while extra-large items exceeding 150 pounds hit $158.49 base plus $0.83 per pound.

Monthly storage fees for standard-size products are $0.78 per cubic foot during January-September and surge to $2.40 per cubic foot during the October-December peak season, reflecting the impact of high demand periods. Oversized products pay $0.56 off-peak and $1.40 peak. The aged inventory surcharge compounds costs for slow-moving stock: $1.50 per cubic foot at 181-270 days, $3.80 at 271-365 days, and $6.90 per unit or $0.15 per unit monthly (whichever is greater) beyond 365 days.